PM

DailyPlay – Closing Trade (PM) – December 05, 2025

Closing Trade

- PM – 38% gain: Buy to Close 3 Contracts (or 100% of your Contracts) Dec 19 $150/$160 Call Vertical Spreads @ $2.30 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $690. We initially opened these 3 contracts on November 07 @ $3.70 Credit. Our gain, therefore, is $420.

MU

DailyPlay – Opening Trade (MU) – December 04, 2025

MU Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Micron Technology (MU) remains a compelling bullish opportunity as the company continues to benefit from structural demand strength in AI-driven memory and storage markets. With earnings scheduled for Wednesday, December 17th after the close, the setup favors continued momentum as investors position for potentially strong guidance tied to improving DRAM/NAND pricing and accelerating data-center demand. The stock’s recent performance underscores a market increasingly willing to reward high-quality semiconductor names with exposure to AI infrastructure, supporting a constructive medium-term outlook.

Technical Analysis

After pushing through its earlier consolidation zone, MU has sustained notable outperformance relative to the broader semiconductor space and the overall market. Price remains firmly anchored above the 50-day and 200-day moving averages, while the 20-day moving average is acting as a resistance level. The stock’s strong recovery from its recent dip improves the setup, and a move back through the $244.37 short-term high would reinforce momentum toward the $250 objective.

Fundamental Analysis

Micron screens as substantially undervalued relative to peers despite materially better growth and margin expectations. The company is entering a favorable phase of the memory cycle supported by strengthening pricing, expanding AI-related demand, and disciplined supply management across the industry. MU’s forward valuation reflects skepticism that appears misaligned with its accelerating fundamental trajectory, especially given the company’s leadership position in high-performance memory essential to AI compute architectures.

- Forward PE Ratio: 13.86x vs. Industry Median 26.41x

- Expected EPS Growth: 37.98% vs. Industry Median 18.61%

- Expected Revenue Growth: 21.38% vs. Industry Median 10.60%

- Net Margins: 22.85% vs. Industry Median 14.16%

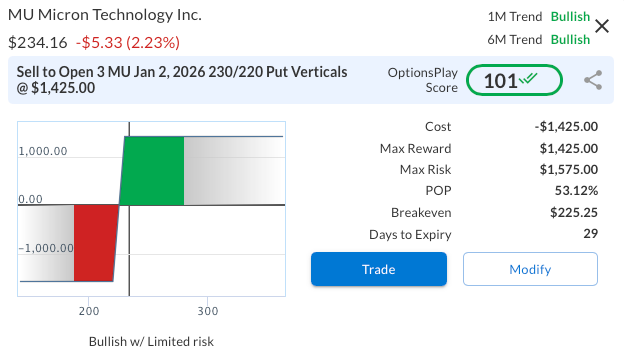

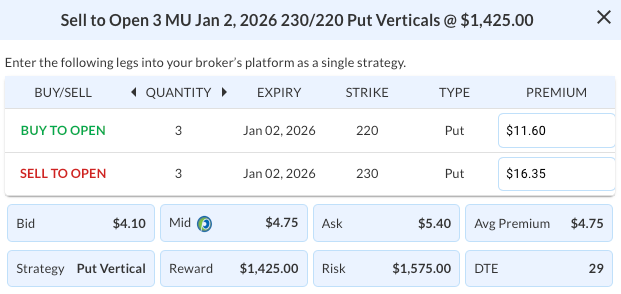

Options Trade

A favorable way to express a bullish stance ahead of the December 17 earnings event is the MU Jan 2, 2026 230/220 Put Vertical spread, selling the 230 strike put and buying the 220 strike put for a net credit of approximately $4.75, offering a $475 maximum reward against a defined $525 maximum risk. This structure benefits from MU holding above the $230 level—consistent with current technical support—and provides a cushion below spot, allowing the trade to profit even if the stock pulls back modestly after earnings. The spread offers attractive risk-adjusted income while maintaining directionally bullish exposure with limited downside.

MU – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 MU Jan 02 $230/$220 Put Vertical Spreads @ $4.75 Credit per Contract.

