HOOD, REGN, NVDA

OptionsPlay DailyPlay Ideas Menu – February 25th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- HOOD: Bullish Put Spread capitalizing on a potential trend reversal driven by a resurgence in retail trading and crypto volumes.

- REGN: Bullish Put Spread leveraging resilient pipeline execution and defensive biotech valuation during a technical pullback.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- NVDA: Bullish Call Spread betting on continued AI infrastructure dominance and data center growth ahead of a critical earnings report.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

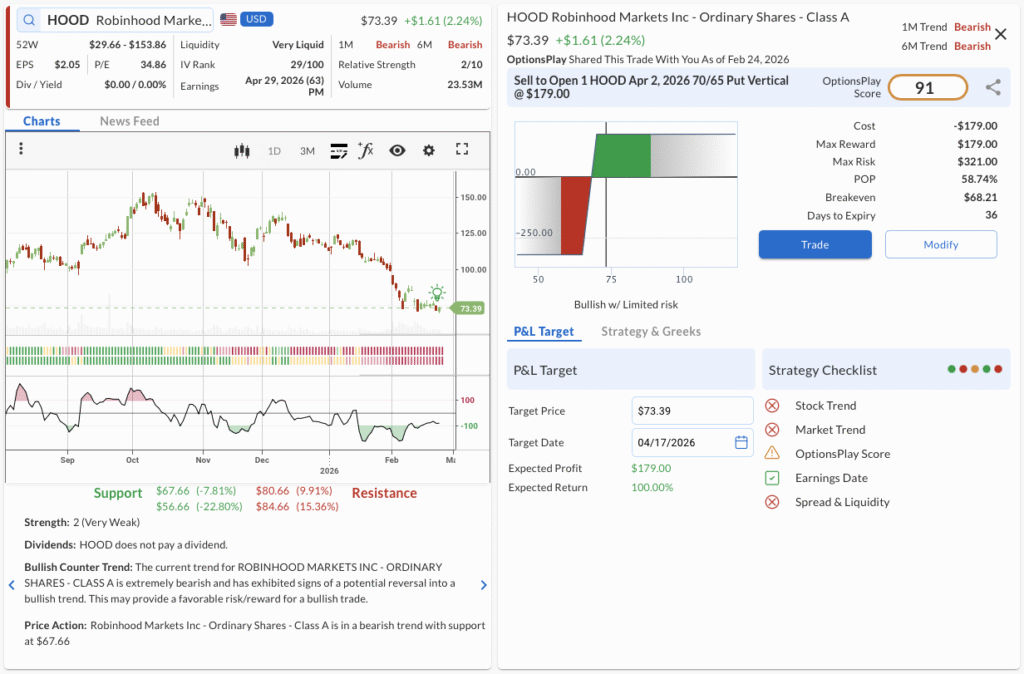

1. HOOD ($73.39) – The Retail Reversal

- The Trade: Sell to Open the HOOD Apr 02, 2026 70/65 Put Vertical @ $1.79 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 65 Put @ $2.84

- 🔴 SELL TO OPEN Apr 02, 2026 70 Put @ $4.63

- Trade Metrics: POP: 58.74% | Collect $179.00 per contract vs. a Max Risk of $321.00 (1.8:1).

- The Why: Despite recent bearish technicals, Robinhood’s expanding product suite and a resurgence in retail crypto trading volumes provide a strong fundamental catalyst for a stabilization and reversal.

- The Technicals: Although entrenched in a Bearish Trend (1M & 6M) with a weak Relative Strength of 2/10, the stock has recently bounced off its $67.66 support, exhibiting signs of a bullish counter-trend reversal toward the $80.66 resistance level.

- Management:

- Stop Loss: Buy back the spread at $3.58 (100% of credit received).

- Take Profit: Buy back the spread at $0.90 (50% of max gain).

2. REGN ($772.19) – Biotech Resilience

- The Trade: Sell to Open the REGN Apr 02, 2026 760/740 Put Vertical @ $7.50 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 740 Put @ $22.15

- 🔴 SELL TO OPEN Apr 02, 2026 760 Put @ $29.65

- Trade Metrics: POP: 56.13% | Collect $750.00 per contract vs. a Max Risk of $1,250.00 (1.7:1).

- The Why: Regeneron’s dominant position with Dupixent and its robust oncology pipeline continue to drive steady cash flows, making this technical pullback to support a compelling income opportunity.

- The Technicals: With a Strong Relative Strength of 9/10, the stock is currently consolidating in a Neutral 1M trend within a broader 6M Bullish Trend, experiencing a short-term dip that offers a favorable entry towards an $820 resistance target.

- Management:

- Stop Loss: Buy back the spread at $15.00 (100% of credit received).

- Take Profit: Buy back the spread at $3.75 (50% of max gain).

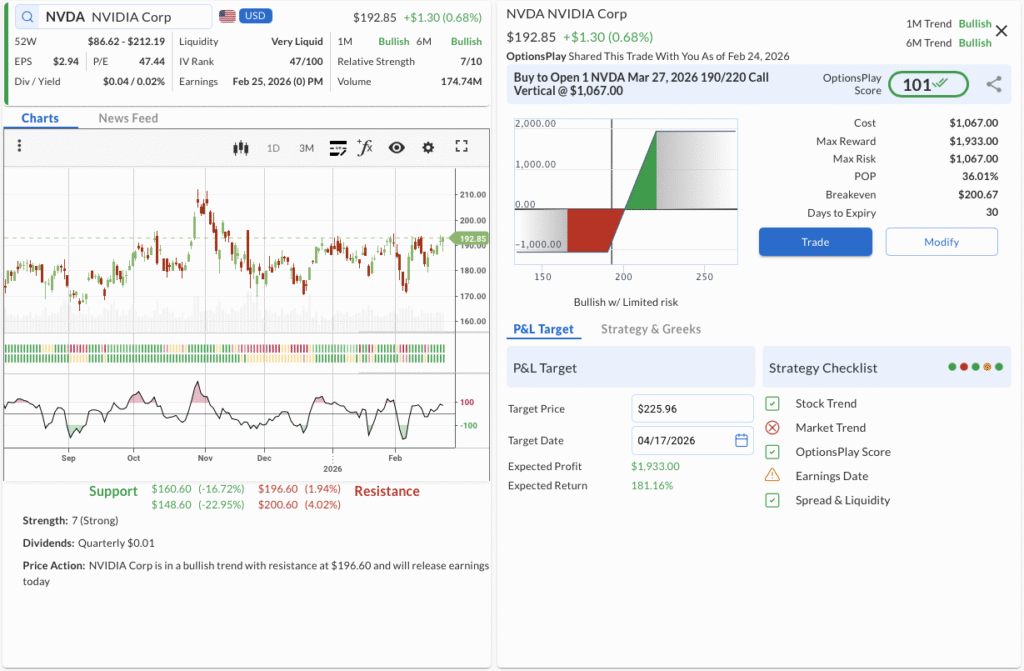

3. NVDA ($192.85) – The AI Infrastructure Engine

- The Trade: Buy to Open the NVDA Mar 27, 2026 190/220 Call Vertical @ $10.67 Debit.

- 🟢 BUY TO OPEN Mar 27, 2026 190 Call @ $13.05

- 🔴 SELL TO OPEN Mar 27, 2026 220 Call @ $2.38

- Trade Metrics: POP: 36.01% | Pay $1,067.00 per contract vs. a Max Reward of $1,933.00 (1.8:1).

- The Why: Nvidia remains the undisputed leader in AI accelerators, and persistent hyper-scaler CapEx spending on data centers provides a massive fundamental tailwind to support a post-earnings breakout.

- The Technicals: The stock is maintaining a confirmed Bullish Trend (1M & 6M) with a solid Relative Strength of 7/10, currently testing overhead resistance at $196.60 ahead of an imminent earnings catalyst.

- Management:

- ⚠️ Warning: Earnings is scheduled for Feb 25, which may require active management.

- Stop Loss: Sell the spread at $5.34 (50% loss on premium).

- Take Profit: Sell the spread at $18.67 (75% gain on premium).

GLD, HCA, LOW

OptionsPlay DailyPlay Ideas Menu – February 24th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- GLD: Bullish Put Spread capitalizing on robust safe-haven demand and continued central bank accumulation driving gold to sustained highs.

- HCA: Bullish Put Spread leveraging resilient patient volume growth and stabilizing labor costs within a defensive healthcare sector.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- LOW: Bullish Call Spread betting on a long-term stabilization in housing turnover and resilience in the pro-contractor segment.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

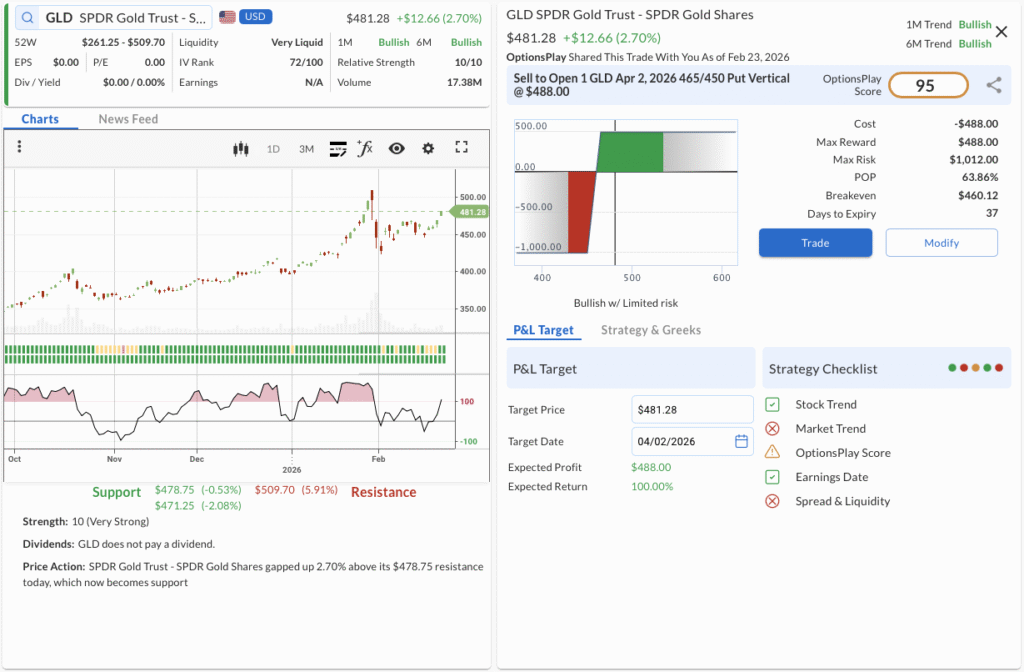

1. GLD ($481.28) – The Golden Breakout

- The Trade: Sell to Open the GLD Apr 02, 2026 465/450 Put Vertical @ $4.88 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 450 Put @ $7.85

- 🔴 SELL TO OPEN Apr 02, 2026 465 Put @ $12.73

- Trade Metrics: POP: 63.86% | Collect $488.00 per contract vs. a Max Risk of $1,012.00 (2.1:1).

- The Why: Macroeconomic uncertainties and persistent inflation concerns are driving strong safe-haven flows into gold, providing a fundamental tailwind for continuous price appreciation.

- The Technicals: Displaying maximum Relative Strength (10/10) within a confirmed Bullish Trend (1M & 6M), the ETF has gapped up above its $470 resistance level after consolidating over the past couple of weeks towards its $510 all-time highs.

- Management:

- Stop Loss: Buy back the spread at $9.76 (100% of credit received).

