DailyPlay – Opening Trade (GLD) – September 18, 2025

GLD Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

The SPDR Gold Shares ETF (GLD) has delivered an exceptional rally in 2025, advancing more than 50% year-to-date as investors sought safety amid geopolitical risks, central bank accumulation, and shifting policy expectations. However, the rally appears stretched, with gold prices trading at extreme levels relative to both technical conditions and historical benchmarks. As the Federal Reserve signals resilience in the U.S. economy while moderating its rate policy, the risk/reward dynamic for gold shifts toward a potential downside correction. This setup makes GLD a compelling candidate for a tactical bearish trade.

Technical Analysis

GLD is trading near all-time highs just below $341 after a parabolic upside move, suggesting exhaustion risk. The ETF’s RSI stands at 72.85, firmly in overbought territory. Notably, within the options play platform yesterday, a “Bearish Counter Trend” alert was generated, highlighting that GLD has been extremely bullish but is now exhibiting signs of a potential reversal into a bearish trend. Key downside levels include the 20-day moving average near $325 as an initial trigger, followed by the 50-day moving average around $315 and the 200-day at $287. A sustained break below $325 would confirm downside momentum, with an upside resistance existing near the recent all-time high around $341.

Fundamental Analysis

From a fundamental perspective, gold is trading well above its long-term, inflation-adjusted average, raising questions about the sustainability of its current premium. While demand drivers like persistent inflation and central bank buying have supported prices, the potential for shifts in global risk appetite or reduced safe-haven demand present downside risks. With U.S. yields stabilizing but the dollar remaining weak, gold’s safe-haven premium could begin to compress if dollar sentiment reverses or if other asset classes regain investor favor. Current macro conditions may therefore limit further upside for gold in the near term, putting its elevated premium at risk of correction.

Options Trade

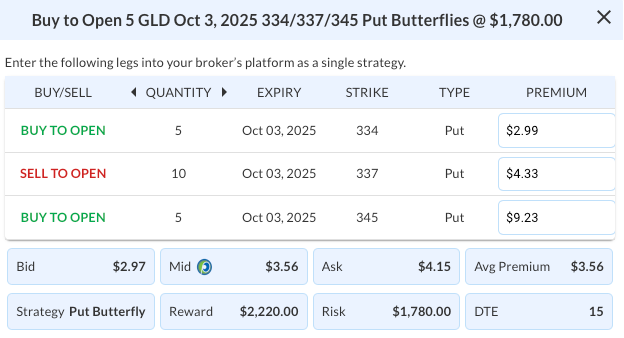

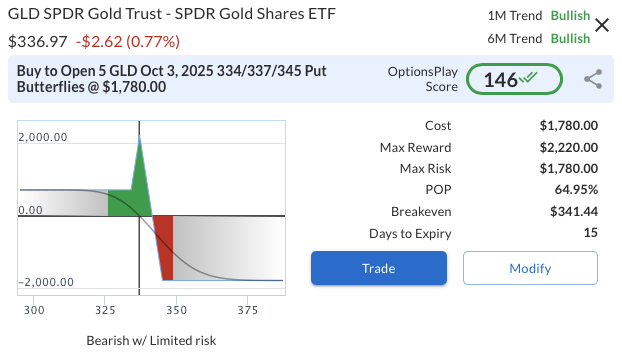

A tactical bearish expression can be structured with a GLD Oct 3, 2025, 334/337/345 Put Butterfly entered at a $356 debit. This is a non-standard butterfly, often referred to as an Open-Wing Butterfly, where the long spread is 8 points wide and the short spread is 3 points wide, which creates profitability not only near the $337 strike but also anywhere below the $334 put strike at expiration. The maximum potential reward is $444, with risk capped at the $356 cost. This structure aligns with the view that GLD may retrace sharply from overbought levels, offering attractive asymmetric exposure to downside while containing risk through defined premium outlay.

GLD – Daily

Trade Details

Strategy Details

Strategy: Long Put Butterfly Spread

Direction: Bearish Butterfly Spread

Details: Buy to Open 5 GLD Oct 03 $334/$337/$345 Put Butterfly Spreads @ $3.56 Debit per Contract.

Total Risk: This trade has a max risk of $1,780 (5 Contracts x $356) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $356 to select the # contracts for your portfolio.

Counter-Trend Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 146

Stop Loss: @ $1.78 (50% loss of premium)

View GLD Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View GLD Trade

More DailyPlay

DailyPlay – Opening Trade (SPY) & Closing Trade (C) – October 15, 2025

Closing Trade SPY Bearish Opening Trade Signal Investment...

Read More

DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Closing Trade (FDX) & Portfolio Review – October 13, 2025

Closing Trade DailyPlay Portfolio Review Our Trades C...

Read More

Share this on