$AWK

DailyPlay Taking Profits (AWK) – March 15, 2022

Taking Profits

- AWK:82% Gain: Sell to close Mar 18, 2022 $145/$155 Call Vertical @ $6.75 Credit. Please note, that half of this position was closed on Mar 4 at $6.30 Credit. Therefore, the average price of the entire position is $6.75, between the $6.30 and $7.20 closing prices.

- MRNA Update – on Thursday, March 10, we sent an MRNA bullish signal where we recommended only opening half a position size, and adding the other half any subsequent day MRNA closes above the previous day’s close. While this condition was met yesterday, we will not be adding to our MRNA position due to the strong move higher yesterday.

$TAN

TAN Bullish Opening Trade Signal – March 14, 2022

View TAN Trade

Strategy Details

Strategy: Put Credit Spread

Strategy Direction: Bullish

Details: Sell to open April 22, 2022 $74/$66 Put Vertical @ $3.32 Credit

Trend Continuation Signal: This is a bullish vertical spread trade on the a ETF that has a bullish 1M trend.

1M/6M Trends: Bullish/Neutral

Technical Score: 6/10

OptionsPlay Score: 92

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Our bullish DailyPlay today is the Solar Invesco ETF (TAN). TAN is an ETF that has strong exposure to companies within the solar industry. The rationale behind this bullish play comes down to sharp moves higher in oil and electricity prices that has reignited interest in solar energy. From a technical perspective, price has recently formed an inverted head and shoulders pattern and has also broken above the $68 support level with strong momentum. This provides evidence of further upside ahead with the next major resistance level at $100.

$XBI

XBI Bullish Opening Trade Signal – March 11, 2022

View XBI Trade

Strategy Details

Strategy: Call Debit Spread

Strategy Direction: Bullish

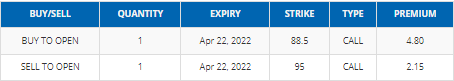

Details: Buy to open April 22, 2022 $88.5/$95 Call Vertical @ $2.65 Debit

Counter Trend Signal: This is a bullish strategy on a stock or ETF that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 89

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Though falling sharply since November, the ETF is about 50% of its all-time high; has been basing for over a month; and earlier this week posted a daily Combo -13 signal from its most oversold level to its 200-DMA we’ve seen in a couple of years.

Thus, we will look to buy an April 22nd $88.5/$95 call vertical for $2.65 debit – its closing mid-price spread from yesterday.

$MRNA

MRNA Bullish Opening Trade Signal – March 10, 2022

View MRNA Trade

Strategy Details

Strategy: Call Debit Spread

Strategy Direction: Bullish

Details: Buy to open April 22, 2022 $140/$170 Call Vertical @ $10.40 Debit

Counter Signal: This is a bullish strategy on a stock or ETF that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 1/10

OptionsPlay Score: 103

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

MRNA has sold off some 60% from all-time highs, with it even having been as much as 75% off that high earlier this week. But it held the March 2021 low this week, which was the last low before last year’s surge higher, while also three weeks ago marking a weekly Setup -9 count and this week seeing the weekly cloud’s Lagging Line bounce on the top of its cloud. It also bottomed against the most recent downtrend line drawn. Yesterday’s large move higher is attributed to a sell-side analyst upgrading the name. That may be the first of several more to come, and we think it’s now worth getting long for a trading bounce.

Thus, we will look to buy an April 22 $140/$170 call spread for a $10.40 debit – its closing mid-price spread from yesterday.

$TJX

DailyPlay Closing Trade (TJX) – March 9, 2022

Closing Trade

- TJX:64% Loss: Sell to close Apr 14, 2022 $65/$72.5 Call Verticals @ $0.95 Credit.

Equities experienced a quick reversal yesterday on news regarding a possible ceasefire between Russia and Ukraine, however, the major indices reversed lower to end the day in the red. SPY and QQQ are set to open higher this morning but still remain below the $428 and $341 key levels respectively. We take this opportunity to close the TJX position that broke below the $63 major support level recently, thus invalidating our thesis.

$XLI

DailyPlay – SPDR Industrial ETF (XLI) – March 8, 2022

View XLI Trade

XLI Bearish Opening Trade Signal

Strategy Details

Strategy: Put Debit Spread

Strategy Direction: Bearish

Details: Buy to open April 14, 2022 $97/$89 Put Vertical @ $2.09 Debit. Please note that the price at the open may differ slightly due to pre-market activity and wider bid/ask spreads at the close. Adjust the strikes based on how far XLI opens from yesterday’s closing price at $97.70. Please refer to the DailyPlay video at the bottom of this email to learn more.

