DailyPlay – Opening Trade (SPOT) & Closing Trade (GILD, SNPS) – September 11, 2025

Closing Trade SPOT Bearish Opening Trade Signal Investment...

Read MoreAdjustment Rationale:

Goldman Sachs Group, Inc. (GS) – Our outlook remains bullish over the long term. A strengthening macroeconomic environment is expected to fuel growth in deal-making, lending, and trading activity, while potential changes in M&A regulation could reduce costs and accelerate approvals. Together, these factors support GS’s potential to generate solid returns as we head into the new year.

Adjustment Trade:

GS @ $784.73

Days to Expiration (DTE): 21

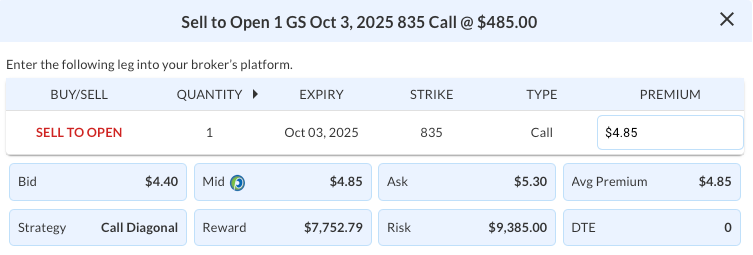

Sell to Open 1 Oct 3, 2025 835 Call @ $4.85

Mid: $4.85

Premium Received: $485.00 per call option sold

or $485 total adjustment in the cost basis for the position.

The total risk for the new position is $9,870 (original cost basis) minus $485 (net credit from the adjustment), resulting in a revised cost basis of $9,385.

Resulting Position:

Long 1 GS Jan 16, 2026 675 Call

Short 1 GS Oct 3, 2025 835 Call

New Cost Basis and total risk of $9,385

Strategy: Short Call

Direction: Resulting in a new Bullish Diagonal Spread

Details: Sell to Open 1 GS Oct 3 $835 Call @ $4.85 Credit.

Total Risk: The resulting position has a maximum risk of $9,385 (9,870-485), calculated as the initial cost basis of the long call ($9,870) minus the premium received from the adjustment ($485).

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of the trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

Stop Loss: @ $46.93 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Closing Trade SPOT Bearish Opening Trade Signal Investment...

Read More

Closing Trade SNPS Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades GILD – 32 DTE...

Read More

Share this on