DailyPlay – Opening Trade (MA) – August 22, 2025

MA Bullish Opening Trade Signal Investment Rationale...

Read MoreInvestment Thesis

Goldman Sachs (GS) remains well-positioned for long-term growth following its strategic restructuring, which has sharpened focus on core revenue drivers and improved operational efficiency. The firm’s dominant capital markets franchise, combined with an experienced management team and disciplined execution, provides a competitive advantage in navigating cyclical and regulatory shifts. A gradually improving macroeconomic environment supports expansion in deal-making, lending, and trading activity, while potential easing in M&A regulation could unlock additional upside by lowering compliance costs and accelerating deal approvals. Together, these factors reinforce GS’s potential to deliver strong shareholder returns over the coming years.

Technical Analysis

GS shares have been in a steady uptrend since May 2025, consistently trading above the 20-day, 50-day, and 200-day moving averages, highlighting strong short- and long-term momentum. After a robust rally from the mid-$600s, the stock recently consolidated around $745, reflecting a healthy pause to absorb gains before a potential breakout. The 200-day moving average continues its upward trajectory, reinforcing the long-term bullish outlook and acting as a key support level. With the RSI at 66, the stock is approaching overbought territory but remains below critical thresholds, indicating room for further upside if buying pressure persists. A decisive move above recent highs could propel GS to new all-time highs.

Fundamental Analysis

GS’s fundamentals highlight a mix of operational efficiency, earnings strength, and disciplined capital allocation. The firm has delivered consistent earnings beats in recent quarters, supported by resilient trading revenue and recovering investment banking activity. Its profitability metrics outpace most peers, aided by strong cost controls and high-margin businesses. Additionally, valuation remains attractive relative to the sector despite the recent price appreciation.

Options Trade

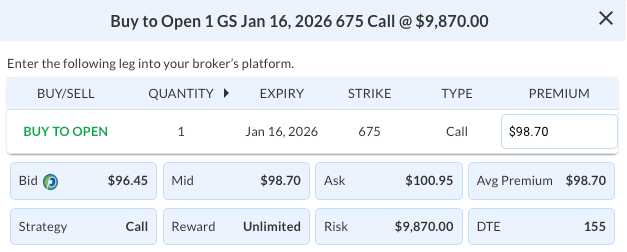

A long-dated call option provides leveraged exposure to GS’s long-term growth potential while capping downside risk to the premium paid. The suggested trade is to Buy to Open 1 GS Jan 16, 2026 675 Call @ $98.70 for a total cost of $9,870. This deep-in-the-money call offers high delta exposure, effectively mimicking stock ownership with significantly reduced capital requirements. The strike price sits well below current levels, providing intrinsic value and lowering the breakeven to $773.70 by expiration. Risk is limited to the premium paid, while upside remains unlimited if GS continues its uptrend over the next 17 months, particularly if macro tailwinds and M&A activity accelerate.

And then below we have an alternative trade for those who are not looking for a stock replacement and just want pure options exposure to GS.

Alternate Options Trade

This trade is a GS Dec 19, 2025 750/800 Call Vertical Spread, entered for a net debit of $2,095. It involves buying the 750 strike call for $45.43 and selling the 800 strike call for $24.48, creating a bullish position with defined risk and reward. The maximum profit potential is $2,905 if GS closes at or above $800 at expiration, while the maximum loss is the initial debit of $2,095. This gives a reward-to-risk ratio of about 1.39:1. With 127 days to expiration, the trade benefits from upward movement toward the $800 strike.

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 1 GS Jan 16 $675 Call @ $98.70 Debit per Contract.

Total Risk: This trade has a max risk of $9,870 (1 Contract x $9,870) roughly 13% of buying 100 shares of GS. We suggest using this longer dated call option as a more capital efficient way to capture upside using options.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 87

Stop Loss: If GS is below $675 (strike price) close the trade.

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 1 GS Dec 19 $750/$800 Call Vertical Spreads @ $20.95 Debit per Contract.

Total Risk: This trade has a max risk of $2,095 (1 Contract x $2,095) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $2,095 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 97

Stop Loss: @ $10.48 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

MA Bullish Opening Trade Signal Investment Rationale...

Read More

PM Bearish Opening Trade Signal Investment Rationale...

Read More

LOW Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on