- Take Profit: Buy back the spread at $2.44 (50% of max gain).

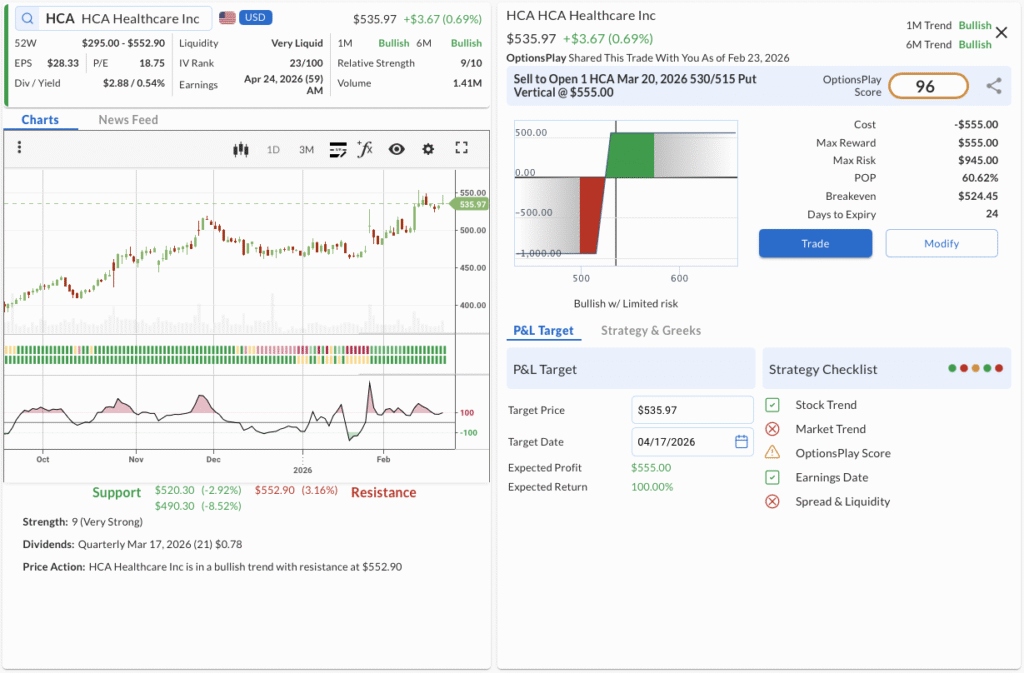

2. HCA ($535.97) – Defensive Healthcare Yield

- The Trade: Sell to Open the HCA Mar 20, 2026 530/515 Put Vertical @ $5.55 Credit.

- 🟢 BUY TO OPEN Mar 20, 2026 515 Put @ $6.30

- 🔴 SELL TO OPEN Mar 20, 2026 530 Put @ $11.85

- Trade Metrics: POP: 60.62% | Collect $555.00 per contract vs. a Max Risk of $945.00 (1.7:1).

- The Why: Hospital operators are experiencing sustained admissions growth and margin expansion as contract labor costs normalize, establishing a strong fundamental base for income trades.

- The Technicals: HCA exhibits strong momentum with a Relative Strength of 9/10 in a dual Bullish Trend (1M & 6M), consolidating constructively above its $520.30 support level before its next leg up.

- Management:

- Stop Loss: Buy back the spread at $11.10 (100% of credit received).

- Take Profit: Buy back the spread at $2.78 (50% of max gain).

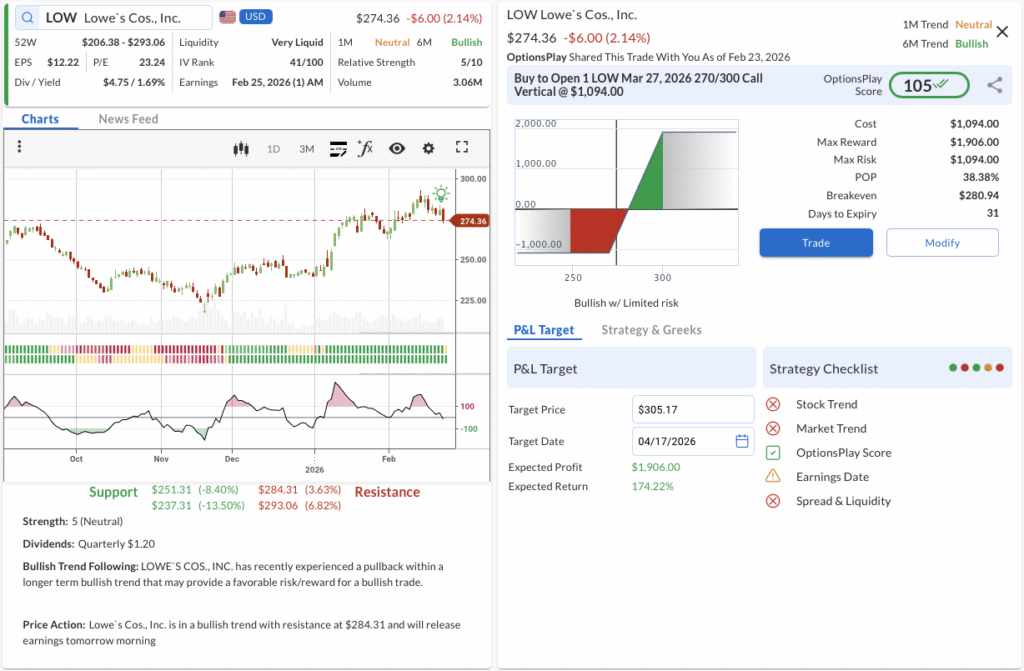

3. LOW ($274.36) – Building the Rebound

- The Trade: Buy to Open the LOW Mar 27, 2026 270/300 Call Vertical @ $10.94 Debit.

- 🟢 BUY TO OPEN Mar 27, 2026 270 Call @ $13.30

- 🔴 SELL TO OPEN Mar 27, 2026 300 Call @ $2.36

- Trade Metrics: POP: 38.38% | Pay $1,094.00 per contract vs. a Max Reward of $1,906.00 (1.7:1).

- The Why: Despite near-term DIY retail softness, Lowe’s continues to capture market share in the high-value Pro segment, positioning the company for a strong fundamental rebound as housing turnover begins to normalize.

- The Technicals: Currently experiencing a pullback within a broader 6M Bullish Trend, the stock has reset to a Neutral 1M trend and is resting above its $251.31 support, offering a favorable entry ahead of testing $284.31 resistance.

- Management

- ⚠️ Warning: Earnings is scheduled for Feb 25, which may require active management.

- Stop Loss: Sell the spread at $5.47 (50% loss on premium).

- Take Profit: Sell the spread at $19.15 (75% gain on premium).

MSFT, CLX, W

OptionsPlay DailyPlay Ideas Menu – February 23rd, 2026

💰 The Income Generators (High Probability, Cash Flow)

- MSFT: Bullish Put Vertical as continued enterprise AI monetization and robust Azure cloud growth provide a strong fundamental floor for the tech giant.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- CLX: Bullish Call Vertical as strong consumer staples pricing power and cost-saving initiatives expand margins.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- W: Bearish Call Vertical as lingering macroeconomic headwinds and weakened consumer discretionary spending on home goods pressure near-term revenue prospects.

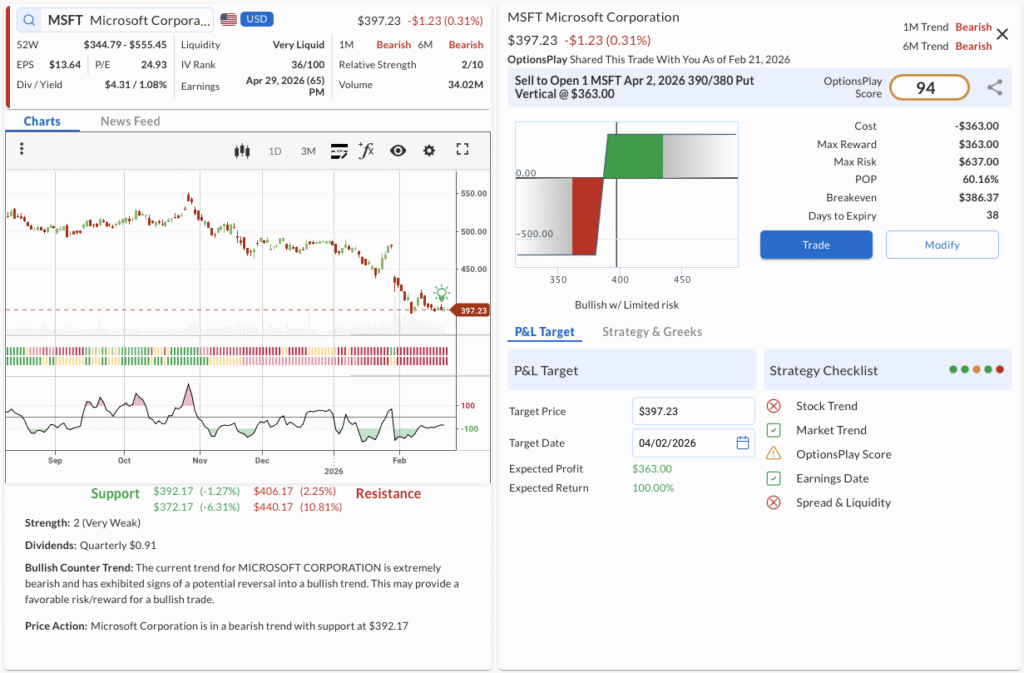

1. MSFT ($397.23) – Azure Cloud Strength Supports the Floor

- The Trade: Sell to Open the MSFT Apr 02, 2026 390/380 Put Vertical @ $3.63 Credit.

- 🔴 SELL TO OPEN Apr 02, 2026 390 Put @ $11.03

- 🟢 BUY TO OPEN Apr 02, 2026 380 Put @ $7.40

- Trade Metrics: POP: 60.16% | Collect $363.00 per contract vs. a Max Risk of $637.00 (1.8:1).

- The Why: Continued enterprise AI monetization and robust Azure cloud growth provide a strong fundamental floor for the tech giant.

- The Technicals: Microsoft’s steep bearish downtrend is showing key signs of exhaustion, potentially reversing off near-term support at $392.17 to favor a bullish income strategy.

- Management:

- Stop Loss: Buy to close the spread at $7.26 (100% of credit received).

- Take Profit: Buy to close the spread at $1.82 (50% of max gain).

