DailyPlay – Opening Trade (PINS) & Closing Trade (TGT, NEM) – August 05, 2025

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read MoreInvestment Rationale

Monday was a sleeper of a session, with the SPX having but a 19-pt. range – less than 40% of the 54-pt. range averaged over the past 10 days. Why was it so small? It was likely because most investors are going to wait for the CPI figure on Wednesday before deciding how to next proceed. So, if one doesn’t need to do something now, they’re not. (Hint, hint.)

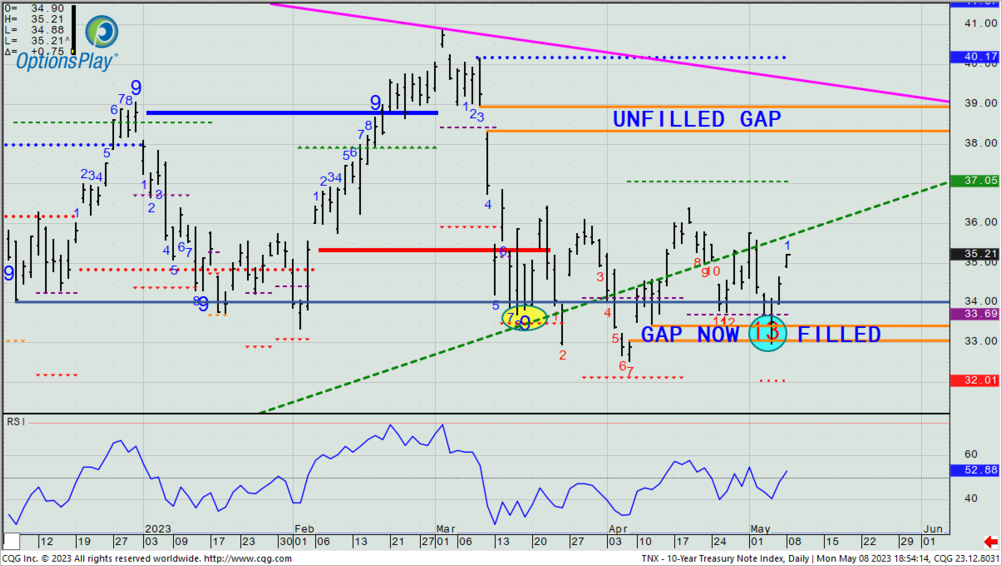

Where we did see some action yesterday was in the bond market, where UST 10yr. rates moved up another 7.5 bps., for as much as 25 bps. since last Thursday’s low yield at 3.3%. I showed you yesterday that the TNX marked a daily -13 signal last Wednesday, and that occurred at the same time that a prior gap got filled down to 3.305%. As an FYI, there still remains a large upside gap from 3.83% to 3.89%, and a continued move up in rates may very well want to test that.

TNX – Daily

With tomorrow’s CPI number potentially being a major determining piece of data to what the Fed may do in the June FOMC meeting, I can tell you that I am personally not now looking to buy or sell anything new in my own accounts — I am simply continuously managing the positions that I already have on. I see little to no reason to employ new capital when we are at the top of the range, and it seems like it’s a pure flip of a coin to where the next 100-200 SPX point move goes.

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on