DailyPlay – Opening Trade (AMZN) & Closing Trade (LOW) – August 15, 2025

Closing Trade AMZN Bullish Opening Trade Signal Investment...

Read MoreDailyPlay Portfolio Review

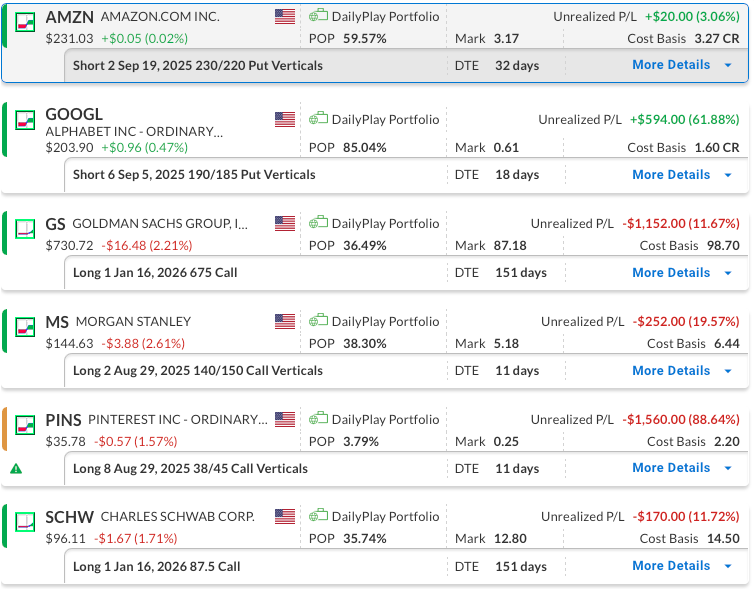

Our Trades

AMZN – 32 DTE

Bullish Credit Spread – Amazon.com, Inc. (AMZN) – We recently established this position and we plan to stay the course for now.

GOOGL – 18 DTE

Bullish Credit Spread – Alphabet Inc. (GOOGL) – The position remains profitable. Bullish momentum continued last week, with GOOGL trading above all major moving averages. The 20-day moving average is acting as short-term support, so we plan to continue holding the trade.

GS – 151 DTE

Bullish Long Call – Goldman Sachs Group, Inc. (GS) – We recently established this position and we plan to stay the course for now.

MS – 11 DTE

Bullish Debit Spread – Morgan Stanley (MS) – The position is currently at a slight loss. We made an adjustment a few weeks ago to reduce overall risk, and with expiration drawing near, we will continue holding but will monitor it closely.

PINS – 11 DTE

Bullish Call Spread – Pinterest, Inc. (PINS) – The stock fell sharply following the company’s earnings announcement. The position is down near its maximum loss, and since we did not have the opportunity to close at the 50% stop loss, we may allow the position to run its course.

SCHW – 151 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We continue to see upside potential, supported by strong fundamentals and resilience in the financial sector. We closed our initial long call position once the option’s delta hit 1.00, then shifted into a higher strike call with a 0.80 delta and a later expiration. We plan to hold steady with this adjustment.

Closing Trade AMZN Bullish Opening Trade Signal Investment...

Read More

GS Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade LOW Bullish Opening Trade Signal Investment...

Read More

Share this on