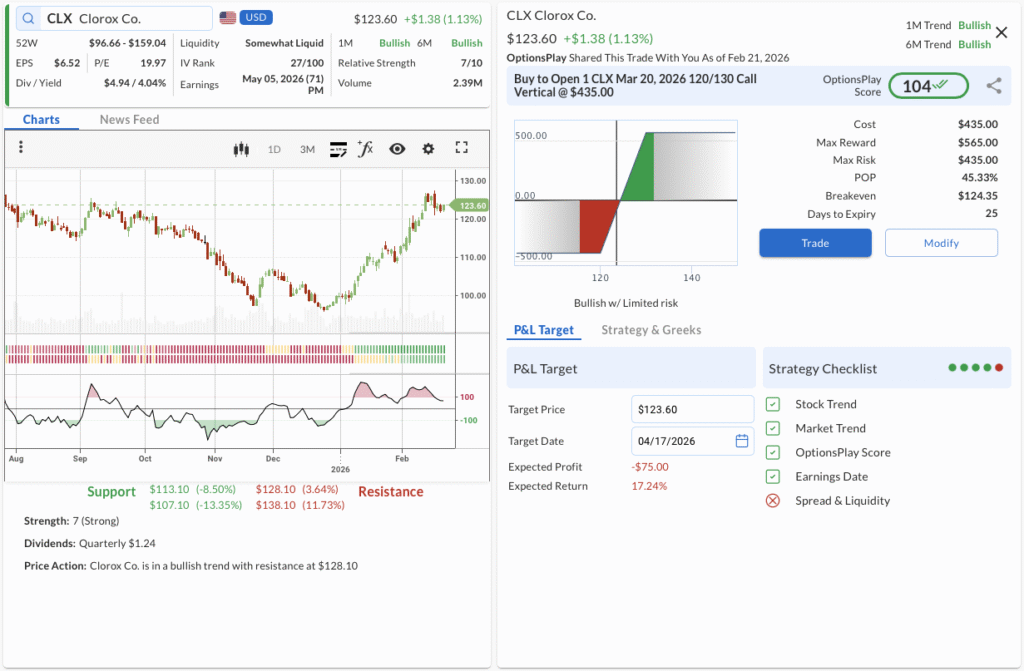

2. CLX ($123.60) – Margins Expand in Consumer Staples

- The Trade: Buy to Open the CLX Mar 20, 2026 120/130 Call Vertical @ $4.35 Debit.

- 🟢 BUY TO OPEN Mar 20, 2026 120 Call @ $5.40

- 🔴 SELL TO OPEN Mar 20, 2026 130 Call @ $1.05

- Trade Metrics: POP: 45.33% | Pay $435.00 per contract vs. a Max Reward of $565.00 (1.3:1).

- The Why: Strong consumer staples pricing power and cost-saving initiatives are expanding margins.

- The Technicals: Clorox exhibits a strong bullish 1-month and 6-month trend, with room to run toward the $128.10 resistance level following recent consolidation.

- Management:

- Stop Loss: Sell to close the spread at $2.18 (50% loss on premium).

- Take Profit: Sell to close the spread at $7.61 (75% gain on premium).

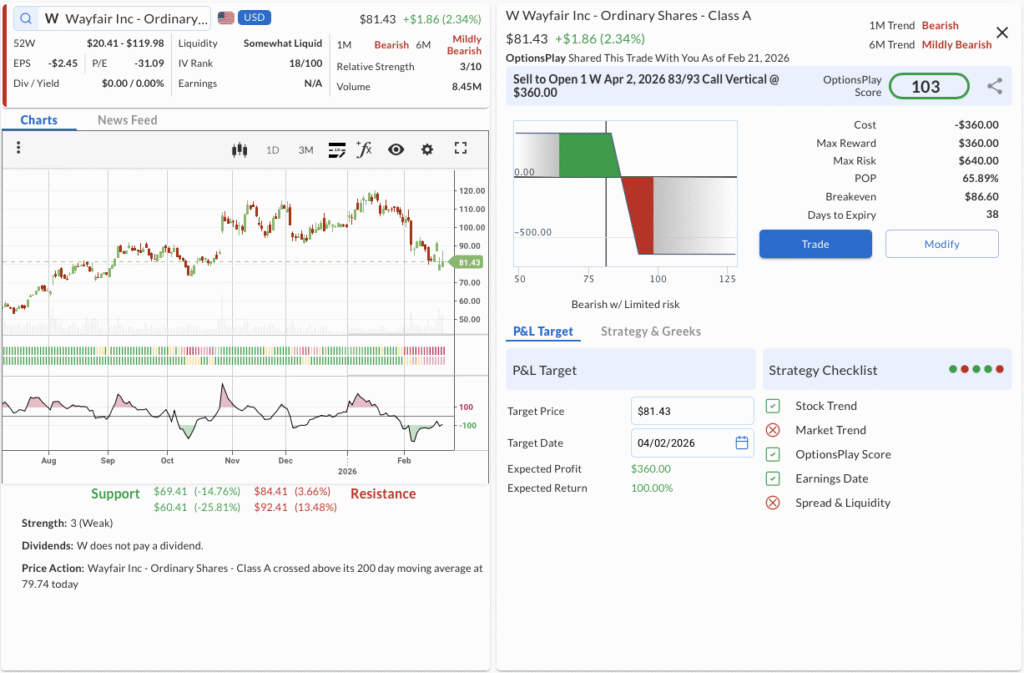

3. W ($81.43) – Discretionary Spending Headwinds Persist

- The Trade: Sell to Open the W Apr 02, 2026 83/93 Call Vertical @ $3.60 Credit.

- 🔴 SELL TO OPEN Apr 02, 2026 83 Call @ $6.60

- 🟢 BUY TO OPEN Apr 02, 2026 93 Call @ $3.00

- Trade Metrics: POP: 65.89% | Collect $360.00 per contract vs. a Max Risk of $640.00 (1.8:1).

- The Why: Lingering macroeconomic headwinds and weakened consumer discretionary spending on home goods pressure near-term revenue prospects.

- The Technicals: Despite a recent moving average crossover, Wayfair remains in a longer-term bearish trend and is approaching a heavy resistance zone near $84.41.

- Management:

- Stop Loss: Buy to close the spread at $7.20 (100% of credit received).

- Take Profit: Buy to close the spread at $1.80 (50% of max gain).

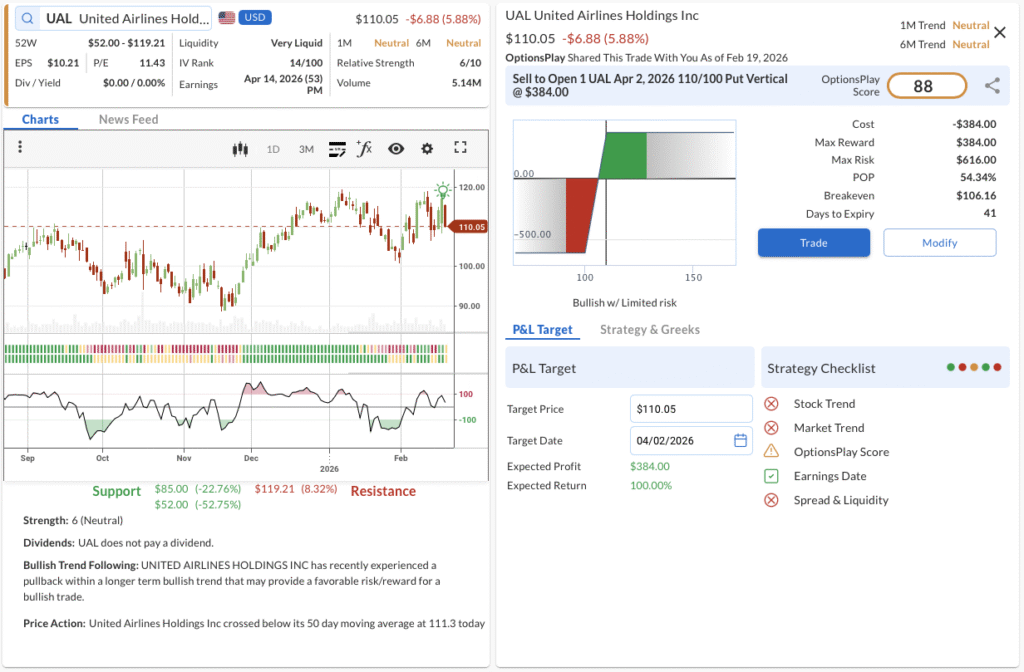

UAL, EOG, MRNA

OptionsPlay DailyPlay Ideas Menu – February 20th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- UAL: Bullish Put Spread leveraging United Airlines’ strong premium cabin demand and record bookings as it consolidates near moving average support.

- EOG: Bullish Put Spread capitalizing on disciplined capital allocation and robust free cash flow generation as EOG consolidates near recent highs.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- MRNA: Bullish Call Spread betting on a renewed growth narrative as Moderna’s non-COVID pipeline (including personalized cancer vaccines) shows promising clinical momentum.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

1. UAL ($110.05) – Cruising Altitude Income

- The Trade: Sell to Open the UAL Apr 2, 2026 110/100 Put Vertical @ $3.84 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 100 Put @ $3.41

- 🔴 SELL TO OPEN Apr 02, 2026 110 Put @ $7.25

- Trade Metrics: POP: 54.34% | Collect $384.00 per contract vs. a Max Risk of $616.00 (1.6:1).

- The Why: Despite temporary capacity constraints, United Airlines is demonstrating resilient pricing power and generating strong free cash flow from elevated travel demand, providing a solid fundamental floor for premium collection.

- The Technicals: UAL is in a Neutral Trend (1M & 6M) with a Relative Strength of 6/10, currently experiencing a pullback to its $110 support level that was prior resistance, providing an attractive risk to reward for a bullish setup.

- Management:

- Stop Loss: Buy back the spread at $7.68 (100% of credit received).

- Take Profit: Buy back the spread at $1.92 (50% of max gain).

2. EOG ($123.87) – Disciplined Energy Yield

- The Trade: Sell to Open the EOG Apr 2, 2026 123/115 Put Vertical @ $2.77 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 115 Put @ $1.98

- 🔴 SELL TO OPEN Apr 02, 2026 123 Put @ $4.75

- Trade Metrics: POP: 57.75% | Collect $277.00 per contract vs. a Max Risk of $523.00 (1.9:1).

- The Why: EOG Resources remains a premier operator in the energy space, and its commitment to returning capital to shareholders via special dividends creates an attractive setup for income generation amidst stabilized crude prices.

- The Technicals: EOG is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 7/10 and breaking out above its $120 resistance level on strong momentum with a $131 resistance target.

- Management:⚠️ Warning: Earnings is scheduled for Feb 24, which may require active management.

- Stop Loss: Buy back the spread at $5.54 (100% of credit received).

- Take Profit: Buy back the spread at $1.38 (50% of max gain).

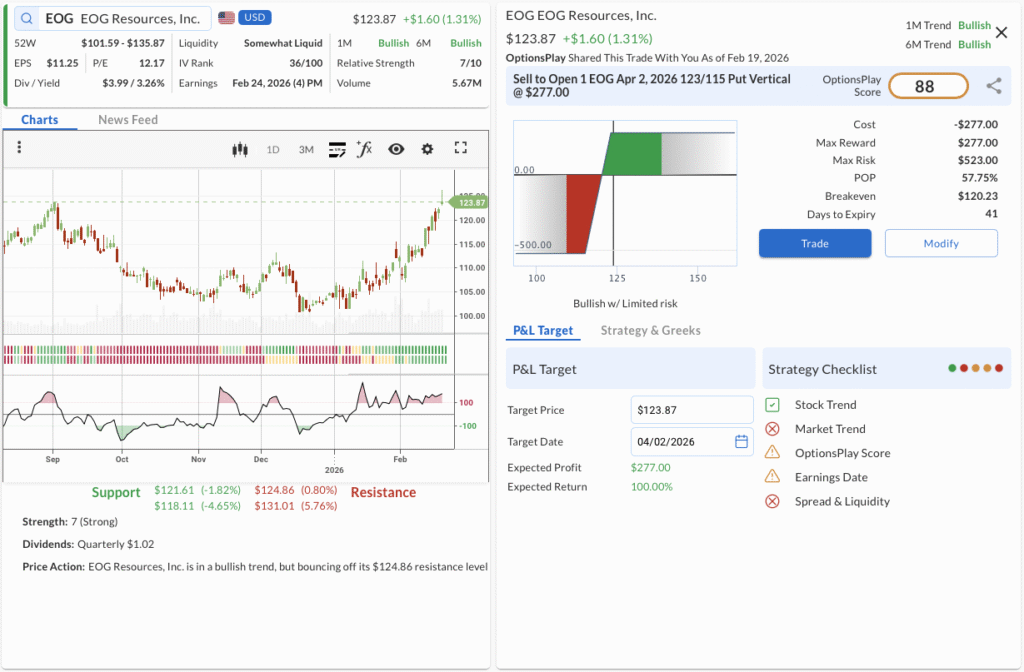

3. MRNA ($49.70) – Biotech Breakout View Trade in OptionsPlay

- The Trade: Buy to Open the MRNA Apr 2, 2026 49/60 Call Vertical @ $3.81 Debit.

