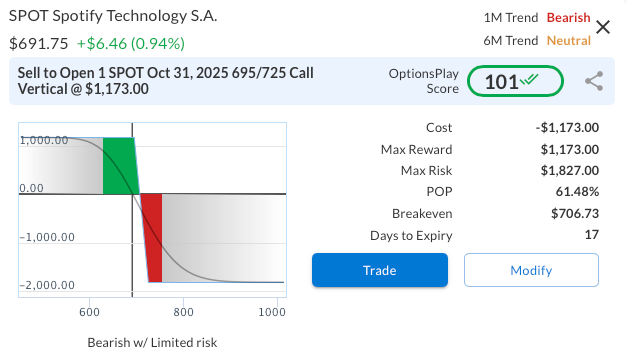

DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

Spotify Technology S.A. (SPOT) provides audio streaming subscription services worldwide through its Premium and Ad-Supported segments. Despite its strong brand recognition and market leadership, the company’s recent performance highlights growing operational challenges. SPOT has missed EPS expectations in each of the last four quarters, with the most recent June 2025 report showing a sharp swing to a loss of –$0.48 vs. a $2.13 consensus, underscoring weakening profitability. Shares, now near $692, remain well below their $785 peak as investors question cost discipline and growth sustainability amid fierce competition from Apple Music and YouTube. While Spotify’s global scale remains an advantage, its elevated valuation and deteriorating earnings trajectory keep the risk/reward profile skewed to the downside.

Technical Analysis

From a technical perspective, SPOT’s powerful 130% advance from the November 2024 lows around $300 culminated in a failed breakout attempt near $785 in June 2025. Since then, the stock has carved out a broad consolidation pattern, with the recent rebound to $692 representing a modest corrective move rather than a sustained reversal. Price action remains constrained below the flattening 20-day and 50-day moving averages, which have converged and now serve as firm resistance around $700. Momentum indicators continue to favor the bears, and a breakdown through the $663 support level could open the path toward the 200-day moving average at $611, reinforcing the bearish technical bias.

Fundamental Analysis

Spotify’s premium valuation remains difficult to justify amid mixed growth execution and rising competitive pressures. While the company’s leadership position and user growth remain strengths, margin improvement has lagged expectations, and investors are increasingly questioning the scalability of its model. Current valuation and profitability data highlight this imbalance:

- Forward PE Ratio: 51.59x vs. Industry Median 21.29x

- Expected EPS Growth: 45.57% vs. Industry Median 13.75%

- Expected Revenue Growth: 17.59% vs. Industry Median 13.01%

- Net Margins: 4.72% vs. Industry Median 3.98%

Options Trade

To express a bearish view with defined risk, consider selling the SPOT Oct 31, 2025 695/725 Call Vertical for a net credit of $11.73. This trade profits if SPOT remains below $695 at expiration, with a maximum reward of $1,173 and maximum risk of $1,827. The October 31, 2025 expiration was deliberately chosen to avoid exposure to the November 4 earnings report, thereby minimizing event-driven risk while maintaining exposure to a potential downside continuation into late October.

SPOT – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 1 SPOT Oct 31 $695/$725 Call Vertical Spreads @ $11.73 Credit per Contract.

Total Risk: This trade has a max risk of $1,827 (1 Contract x $1,827) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,827 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Neutral

Relative Strength: 7/10

OptionsPlay Score: 101

Stop Loss: @ $23.46 (100% loss to value of premium)

View SPOT Trade

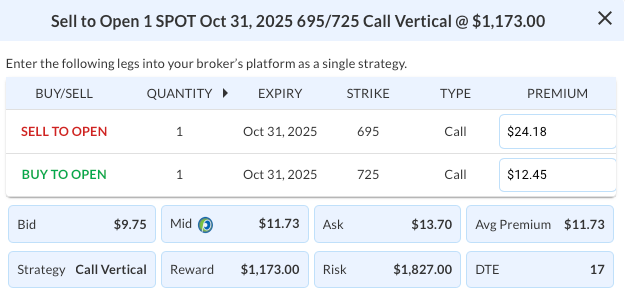

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SPOT Trade

More DailyPlay

DailyPlay – Opening Trade (MU) – December 04, 2025

MU Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Adjusting Trade (META) – December 02, 2025

META Bullish Trade Adjustment Signal Investment...

Read More

Share this on