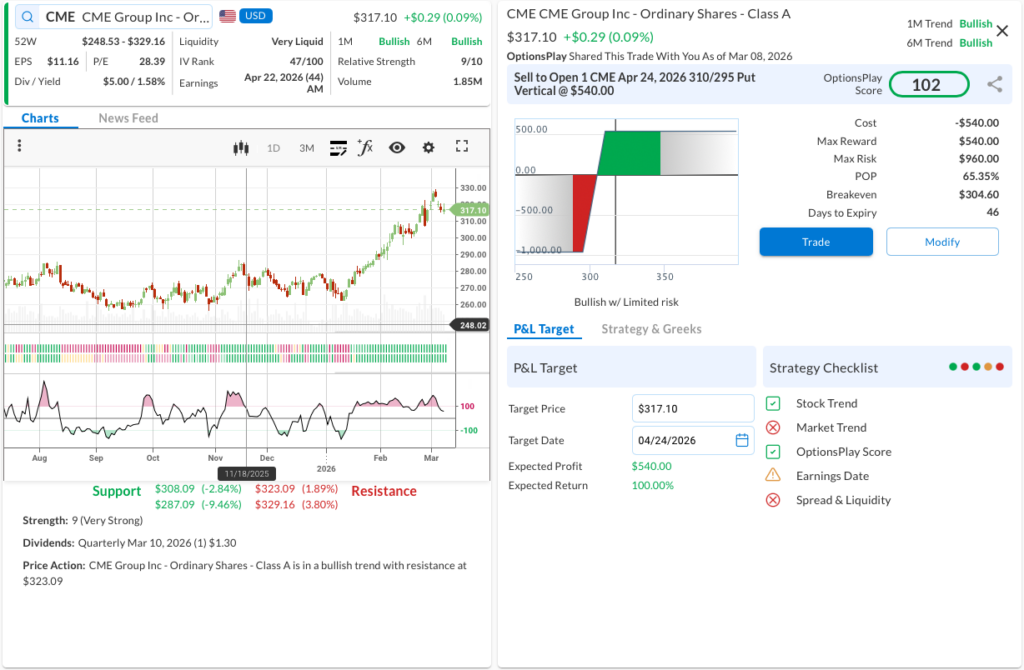

CME, V

OptionsPlay DailyPlay Ideas Menu – March 9th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- CME: Bullish Put Spread capitalizing on strong, high-margin fundamental tailwinds driven by elevated macroeconomic uncertainty and record derivatives trading volumes.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- (No trades in this category today)

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- V: Bearish Call Spread hedging against regulatory headwinds from the DOJ antitrust lawsuit and early signs of a softening consumer spending environment.

1. CME ($317.10) – Monetizing Market Volatility

- The Trade: Sell to Open the CME Apr 24, 2026 310/295 Put Vertical @ $5.40 Credit.

- 🟢 BUY TO OPEN Apr 24, 2026 295 Put @ $5.85

- 🔴 SELL TO OPEN Apr 24, 2026 310 Put @ $11.25

- Trade Metrics: POP: 65.35% | Collect $540.00 per contract vs. a Max Risk of $960.00 (1.8:1).

- The Why: With ongoing macroeconomic uncertainty and robust hedging activity driving record derivatives volume, CME’s exchange business enjoys a strong, high-margin fundamental tailwind that supports a bullish posture.

- The Technicals: Demonstrating strong Relative Strength (9/10) within a steady Bullish Trend (1M & 6M), the stock is tracking higher above its $308.09 support level and making a push toward overhead resistance at $323.09.

- Management:

- ⚠️ Warning: Earnings is scheduled for Apr 22, which may require active management.

- Stop Loss: Buy back the spread at $10.80 (100% of credit received).

- Take Profit: Buy back the spread at $2.70 (50% of max gain).

2. V ($317.36) – Regulatory Roadblocks

- The Trade: Sell to Open the V Apr 17, 2026 325/340 Call Vertical @ $4.83 Credit.

- 🔴 SELL TO OPEN Apr 17, 2026 325 Call @ $8.23

- 🟢 BUY TO OPEN Apr 17, 2026 340 Call @ $3.40

- Trade Metrics: POP: 67.21% | Collect $483.00 per contract vs. a Max Risk of $1,017.00 (2.1:1).

- The Why: Lingering concerns over the DOJ’s antitrust lawsuit and signs of a softening consumer spending environment have created fundamental headwinds that cap near-term upside for the payment giant.

- The Technicals: The stock is mired in a confirmed Bearish Trend (1M & 6M) with weak Relative Strength (3/10), recently breaking lower and establishing clear resistance at $321.78 with structural support sitting lower at $296.78.

- Management:

- Stop Loss: Buy back the spread at $9.66 (100% of credit received).

- Take Profit: Buy back the spread at $2.42 (50% of max gain).

Semiconductor & Compute: Industry Deep Dive #1 Is Live

By Tony Zhang | Chief Strategist, OptionsPlay | March 2026

Today we are publishing the first industry deep dive in our AI Infrastructure series: Semiconductor & Compute.

Last week, we published the AI Infrastructure Inversion Macro Thesis, the big-picture framework explaining why $675+ billion in hyperscaler capex is not enough and mapping the eight industries positioned to capture this capital flow. Now we are going layer by layer, starting with the foundational layer: the chips that power every AI workload on the planet.

If you have been following our AI Infrastructure Inversion Macro Thesis, you know the macro picture. Now it’s time to go deeper—starting with the layer that makes everything else possible.

Why Semiconductors Come First

In our macro research, we scored eight industries across the AI infrastructure stack. Semiconductor & Compute received the highest rating: Bullish +10. That was not an accident. Every other layer of the AI buildout—memory, power, cooling, networking, data centers, platforms—depends on what happens at the silicon level first.

The semiconductor industry is experiencing something it has never seen before: simultaneous demand surges from training, inference, and edge deployment—all accelerating at once. GPU order backlogs extend well into 2027. Custom silicon programs at every major hyperscaler are reshaping the competitive landscape. And the shift from training-dominated to inference-dominated workloads is creating entirely new winners.

