DailyPlay – Opening Trade (MCHP) – November 05, 2025

MCHP Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

Microchip Technology Inc. (MCHP) is showing structural underperformance within the semiconductor sector, driven by both cyclical weakness and valuation pressure. The company reports earnings this Thursday, November 6th, after the close, which could act as a catalyst for further downside if results or guidance fail to justify its elevated valuation. While MCHP continues to deliver steady top-line growth, profitability pressures and weakening technical momentum suggest near-term risk outweighs potential reward. As investors favor higher-margin, AI-focused semiconductor names, Microchip’s relative weakness underscores its loss of leadership within the group. The recent break of key support levels reinforces a bearish outlook, positioning the stock for continued downside participation.

Technical Analysis

Since early August, the 200-day moving average around $60 has acted as key support, holding multiple times before the recent close below $59.50. Trading now beneath its 20-, 50-, and 200-day moving averages, all trending lower, MCHP shows clear bearish momentum. The RSI near 35 signals ongoing weakness but not yet oversold conditions, leaving room for further downside toward the next support area around $50.

Fundamental Analysis

Microchip’s valuation remains elevated relative to peers despite declining margins and slowing profitability. A premium multiple combined with negative net margins creates a challenging setup in a risk-averse environment. Without improvement in earnings quality, MCHP may continue to face valuation pressure and multiple contraction.

- Forward PE Ratio: 42.49x vs. Industry Median 26.41x

- Expected EPS Growth: 40.98% vs. Industry Median 18.61%

- Expected Revenue Growth: 14.54% vs. Industry Median 10.60%

- Net Margins: -3.50% vs. Industry Median 14.16%

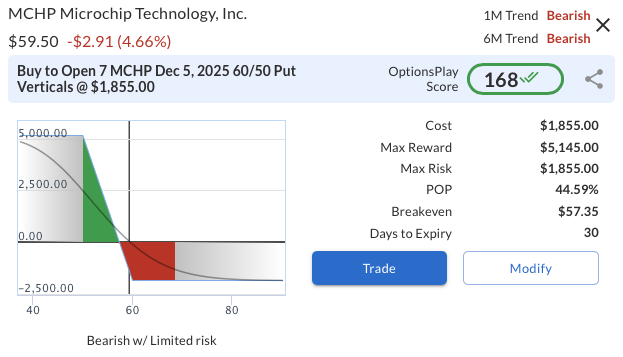

Options Trade

A bearish put vertical spread can be initiated using the Dec 5, 2025, $60/$50 strikes at a net debit of $2.65. This defined-risk position offers a maximum reward of $7.35 versus a maximum loss of $2.65, yielding a risk/reward ratio of approximately 2.8 to 1. The trade benefits from continued downside momentum, particularly if MCHP extends its decline below $60 following earnings, providing a limited-risk way to express a bearish view ahead of a potential volatility-driven move.

MCHP – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 7 MCHP Dec 05 $60/$50 Put Vertical Spreads @ $2.65 Debit per Contract.

Total Risk: This trade has a max risk of $1,855 (7 Contracts x $265) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $265 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 7/10

OptionsPlay Score: 168

Stop Loss: @ $1.33 (50% loss of premium)

View MCHP Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MCHP Trade

More DailyPlay

DailyPlay – Opening Trade (FDX) & Closing Trade (LMT) – November 25, 2025

Closing Trade FDX Bullish Opening Trade Signal Investment...

Read More

DailyPlay – Portfolio Review – November 24, 2025

DailyPlay Portfolio Review Our Trades LMT – 11 DTE...

Read More

DailyPlay – Opening Trade (META) & Closing Trade (WMT) – November 21, 2025

Closing Trade META Bullish Opening Trade Signal Investment...

Read More

Share this on