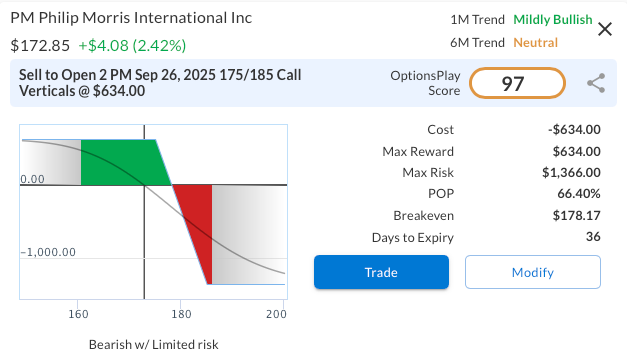

DailyPlay – Opening Trade (PM) – August 21, 2025

PM Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

With a premium valuation and softening margins, Philip Morris International offers limited upside while carrying heightened downside risk. The company’s inability to sustain profitability growth at levels that justify its multiple leaves shares vulnerable, particularly as price action continues to reject higher levels. This alignment of weak fundamentals and technical resistance supports a bearish stance.

Technical Analysis

The recent bounce in PM has stalled at the 50-day moving average, underscoring the lack of follow-through from buyers. The move fits the pattern of a counter-trend rally within a broader downtrend, rather than a true reversal. A decisive break of the $160 support level could act as a catalyst for accelerated selling, opening the door to a retest of $130 and confirming the bearish setup.

Fundamental Analysis

Philip Morris maintains stronger revenue and earnings growth than industry averages, but its valuation premium and weaker margins highlight a disconnect. Investors are paying a higher multiple for growth that may already be priced in, while profitability lags peers. This imbalance increases downside risk should growth expectations disappoint.

- Forward PE Ratio: 22.03x vs. Industry Median 17.36x

- Expected EPS Growth: 11.80% vs. Industry Median 7.57%

- Expected Revenue Growth: 7.84% vs. Industry Median 3.68%

- Net Margins: 21.08% vs. Industry Median 32.23%

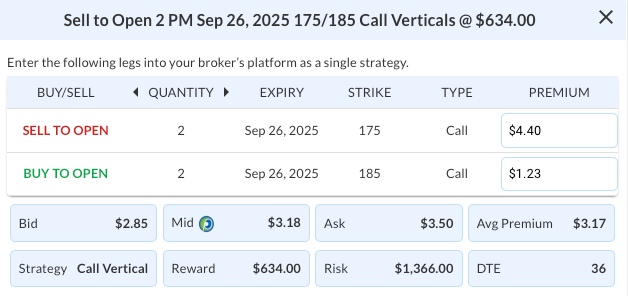

Options Trade

To capture downside while defining risk, consider the Sep 26, 2025 175/185 call credit spread. This trade sells the 175 strike call and buys the 185 strike call for a net credit of $3.17, offering a maximum reward of $317 against a maximum risk of $683 per contract. The position profits if PM stays below $175, aligning with the expectation that resistance near the 50-day moving average holds. The structure provides favorable risk/reward and defined risk while taking advantage of bearish technical and fundamental signals.

PM – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 PM Sep 26 $175/$185 Call Vertical Spreads @ $3.17 Credit per Contract.

Total Risk: This trade has a max risk of $1,366 (2 Contract x $683) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $683 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Mildly Bullish/Neutral

Relative Strength: 9/10

OptionsPlay Score: 97

Stop Loss: @ $6.34 (100% loss to value of premium)

View PM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View PM Trade

More DailyPlay

DailyPlay – Opening Trade (LOW) – August 19, 2025

LOW Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Portfolio Review – August 18, 2025

DailyPlay Portfolio Review Our Trades AMZN – 32 DTE...

Read More

DailyPlay – Opening Trade (AMZN) & Closing Trade (LOW) – August 15, 2025

Closing Trade AMZN Bullish Opening Trade Signal Investment...

Read More

Share this on