This deep dive goes company by company through the semiconductor landscape—from dominant GPU makers to emerging custom silicon players to the critical suppliers most investors overlook—and identifies exactly where the asymmetric opportunities are right now.

| Semiconductor & Compute scored Bullish +10 in our framework—the highest rating of any industry. This deep dive explains why, breaks down the competitive landscape company by company, and shows you exactly how to position. |

What Is in the Deep Dive

The Semiconductor & Compute Deep Dive is a comprehensive industry analysis covering:

- The semiconductor landscape: A full competitive map of GPU leaders, custom silicon challengers, and the critical suppliers powering the AI buildout.

- Company-level analysis: Deep profiles on the key semiconductor companies—financial analysis, competitive positioning, risk factors, and proprietary ratings.

- The training-to-inference shift: How the transition from training-dominated to inference-dominated workloads is reshaping which chip architectures win—and which fall behind.

- Custom silicon wars: Why every major hyperscaler is developing in-house chips, what it means for NVIDIA’s dominance, and where the real competitive moats are forming.

- Portfolio positioning: How this semiconductor analysis fits within the broader AI Infrastructure Inversion framework, and how to build a cohesive portfolio across the full eight-layer stack.

Why Now

The semiconductor cycle is accelerating faster than any previous infrastructure buildout. GPU order backlogs, custom silicon timelines, and inference demand curves all point to the same conclusion: the companies that secure compute capacity now will define the winners of the AI era. And the stocks that supply that capacity are still being priced on backward-looking metrics.

This is the first of eight industry deep dives we will publish as part of the AI Infrastructure Inversion series. We are starting with semiconductors because it is the foundational layer—the one that every other industry in our framework depends on. Understanding it first gives you the lens to evaluate everything that comes after.

That is what this deep dive is about. Not hype. Not headline-chasing. A rigorous, company-by-company analysis of the semiconductor landscape with specific investment opportunities and the options strategies to execute on them.

When the Iran conflict escalated and energy markets surged, you needed answers fast — which oil and gas companies benefit, which ones are exposed, and where the real opportunities are. We got to work immediately.

Today, we’re delivering our most comprehensive sector research to date — a full Oil & Gas Supply Disruption Deep Dive covering the entire energy value chain, built from scratch in record time so you can navigate this market with clarity and confidence.

What We Built for You

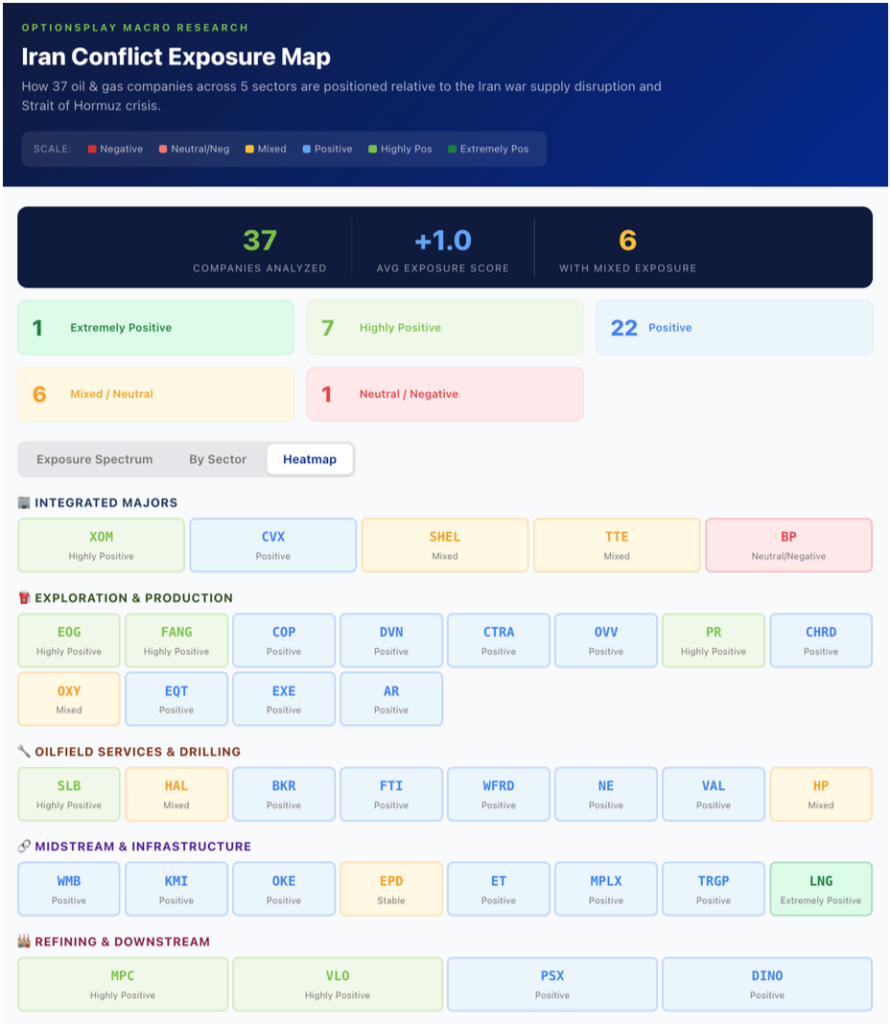

Every company in this report has been individually analyzed with a dedicated OptionsPlay rating, Iran crisis exposure assessment, recent catalysts, key operations breakdown, and a Company vs. Industry fundamentals comparison — the same rigorous format you’ve come to expect from our Semiconductor Deep Dive.

What’s Inside the Report

- Executive Summary — The macro thesis: why this supply disruption creates asymmetric opportunity

- Oil & Gas Value Chain Breakdown — How crude flows from wellhead to end product, and where the margin leverage lives

- OptionsPlay Rating Methodology — Our framework for rating each company through the Iran crisis lens

- 37 Individual Company Profiles — Investment thesis, crisis impact, catalysts, operations, customers, and fundamentals for every name

- Iran Conflict Exposure Map — Visual heat map of positive and negative exposure across the entire universe

- Full Rating Tracker — Every ticker, rating, price target, and upside in one dashboard

We processed an enormous amount of data — analyst estimates, earnings transcripts, production figures, supply chain mappings, geopolitical risk assessments, and real-time market data — and distilled it into actionable research so you don’t have to.

