DailyPlay – Opening Trade (SPOT) & Closing Trade (GILD, SNPS) – September 11, 2025

Closing Trade

- GILD – 41% gain: Buy to Close 5 Contracts (or 100% of your Contracts) Oct 10 $110/$105 Put Vertical Spreads @ $0.89 Debit. DailyPlay Portfolio: By Closing 5 Contracts, we will be paying $445. We initially opened these 5 contracts on August 29 @ $1.50 Credit. Our gain, therefore, is $305.

- SNPS – 92% loss: Sell to Close 1 Contract (or 100% of your Contracts) Oct 24 $610/$670 Call Vertical Spreads @ $1.67 Credit. DailyPlay Portfolio: By Closing 1 Contract, we will be collecting $167. We initially opened this contract on September 09 @ $20.70 Debit. Our loss, therefore, is $1,903 per contract.

SPOT Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

Spotify Technology (SPOT) has come under pressure following a disappointing Q2 2025 earnings report that underscored cracks in its growth execution and cost management. The stock, now trading near $704, sits meaningfully below its $785 peak, reflecting diminished investor confidence. While the company continues to benefit from strong brand recognition and a leading position in streaming, its premium valuation and weaker-than-expected profitability make it vulnerable to further downside. With revenue growth under scrutiny and cost efficiency challenges weighing on margins, risk/reward skews bearish at current levels.

Technical Analysis

SPOT’s price action shows clear rejection at the $750 resistance area, with subsequent selling pressure pushing shares back toward the 50- and 20-day moving averages. The stock is currently trading tightly around these levels, reflecting indecision but with a downside bias given the recent failure at the highs. It appears to be in a consolidation phase near the moving averages, and a break below the recently established $663 low could accelerate selling momentum, potentially driving the stock back toward the 200-day moving average.

Fundamental Analysis

Despite its strong market position, Spotify trades at a valuation that looks stretched relative to peers. Elevated expectations for growth have not been fully met, as evidenced by recent revenue and operating income misses. This raises questions about sustainability in a competitive landscape. Key valuation and profitability metrics include:

- Forward PE Ratio: 51.59x vs. Industry Median 21.29x

- Expected EPS Growth: 45.57% vs. Industry Median 13.75%

- Expected Revenue Growth: 17.59% vs. Industry Median 13.01%

- Net Margins: 4.72% vs. Industry Median 3.98%

Options Trade

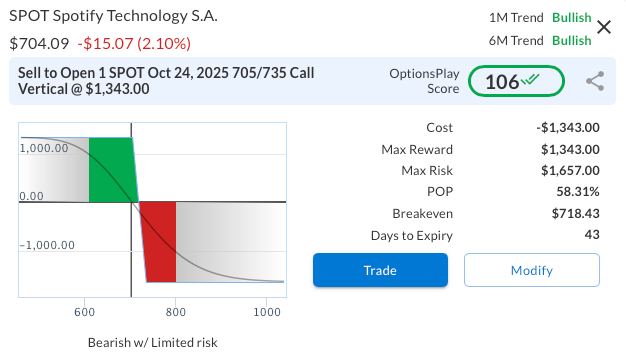

A defined-risk bearish strategy can be structured through a bear call vertical spread. Specifically, selling the SPOT October 24, 2025, 705/735 call vertical at $13.43 offers a maximum profit of $1,343 against a maximum risk of $1,657, equating to a risk/reward ratio of roughly 1.23:1. This setup benefits if SPOT remains below $705 at expiry. The trade provides a balanced profile, where the limited upside risk is manageable relative to the potential return, while time decay steadily works in favor of the short premium. Overall, this spread provides an efficient and disciplined way to express a bearish view.

SPOT – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 1 SPOT Oct 24 $705/$735 Call Vertical Spreads @ $13.43 Credit per Contract.

Total Risk: This trade has a max risk of $1,657 (1 Contract x $1,657) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,657 to select the # contracts for your portfolio.

Counter-Trend Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 106

Stop Loss: @ $26.86 (100% loss to value of premium)

View SPOT Trade

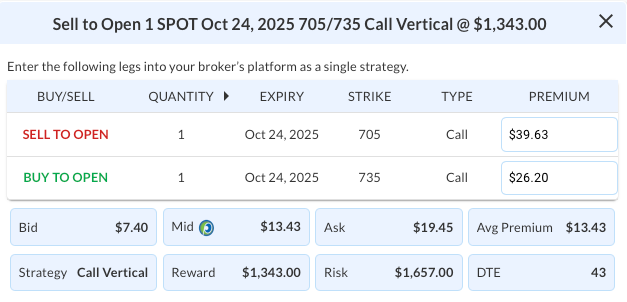

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SPOT Trade

More DailyPlay

DailyPlay – Opening Trade (SNPS) & Closing Trade (TTWO) – September 09, 2025

Closing Trade SNPS Bullish Opening Trade Signal Investment...

Read More

DailyPlay – Portfolio Review – September 08, 2025

DailyPlay Portfolio Review Our Trades GILD – 32 DTE...

Read More

DailyPlay – Adjusting Trade (MA) & Closing Trade (AMZN) – September 05, 2025

Closing Trade MA Bullish Trade Adjustment Signal...

Read More

Share this on