- 🟢 BUY TO OPEN Apr 02, 2026 49 Call @ $5.90

- 🔴 SELL TO OPEN Apr 02, 2026 60 Call @ $2.09

- Trade Metrics: POP: 35.28% | Pay $381.00 per contract vs. a Max Reward of $719.00 (1.9:1).

- The Why: The market is beginning to re-rate Moderna as the focus shifts from legacy COVID revenues toward its expansive mRNA pipeline and upcoming commercial launches in oncology and rare diseases.

- The Technicals: Moderna exhibits extremely strong momentum (10/10 RS) within a Bullish Trend (1M & 6M), pushing up over 6% today to immediately challenge resistance at $49.78 above a solid support floor at $45.28.

- Management:

- Stop Loss: Sell the spread at $1.90 (50% loss on premium).

- Take Profit: Sell the spread at $6.66 (75% gain on premium).

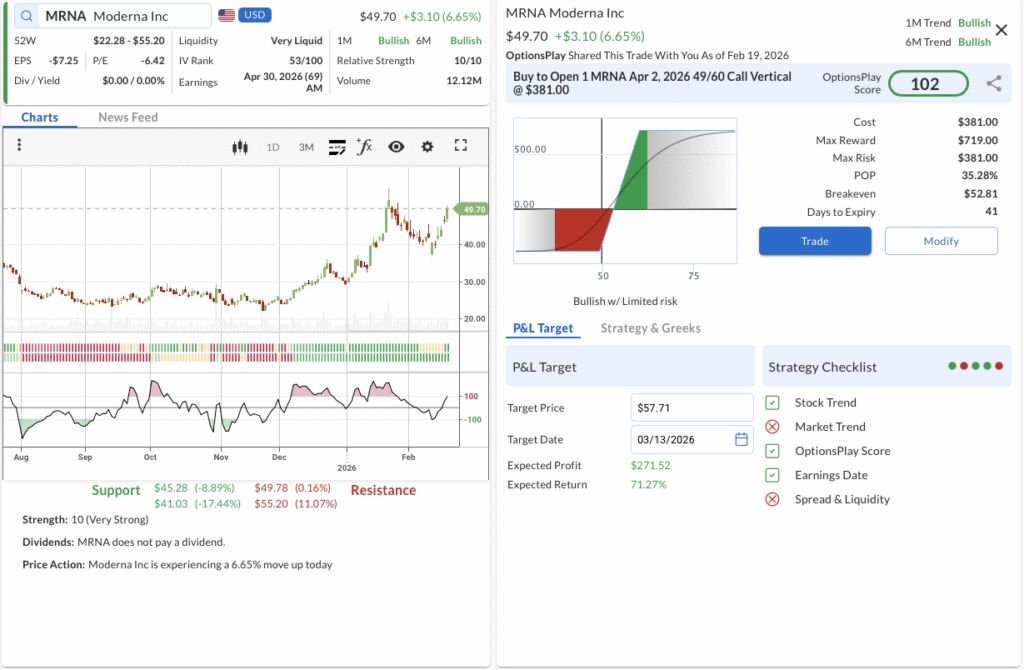

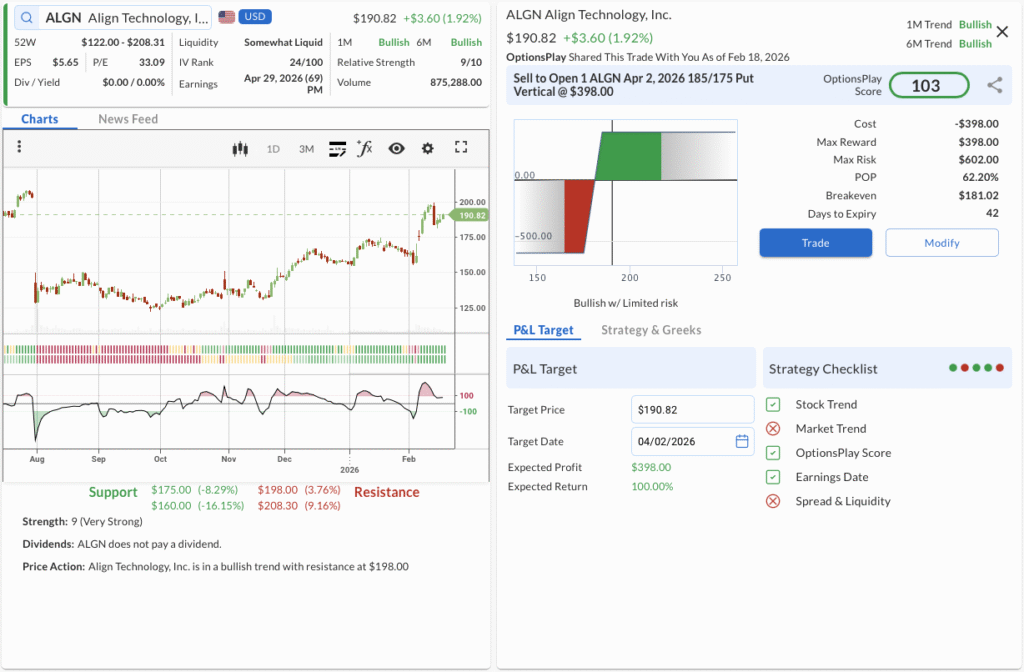

ALGN, MCD, TFC

OptionsPlay DailyPlay Ideas Menu – February 19th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- ALGN: Bullish Put Spread capitalizing on resilient clear aligner demand and digital ecosystem growth during a technical pullback.

- MCD: Bullish Put Spread leveraging McDonald’s defensive value-menu strategy and consistent foot traffic within a strong uptrend.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- TFC: Long Call betting on net interest income expansion and cost rationalization driving a continued technical breakout.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

1. ALGN ($190.82) – Smiling Through the Dip

- The Trade: Sell to Open the ALGN Apr 2, 2026 185/175 Put Vertical @ $3.98 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 175 Put @ $4.02

- 🔴 SELL TO OPEN Apr 02, 2026 185 Put @ $8.00

- Trade Metrics: POP: 62.20% | Collect $398.00 per contract vs. a Max Risk of $602.00 (1.5:1).

- The Why: Align Technology is seeing resilient demand in teen clear aligner adoption and margin expansion from its digital scanning ecosystem, making this technical pullback an attractive entry.

- The Technicals: The stock boasts a Very Strong Relative Strength of 9/10 within a confirmed Bullish Trend (1M & 6M), currently experiencing a pause after breaking out above $175, providing a strong risk to reward entry for a continuation higher.

- Management:

- Stop Loss: Buy back the spread at $7.96 (100% of credit received).

- Take Profit: Buy back the spread at $1.99 (50% of max gain).

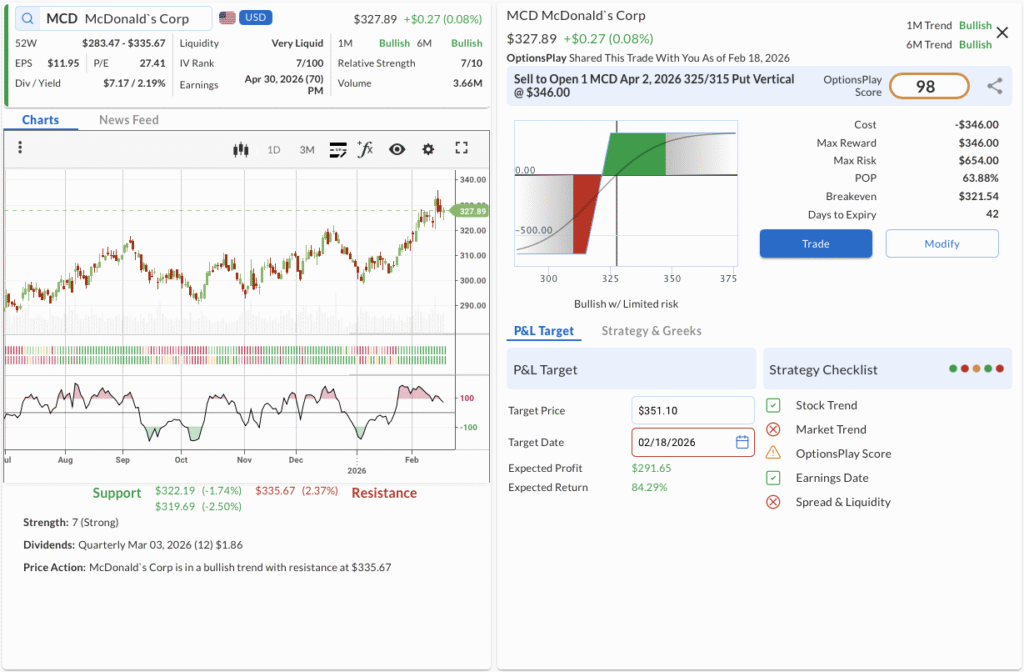

2. MCD ($327.89) – Defensive Value Momentum

- The Trade: Sell to Open the MCD Apr 2, 2026 325/315 Put Vertical @ $3.46 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 315 Put @ $3.19

- 🔴 SELL TO OPEN Apr 02, 2026 325 Put @ $6.65

- Trade Metrics: POP: 63.88% | Collect $346.00 per contract vs. a Max Risk of $654.00 (1.9:1).

- The Why: McDonald’s robust value-menu strategy is successfully driving foot traffic and defending market share despite a softer consumer discretionary environment.

- The Technicals: Maintaining a solid Bullish Trend (1M & 6M) with a Relative Strength of 7/10, the stock has recently bounced off its $322.19 support level and is aiming to retest resistance at $335.67.

- Management:

- Stop Loss: Buy back the spread at $6.92 (100% of credit received).

- Take Profit: Buy back the spread at $1.73 (50% of max gain).