This is what your subscription is for: when the market moves fast, we move faster.

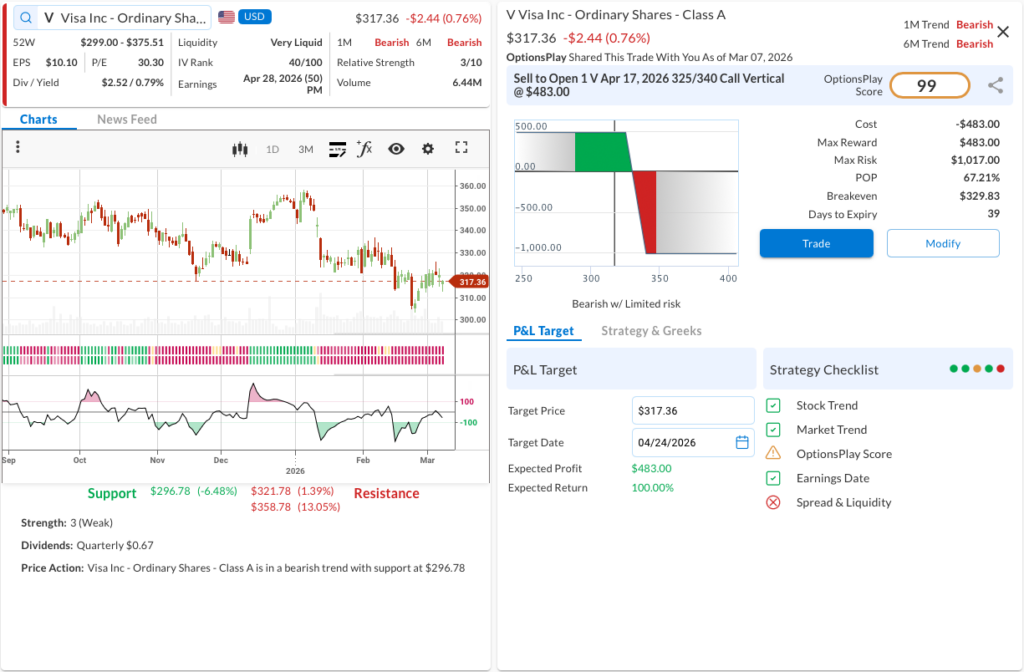

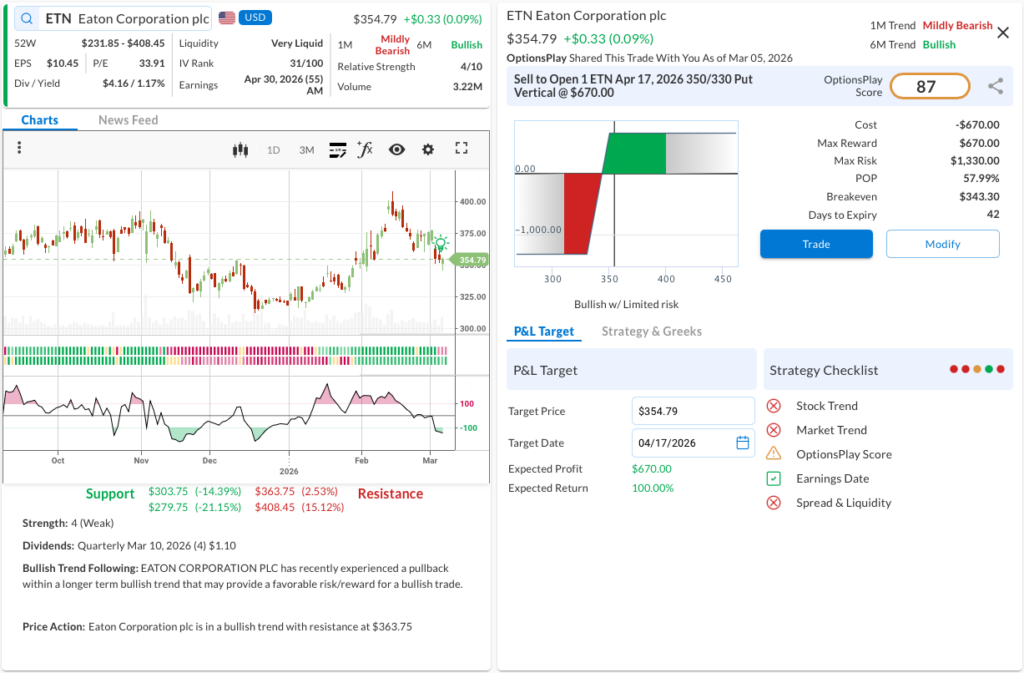

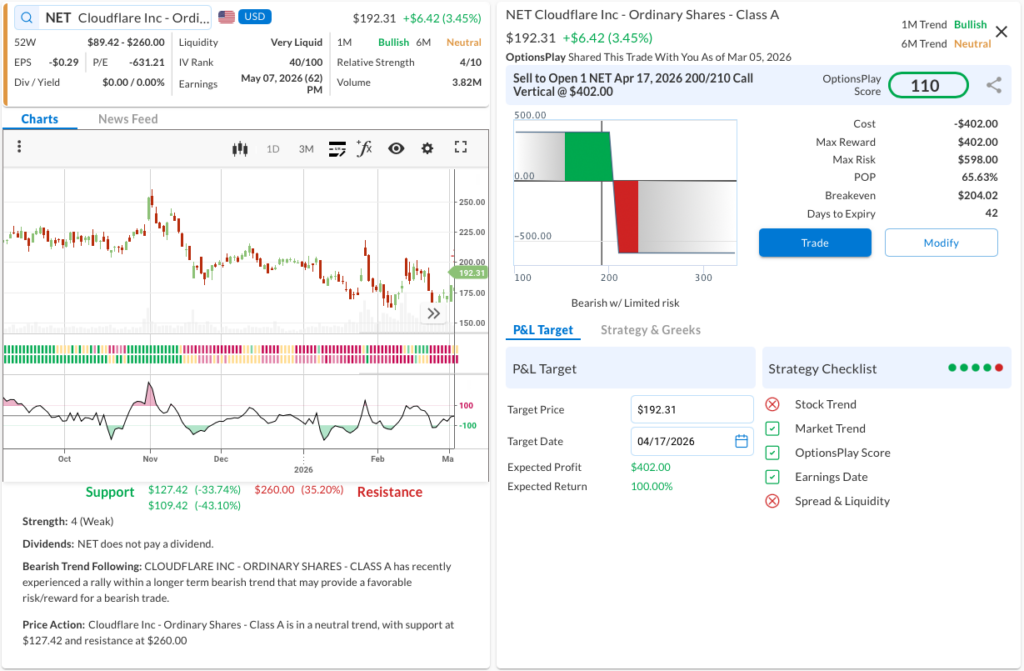

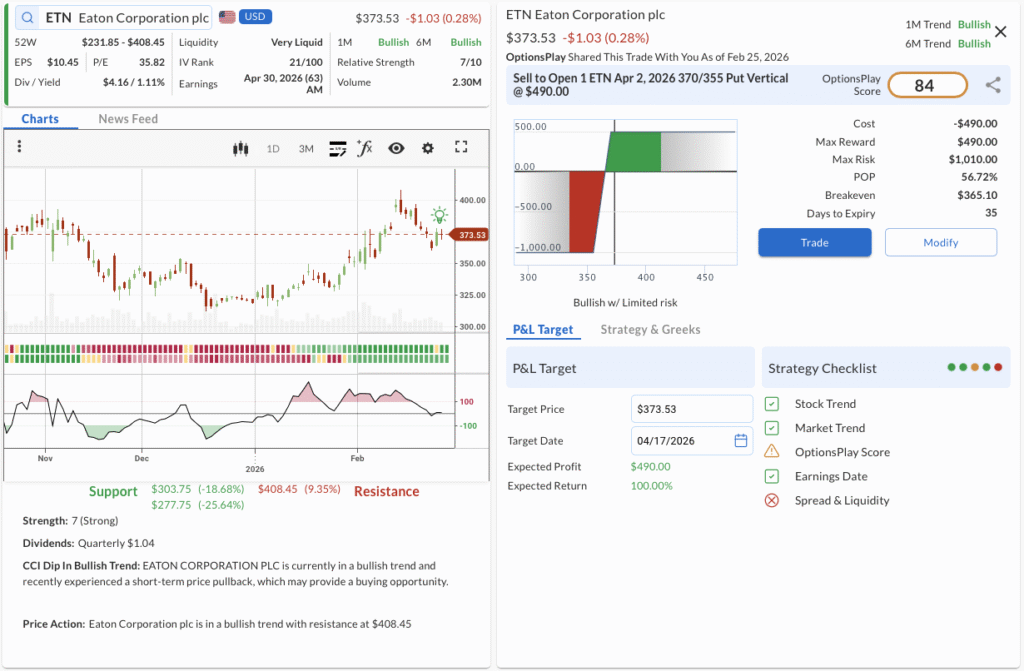

ETN, NET

OptionsPlay DailyPlay Ideas Menu – March 6th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- ETN: Bullish Put Spread capitalizing on a technical pullback as the electrification megatrend and data center demand provide a solid fundamental floor.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- (No trades in this category today)

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- NET: Bearish Call Spread hedging against valuation compression and IT spending headwinds during a counter-trend technical rally.

1. ETN ($354.79) – Buying the Electrification Dip

- The Trade: Sell to Open the ETN Apr 17, 2026 350/330 Put Vertical @ $6.70 Credit.

- 🟢 BUY TO OPEN Apr 17, 2026 330 Put @ $8.35

- 🔴 SELL TO OPEN Apr 17, 2026 350 Put @ $15.05

- Trade Metrics: POP: 57.99% | Collect $670.00 per contract vs. a Max Risk of $1,330.00 (2.0:1).

- The Why: Eaton remains a high-conviction play on the electrification megatrend and data center buildout, offering defensive growth characteristics that make this pullback a compelling entry point for premium collection.