Total Risk: This trade has a max risk of $1,575 (3 Contracts x $525) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $525 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 101

Stop Loss: @ $9.50 (100% loss to value of premium)

View MU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MU Trade

NVDA

DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

NVIDIA Corporation continues to represent a premier AI and semiconductor leader, supported by accelerating demand across data center, enterprise AI, and next-generation GPU deployments. While near-term price action has been range-bound, the broader setup remains constructive as the company builds on its strong earnings results and robust forward guidance. NVDA’s dominant position in accelerated computing, combined with its expanding software and networking ecosystem, supports a durable long-term growth outlook. With fundamentals firmly intact and sentiment stabilizing after a healthy consolidation, the stock offers an attractive opportunity for investors seeking leveraged exposure to AI infrastructure growth.

Technical Analysis

NVIDIA’s technical picture has been relatively muted in recent weeks, with the stock building modest upside momentum off the $175 region before settling into a consolidation zone around $180. Price currently sits just below both the 20- and 50-day moving averages, reflecting a temporary loss of short-term trend strength. The $185 level remains an important region of interest, acting as overhead resistance and a prior breakout zone that NVDA has interacted with several times in recent months. Notably, the stock has not revisited its 200-day moving average, currently near $154, since breaking above it back in May, underscoring the durability of the broader uptrend. A sustained move back above the 50-day moving average would likely open the door for a retest of the $200 level and potential continuation higher. While the chart shows consolidation rather than decisive strength, the trade setup leans more heavily on fundamentals and the momentum stemming from the company’s recent earnings and guidance.

Fundamental Analysis

NVIDIA’s latest quarterly results reinforced its position as the clear leader in accelerated compute, supported by standout performance in data center and continued margin expansion. Despite sector volatility, NVDA’s growth trajectory remains well ahead of peers, and profitability continues to track at best-in-class levels. The company’s ability to convert demand into sustained revenue and earnings acceleration supports the case for continued multiple expansion relative to the industry.

- Forward PE Ratio: 23.25x vs. Industry Median 26.41x

- Expected EPS Growth: 48.89% vs. Industry Median 18.61%

- Expected Revenue Growth: 47.00% vs. Industry Median 10.60%

- Net Margins: 53.01% vs. Industry Median 14.16%

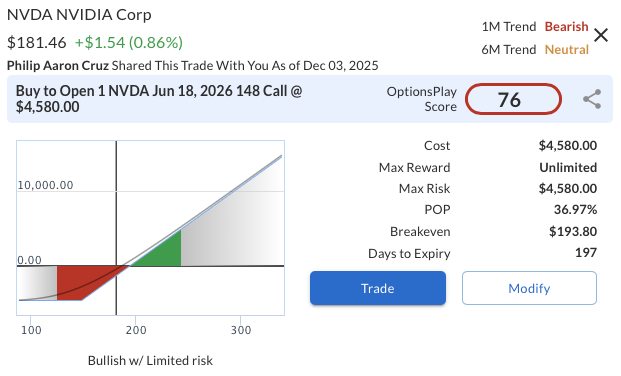

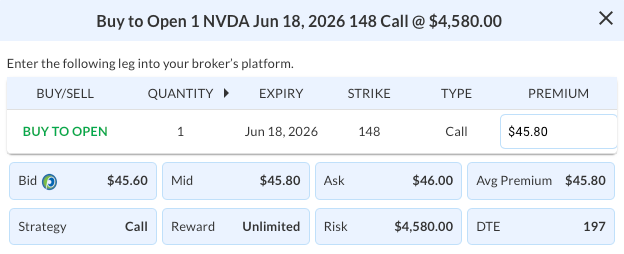

Options Trade

To express a fundamentally driven long-term bullish view, the preferred strategy is to Buy to Open the NVDA June 18, 2026 $148 Call at $45.80, requiring a total premium outlay of $4,580 per contract. This deep-in-the-money LEAPS call provides high delta exposure with defined risk, allowing participation in long-term appreciation without the capital commitment of owning shares outright. With nearly 200 days to expiration, the position provides ample time for the fundamental thesis—anchored in NVDA’s strong earnings, guidance, and AI leadership—to play out. Risk is limited strictly to the premium paid, while upside remains unlimited, creating an attractive asymmetry for a fundamentally driven long-term setup.