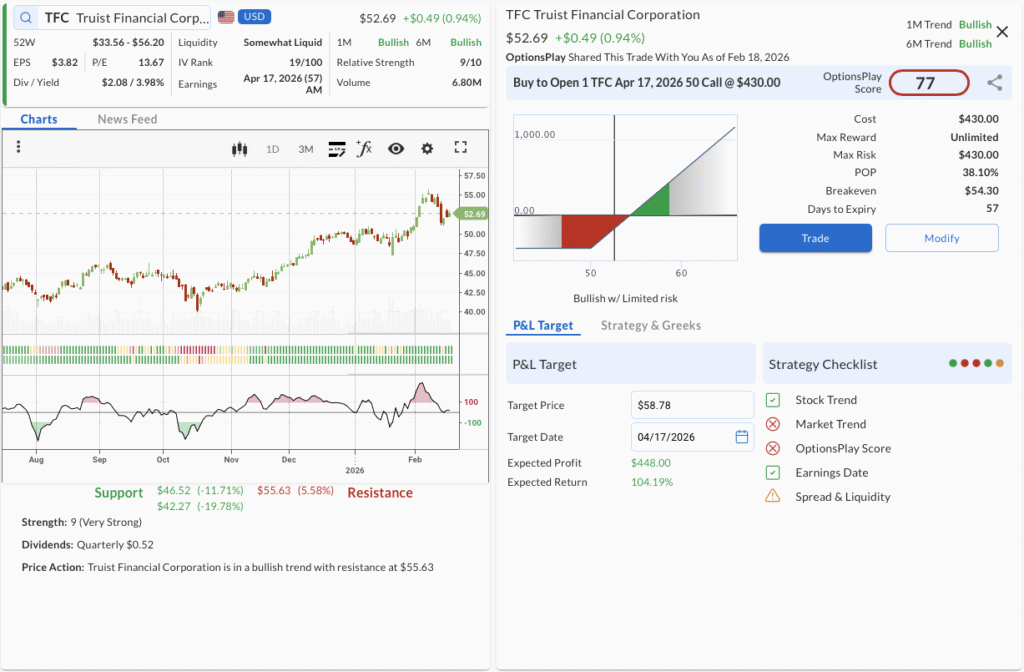

3. TFC ($52.69) – Banking on the Breakout

- The Trade: Buy to Open the TFC Apr 17, 2026 50 Call @ $4.30 Debit.

- 🟢 BUY TO OPEN Apr 17, 2026 50 Call @ $4.30

- Trade Metrics: POP: 38.10% | Pay $430.00 per contract vs. a Max Reward of Unlimited.

- The Why: Truist Financial is benefiting from a steeper yield curve and successful post-merger cost rationalization, driving strong net interest income growth potential.

- The Technicals: Demonstrating exceptional momentum with a Relative Strength of 9/10, the stock is consolidating within a broad Bullish Trend (1M & 6M) above its $46.52 support, setting up for a potential breakout toward $55.63 resistance.

- Management:⚠️ Warning: Earnings is scheduled for Apr 17, which may require active management.

- Stop Loss: Sell the call at $2.15 (50% loss on premium).

- Take Profit: Sell the call at $7.53 (75% gain on premium).

CME, ETN, AMZN

OptionsPlay DailyPlay Ideas Menu – February 18th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- CME: Bullish Put Spread capitalizing on record-breaking global derivatives volume and structural revenue growth from non-U.S. trading hours.

- ETN: Bullish Put Spread leveraging a dip in a high-conviction secular winner, supported by confident 2026 guidance for 7-9% organic growth driven by data center electrification.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- AMZN: Bullish Call Spread betting on a mean-reversion bounce as the stock hits multi-year valuation lows and extreme oversold technical conditions.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

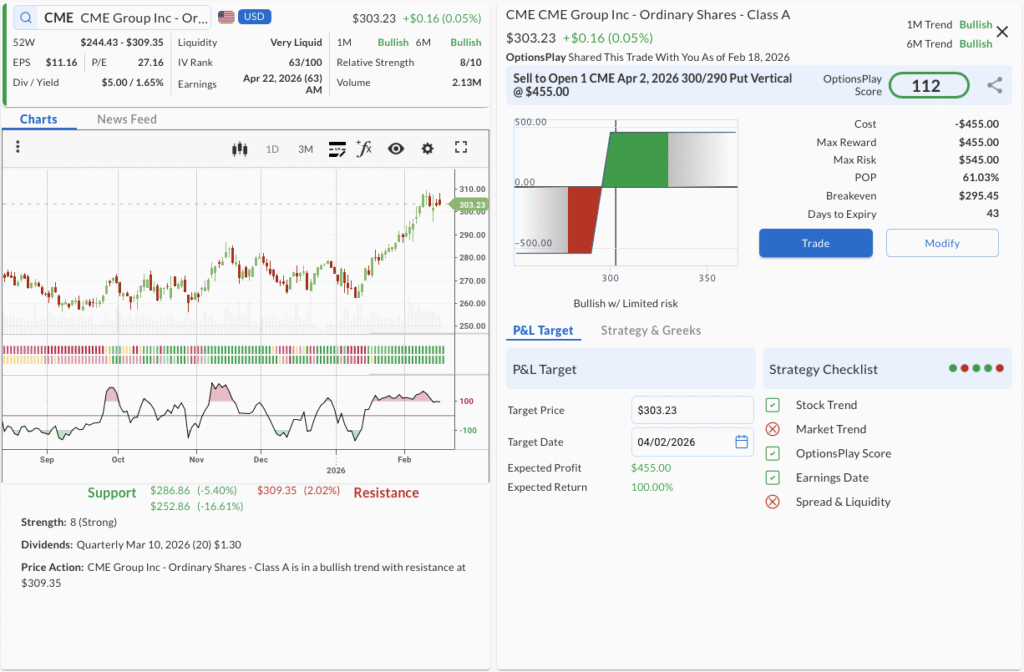

1. CME ($303.23) – Volatility is the Product

- The Trade: Sell to Open the CME Apr 02, 2026 300/290 Put Vertical @ $4.55 Credit.

- 🔴 SELL TO OPEN Apr 02, 2026 300 Put @ $11.00

- 🟢 BUY TO OPEN Apr 02, 2026 290 Put @ $6.45

- Trade Metrics: POP: 61.03% | Collect $455.00 per contract vs. a Max Risk of $545.00 (1.2:1).

- The Why: CME Group is seeing record average daily volume in equity and commodity options, particularly outside U.S. hours; this structural volatility demand supports a bullish thesis despite short-term fluctuations.

- The Technicals: The stock remains in a confirmed Bullish Trend (1M & 6M) and is currently finding support at the $300 level (previous resistance turned support) after a minor pullback, aiming for a retest of highs near $310.

- Management:

- Stop Loss: Buy back the spread at $9.10 (100% of credit received).

- Take Profit: Buy back the spread at $2.28 (50% of max gain).

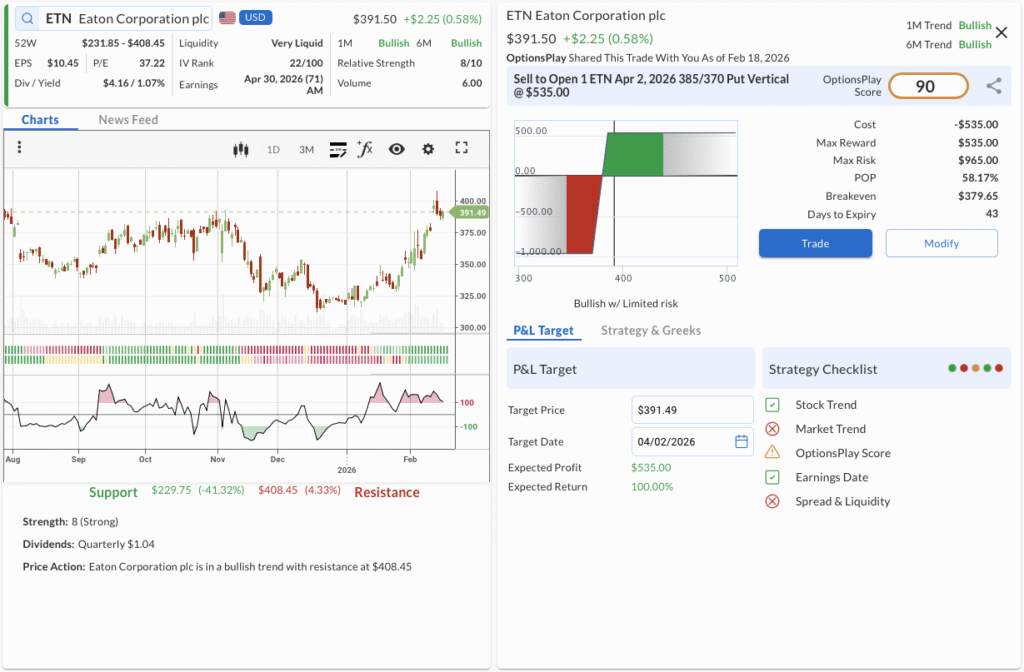

2. ETN ($391.50) – Electrification Supercycle

- The Trade: Sell to Open the ETN Apr 02, 2026 385/370 Put Vertical @ $5.35 Credit.

- 🔴 SELL TO OPEN Apr 02, 2026 385 Put @ $14.80

- 🟢 BUY TO OPEN Apr 02, 2026 370 Put @ $9.45

- Trade Metrics: POP: 58.17% | Collect $535.00 per contract vs. a Max Risk of $965.00 (1.8:1).

- The Why: Management recently reaffirmed confident 2026 guidance, citing strong backlogs in aerospace and data centers; we view the recent sell-off as a temporary reaction to conservative outlooks rather than a broken thesis.

- The Technicals: Eaton is maintaining a robust Bullish Trend (1M & 6M) with a Relative Strength of 8/10, currently consolidating above major support at $380, providing a high-probability entry for trend continuation.

- Management:

- Stop Loss: Buy back the spread at $10.70 (100% of credit received).

- Take Profit: Buy back the spread at $2.68 (50% of max gain).

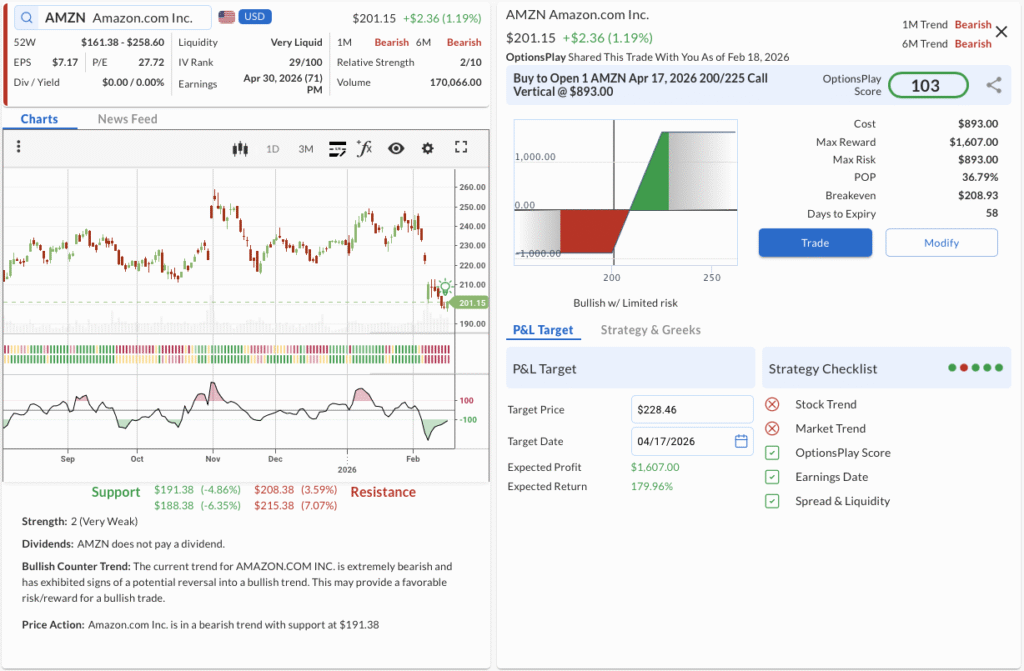

3. AMZN ($201.15) – The Valuation Disconnect

- The Trade: Buy to Open the AMZN Apr 17, 2026 200/225 Call Vertical @ $8.93 Debit.