- The Technicals: Eaton remains in a 6M Bullish Trend and is currently experiencing a short-term pullback, testing near-term resistance-turned-support levels, offering a favorable dip-buying opportunity for trend continuation.

- Management:

- Stop Loss: Buy back the spread at $13.40 (100% of credit received).

- Take Profit: Buy back the spread at $3.35 (50% of max gain).

2. NET ($192.31) – Fading the Cloud Rally

- The Trade: Sell to Open the NET Apr 17, 2026 200/210 Call Vertical @ $4.02 Credit.

- 🔴 SELL TO OPEN Apr 17, 2026 200 Call @ $12.15

- 🟢 BUY TO OPEN Apr 17, 2026 210 Call @ $8.13

- Trade Metrics: POP: 65.63% | Collect $402.00 per contract vs. a Max Risk of $598.00 (1.5:1).

- The Why: While Cloudflare holds a strong long-term position in cybersecurity, stretched valuations and potential macro IT spending headwinds make this counter-trend rally an ideal spot to deploy a portfolio hedge.

- The Technicals: The stock is technically in a Neutral 1M/6M trend but has recently experienced a counter-trend rally within a longer-term bearish context, providing a favorable risk/reward scenario for a bearish position.

- Management:

- Stop Loss: Buy back the spread at $8.04 (100% of credit received).

- Take Profit: Buy back the spread at $2.01 (50% of max gain).

