DailyPlay – Closing Trade (META) & Portfolio Review – November 03, 2025

Closing Trade

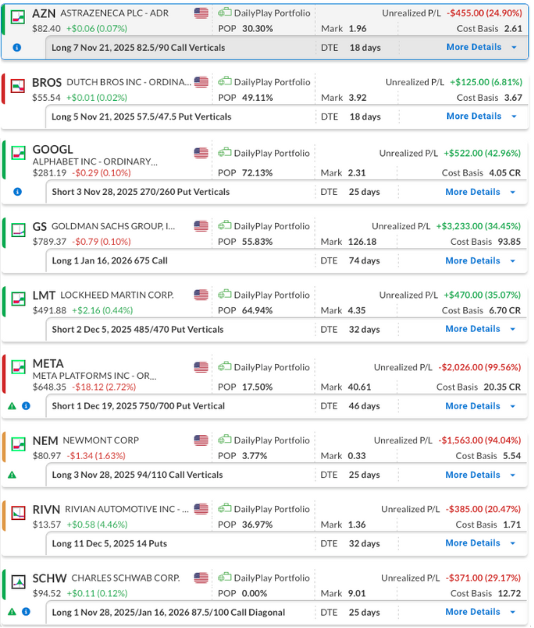

- META – 50% loss: Buy to Close 1 Contract (or 100% of your Contracts) Dec 19 $750/$700 Put Vertical Spreads @ $40.61 Debit. DailyPlay Portfolio: By Closing 1 Contract, we will be paying $4,061. We initially opened this position on October 7 @ $11.10 Debit and rolled it on October 29, realizing a $4.62 gain from the initial trade and entering a new short put at $20.35 per contract. Our net loss, therefore, is $1,564 per contract.

DailyPlay Portfolio Review

Our Trades

AZN – 18 DTE

Bullish Debit Spread – AstraZeneca PLC (AZN) – This position is currently showing a loss, and we plan to maintain it for now. The company is set to release its earnings report on Thursday, November 6th, before the open.

BROS – 18 DTE

Bearish Debit Spread – Dutch Bros Inc. (BROS) – This position is showing a minor gain, and we plan to hold it for now. The company is approaching its upcoming earnings report on Wednesday, November 5, after the close.

GOOGL – 25 DTE

Bullish Credit Spread – Alphabet Inc. (GOOGL) – Alphabet recently reported earnings that exceeded both revenue and profit expectations. The stock has built up bullish momentum ever since the announcement, and we plan to stay the course.

GS – 74 DTE

Bullish Long Call – Goldman Sachs Group, Inc. (GS) – We remain bullish on the stock over the longer term and intend to hold the position. The cost basis has been reduced by selling a shorter-term call that expired worthless, and we may look to sell another call in the near future.

LMT – 32 DTE

Bullish Credit Spread – Lockheed Martin Corp. (LMT) – This position, which we recently opened, is showing a solid gain. The company’s recent strong third-quarter earnings report reinforced our bullish outlook. We plan to hold the position and may look to roll up if strength continues.

META – 46 DTE

Bullish Credit Spread – Meta Platforms, Inc. (META) – We are closing the position today.

NEM – 25 DTE

Bullish Debit Spread – Newmont Corporation (NEM) – The stock moved too quickly to the downside for us to close the position, as we only post closing trades overnight. The position is now showing nearly a 100% loss, but with many days still remaining until expiration, we will hold and hope for a recovery given the current situation.

RIVN – 32 DTE

Bearish Long Put – Rivian Automotive Inc. (RIVN) – We recently opened this position, which is currently showing a loss, and we plan to maintain it for now. Rivian is set to report earnings on Tuesday, November 4th, after the close, and the setup into the event remains bearish.

SCHW – 25 DTE & 74 DTE

Bullish Diagonal Debit Spread – Charles Schwab Corp. (SCHW) – Schwab reported solid earnings that exceeded both revenue and profit expectations. We remain bullish on the stock. After realizing gains on our initial long call, we rolled into a higher strike with a longer expiration and later sold a short-term out-of-the-money call to lower our cost basis.

More DailyPlay

DailyPlay – Opening Trade (FDX) & Closing Trade (LMT) – November 25, 2025

Closing Trade FDX Bullish Opening Trade Signal Investment...

Read More

DailyPlay – Portfolio Review – November 24, 2025

DailyPlay Portfolio Review Our Trades LMT – 11 DTE...

Read More

DailyPlay – Opening Trade (META) & Closing Trade (WMT) – November 21, 2025

Closing Trade META Bullish Opening Trade Signal Investment...

Read More

Share this on