NVDA – Daily

Trade Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 1 NVDA Jun 18 $148 Call @ $45.80 Debit per Contract.

Total Risk: This trade has a max risk of $4,580 (1 Contract x $4,580) roughly 25% of buying 100 shares of NVDA. We suggest using this longer dated call option as a more capital efficient way to capture upside using options.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bearish/Neutral

Relative Strength: 8/10

OptionsPlay Score: 76

Stop Loss: If NVDA is below $148 (strike price) close the trade.

View NVDA Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NVDA Trade

META

DailyPlay – Adjusting Trade (META) – December 02, 2025

META Bullish Trade Adjustment Signal

Investment Rationale

Adjustment Rationale:

We continue to hold a positive outlook on Meta Platforms, Inc. (META), and while we remain bullish, we are cautious in the short term. The recent pullback in the hyperscalers, including META, created a favorable setup for a longer-term bullish approach, so we opened the position by purchasing a deep-in-the-money June 18th expiration call option. We currently have a gain in the position and intend to remain bullish longer term, but the OptionsPlay platform generated a Bearish Trend Following Alert, indicating META has rallied within a broader bearish trend. As a hedge for the long-term call position, we will sell a short-term call against the longer-dated call to help lower the cost basis.

Adjustment Trade:

META @ $640.87

Days to Expiration (DTE): 18

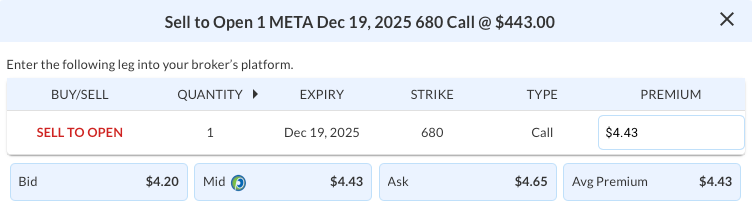

Sell to Open 1 META Dec 18, 2025 680 Call @ $4.43

Mid: $4.43

Premium Received: $443.00 per call option sold

or $443 total adjustment in the cost basis for the position.

The total risk for the new position is $13,620 (original cost basis) minus $443 (net credit), resulting in a revised cost basis of $13,177.

Resulting Position:

Long 1 META Jun 18, 2026 490 Call

Short 1 META Dec 19, 2025 680 Call

New cost basis and total risk: $13,177

META – Daily

Trade Details

Strategy Details

Strategy: Short Call

Direction: Resulting in a new Bullish Diagonal Spread

Details: Sell to Open 1 META Dec 19 $680 Call @ $4.43 Credit.

Total Risk: The resulting position has a maximum risk of $13,177 (13,620-443), calculated as the initial cost basis of the long call ($13,620) minus the premium received from the adjustment ($443).

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of the trade.

1M/6M Trends: Neutral/Bearish

Relative Strength: 3/10

Stop Loss: @ $65.89 (50% loss of premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