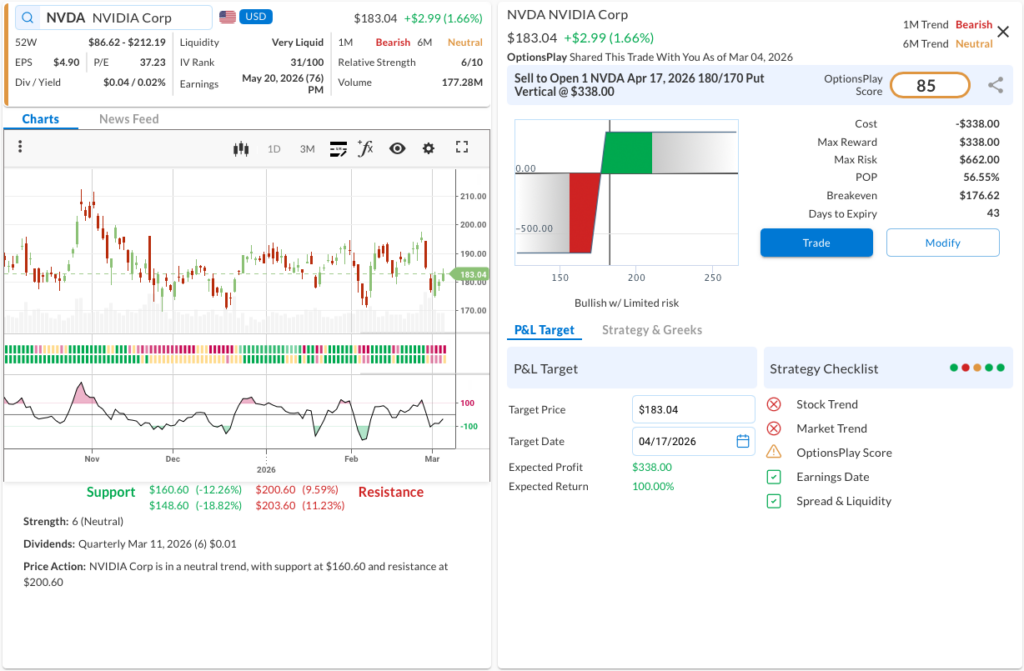

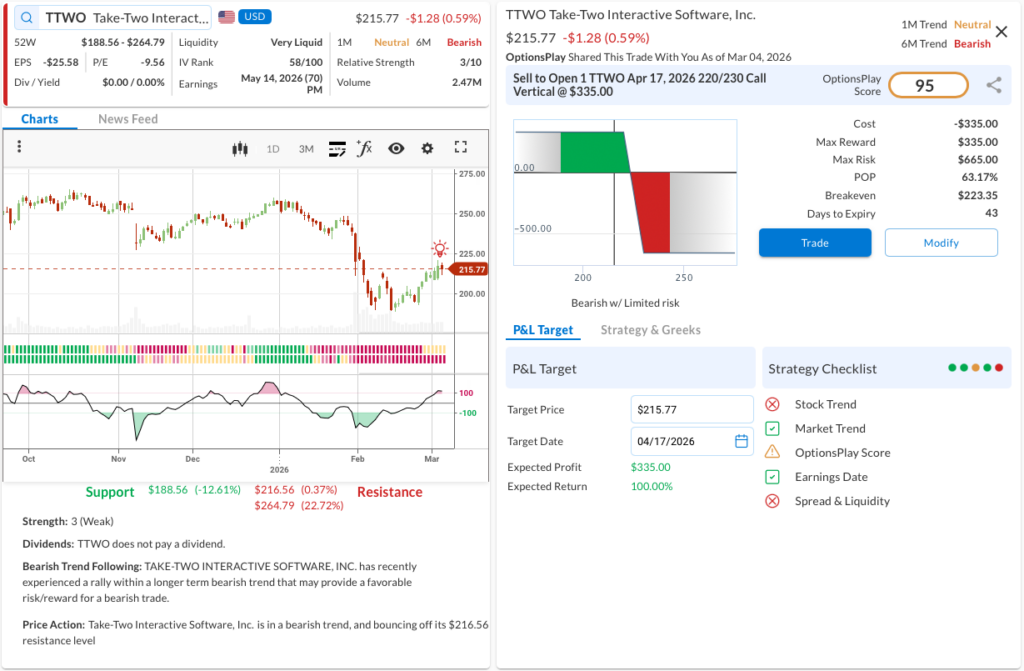

NVDA, TTWO

OptionsPlay DailyPlay Ideas Menu – March 5th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- NVDA: Bullish Put Spread capitalizing on sustained AI infrastructure spending as the stock successfully tests the bottom of its multi-month consolidation range.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- (No trades in this category today)

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- TTWO: Bearish Call Spread hedging against a lull in major franchise releases and softer consumer discretionary spending amid a weak technical setup.

1. NVDA ($183.04) – Bouncing Off the Range Bottom

- The Trade: Sell to Open the NVDA Apr 17, 2026 180/170 Put Vertical @ $3.38 Credit.

- 🔴 SELL TO OPEN Apr 17, 2026 180 Put @ $9.20

- 🟢 BUY TO OPEN Apr 17, 2026 170 Put @ $5.82

- Trade Metrics: POP: 56.55% | Collect $338.00 per contract vs. a Max Risk of $662.00 (2.0:1).

- The Why: Robust and sustained hyperscaler capital expenditures into AI infrastructure continue to cement Nvidia’s fundamental dominance, providing a strong valuation floor for premium collection during price consolidations.

- The Technicals: While the stock has been in a longer-term Neutral Trend (6M), it just successfully bounced off a key $180 support level—the bottom end of its established trading range—presenting a highly favorable mean-reversion setup.

- Management:

- Stop Loss: Buy back the spread at $6.76 (100% of credit received).

- Take Profit: Buy back the spread at $1.69 (50% of max gain).

2. TTWO ($215.77) – Fading the Counter-Trend Rally

- The Trade: Sell to Open the TTWO Apr 17, 2026 220/230 Call Vertical @ $3.35 Credit.

- 🔴 SELL TO OPEN Apr 17, 2026 220 Call @ $8.90

- 🟢 BUY TO OPEN Apr 17, 2026 230 Call @ $5.55

- Trade Metrics: POP: 63.17% | Collect $335.00 per contract vs. a Max Risk of $665.00 (2.0:1).

- The Why: A lull in major new game releases and broader signs of consumer discretionary fatigue create a fundamental headwind, justifying a bearish position against recent price strength.

- The Technicals: Exhibiting weak Relative Strength (3/10) within a longer-term Bearish Trend (6M), the stock recently experienced a counter-trend rally that is now failing exactly at its overhead resistance level of $216.56.

