DailyPlay – Opening Trade (PINS) & Closing Trade (TGT, NEM) – August 05, 2025

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

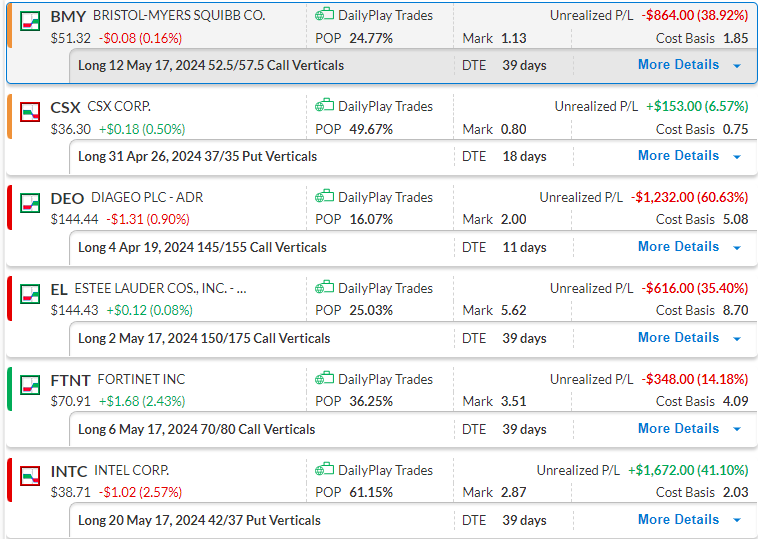

Bullish Debit Spread – Our key level is $53, if this level fails over the next few trading days, we will likely look to cut our position.

Bearish Debit Spread – This trade is moving in our direction and we will closely monitor it over the next few days, to potentially add more exposure.

Bullish Debit Spread – We are closing this position today as it has hit our stop loss level of 50% loss.

EL – 39 DTE

Bullish Debit Spread – A break and close above $150 would confirm our bullish thesis on this trade, so the next few days will be decisive.

FTNT – 39 DTE

Bullish Debit Spread – A break and close above $72 would confirm our bullish thesis for this trade. We will keep a close eye on this position.

INTC – 39 DTE

Bearish Debit Spread – We recently added more exposure to this trade and we are up over 40%. As it is a Debit Spread, we will aim to close this position at around 100% gain.

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on