DailyPlay – Opening Trade (GS) – August 14, 2025

GS Bullish Opening Trade Signal Investment Rationale...

Read More

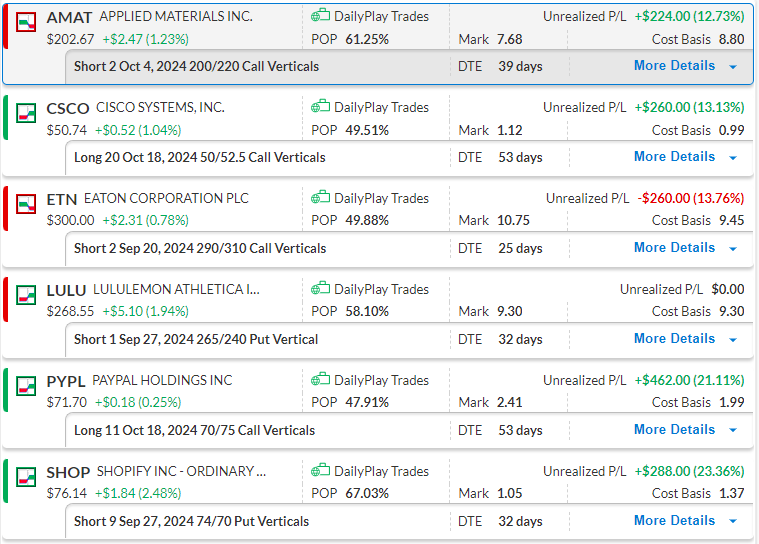

As equities rally back towards their all-time highs, bond markets and other asset classes are confirming a risk-on environment. All eyes are on NVDA earnings this week, as AI has lead this market higher over the past 18 months and investors are keeping a close eye on CapEx spending and its future expected revenue. Any surprises to NVDA chip demand will likely have a large affect on how equities perform going forward. We are taking this time to review our DailyPlay portfolio.

Bearish Credit Spread – AMAT is pulling back from a recent lower high and a break below $200 will likely target support at $190.

Bullish Debit Spread – Following a break above $50 CSCO is continuing higher. The next key level is at around $54.

Bearish Credit Spread – Resistance at $300 remains intact and a break lower is likely following, with the next area of support at around $275.

Bullish Credit Spread – Following a bounce off support at $250 LULU continues to grind higher, likely targeting a key level at around $295.

Bullish Debit Spread – We will keep a close eye on this trade as we see possible consolidation at this price level. A break above $73 is needed to warrant keeping this position.

Bullish Credit Spread – SHOP remains in a strong bullish trend with the next key level being at $80.

GS Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade LOW Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Share this on