- Management:

- Stop Loss: Buy back the spread at $6.70 (100% of credit received).

- Take Profit: Buy back the spread at $1.68 (50% of max gain).

OptionsPlay DailyPlay Ideas Menu – March 4th, 2026

⚠️ No trades today due to current market conditions

Overall: DEEP RED — Situation Deteriorating

Day 5 with no de-escalation signals and several key reversals. The one opening signal from Day 4 — Ben Gurion’s phased reopening — has been revoked: Israel extended total airspace closure through March 6. South Korea’s Kospi crashed 12.06% (circuit breaker triggered, worst since 9/11/2001) as energy-dependent Asian exporters re-price the war premium. Kosdaq -14%. Iraq forced 1.5M bpd production cuts due to storage saturation from the Hormuz blockade, warning cuts could expand to 3M bpd. QatarEnergy halted all LNG and oil production after the Ras Laffan drone strike. VLCC rates at new all-time highs ($445K/day) with near-zero actual contracts — Sinokor quoting 700 Worldscale (~$20/barrel freight). Strait transits collapsed to 7 vessels on March 2 (from 79/day average), with some Greek owners running AIS-off nighttime transits. ~6% of the global tanker fleet is trapped. Qatar Airways pushed its next airspace update to Friday March 6 — signaling no imminent reopening. The only developments to watch today: UAE exchanges reopen (first Gulf price discovery since Friday), and several NOTAM expiries (Qatar, Bahrain, UAE FIRs) that will either extend or — in the most optimistic case — partially lift. SPX futures approaching the 6,700–6,750 negative gamma danger zone. Until physical tanker traffic resumes and at least one major Gulf FIR reopens, remain fully defensive.

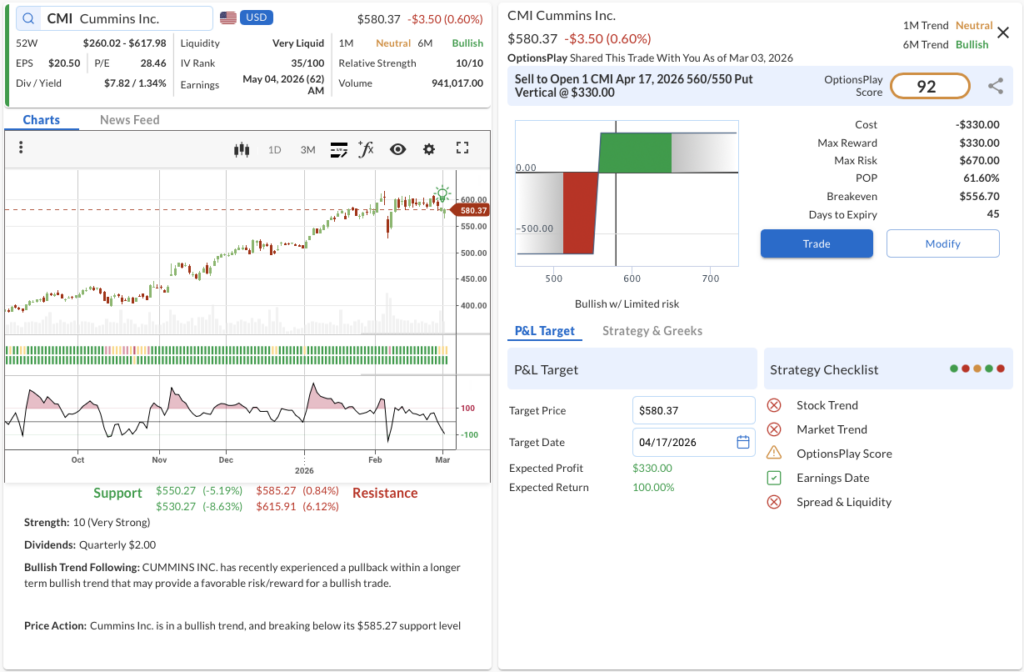

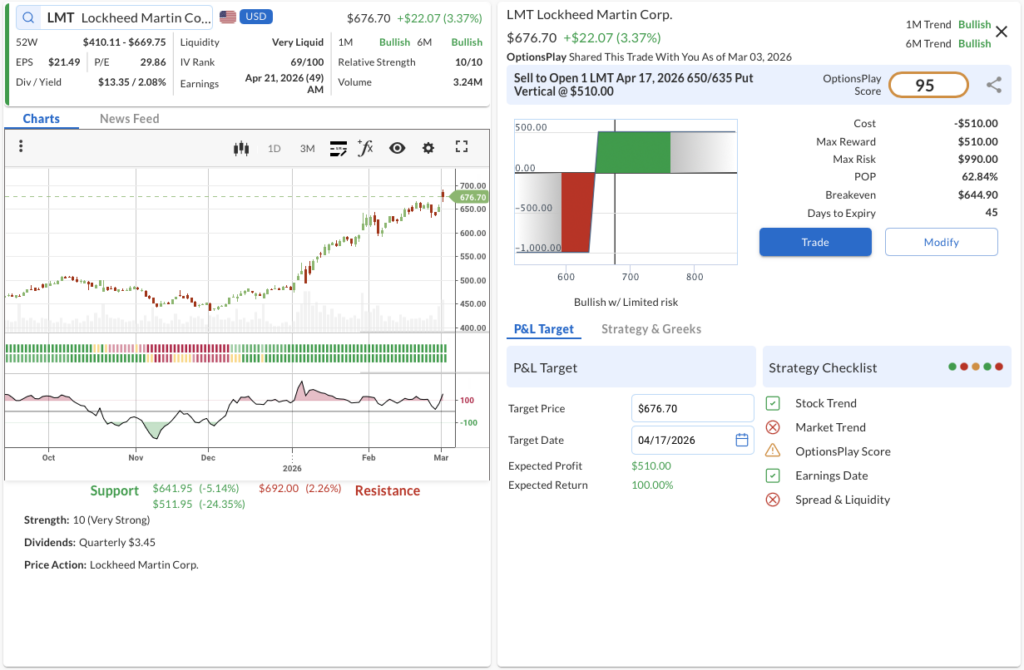

CMI, LMT, NEM

OptionsPlay DailyPlay Ideas Menu – March 3rd, 2026

💰 The Income Generators (High Probability, Cash Flow)

- CMI: Bullish Put Spread capitalizing on a technical pullback as strong demand in data center backup power and heavy-duty truck markets provides solid fundamental support.

