DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read MoreStrategy: Long Call Spread Risk Reversal

Direction: Bullish

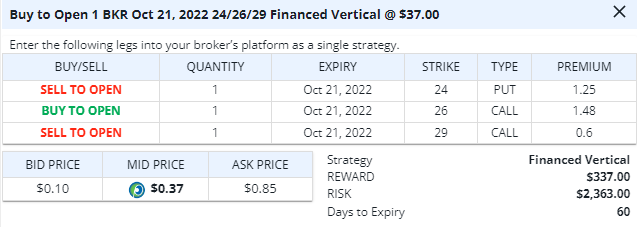

Details: Buy to Open 1 Contract October 21, 2022 $24/$26/$29 Call Spread Risk Reversal @ $0.37 Credit.

Total Risk: This trade has a max risk of $2,363 (1 Contract x $2,363).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a neutral to bearish trend.

1M/6M Trends: Neutral/Bearish

Technical Score: 4/10

OptionsPlay Score: 125

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Today’s DailyPlay is Baker Hughes Company (BKR), which is currently down 40% from its all-time highs. If we look at the OIH ETF (Oil Services EFT), of which BKR is part of, we see a very clear uptrend over the last few years. OIT has pulled back towards the trendline and now we have seen a bounce higher, which is likely going to continue. When we look at the chart of BKR, we see the same clear uptrend where we pulled back to after the 40% decline, and we believe that this is where it will bounce higher and continue higher. Looking at the relative performance of BKR to OIH, we can see that BKR is trading largely on par with the ETF, we, therefore, expect both BKR and OIH to bounce higher, with BKR most probably outperforming this ETF.

BKR – Weekly

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on