Bearish Trend Signal: This is a bearish strategy on a stock or ETF that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 6/10

Investment Rationale

Weekly Lagging Line has now broken its Base Line, while cloud top and Conversion and Base Lines are last and this week’s highs. We’ll look for this to decline to cloud bottom, using the weekly close above cloud top at $102 as an area where we know we don’t want to be short.

$SPY

DailyPlay – SPDR S&P 50 ETF (SPY) – March 7, 2022

View SPY Trade

SPY Bearish Hedge Opening Trade Signal

Strategy Details

Strategy: Put Debit Spread

Strategy Direction: Bearish

Details: Buy to open April 14, 2022 $422/$387 Put Vertical @ $7.48 Debit

Hedge Signal: This is a bearish vertical spread trade on the SPY ETF to hedge against further market decline

1M/6M Trends: Bearish/Bearish

Technical Score: 6/10

OptionsPlay Score: 132

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

As the implied correlation of stocks rise with the high market volatility, it is time to play more defensive, and placing a hedge to protect against further decline is our DailyPlay trade today. SPY’s trends have turned bearish and price has broken below a 2-year trendline indicating further downside is on the cards. With the ongoing crisis in Ukraine, the geopolitical picture is also negative. Thus, we will look to buy the April 14 $422/$387 put spread for a $7.48 Debit (Friday’s close price). This trade will act as a hedge against further market declines.

In the event that SPY opens significantly below $429, the strike prices may need to be adjusted accordingly.

$MS

DailyPlay Taking Profits (MS) – March 4, 2022

Taking Profits

- MS: 95% Gain: Buy to close Apr 1, 2022 $102/$109 Call Verticals @ $0.12 Debit.

Risk appetite took a hit this morning as news relating to a nuclear power station attack dragged European Indices lower this morning. Both SPY and QQQ are showing signs of weakening momentum despite the strong bounce at the end of last week and both indices are failing to break above their 21 D EMA. We take this opportunity to close the remainder of the MS position which is just shy of max profit with 28 days to expiration.

Please note, that half of this position was closed on Feb 25 at $0.58 Debit. Therefore, the average price of the entire position is $0.35, between the $0.58 and $0.12 closing prices.

$AWK

Taking Partial Profits (AWK) – Mar 3, 2022

- AWK:59% Gain: Sell to close Mar 18, 2022 $145/$155 Call Vertical @ $6.30 Credit. Close half of this position. For example, if 10 contracts were opened for this trade, we recommend closing 5 contracts.

While the ongoing Ukraine conflict continues to add pressure to markets, equities managed to move higher yesterday as investors reacted positively to the Fed’s rate hikes being less aggressive than originally estimated. However, Fed Chair, Jerome Powell, stated that a more aggressive approach would be warranted in the event that inflation does not cool as quickly as expected. Both SPY and QQQ managed to end the day in the green and remain above key support areas at $429 and $341 respectively.

$PAAS

DailyPlay – Pan American Silver (PAAS) – March 2, 2022

PAAS Bullish Opening Trade Signal

Strategy Details

Strategy: Call Debit Spread

Strategy Direction: Bullish

Details: Buy to open April 14, 2022 $26/$30 Call Vertical @ $1.11 Debit

Bullish Trend Signal: This is a bullish strategy on a stock or ETF that is experiencing a bullish 1M trend.

1M/6M Trends: Bullish/Neutral

Technical Score: 7/10

OptionsPlay Score: 124

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

With the Ukraine crisis continuing, many markets have recently turned around, including bond yields peaking; the dollar getting a bid; stocks still pulling back, and precious metals seeing new life after a long sleep time. It is the latter that will be our focus for today’s Options Play, for we see the beginnings of a new upside breakout in Pan American Silver Corp. (PAAS).

Yesterday we saw a bullish closing breach of the horizontal, green-dashed line that represents the highs of the two-month trading range ($25.55) and a stall right against the downtrend line ($25.73 today and falling 5 cts./day) from the Feb. 2021 high (in light blue). We think in short order that this will get a more substantial upside breakout that will exceed the November highs to target the unfilled gap between $29.94 and $30.26.

Therefore, we are going to look to buy the April 14th $26/$30 call vertical spread at last night’s closing mid-price ($1.11) or better. We are laying out only 27.75% of the strike differential. The maximum gain on this is $2.89. (Should we wake up to find that metals are down sharply Tues. morn, you could also consider the April $25/$30 vertical.)