- LMT: Bullish Put Spread leveraging a dip in a high-quality defense contractor, supported by escalating geopolitical tensions driving record defense backlogs and highly visible cash flows.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- NEM: Bullish Call Spread betting on continued margin expansion and free cash flow generation as persistent inflationary pressures sustain high gold prices.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

1. CMI ($580.37) – Powering the Data Center Boom

- The Trade: Sell to Open the CMI Apr 17, 2026 560/550 Put Vertical @ $3.30 Credit.

- 🟢 BUY TO OPEN Apr 17, 2026 550 Put @ $14.95

- 🔴 SELL TO OPEN Apr 17, 2026 560 Put @ $18.25

- Trade Metrics: POP: 61.60% | Collect $330.00 per contract vs. a Max Risk of $670.00 (2.0:1).

- The Why: Cummins is seeing robust structural tailwinds from the surging need for data center backup power generation, creating defensive revenue streams that make this technical dip an attractive premium collection opportunity.

- The Technicals: The stock maintains a long-term Bullish Trend (6M) with exceptional Relative Strength (10/10), and while it recently dipped below the $585.27 level, it is testing lower support zones to set up a potential mean-reversion bounce.

- Management:

- Stop Loss: Buy back the spread at $6.60 (100% of credit received).

- Take Profit: Buy back the spread at $1.65 (50% of max gain).

2. LMT ($676.70) – Defense and Dividends

- The Trade: Sell to Open the LMT Apr 17, 2026 650/635 Put Vertical @ $5.10 Credit.

- 🟢 BUY TO OPEN Apr 17, 2026 635 Put @ $16.25

- 🔴 SELL TO OPEN Apr 17, 2026 650 Put @ $21.35

- Trade Metrics: POP: 62.84% | Collect $510.00 per contract vs. a Max Risk of $990.00 (1.9:1).

- The Why: Lockheed Martin’s massive backlog and reliable dividend program offer an incredibly stable fundamental floor, making the stock a prime candidate for income generation during market consolidations.

- The Technicals: Exhibiting perfect Relative Strength (10/10) within a confirmed Bullish Trend (1M & 6M), the stock is currently offering a classic CCI dip buying opportunity as it consolidates above major support at $641.95.

- Management:

- Stop Loss: Buy back the spread at $10.20 (100% of credit received).

- Take Profit: Buy back the spread at $2.55 (50% of max gain).

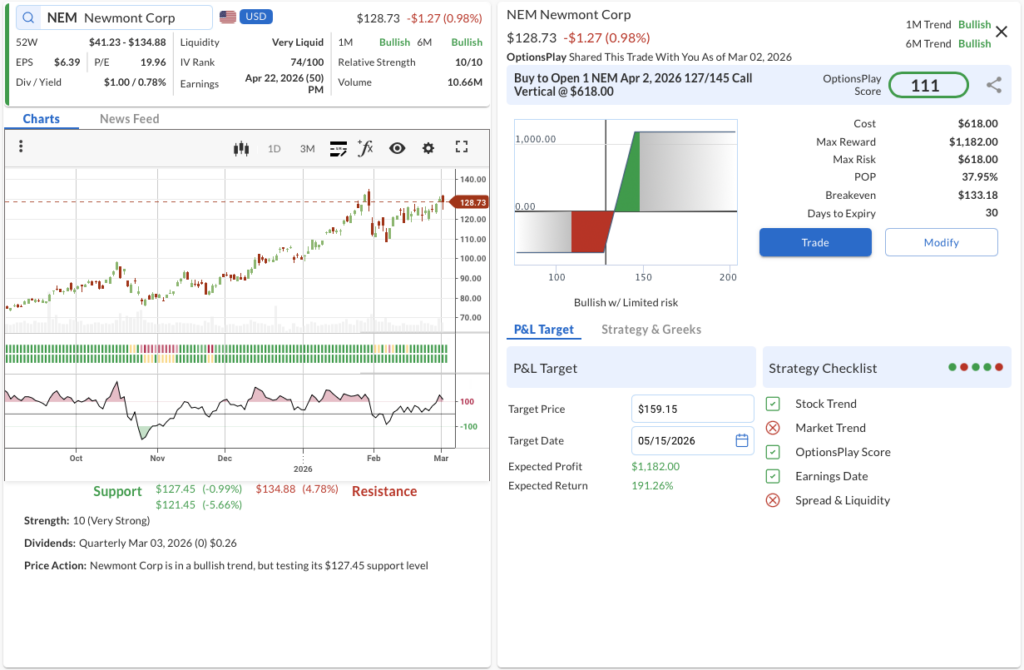

3. NEM ($128.73) – The Golden Breakout

- The Trade: Buy to Open the NEM Apr 02, 2026 127/145 Call Vertical @ $6.18 Debit.

- 🟢 BUY TO OPEN Apr 02, 2026 127 Call @ $8.98

- 🔴 SELL TO OPEN Apr 02, 2026 145 Call @ $2.80

- Trade Metrics: POP: 37.95% | Pay $618.00 per contract vs. a Max Reward of $1,182.00 (1.9:1).

- The Why: Strong execution and structurally elevated gold prices are driving impressive free cash flow yields for Newmont, paving the way for outperformance as it bounces off technical floors.

- The Technicals: Demonstrating exceptional Relative Strength (10/10) in a steady Bullish Trend (1M & 6M), the stock is currently testing a critical support level at $127.45, creating an optimal risk/reward entry for a technical bounce toward $134.88 resistance.

- Management:

- Stop Loss: Sell the spread at $3.09 (50% loss on premium).

- Take Profit: Sell the spread at $10.82 (75% gain on premium).