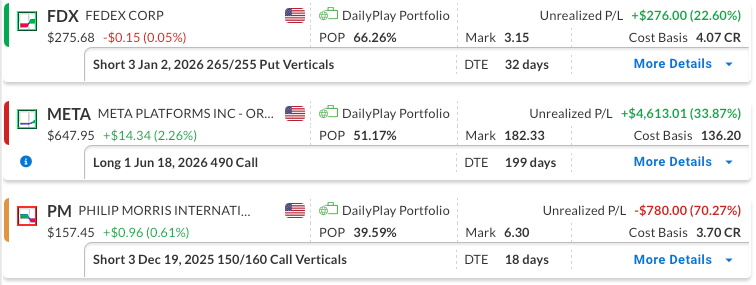

DailyPlay – Portfolio Review – December 01, 2025

DailyPlay Portfolio Review

Our Trades

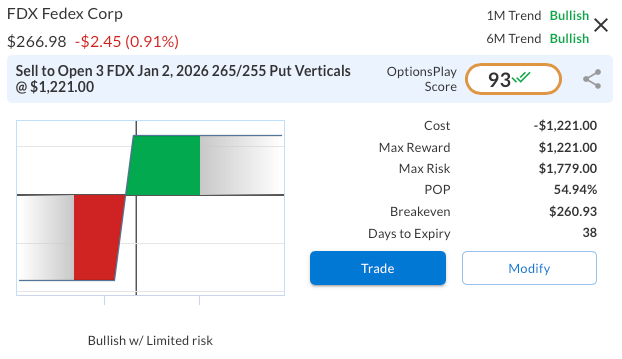

FDX – 32 DTE

Bullish Credit Spread – FedEx Corp (FDX) – We recently established this position, currently have a gain, and plan to stay the course for now.

META – 199 DTE

Bullish Long Call – Meta Platforms, Inc. (META) – The short-lived market dip and META’s pullback have created a favorable setup for a longer-term bullish approach. We currently have a gain in the position and intend to maintain it for now, and will look for an opportunity to sell a short-term call against the longer-dated call to lower the cost basis of the long call.

PM – 18 DTE

Bearish Credit Spread – Philip Morris (PM) – The stock remains in a consolidation phase. With expiration approaching and the position currently at a loss, we will likely close the trade unless a bearish trend emerges early next week.

NVDA

DailyPlay – Closing Trade (NVDA) – November 26, 2025

Closing Trade

- NVDA – 89% loss: Buy to Close 3 Contracts (or 100% of your Contracts) Dec 12 $190/$180 Put Vertical Spreads @ $7.18 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $2,154. We initially opened these 3 contracts on November 12 @ $3.79 Credit. Our loss, therefore, is $339 per contract.

FDX

DailyPlay – Opening Trade (FDX) & Closing Trade (LMT) – November 25, 2025

Closing Trade

- LMT – 110% loss: Buy to Close 2 Contracts (or 100% of your Contracts) Dec 05 $485/$470 Put Vertical Spreads @ $14.10 Debit. DailyPlay Portfolio: By Closing 2 Contracts, we will be paying $2,820. We initially opened these 2 contracts on October 28 @ $6.70 Credit. Our loss, therefore, is $740 per contract.

FDX Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

FedEx (FDX) continues to demonstrate improving momentum supported by stabilizing demand trends and favorable sector dynamics. With shares breaking out and sentiment strengthening, the stock appears positioned for continued appreciation into 2025. The combination of modest valuation, steady forward growth expectations, and firm price action supports a bullish directional view with a preference for strategies that take advantage of elevated premium levels and defined risk.

Technical Analysis

After FDX broke above the key $250 resistance area at the beginning of November, the stock has built strong upside momentum. The 50-day moving average has crossed above the 200-day (a golden cross), and the stock is now trading above the 20-, 50-, and 200-day moving averages, signaling a healthy uptrend with broad participation.

Fundamental Analysis

FDX trades at a discount to peers despite maintaining growth and profitability metrics that largely align with industry norms. While margins remain below peak levels, the company has made visible progress in cost efficiency, creating a path for improved operating performance if volume trends continue to recover. This valuation gap offers potential for multiple expansion should execution stay on track.

- Forward PE Ratio: 14.90x vs. Industry Median 18.87x

- Expected EPS Growth: 9.27% vs. Industry Median 10.85%

- Expected Revenue Growth: 4.02% vs. Industry Median 4.05%

- Net Margins: 4.65% vs. Industry Median 5.20%

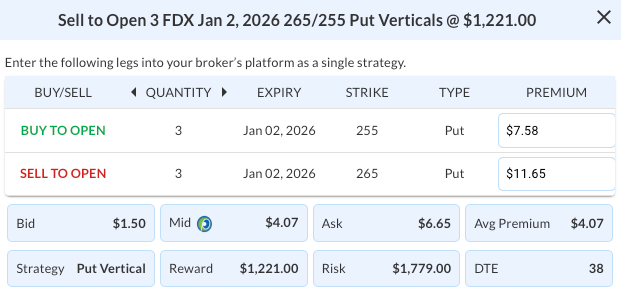

Options Trade

To express a bullish view with defined risk, consider selling the Jan 2, 2026 265/255 put vertical for a credit of approximately $4.07. This spread brings in $4.07 in premium against a maximum potential loss of $5.93, resulting in a solid risk-reward ratio of roughly 1.46:1 for a neutral-to-bullish trade. The position benefits from FDX remaining above $265 at expiration, with exposure limited and defined.

