DailyPlay – Opening Trade (CZR) – September 23, 2025

CZR Bearish Opening Trade Signal

Investment Rationale

Investment Thesis

Caesars Entertainment (CZR) faces a challenging macro and competitive backdrop that supports a bearish stance. Intensifying competition from online gambling platforms and rival casino operators is eroding market share at a time when consumer discretionary spending is under pressure from sticky inflation and softening labor market trends. These headwinds are particularly problematic for companies like CZR that rely heavily on discretionary leisure spending and sustained consumer confidence. Against this backdrop, the stock’s elevated valuation relative to peers leaves it vulnerable to further downside repricing.

Technical Analysis

CZR was recently rejected at its $31 resistance level and has since slipped back below both its 20-day and 50-day moving averages, signaling renewed downside momentum. The 200-day moving average, currently near $29.60, continues to act as longer-term resistance and reinforces the bearish setup. Momentum indicators remain weak, with RSI stalled near neutral, leaving room for further downside. With near-term support around $24 and a downside target closer to $18, the overall chart structure favors bearish positioning.

Fundamental Analysis

CZR’s financial profile reinforces the technical weakness, as the company trades at a steep premium despite underwhelming growth and margin trends compared to the industry. Elevated valuation multiples paired with negative profitability raise concerns about downside risk if macro conditions worsen or market share pressures intensify.

- Forward PE Ratio: 32.56x vs. Industry Median 15.93x

- Expected EPS Growth: 0% vs. Industry Median 11.75%

- Expected Revenue Growth: 2.50% vs. Industry Median 5.47%

- Net Margins: -1.71% vs. Industry Median 9.73%

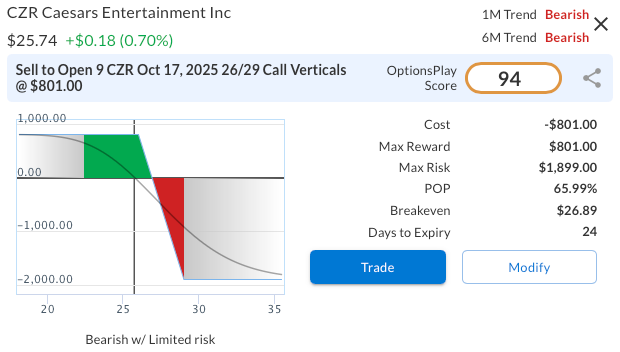

Options Trade

To capitalize on this bearish view, we recommend initiating a bear call spread by selling the CZR Oct 17, 2025, $26 call and buying the $29 call for a net credit of $0.89. This trade structure benefits from the stock remaining below the $26 strike, aligning. The maximum profit is $89 per spread, realized if CZR closes at or below $26 at expiration, while the maximum risk is $211, creating a reward-to-risk ratio of roughly 1:2.4. This setup offers defined risk and efficient capital usage, making it an attractive way to express bearish exposure while taking advantage of elevated option premiums.

CZR – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 9 CZR Oct 17 $26/$29 Call Vertical Spreads @ $0.89 Credit per Contract.

Total Risk: This trade has a max risk of $1,899 (9 Contracts x $211) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $211 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 94

Stop Loss: @ $1.78 (100% loss to value of premium)

View CZR Trade

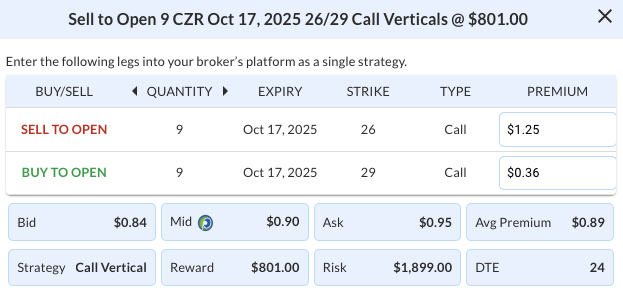

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View CZR Trade

More DailyPlay

DailyPlay – Opening Trade (SPY) & Closing Trade (C) – October 15, 2025

Closing Trade SPY Bearish Opening Trade Signal Investment...

Read More

DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on