DailyPlay – Opening Trade (TSLA) Closing Trade (TSLA) – April 22, 2025

Closing Trade

- TSLA – 73% gain: Sell to Close 2 Contracts (or 100% of your Contracts) May 2 $265/$220 Put Vertical Spreads @ $28.75 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $5,750. We initially opened these 2 Contracts on April 10 @ $16.60 Debit. Our gain on this trade, therefore, is $2,430.

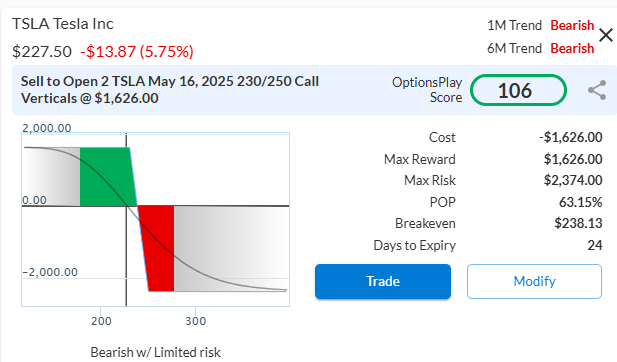

TSLA Bearish Opening Trade Signal

Investment Rationale

Tesla (TSLA) continues to present a compelling bearish setup, as elevated growth expectations remain out of sync with its weakening operational performance and margin trajectory. Broader headwinds in the EV sector, including slowing global demand and margin pressure from pricing competition, weigh heavily on the near-term outlook. Investor sentiment has shifted due to concerns over execution risk and substantial capital commitments to long-horizon projects. With valuation metrics still disconnected from industry norms, the stock appears vulnerable to a downside reset, particularly in the lead-up to a volatile earnings catalyst.

TSLA has decisively broken below its 200-day moving average, closing at $227.50 and signaling a significant technical breakdown through prior support near $257. The stock now trades beneath its 20-day, 50-day, and 200-day moving averages, reinforcing the prevailing bearish trend. Price action reflects a firm shift in momentum, with sellers maintaining control into earnings. A failed rebound above the $257 zone confirms that former support has turned into resistance. A continued decline could target the $200 psychological level, with potential extension toward $190 if earnings disappoint and selling pressure intensifies.

Tesla’s fundamentals show increasing pressure from both external market forces and internal strategic decisions. Aggressive pricing aimed at defending volume is compressing margins, while global EV demand moderates. At the same time, the company’s shift toward long-term innovation adds execution risk without near-term earnings clarity. Despite strong brand recognition and long-term vision, the near-term setup remains weak.

- Forward PE Ratio: 105x vs. Industry Median 11.66x

- Expected EPS Growth: 21.93% vs. Industry Median 5.93%

- Expected Revenue Growth: 16% vs. Industry Median 3.02%

- Net Margins: 7.6% vs. Industry Median 3.85%

To position for potential downside into earnings and a continuation of the technical breakdown, consider a May 16, 2025 TSLA $230/$250 call vertical spread. This trade profits fully if TSLA remains below $230 at expiration. With 24 days to expiry and earnings set for April 22, the structure benefits from elevated volatility while offering an asymmetric risk/reward profile.

TSLA – Daily

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 Contracts TSLA May 16 $230/$250 Call Vertical Spreads @ $8.13 Credit per Contract.

Total Risk: This trade has a max risk of $2,374 (2 Contracts x $1,187) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,187 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 8/10

OptionsPlay Score: 106

Stop Loss: @ $16.26 (100% loss to value of premium)

View TSLA Trade

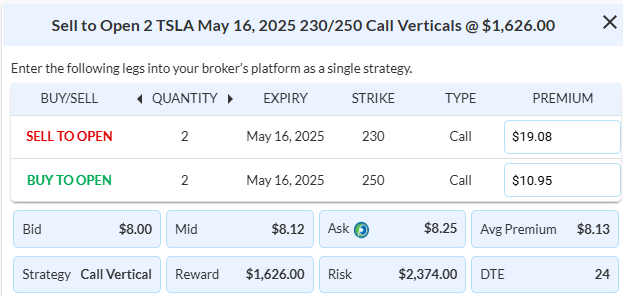

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View TSLA Trade

More DailyPlay

DailyPlay – Opening Trade (WMT) – November 18, 2025

WMT Bearish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Portfolio Review – November 17, 2025

DailyPlay Portfolio Review Our Trades AFRM – 39 DTE...

Read More

DailyPlay – Opening Trade (AFRM) – November 14, 2025

AFRM Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on