FDX – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 FDX Jan 02 $265/$255 Put Vertical Spreads @ $4.07 Credit per Contract.

Total Risk: This trade has a max risk of $1,779 (3 Contracts x $593) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $593 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 93

Stop Loss: @ $8.14 (100% loss to value of premium)

View FDX Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View FDX Trade

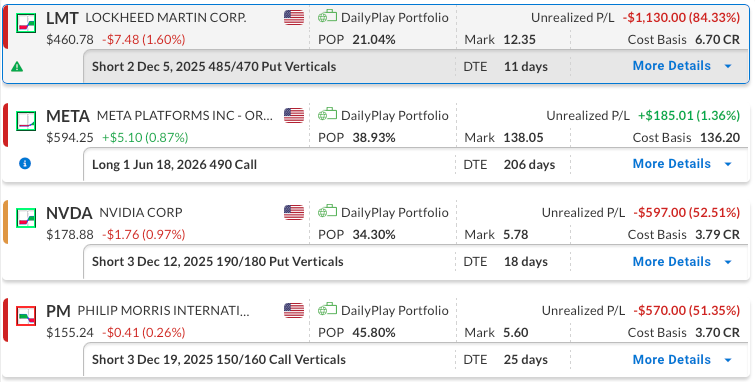

DailyPlay – Portfolio Review – November 24, 2025

DailyPlay Portfolio Review

Our Trades

LMT – 11 DTE

Bullish Credit Spread – Lockheed Martin Corp. (LMT) – The US government shutdown had weighed on LMT by slowing defense contracts and budget processes, but following its resolution the stock began to strengthen. Recent market weakness, however, has stalled that momentum. We plan to hold the position, anticipating a potential rebound, yet with expiration fast approaching, we will likely need to exit early in the week unless the stock recovers quickly.

META – 206 DTE

Bullish Long Call, Meta Platforms, Inc. (META), the market dip and META’s pullback provided a favorable setup for a longer term bullish approach. We recently established the position and intend to maintain it for now.

NVDA – 18 DTE

Bullish Credit Spread – NVIDIA Corporation (NVDA) – The company delivered a very strong earnings report and raised guidance. After an initial move higher, the stock reversed as the market chose to sell off. With plenty of time until expiration, we plan to maintain the position for now.

PM – 25 DTE

Bearish Credit Spread – Philip Morris (PM) – our outlook remains bearish as transition growth slows, margins compress, and regulations tighten. The recent rally bumped against the 50-day moving average and then retreated, pointing to a potential near-term pullback. We will maintain the position in the short term with ample time until expiration.

META

DailyPlay – Opening Trade (META) & Closing Trade (WMT) – November 21, 2025

Closing Trade

- WMT – 65% loss: Sell to Close 15 Contracts (or 100% of your Contracts) Dec 19 $100/$95 Put Vertical Spreads @ $0.46 Credit. DailyPlay Portfolio: By Closing 15 Contracts, we will be collecting $690. We initially opened these 15 contracts on November 18 @ $1.32 Debit. Our loss, therefore, is $86 per contract.

META Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Meta Platforms’ recent pullback appears to stem not from weakening fundamentals, but from the company’s updated 2025 capital-expenditure outlook, which introduced near-term uncertainty around the monetization timeline of its AI investments. Management’s decision to substantially increase spending on AI infrastructure has weighed on valuation as investors reassess the short-term return profile, even though the long-term rationale and competitive positioning remain compelling. Meta still benefits from a resilient advertising engine, strong cash-flow generation, and expanding capabilities across AI-driven engagement and automation. With analysts continuing to project meaningful upside and maintaining consensus price targets well above current levels, this dislocation offers an opportunity to position for long-term strength despite near-term sentiment pressure tied to elevated spending.

