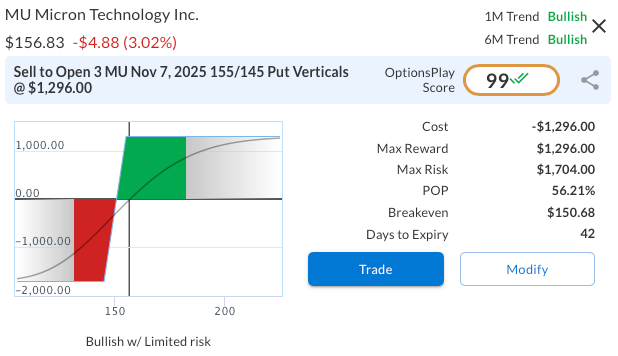

DailyPlay – Opening Trade (MU) – September 26, 2025

MU Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Micron Technology (MU) delivered a strong Q4 FY2024 earnings report that significantly exceeded expectations, reinforcing the view that the company is well-positioned to capitalize on secular growth trends in AI and data center demand. Revenue surged both sequentially and year-over-year, marking a decisive turnaround in the memory cycle. The return to profitability, coupled with strong balance sheet positioning, highlights Micron’s ability to weather cyclical volatility while benefiting from structural growth drivers. With shares recently breaking out to multi-year highs, MU presents a compelling opportunity for continued upside participation in the semiconductor industry.

Technical Analysis

MU’s price action showed strong bullish momentum heading into earnings, and while the stock has retraced modestly afterward, it continues to hold firmly above all major moving averages. The 20-day and 50-day averages remain in clear uptrends and sit well above the 200-day, reinforcing the strength of the longer-term move. The pullback from the $170 area looks constructive, allowing the stock to consolidate gains within a solid uptrend. Support is now defined near $156, and a decisive break above recent highs could set the stage for an advance toward the $175 zone.

Fundamental Analysis

Micron’s latest results demonstrate its undervaluation relative to peers despite superior growth and profitability metrics. Strength in data center and NAND demand, driven by AI adoption, underpins forward growth visibility, while the company’s balance sheet supports ongoing dividends and reinvestment. The stock remains substantially discounted on earnings multiples, suggesting further rerating potential.

- Forward PE Ratio: 12.19x vs. Industry Median 23.11x

- Expected EPS Growth: 17.88% vs. Industry Median 17.39%

- Expected Revenue Growth: 12.82% vs. Industry Median 10.87%

- Net Margins: 22.85% vs. Industry Median 11.78%

Options Trade

A bullish trade idea is selling the MU Nov 7, 2025, $155/$145 put vertical spread for a $4.32 credit. This trade collects $432 in premium while capping risk at $568, producing a favorable risk/reward profile of about 0.76 to 1. The breakeven sits at $150.68, allowing the position to work as long as MU stays above that level or continues higher.

MU – Daily

Trade Details

Strategy Details

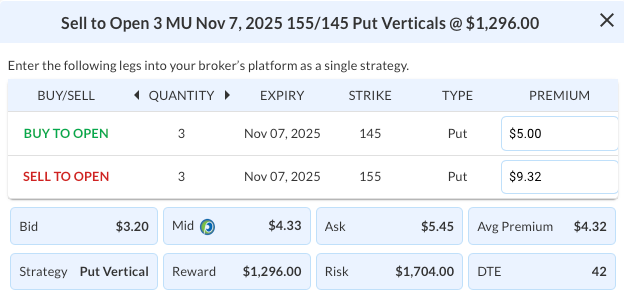

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 3 MU Nov 07 $155/$145 Put Vertical Spreads @ $4.32 Credit per Contract.

Total Risk: This trade has a max risk of $1,704 (3 Contracts x $568) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $568 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 99

Stop Loss: @ $8.64 (100% loss to value of premium)

View MU Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MU Trade

More DailyPlay

DailyPlay – Opening Trade (SPY) & Closing Trade (C) – October 15, 2025

Closing Trade SPY Bearish Opening Trade Signal Investment...

Read More

DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on