DailyPlay – Portfolio Review – September 22, 2025

DailyPlay Portfolio Review

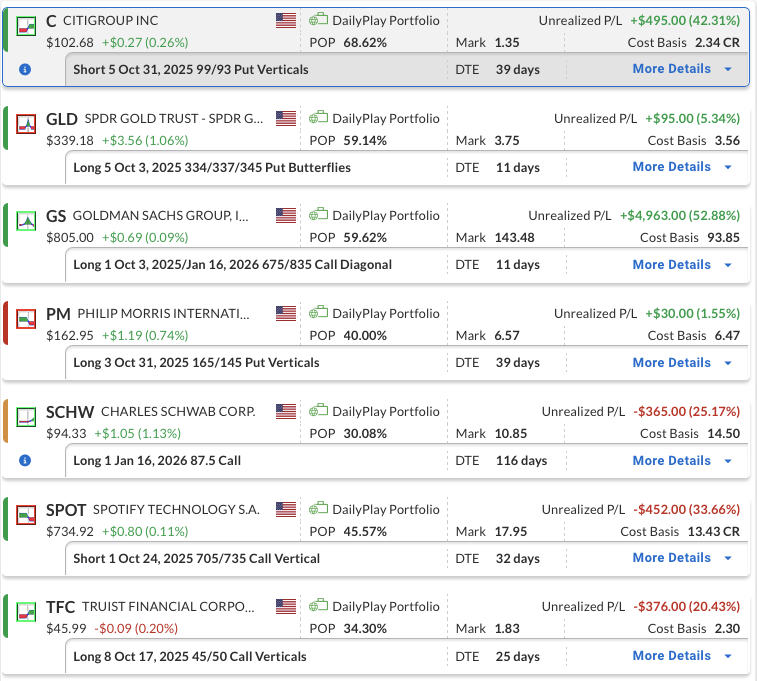

Our Trades

C – 39 DTE

Bullish Credit Spread – Citigroup Inc (C) – We recently established this position, it is currently profitable, and we plan to stay the course for now.

GLD – 11 DTE

Bearish Butterfly – SPDR Gold Shares (GLD) – We have a neutral to bearish strategy on GLD. With expiration approaching and the position showing a small gain currently, it is okay to exit at any point. We will hold the position and will also be prepared to close at the beginning of the week. The strategy benefits if GLD drops to 337, the middle strike of the butterfly, or below. Keep a close eye on the position and close during the day if the opportunity presents itself to take a gain or if the stop loss point is hit. The position’s profit and loss will be volatile with expiration so close.

GS – 11 DTE & 116 DTE

Bullish Diagonal Debit Spread – Goldman Sachs Group, Inc. (GS) – We maintain a bullish outlook over the longer term and plan to hold this position. To lower the cost basis, we sold a short-term OTM call against the long position.

PM – 39 DTE

Bearish Put Debit Spread – Philip Morris International Inc. (PM) – We recently established this position, it is showing a slight profit, and we plan to stay the course for now.

SCHW – 116 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We maintain our bullish outlook on Schwab. After our initial long call, we captured the gain and rolled into a higher strike call with a later expiration. We may sell calls to reduce risk if the timing is appropriate.

SPOT – 32 DTE

Bearish Credit Spread – Spotify Technology (SPOT) – We recently established this position, it is currently down, but with plenty of time until expiration we plan to stay the course for now.

TFC – 25 DTE

Bullish Debit Spread – Truist Financial Corporation (TFC) – The position is showing a loss, but we plan to stay the course for now and keep a close eye on it as expiration approaches.

More DailyPlay

DailyPlay – Opening Trade (SPY) & Closing Trade (C) – October 15, 2025

Closing Trade SPY Bearish Opening Trade Signal Investment...

Read More

DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Closing Trade (FDX) & Portfolio Review – October 13, 2025

Closing Trade DailyPlay Portfolio Review Our Trades C...

Read More

Share this on