DailyPlay – Opening Trade (GILD) – August 29, 2025

GILD Bullish Opening Trade Signal Investment Rationale...

Read MoreStrategy: Long Call Vertical Spread

Direction: Bullish

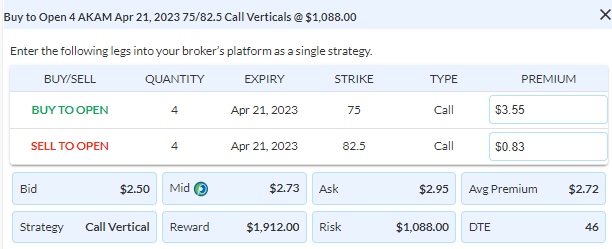

Details: Buy to Open 4 Contracts April 21st $75/$82.50 Call Vertical Spreads @ $2.73 Debit per contract.

Total Risk: This trade has a max risk of $1,088 (4 Contracts x $272).

Counter Trend Signal: This sock is currently trading lower but is expected to bounce higher from support.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 106

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

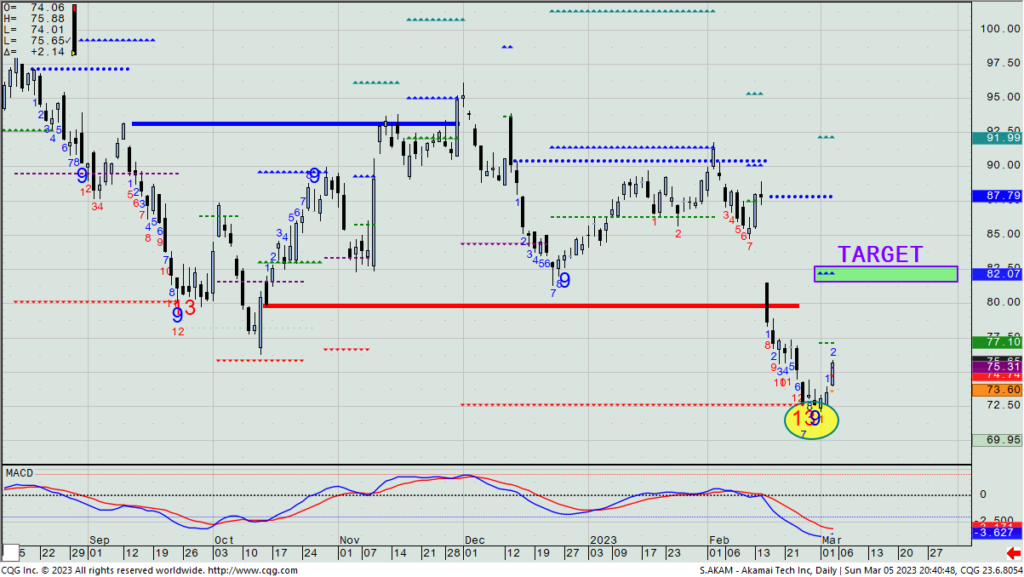

The rally that started on Thursday continued throughout Friday, as stocks posted a significant two-day gain right from where I called it would likely come from. At this point, I look at both last week’s low and February’s high as significant levels to key on in the short term. As of now, no one with a strong bullish or bearish view has been rewarded in 2023, but those who have traded the range – as we have – have been in much better shape.

Here’s a new idea: With Akamai (AKAM) having marked a daily Sequential -13 and Setup -9 at the very end of February, the three-day rally has taken it out of further near-term danger. Right now, the calls are a bit expensive, and selling ATM put spreads yields only 30% — hardly ideal.

AKAM – Daily

So, let’s get a bit more tactical by buying only a 1% position (vs. the standard 2%) in a bullish April 21 $75/$82.5 call spread. (This closed at $2.73 mid on Friday, or about 36% of the strike differential.) Then, let’s also look to buy the other half position of the same series and strikes if we see a pullback any day this week to the unfilled gap between $74 and $73.50. We’ll buy this at what the then current mid-price is. My upside target is when the stock reaches ~$87.79 (where we see the green highlighted Propulsion Exhaustion level).

GILD Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

TTWO Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on