- 🟢 BUY TO OPEN Apr 17, 2026 200 Call @ $12.08

- 🔴 SELL TO OPEN Apr 17, 2026 225 Call @ $3.15

- Trade Metrics: POP: 36.79% | Pay $893.00 per contract vs. a Max Reward of $1,607.00 (1.8:1).

- The Why: Market fears over $200B in CapEx have driven Amazon’s valuation to multi-year lows, ignoring the acceleration in AWS and ad revenue that analysts believe will drive a significant rerating once sentiment stabilizes.

- The Technicals: While the trend is Bearish (1M & 6M), the RSI has hit historically oversold levels (low 20s) that have previously preceded 60% rallies, signaling a potential capitulation bottom near $200 support.

- Management:

- Stop Loss: Sell the spread at $4.47 (50% loss on premium).

- Take Profit: Sell the spread at $15.63 (75% gain on premium).

CARR, COHR, TSN

OptionsPlay DailyPlay Ideas Menu – February 17th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- CARR: Bullish Put Spread capitalizing on a technical pullback to support as data center cooling demand provides a structural fundamental tailwind.

- COHR: Bullish Put Spread leveraging elevated implied volatility and robust AI-driven margin expansion during a classic technical dip.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- TSN: Long Call betting on improved operational execution and stabilizing protein margins driving a technical breakout.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

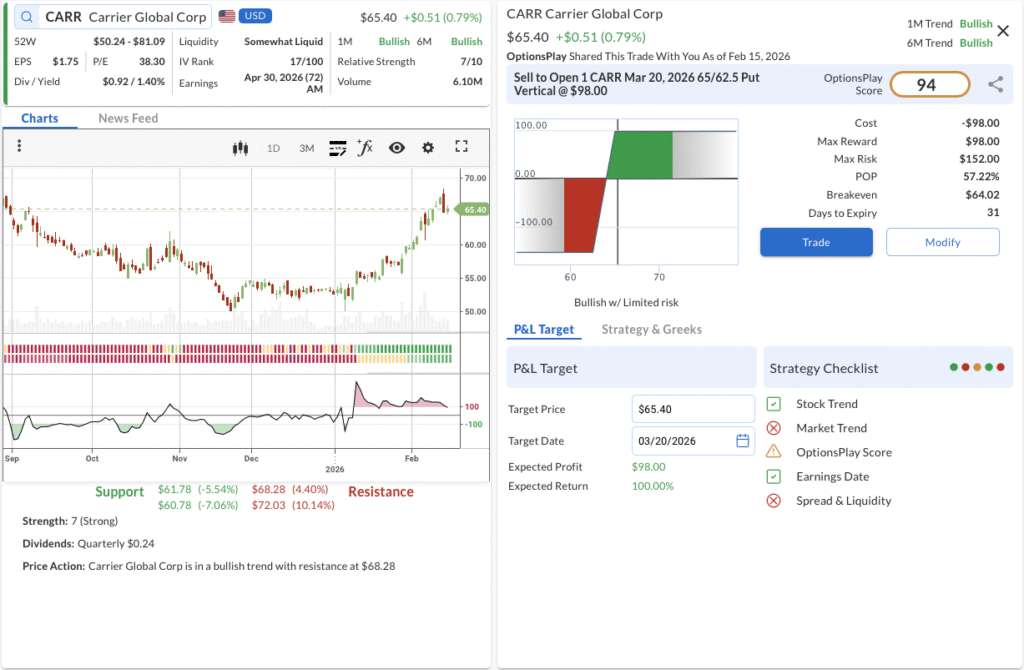

1. CARR ($65.40) – Cooling Demand Tailwind

- The Trade: Sell to Open the CARR Mar 20, 2026 65/62.5 Put Vertical @ $0.98 Credit.

- 🟢 BUY TO OPEN Mar 20, 2026 62.5 Put @ $1.15

- 🔴 SELL TO OPEN Mar 20, 2026 65 Put @ $2.13

- Trade Metrics: POP: 57.22% | Collect $98.00 per contract vs. a Max Risk of $152.00 (1.6:1).

- The Why: Carrier Global is successfully focusing on its higher-margin HVAC and climate solutions business, and the surging demand for data center cooling offers a structural growth tailwind that makes this pullback an attractive income-generation entry point.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 7/10 and recently broke out above its $60 resistance level, targeting $70 to the upside.

- Management:

- Stop Loss: Buy back the spread at $1.96 (100% of credit received).

- Take Profit: Buy back the spread at $0.49 (50% of max gain).

2. COHR ($217.23) – The AI Hardware Dip

- The Trade: Sell to Open the COHR Apr 2, 2026 195/185 Put Vertical @ $3.50 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 185 Put @ $11.10

- 🔴 SELL TO OPEN Apr 02, 2026 195 Put @ $14.60

- Trade Metrics: POP: 60.44% | Collect $350.00 per contract vs. a Max Risk of $650.00 (1.9:1).

- The Why: Coherent’s dominant position in optical transceivers for AI data centers is driving robust margin expansion, making this recent technical dip a prime opportunity to sell premium against elevated implied volatility.

- The Technicals: Demonstrating extremely strong Relative Strength (10/10) within a dual 1M and 6M Bullish Trend, the stock is pulling back toward its $201.58 support zone, presenting a classic buying opportunity before its next leg toward $223.58 resistance.

- Management:

- Stop Loss: Buy back the spread at $7.00 (100% of credit received).

- Take Profit: Buy back the spread at $1.75 (50% of max gain).

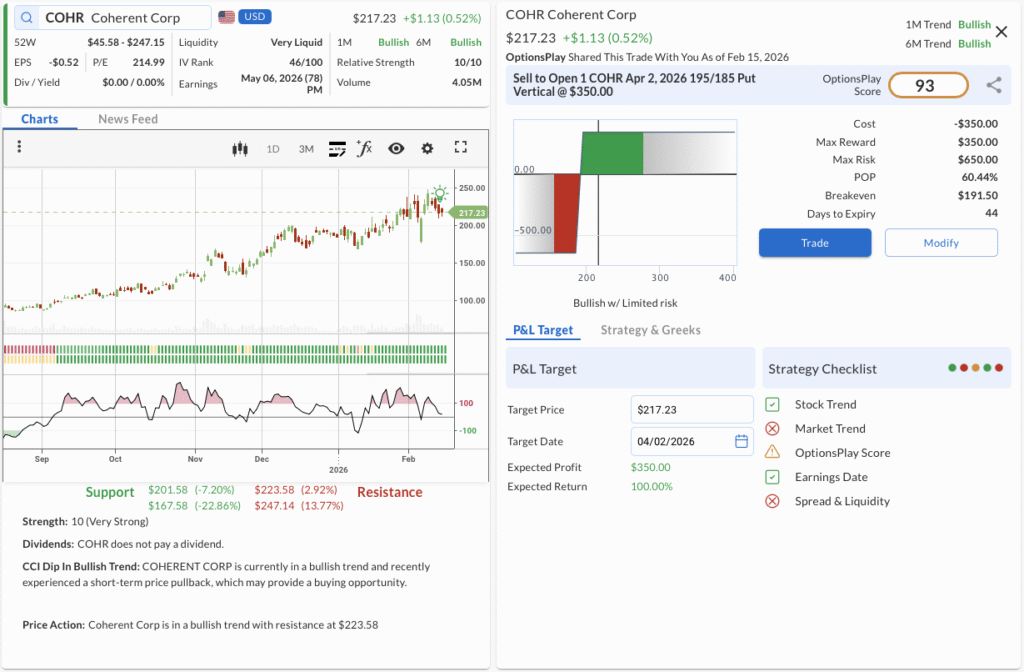

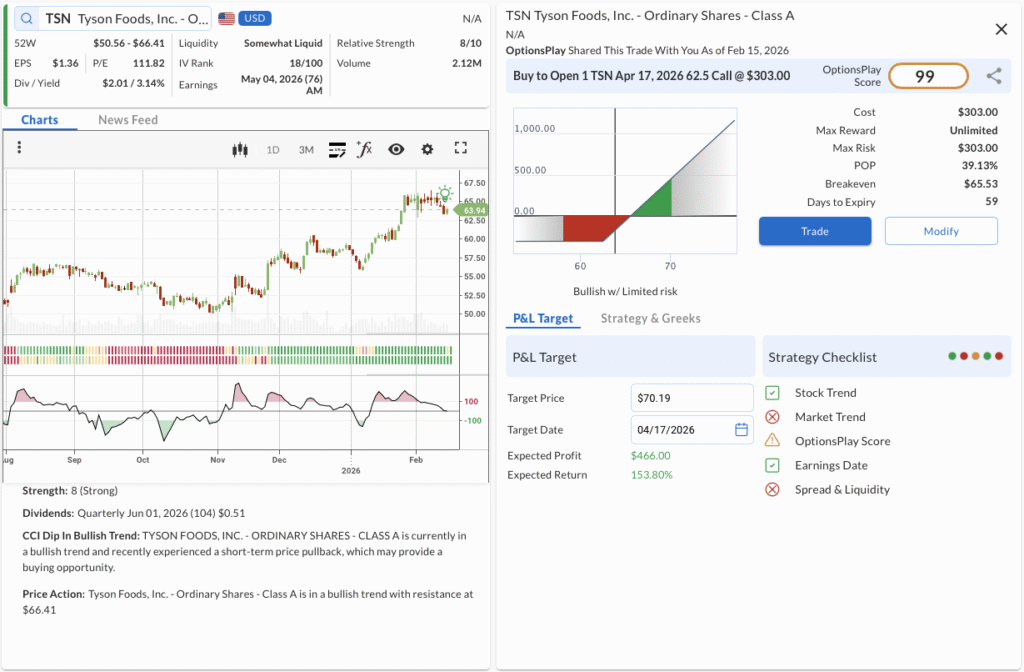

3. TSN ($63.94) – Stabilizing the Margins

- The Trade: Buy to Open the TSN Apr 17, 2026 62.5 Call @ $3.03 Debit.

- 🟢 BUY TO OPEN Apr 17, 2026 62.5 Call @ $3.03

- Trade Metrics: POP: 39.13% | Pay $303.00 per contract vs. a Max Reward of Unlimited.

- The Why: Tyson Foods is demonstrating improved operational execution and stabilizing protein margins through aggressive cost-cutting initiatives, positioning the stock for a breakout as consumer demand for chicken and beef normalizes.

- The Technicals: Consolidating within a steady Bullish Trend (1M & 6M) and maintaining a solid Relative Strength of 8/10, the stock has pulled back to its $63 support level, providing a strong entry for further upside.

- Management:

- Stop Loss: Sell the call at $1.52 (50% loss on premium).

- Take Profit: Sell the call at $5.30 (75% gain on premium).

