DailyPlay – Portfolio Review – October 20, 2025

DailyPlay Portfolio Review

Our Trades

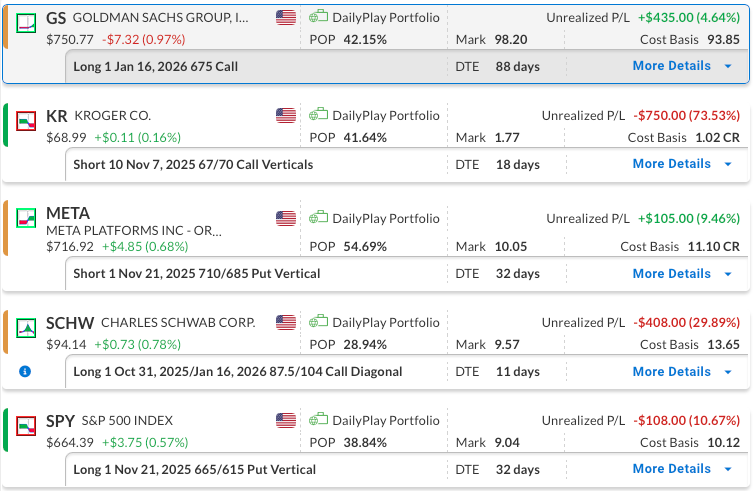

GS – 88 DTE

Bullish Long Call – Goldman Sachs Group, Inc. (GS) – We maintain a longer-term bullish outlook and plan to continue holding this position. We have lowered the cost basis of the position by selling a shorter-term call that expired worthless. The company reported earnings this Tuesday, the 14th and beat expectations.

KR – 18 DTE

Bearish Credit Spread – The Kroger Co. (KR) – This position is currently showing a loss. We need bearish momentum to pick up early in the week, or we may have to exit at the stop loss.

META – 32 DTE

Bullish Credit Spread – Meta Platforms, Inc. (META) – This position currently has a minimal gain, which we plan to maintain for now. Meta is expected to release earnings on Wednesday, October 29th, after the close.

SCHW – 11 DTE & 88 DTE

Bullish Diagonal Debit Spread – Charles Schwab Corp. (SCHW) – The company reported earnings on Thursday, October 16th, before the open and beat expectations on both the top and bottom line. We continue to maintain a bullish outlook on Schwab. After realizing gains on the initial long call, we rolled into a higher strike with a later expiration. To further reduce our cost basis, we recently sold a short-term out-of-the-money call against the long position.

SPY – 32 DTE

Bearish Debit Spread – SPDR S&P 500 ETF (SPY) – This position is currently showing a small loss, and we plan to maintain it for now.

More DailyPlay

DailyPlay – Opening Trade (SPY) & Closing Trade (C) – October 15, 2025

Closing Trade SPY Bearish Opening Trade Signal Investment...

Read More

DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on