DailyPlay – Adjusting Trade (GS) – September 12, 2025

GS Bullish Trade Adjustment Signal Investment...

Read MoreAdjustment Rationale:

Mastercard (MA) continues to lead the global payments space, driven by structural tailwinds including the growth of digital transactions, robust cross-border volumes, and the steady decline in cash usage. The company has consistently delivered strong profitability and cash flows, and despite its premium valuation, these fundamentals support the case for further upside. Recent price action has confirmed its strength relative to the broader market, reinforcing a bullish outlook with a medium-term target of $640.

Bullish Long Call – Mastercard Incorporated (MA) – We entered this position with a straight long call because the implied volatility (IV) rank was very low at 6/100, making spread strategies less favorable compared to buying the call outright. The position is currently close to flat, and with less than 30 days until option expiration, adding a short option to create a bull call vertical spread would reduce overall risk while still allowing for meaningful upside if the stock continues higher. Although this adjustment would limit some gains if Mastercard breaks out sharply, it keeps the trade aligned with the broader bullish thesis.

Adjustment Trade:

MA @ $595.64

Days to Expiration (DTE): 28

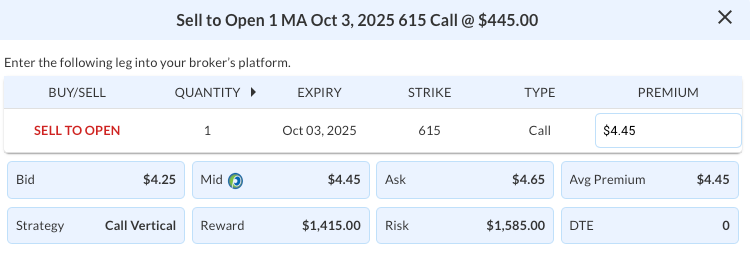

Sell to Open 1 MA Oct 3, 2025 615 Call @ $4.45

Mid: $4.45

Premium Received: $445.00 per call option sold

or $445 total adjustment in the cost basis for the position.

The total risk for the new position is $2,030 (original cost basis) minus $445 (net credit from the adjustment), resulting in a revised cost basis of $1,585.

Resulting Position:

Long 1 MA Oct 3, 2025 585 Call

Short 1 MA Oct 3, 2025 615 Call

New Cost Basis and total risk of $1585

Strategy: Short Call

Direction: Resulting in a new Bullish Debit Spread

Details: Sell to Open 1 MA Oct 3 $615 Call @ $4.45 Credit.

Total Risk: The resulting position has a maximum risk of $1,585 (2,030-445), calculated as the initial cost basis of the long call ($2,030) minus the premium received from the adjustment ($445).

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of the trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 6/10

Stop Loss: @ $7.93 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

GS Bullish Trade Adjustment Signal Investment...

Read More

Closing Trade SPOT Bearish Opening Trade Signal Investment...

Read More

Closing Trade SNPS Bullish Opening Trade Signal Investment...

Read More

Share this on