MMM, FANG

OptionsPlay DailyPlay Ideas Menu – February 13th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- MMM: Bullish Put Spread capitalizing on 3M’s operational restructuring and improving industrial demand as the stock consolidates near highs.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- FANG: Bullish Call Spread targeting the premier Permian operator as energy prices stabilize, using a technical pullback to enter a high-reward trend resumption trade.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No Trades in this category today)

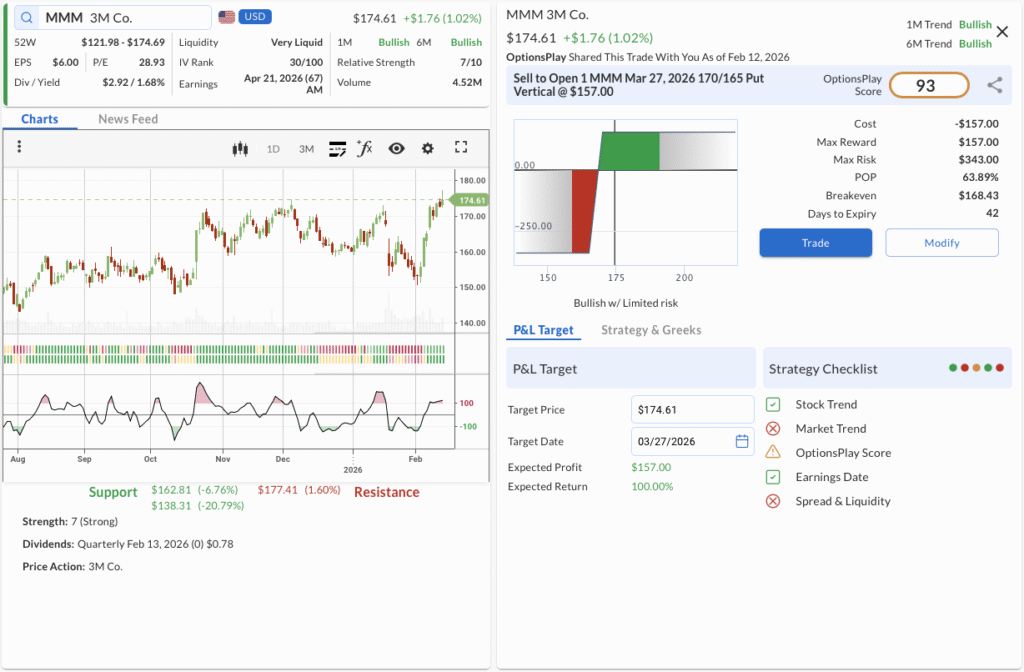

1. MMM ($174.61) – Industrial Turnaround Play

- The Trade: Sell to Open the MMM Mar 27, 2026 170/165 Put Vertical @ $1.57 Credit.

- 🔴 SELL TO OPEN Mar 27, 2026 170 Put @ $4.33

- 🟢 BUY TO OPEN Mar 27, 2026 165 Put @ $2.76

- Trade Metrics: POP: 63.89% | Collect $157.00 per contract vs. a Max Risk of $343.00 (1:2.2).

- The Why: 3M is executing its turnaround strategy effectively, streamlining operations and focusing on high-growth segments. The valuation remains attractive as legal overhangs clear, supporting a steady income strategy.

- The Technicals: MMM is confirming a strong Bullish Trend (1M & 6M) with improving relative strength. The stock is consolidating near recent highs, offering a support-driven entry point for income generation.

- Management:

- Stop Loss: Buy back the spread at $3.14 (100% of credit received).

- Take Profit: Buy back the spread at $0.79 (50% of max gain).

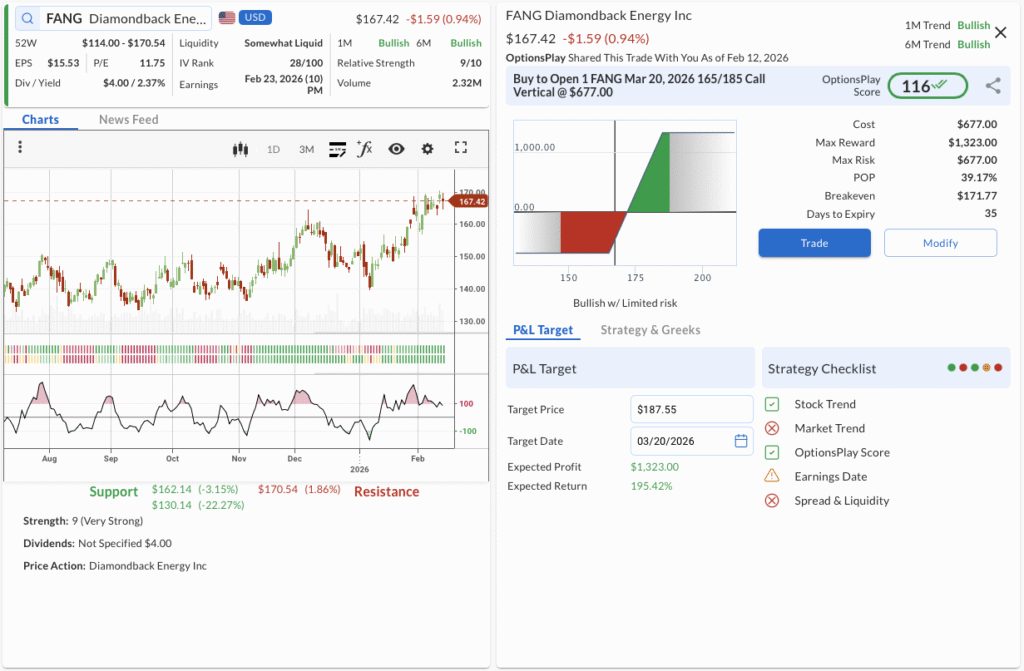

2. FANG ($167.42) – Energy Trend Resumption

- The Trade: Buy to Open the FANG Mar 20, 2026 165/185 Call Vertical @ $6.77 Debit.

- 🟢 BUY TO OPEN Mar 20, 2026 165 Call @ $8.90

- 🔴 SELL TO OPEN Mar 20, 2026 185 Call @ $2.13

- Trade Metrics: POP: 39.17% | Pay $677.00 per contract vs. a Max Reward of $1,323.00 (1.9:1).

- The Why: Diamondback Energy remains a top-tier operator in the Permian, benefitting from strict capital discipline and robust shareholder returns. The recent sector pullback provides a tactical entry point before the next leg up.

- The Technicals: Despite a short-term pullback, FANG remains in a primary Bullish Trend (1M & 6M). The stock is testing key support levels near $162, creating a favorable risk/reward setup for a resumption of the uptrend.

- Management:

- Stop Loss: Sell the spread at $3.39 (50% loss on premium).

- Take Profit: Sell the spread at $11.85 (75% gain on premium).

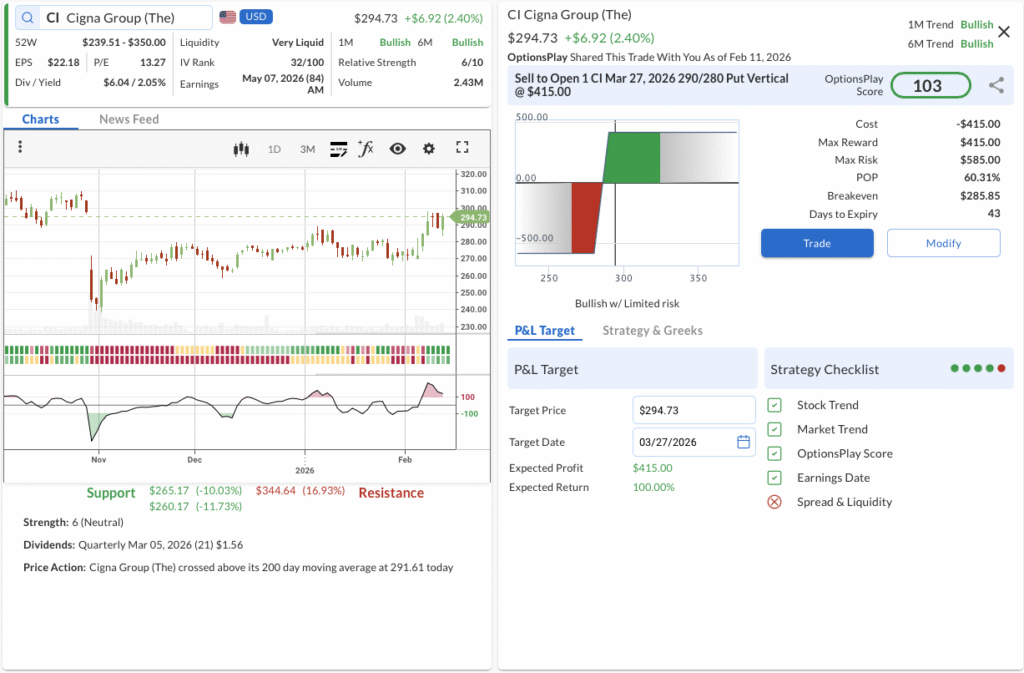

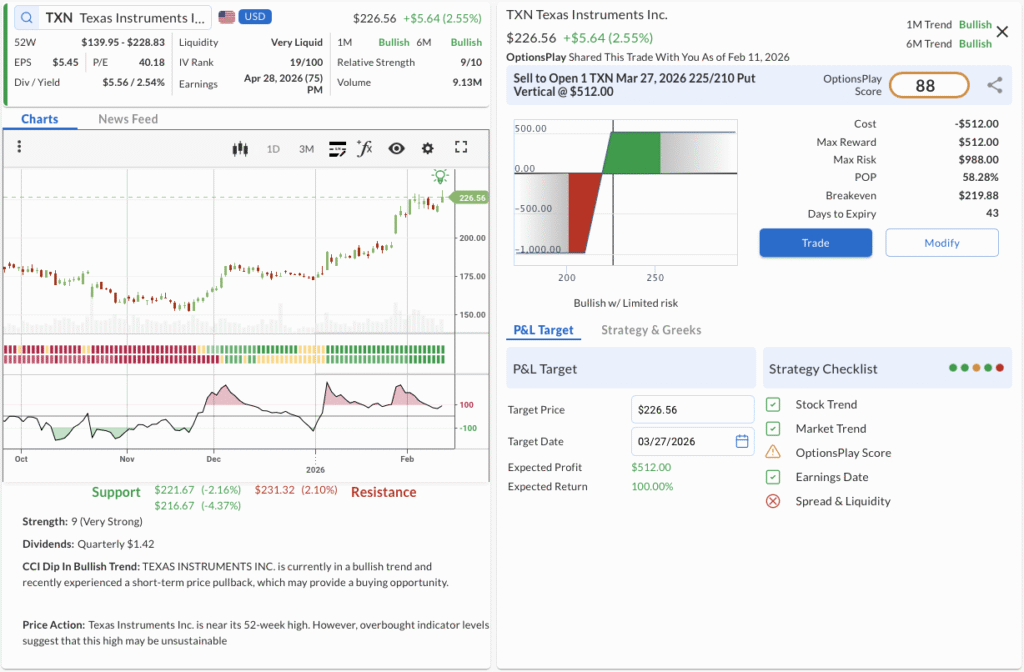

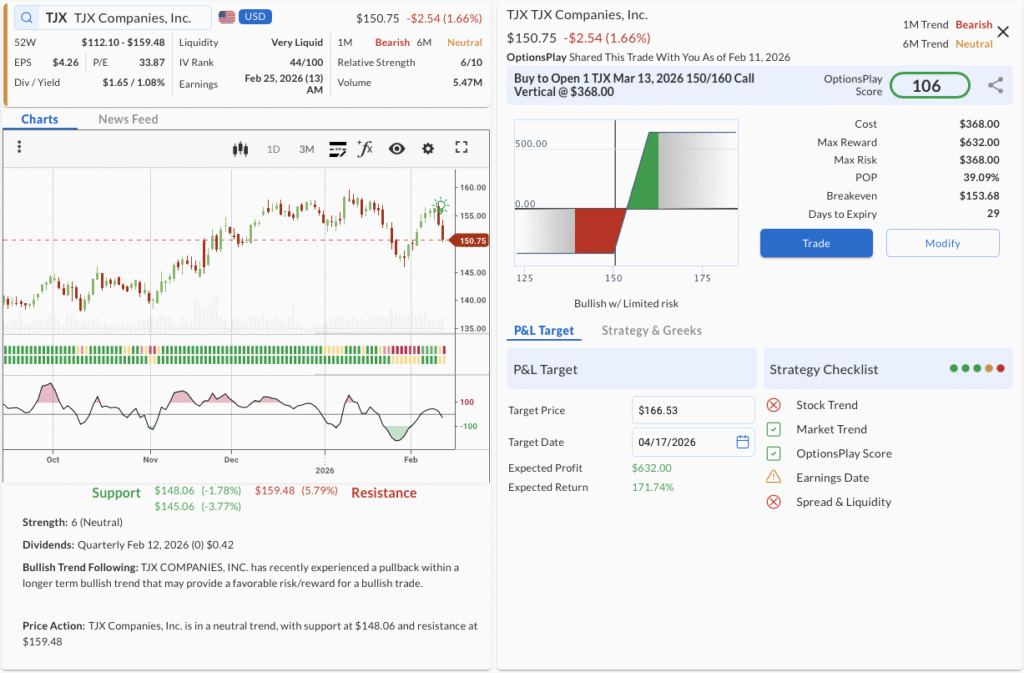

CI, TXN, TJX

OptionsPlay DailyPlay Ideas Menu – February 12th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- CI: Bullish Put Spread leveraging Cigna’s Evernorth growth engine and defensive valuation as the stock reclaims a key technical moving average.

