DailyPlay – Portfolio Review – August 04, 2025

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read MoreAlphabet Inc. (GOOGL) presents a compelling bullish opportunity as a high-quality mega-cap growth name that appears to be basing following a steep correction. The recent drawdown has created an attractive entry point for long-term investors, particularly as broader market sentiment begins to rotate back into tech leadership. With valuation metrics now modestly below peers and improving earnings visibility, GOOGL offers a favorable asymmetric setup into upcoming catalysts. Most notably, the company is set to report earnings on Thursday, April 24th after the market close, which could serve as a meaningful trigger for a trend reversal.

GOOGL is currently stabilizing after an extended downtrend, with price action finding support near the $140–$145 zone. The recent bounce from oversold territory on both daily and weekly timeframes, combined with bullish divergence on momentum indicators, suggests a potential trend reversal. Price is now testing the declining 20-day moving average, with a move above $155 likely confirming a short-term base. Upside targets include the $165 and $185 resistance zones, with improving volume trends lending support to the rally setup.

GOOGL’s fundamentals remain solid despite the recent correction in share price, positioning the stock as modestly undervalued relative to its sector:

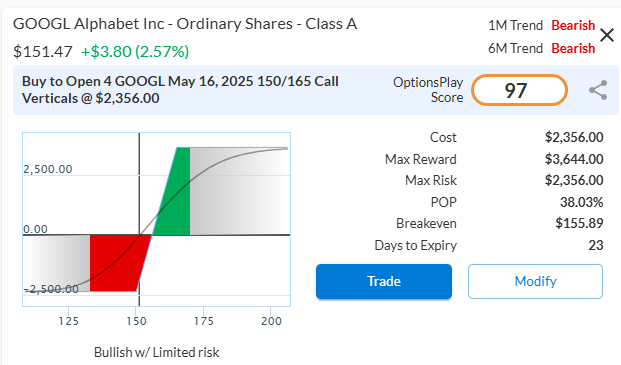

Buy the GOOGL May 16th, 2025 $150/$165 call vertical for $5.89. This spread offers a defined-risk bullish exposure heading into a key catalyst: Alphabet is scheduled to report earnings on Thursday, April 24th after the close, which could spark a sharp move if results exceed subdued expectations. The trade risks $589 to make up to $911, with breakeven at $155.89 and max profit if GOOGL closes at or above $165 by expiration. This structure captures a potential post-earnings gap higher while limiting downside, making it an attractive setup for a tactical swing long with 4:1 reward-to-risk and 23 days to play out.

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 4 Contracts GOOGL May 16 $150/$165 Call Vertical Spreads @ $5.89 Debit per Contract.

Total Risk: This trade has a max risk of $2,356 (4 Contracts x $589) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $589 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is expected to bounce higher over the coming earnings announcement.

1M/6M Trends: Bearish/Bearish

Relative Strength: 5/10

OptionsPlay Score: 97

Stop Loss: @ $2.95 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade FSLR Bullish Opening Trade Signal Investment...

Read More

Share this on