DailyPlay – Opening Trade (GOOGL) & Closing Trade (USO) – July 16, 2025

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read MoreInvestment Thesis

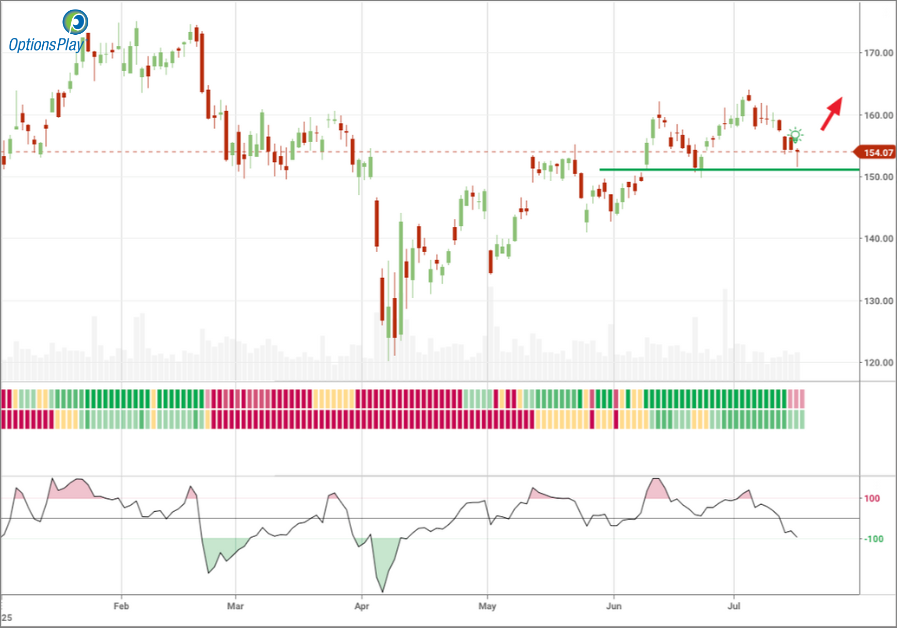

QUALCOMM (QCOM) presents a compelling bullish setup ahead of its earnings report on July 30, 2025. The company has outperformed consensus estimates for four consecutive quarters, highlighting operational consistency and execution strength. With sentiment modest and valuation attractive, QCOM offers upside potential into earnings season, supported by strong profitability metrics and a conservative multiple relative to peers. The recent pullback provides an entry point for bullish positioning through defined-risk strategies that benefit from the stock remaining above key support levels.

Technical Analysis

A bullish trend-following signal has emerged as QUALCOMM, Inc. has recently experienced a pullback within a broader uptrend that may provide favorable risk/reward for bullish trades. The stock is currently consolidating above the $150 level, holding the 50-day moving average ($152.86) with the 20-day just overhead at $157.01. While RSI is neutral at 45.57, price action remains constructive, and continued stability above $150 suggests buyers are defending trend support and positioning for another leg higher.

Fundamental Analysis

QUALCOMM continues to exhibit solid profitability and relative value in the semiconductor space, despite facing slower expected growth than the broader industry. Its lean valuation and best-in-class margins suggest the company is well-positioned for upside re-rating, particularly if it delivers another earnings beat.

Options Trade

Sell the QCOM Aug 15, 2025 150/145 Put Vertical for a $1.68 credit. This trade profits if QCOM remains above $150 at expiration, aligning with the view that the stock holds its current base into and post-earnings. Max profit is $168 per spread, with a defined max loss of $332, offering a 50.6% return on risk. The $150 short strike provides a technical cushion just below recent support, while the August expiry allows time for post-earnings momentum to play out. This is a high-probability income trade with favorable risk/reward.

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 6 QCOM Aug 15 $150/$145 Put Vertical Spreads @ $1.68 Credit per Contract.

Total Risk: This trade has a max risk of $1,992 (6 Contracts x $332) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $332 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Mildly Bearish/Mildly Bullish

Relative Strength: 3/10

OptionsPlay Score: 92

Stop Loss: @ $3.36 (100% loss to value of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read More

MS Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay Portfolio Review Our Trades GS – DTE...

Read More

ABNB – 0.37% loss: Buy to Close 3 Contracts (or 100%...

Read More

Share this on