- TXN: Bullish Put Spread positioning for the analog chip cycle trough, capitalizing on robust free cash flow and a technical dip within a strong uptrend.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- TJX: Bullish Call Spread targeting the off-price retail leader as consumer trade-down behavior drives traffic, setting up a potential earnings breakout.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

1. CI ($294.73) – Healthcare Defensive Breakout

- The Trade: Sell to Open the CI Mar 27, 2026 290/280 Put Vertical @ $4.15 Credit.

- 🔴 SELL TO OPEN Mar 27, 2026 290 Put @ $10.30

- 🟢 BUY TO OPEN Mar 27, 2026 280 Put @ $6.15

- Trade Metrics: POP: 60.31% | Collect $415.00 per contract vs. a Max Risk of $585.00 (1.4:1).

- The Why: Cigna’s strategic pivot toward high-margin health services via Evernorth, combined with a valuation discount relative to peers, offers a compelling defensive growth thesis as the sector stabilizes.

- The Technicals: Cigna has staged a powerful recovery, reclaiming its 200-day moving average and confirming a Bullish Trend (1M & 6M) with improving relative strength that supports a continued move toward resistance at $344.

- Management:

- Stop Loss: Buy back the spread at $8.30 (100% of credit received).

- Take Profit: Buy back the spread at $2.08 (50% of max gain).

2. TXN ($226.56) – Analog Chip Recovery Play

- The Trade: Sell to Open the TXN Mar 27, 2026 225/210 Put Vertical @ $5.12 Credit.

- 🔴 SELL TO OPEN Mar 27, 2026 225 Put @ $9.10

- 🟢 BUY TO OPEN Mar 27, 2026 210 Put @ $3.98

- Trade Metrics: POP: 58.28% | Collect $512.00 per contract vs. a Max Risk of $988.00 (1.9:1).

- The Why: Texas Instruments is poised to benefit from the stabilizing industrial and automotive semiconductor cycle, with its disciplined inventory management and capital allocation signaling a fundamental turning point.

- The Technicals: The stock maintains a Bullish Trend (1M & 6M) and recently triggered a “CCI Trend” signal, suggesting the pullback to the $221 support zone offers a high-probability entry point.

- Management:

- Stop Loss: Buy back the spread at $10.24 (100% of credit received).

- Take Profit: Buy back the spread at $2.56 (50% of max gain).

3. TJX ($150.75) – The Off-Price Consumer Pivot

- The Trade: Buy to Open the TJX Mar 13, 2026 150/160 Call Vertical @ $3.68 Debit.

- 🟢 BUY TO OPEN Mar 13, 2026 150 Call @ $5.20

- 🔴 SELL TO OPEN Mar 13, 2026 160 Call @ $1.52

- Trade Metrics: POP: 39.09% | Pay $368.00 per contract vs. a Max Reward of $632.00 (1.7:1).

- The Why: TJX Companies thrives in the current consumer environment as shoppers trade down for value, driving consistent traffic growth and market share gains that could surprise to the upside in the upcoming earnings print.

- The Technicals: Although short-term momentum has cooled, TJX is testing critical support at $148 within a longer-term bullish context, offering a favorable risk/reward ratio for a reversal ahead of earnings.

- Management:

- ⚠️ Warning: Earnings is scheduled for Feb 25, 2026, which may require active management.

- Stop Loss: Sell the spread at $1.84 (50% loss on premium).

- Take Profit: Sell the spread at $6.44 (75% gain on premium).

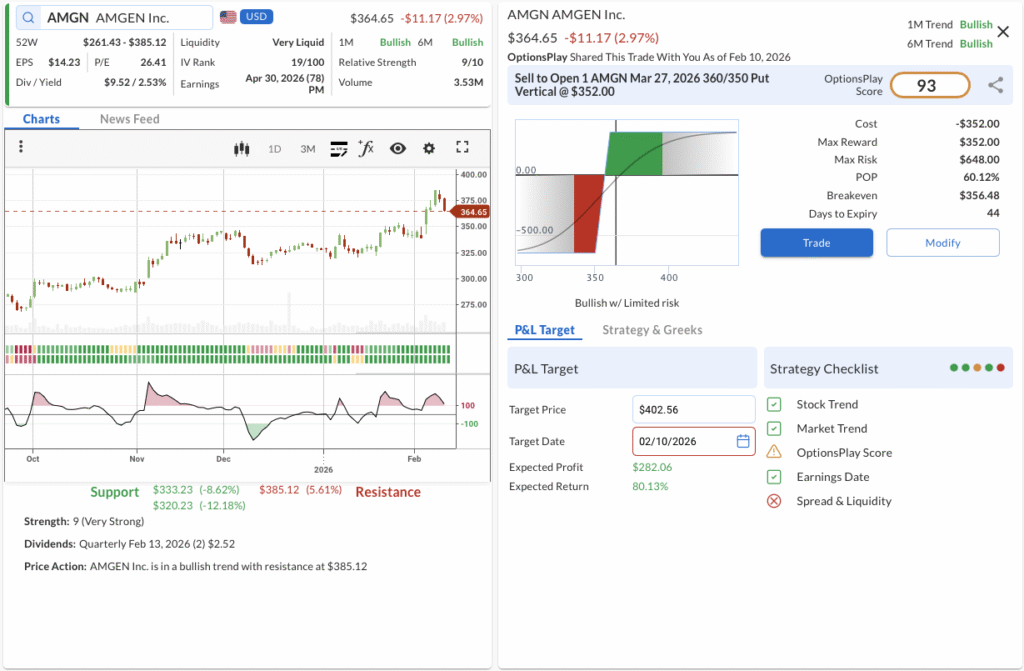

AMGN, MCHP

OptionsPlay DailyPlay Ideas Menu – February 11th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- AMGN: Bullish Put Spread capitalizing on a defensive valuation and robust pipeline catalysts as the stock pulls back to support.

- MCHP: Bullish Put Spread betting on the semiconductor inventory cycle bottoming out, positioning for a cyclical recovery with strong pricing power.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- (No trades in this category today)

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

1. AMGN ($364.65) – Buying the Biotech Dip

- The Trade: Sell to Open the AMGN Mar 27, 2026 360/350 Put Vertical @ $3.52 Credit.

- 🔴 SELL TO OPEN Mar 27, 2026 360 Put @ $10.00

- 🟢 BUY TO OPEN Mar 27, 2026 350 Put @ $6.48

- Trade Metrics: POP: 60.12% | Collect $352.00 per contract vs. a Max Risk of $648.00 (1.8:1).

- The Why: Amgen’s robust pipeline execution, particularly in the obesity space with MariTide, combined with a defensive valuation, makes this pullback an attractive entry point for income generation.

- The Technicals: Despite a short-term dip, Amgen remains in a confirmed Bullish Trend (1M & 6M), finding support near the $360 level, offering a technical “buy the dip” opportunity within a broader uptrend.

- Management:

- Stop Loss: Buy back the spread at $7.04 (100% of credit received).

- Take Profit: Buy back the spread at $1.76 (50% of max gain).

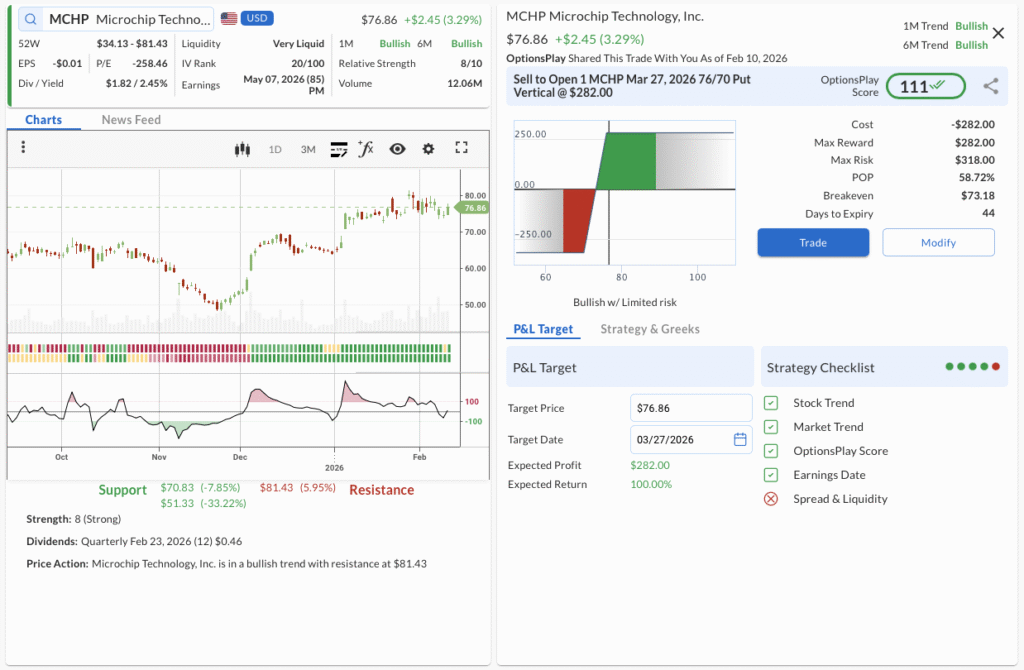

2. MCHP ($76.86) – Semiconductor Cycle Turnaround

- The Trade: Sell to Open the MCHP Mar 27, 2026 76/70 Put Vertical @ $2.82 Credit.

- 🔴 SELL TO OPEN Mar 27, 2026 76 Put @ $4.85

- 🟢 BUY TO OPEN Mar 27, 2026 70 Put @ $2.03

- Trade Metrics: POP: 58.72% | Collect $282.00 per contract vs. a Max Risk of $318.00 (1.1:1).

- The Why: As the semiconductor inventory correction nears its trough, Microchip Technology is positioned for a cyclical recovery, with strong pricing power supporting margin expansion.

- The Technicals: Microchip is exhibiting strong momentum in a confirmed Bullish Trend (1M & 6M), recently reclaiming key levels and aiming for resistance at $81.43, supported by rising volume.

- Management:

- Stop Loss: Buy back the spread at $5.64 (100% of credit received).

- Take Profit: Buy back the spread at $1.41 (50% of max gain).