DailyPlay – Closing Trade (GOOGL) & Portfolio Review – August 25, 2025

Closing Trade DailyPlay Portfolio Review Our Trades AMZN...

Read MoreInvestment Thesis

Take-Two Interactive Software (TTWO) currently presents a compelling bearish opportunity. The OptionsPlay platform recently published a Bearish Trend Following Signal, noting that TTWO has experienced a short-term rally within a longer-term bearish trend that may offer a favorable risk/reward for a bearish trade. While the stock has enjoyed a short-term bounce, it remains fundamentally stretched with unsustainable metrics and deeply negative margins. At current levels, TTWO trades at a significant premium to peers despite delivering no EPS growth and operating with heavy losses. With a downside target of $192.50, the overall setup points to continued weakness and supports a bearish stance.

Technical Analysis

Shares of TTWO closed at $231.83, sitting between strong resistance at $245.08 and key support at $216.76. The recent rebound has failed to establish higher highs, keeping the broader price action neutral with downside risk intact. A break below $216.76 would likely accelerate selling pressure, bringing the $192.50 target into play. Momentum indicators remain mid-range (RSI ~53), suggesting there is room for a renewed bearish push. Price action continues to favor sellers unless the stock can convincingly reclaim and hold above $245 resistance.

Fundamental Analysis

Take-Two’s financial metrics paint a concerning picture relative to industry standards. The company is trading at a steep premium with a forward PE ratio well above peers, yet it shows no earnings growth. Revenue growth expectations are solid, but this has not translated into profitability, as the company struggles with cost management. The most troubling metric is its negative net margins, which remain far below the industry norm and highlight persistent structural challenges.

Options Trade

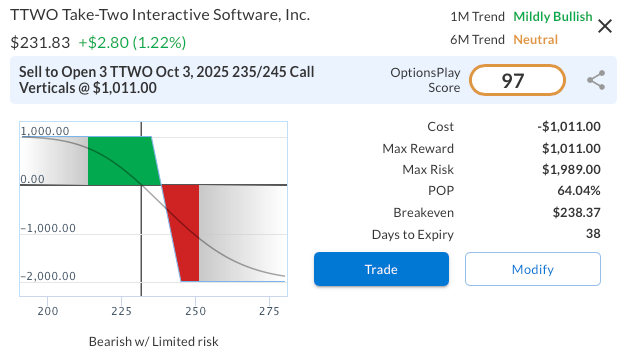

The trade setup is to sell the Oct 3, 2025 $235/$245 call vertical spread at $3.37 credit. This bearish strategy benefits if TTWO remains below $235 at expiration. The maximum profit is $337 per spread, achieved if shares close at or below $235, while the maximum risk is capped at $663 if TTWO closes above $245. With 38 days to expiration, the trade offers a defined setup, effectively risking $2 to make $1, which aligns with the technical resistance overhead and the company’s weak profitability backdrop.

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 3 TTWO Oct 03 $235/$245 Call Vertical Spreads @ $3.37 Credit per Contract.

Total Risk: This trade has a max risk of $1,989 (3 Contracts x $663) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $663 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Mildly Bullish/Neutral

Relative Strength: 7/10

OptionsPlay Score: 97

Stop Loss: @ $6.74 (100% loss to value of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Closing Trade DailyPlay Portfolio Review Our Trades AMZN...

Read More

MA Bullish Opening Trade Signal Investment Rationale...

Read More

PM Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on