Technical Analysis

META recently surged above its previous $720 resistance level before reversing sharply, retesting key support and driving the stock into oversold territory, with RSI dropping into the low 20s. While short-term downside momentum remains a concern and the broader trend retains a bearish bias, highlighted by the 20-day moving average crossing below the 200-day moving average and the 50-day moving average turning lower, the stock is showing early signs of consolidation. Supporting this view, OptionsPlay has triggered a Bullish Counter-Trend Alert, suggesting that although near-term weakness persists, META may be stabilizing. Such alerts typically signal a slowdown in selling pressure and cautious re-entry by buyers, creating a potentially more favorable risk/reward setup for selectively timed, long-dated bullish positions.

Fundamental Analysis

Meta maintains attractive long-term fundamentals supported by strong operating leverage, durable growth, and industry-leading profitability. Despite elevated AI-related capex, the company remains well-positioned to monetize new capabilities over the coming years.

- Forward PE Ratio: 19.69x vs. Industry Median 24.26x

- Expected EPS Growth: 12.79% vs. Industry Median 14.57%

- Expected Revenue Growth: 18.15% vs. Industry Median 14.85%

- Net Margins: 30.89% vs. Industry Median 8.85%

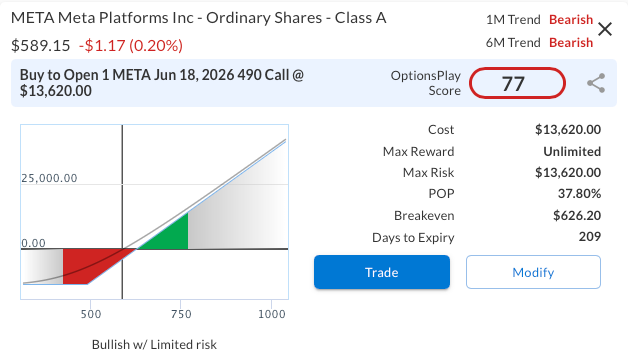

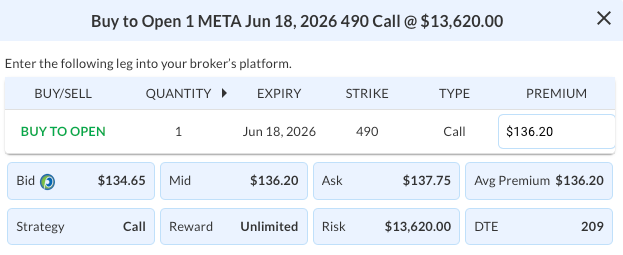

Options Trade

To express a bullish long-term view on META, consider buying a deep-in-the-money call option with a delta near 0.80 as a substitute for owning 100 shares of stock. The META Jun 18, 2026 490 Call, currently priced around $136.20, offers ample time for the anticipated trend reversal to unfold while providing leveraged upside should META reclaim prior highs and resume its longer-term uptrend. The maximum risk is capped at the $13,620 premium paid, while upside remains unlimited until expiry. The extended 209-day duration supports the substitute-stock approach, though it comes at a higher cost compared with the shorter-term strategies typically used in Daily Plays.

META – Daily

Trade Details

Strategy: Long Call

Direction: Bullish Call

Details: Buy to Open 1 META Jun 18 $490 Call @ $136.20 Debit per Contract.

Total Risk: This trade has a max risk of $13,620 (1 Contract x $13,620) roughly 23% of buying 100 shares of META. We suggest using this longer dated call option as a more capital efficient way to capture upside using options.

Counter-Trend Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 77

Stop Loss: If META is below $490 (strike price) close the trade.

View META Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View META Trade

AFRM

DailyPlay – Closing Trade (AFRM) – November 20, 2025

Closing Trade

- AFRM – 53% gain: Buy to Close 3 Contracts (or 100% of your Contracts) Dec 26 $74/$84 Call Vertical Spreads @ $1.65 Debit. DailyPlay Portfolio: By Closing 3 Contracts, we will be paying $495. We initially opened these 3 contracts on November 14 @ $3.50 Credit. Our gain, therefore, is $555.