DailyPlay – Opening Trade (SPY) & Closing Trade (C) – October 15, 2025

Closing Trade

- C – 38% gain: Sell to Close 5 Contracts (or 100% of your Contracts) Oct 31 $95/$105 Call Vertical Spreads @ $5.04 Credit. DailyPlay Portfolio: By Closing 5 Contracts, we will be collecting $2,520. We initially opened these 5 contracts on October 09 @ $3.65 Debit. Our gain, therefore, is $695.

SPY Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

On Day 14 of the U.S. government shutdown, the ongoing political stalemate in Washington continues to pressure market sentiment. With Democrats and Republicans still deadlocked over funding measures, investors face heightened uncertainty at a time when global markets are already strained by escalating trade tensions. The tariff war with Chinahas intensified, as new U.S. levies on imported wood, furniture, and cabinetry take effect alongside Beijing’s export restrictions on rare earth metals and battery components. These combined fiscal and trade headwinds underscore rising risks to growth, supply chains, and corporate margins. Against this backdrop of policy gridlock and global economic fragility, short-term downside in SPY appears increasingly likely, making bearish exposure through options a timely tactical play.

Technical Analysis

SPY has broken below its short-term uptrend, with price now testing support near the 50-day moving average. The 20-day MA has rolled over, signaling a loss of momentum after an extended rally through the summer. Price action shows a firm rejection at recent highs, and the appearance of a bearish engulfing candle confirms renewed selling pressure. A decisive break below the 50-day moving average could trigger a deeper retracement toward the prior consolidation range, where more meaningful support is likely to emerge. Until SPY reclaims the 20-day moving average and resumes forming higher highs, the technical bias remains bearish.

Fundamental Analysis

Macro conditions continue to soften as the combination of trade friction, persistent inflation, and weakening corporate earnings clouds the outlook. Elevated valuations leave little room for earnings disappointment, particularly with monetary policy still tight and fiscal operations disrupted by the government shutdown. Slowing consumer activity and increased import costs pose further risks to profitability, while the IMF’s subdued economic outlook reinforces the view that global growth momentum is losing steam. Altogether, these pressures point to a fragile environment for equities and justify maintaining a defensive posture toward SPY in the near term.

Options Trade

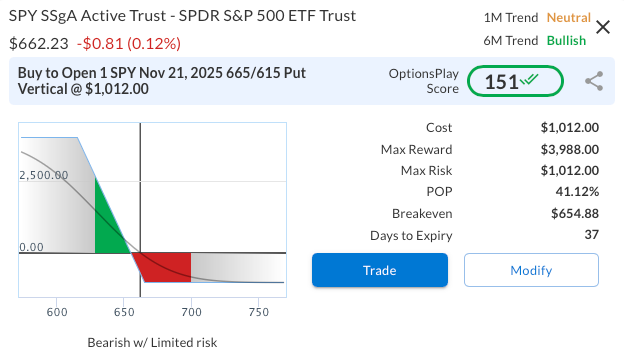

A SPY Nov 21, 2025, 665/615 Put Vertical Spread offers a defined-risk way to capture potential near-term weakness. The trade involves buying the 665 put and selling the 615 put for a net debit of $10.12 ($1,012 total cost). The maximum profit is $3,988 if SPY closes below 615 at expiration, while the maximum loss is capped at $1,012. This setup benefits from continued weakness over the next several weeks and offers an attractive risk/reward ratio of nearly 4:1. With 38 days until expiration, the position provides sufficient time for volatility expansion while minimizing exposure to time decay.

SPY – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 1 SPY Nov 21 $665/$615 Put Vertical Spreads @ $10.12 Debit per Contract.

Total Risk: This trade has a max risk of $1,012 (1 Contract x $1,012) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,012 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Neutral/Bullish

Relative Strength: 7/10

OptionsPlay Score: 151

Stop Loss: @ $5.06 (50% loss of premium)

View SPY Trade

Entering the Trade

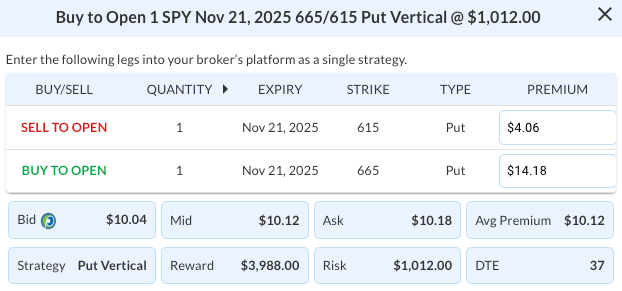

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View SPY Trade

More DailyPlay

DailyPlay – Opening Trade (MU) – December 04, 2025

MU Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Adjusting Trade (META) – December 02, 2025

META Bullish Trade Adjustment Signal Investment...

Read More

Share this on