DailyPlay – Closing Trade (META) & Portfolio Review – November 03, 2025

Closing Trade DailyPlay Portfolio Review Our Trades AZN...

Read MoreStrategy: Long Call Vertical Spread

Direction: Bullish

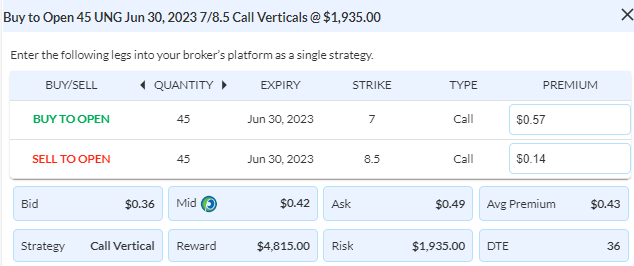

Details: Buy to Open 45 Contracts June 30th $7/$8.50 Call Vertical Spreads @ $0.43 Debit per contract.

Total Risk: This trade has a max risk of $1,935 (45 Contracts x $43) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $43 to select the # contracts for your portfolio.

Trend Continuation Signal: This stock has recently turned bullish and is expected to continue higher.

1M/6M Trends: Bullish/Neutral

Technical Score: 1/10

OptionsPlay Score: 112

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

The disparate thoughts of the Democrats and Republicans to resolve the debt-ceiling issue continues to be front and center for investors, as stocks again fell as the clock continues ticking down to the June 1 deadline that Treasury Secretary Yellen believes will be the day that the US government runs out of money to pay its debts. All three major stock indexes were well lower on the session, and the SPX has already given back some 100 points from the May high from just days ago. (You can thank your politicians on both sides of the aisle for that.) Given my writing this Wednesday evening, NVDA’s surge after reporting earnings after yesterday’s bell, I’d venture a decent guess that stocks open higher today – especially in tech, which has been killing it recently on the demand for AI-related names.

As a reminder, yesterday’s OIH close was above the downtrend line level I had given to you on Tuesday as a conditional trade to get into on either Tuesday or Wednesday if above the respective breakout price. Late yesterday the requirement was met, so on the close we got into our short June 16th $265/$255 put spread recommendation at ~$3.40 – the closing bid/offer mid-price.

OIH – Daily

For a new idea, I’m going to stay in the energy space, and look to play for an impending short squeeze higher in natural gas. We’ll use the UNG ETF as our proxy. Note that after the daily -13 low, we saw a counter move higher that topped on a Setup +9 count a week ago. The pullback has pulled back but held above the bearish Propulsion Momentum level at $6.74, while it also broke out above the downtrend line. s such, look to buy a UNG June 30th $7/$8.5 call spread (it closed yesterday at $0.425, or 28% of the strike differential).

UNG – Daily

Do note that today at 10:30am ET is the weekly natural gas inventory report – a number that can easily move natgas in either direction based upon where it comes in vs. expectation. Depending upon how you like to manage risk, you could put the whole trade on before the number; some before and some after; or completely wait for the number to come out to make sure it’s not a bearish one. The latter may be the safest way, to play but a bullish number is going to move natgas up quickly and then the call spread will cost far more. (Only you can decide which is the best choice for you.)

We are long 17 CSX $31/$29 put spreads that expire tomorrow, and yesterday saw the stock close at $30.89. With time virtually gone and the stock having sold down to a prior downtrend line it broke out from, let’s take 9 of those off today and then the final 8 tomorrow.

CSX – Weekly

Lastly, we are still long 2 GOOGL call spreads, having sold the third one out a few days ago right by the high of the move. Let’s use today’s strength in tech stocks to take one more off (and preferably when the stock is in the $122.50 to $123.50 area).

GOOGL – Weekly

Closing Trade DailyPlay Portfolio Review Our Trades AZN...

Read More

RIVN Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read More

META Bullish Trade Adjustment Signal Investment...

Read More

Share this on