DailyPlay – Opening Trade (QCOM) – July 17, 2025

QCOM Bullish Opening Trade Signal Investment Rationale...

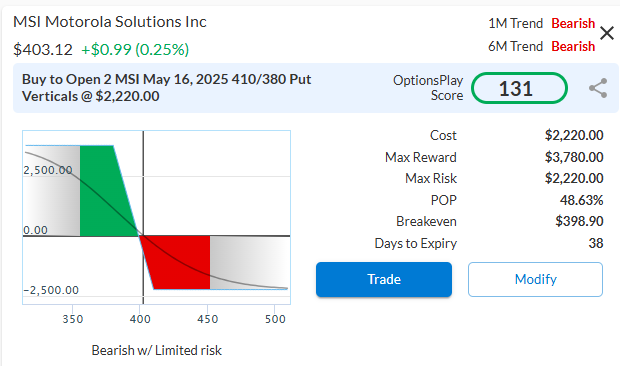

Read MoreMotorola Solutions (MSI), a leader in public safety communications, faces mounting macro and industry headwinds that threaten its rich valuation. After a 60% rally over the past year, the $75B company now looks vulnerable as tariffs, rising input costs, and geopolitical risks loom. Hardware makes up 60% of sales, exposing MSI to higher import costs from potential China tariffs, while heavy reliance on government contracts limits pricing flexibility. At 33x forward earnings with muted growth ahead, the stock appears overextended relative to fundamentals.

MSI recently broke down from a multi-month range and has retested resistance near $430–$440. The weak rebound stalled below the 50-day moving average, with MACD momentum still bearish. Lower highs and increased volume on selloffs suggest distribution is underway. A sustained move below $400 could open the door to a test of the $355 support level from mid-2023.Fundamentals show a stretched valuation:

MSI’s margins barely match peers, yet it trades at a 60% premium. Tariff exposure, a $6.2B debt load, and increasing competition from Axon and Nokia compound the risk, especially amid potential budget cuts from key government clients.

Trade Idea: Buy the MSI May 16, 2025, 410/380 put vertical spread. With 38 days to expiry and earnings on May 8, this setup provides leveraged downside exposure ahead of a potential catalyst.

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 2 Contracts MSI May 16 $410/$380 Put Vertical Spreads @ $11.10 Debit per Contract.

Total Risk: This trade has a max risk of $2,020 (2 Contracts x $1,010) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,010 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 6/10

OptionsPlay Score: 131

Stop Loss: @ $5.55 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

QCOM Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read More

MS Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay Portfolio Review Our Trades GS – DTE...

Read More

Share this on