DailyPlay – Opening Trade (TTWO) – August 26, 2025

TTWO Bearish Opening Trade Signal Investment Rationale...

Read MoreDailyPlay Portfolio Review

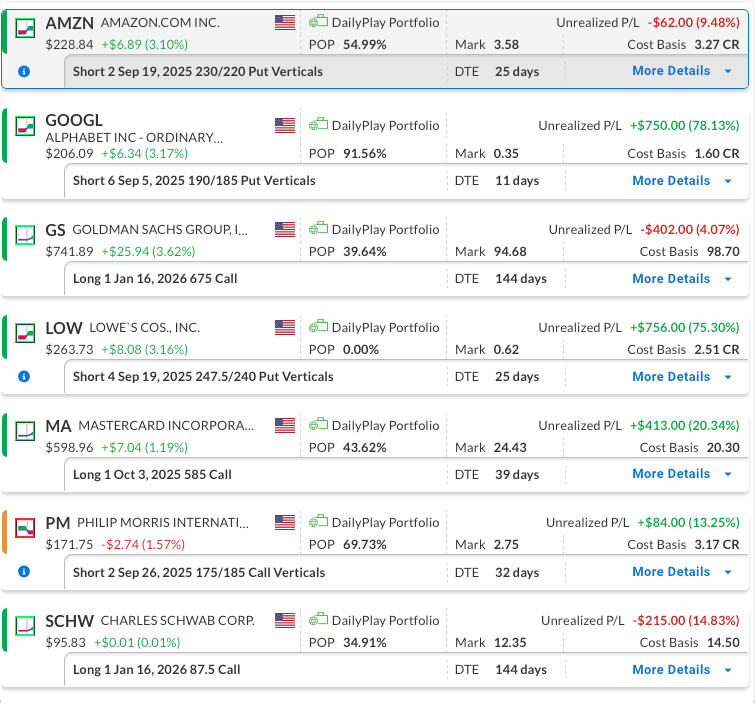

Our Trades

AMZN – 25 DTE

Bullish Credit Spread – Amazon.com, Inc. (AMZN) – The recent CCI dip signaled strength within an established bullish trend, highlighted by a short-term pullback. We entered our position last week and plan to stay the course as the trade develops.

GOOGL – 11 DTE

The position will be closed at the market open on today (Monday).

GS – 144 DTE

Bullish Long Call – Goldman Sachs Group, Inc. (GS) – We recently initiated this position and intend to maintain it. Continued strength in the financial sector, driven by Powell’s dovish comments at Jackson Hole, remains supportive for GS.

LOW – 25 DTE

Bullish Credit Spread – Lowe’s Companies, Inc. (LOW) – We recently established this position and we plan to stay the course for now.

MA – 39 DTE

Bullish Long Call – Mastercard Incorporated (MA) – We recently opened this position and plan to hold it for now. We chose a straight long call because the implied volatility (IV) rank was very low at 6/100, making spread strategies less favorable in terms of the risk/reward ratio compared to purchasing the call outright.

PM – 32 DTE

Bearish Credit Spread – Philip Morris International Inc. (PM) – We recently established this position and we plan to stay the course for now.

SCHW – 144 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We continue to see upside potential, supported by strong fundamentals and resilience in the financial sector. We closed our initial long call position once the option’s delta hit 1.00, then shifted into a higher strike call with a 0.80 delta and a later expiration. We plan to hold steady with this adjustment.

TTWO Bearish Opening Trade Signal Investment Rationale...

Read More

MA Bullish Opening Trade Signal Investment Rationale...

Read More

PM Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on