DailyPlay – Opening Trade (FDX) – October 08, 2025

FDX Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

FedEx Corp. (FDX) presents a compelling bullish setup as it benefits from operational efficiency improvements, stable pricing, and resilient e-commerce-driven volumes despite macroeconomic headwinds. The company’s ongoing cost optimization initiatives and strategic capital allocation are positioning it for margin expansion and earnings stability through FY2025. With the transportation sector showing early signs of cyclical recovery, FedEx’s discounted valuation relative to peers offers an attractive entry point for investors seeking exposure to a potential logistics rebound. Near-term consolidation above key technical support strengthens the case for a continued rally toward the $275 price target.

Technical Analysis

FDX has broken decisively above the $240 resistance, backed by strengthening momentum and a bullish short-term moving average crossover. Price action remains constructive, with the stock holding above key moving averages and RSI trending firmly near 60. Maintaining traction above $240 would confirm trend continuation and set up an upside move toward $260–$275.

Fundamental Analysis

FedEx’s fundamentals underscore a valuation disconnect versus peers, despite growth and profitability metrics that remain highly competitive. The company’s disciplined cost control and network optimization initiatives continue to enhance earnings visibility and free cash flow generation.

- Forward PE Ratio: 13.57x vs. Industry Median 17.27x

- Expected EPS Growth: 9.30% vs. Industry Median 9.53%

- Expected Revenue Growth: 4.03% vs. Industry Median 3.97%

- Net Margins: 4.65% vs. Industry Median 5.71%

This valuation discount, combined with FedEx’s improving efficiency and moderate revenue growth outlook, positions the stock as substantially undervalued within the transportation group.

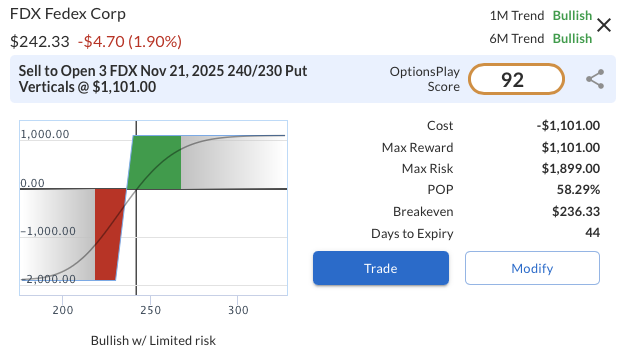

Options Trade

To express a bullish outlook with defined risk, consider selling the FDX Nov 21, 2025 $240/$230 Put Vertical Spread for a net credit of $3.67. The position profits if FDX remains above $240 at expiration, generating a maximum potential reward of $367 against a maximum risk of $633. This setup offers an attractive return on risk of approximately 58% over the holding period. The $240 short strike sits near established support, positioning the trade to benefit from continued strength while preserving downside protection.

FDX – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

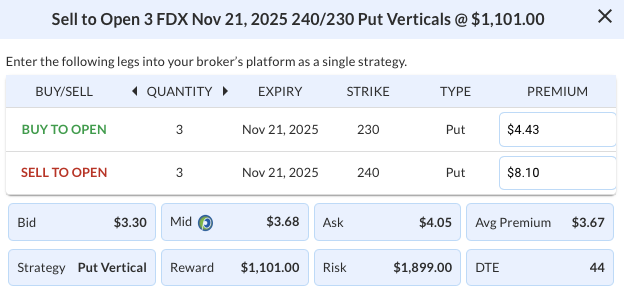

Details: Sell to Open 3 FDX Nov 21 $240/$230 Put Vertical Spreads @ $3.67 Credit per Contract.

Total Risk: This trade has a max risk of $1,899 (3 Contracts x $633) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $633 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 6/10

OptionsPlay Score: 92

Stop Loss: @ $7.34 (100% loss to value of premium)

View FDX Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View FDX Trade

More DailyPlay

DailyPlay – Opening Trade (SPY) & Closing Trade (C) – October 15, 2025

Closing Trade SPY Bearish Opening Trade Signal Investment...

Read More

DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on