MRK, FANG, CMG

OptionsPlay DailyPlay Ideas Menu – March 2nd, 2026

💰 The Income Generators (High Probability, Cash Flow)

- MRK: Bullish Put Spread capitalizing on strong pipeline momentum and a defensive healthcare posture as the stock tests historical support levels.

- FANG: Bullish Put Spread leveraging robust free cash flow generation and increased dividend payouts following strong quarterly earnings.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- (No trades in this category today)

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- CMG: Bearish Put Spread hedging against persistent restaurant traffic declines and valuation compression in a softer consumer discretionary environment.

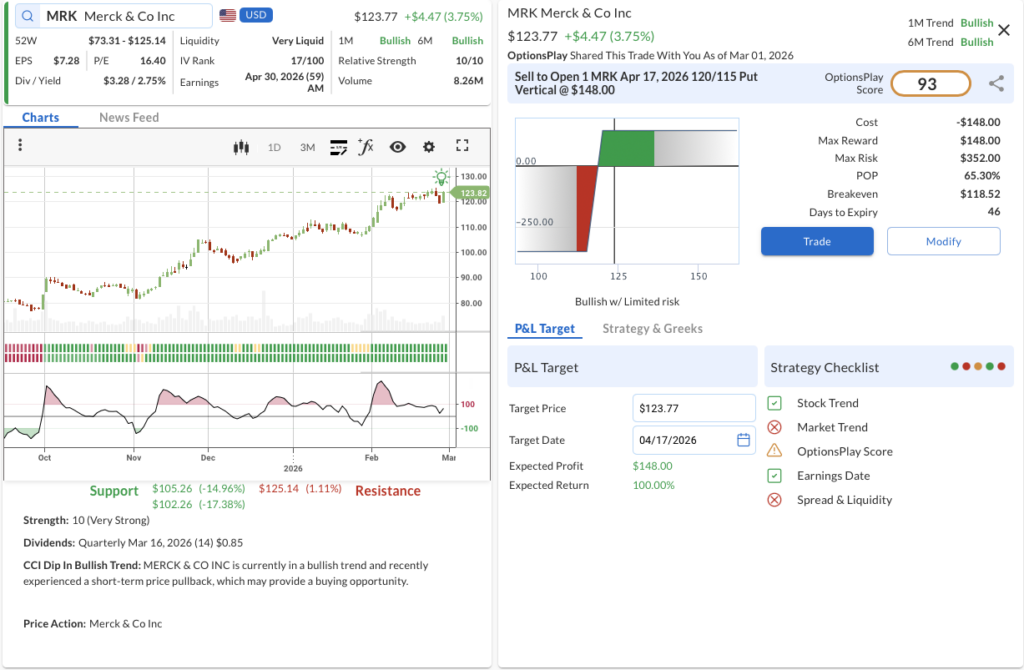

1. MRK ($123.77) – Pipeline Powerhouse

- The Trade: Sell to Open the MRK Apr 17, 2026 120/115 Put Vertical @ $1.48 Credit.

- 🟢 BUY TO OPEN Apr 17, 2026 115 Put @ $2.10

- 🔴 SELL TO OPEN Apr 17, 2026 120 Put @ $3.58

- Trade Metrics: POP: 65.30% | Collect $148.00 per contract vs. a Max Risk of $352.00 (2.4:1).

- The Why: Merck continues to demonstrate pipeline execution with positive trial results across its oncology portfolio, reinforcing its position as a sector leader and offering a defensive fundamental floor.

- The Technicals: MRK remains in a strong Bullish Trend (1M & 6M) with an exceptional 10/10 Relative Strength, currently presenting a CCI dip buying opportunity as it consolidates near its 52-week highs, aiming to test the $125.14 resistance.

- Management:

- Stop Loss: Buy back the spread at $2.96 (100% of credit received).

- Take Profit: Buy back the spread at $0.74 (50% of max gain).

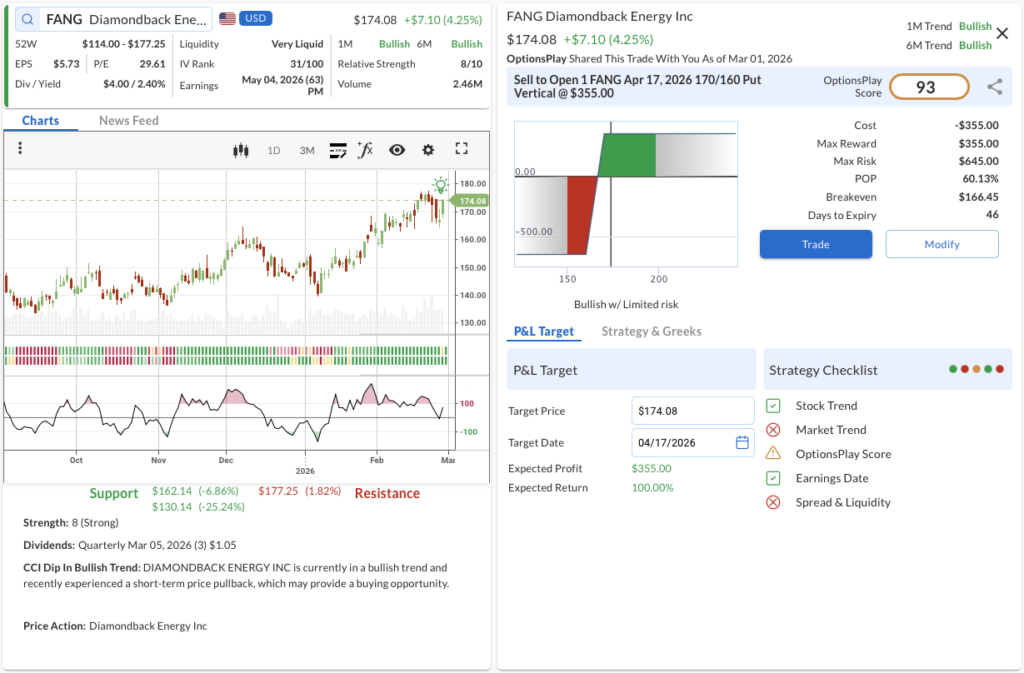

2. FANG ($174.08) – Yielding the Permian

- The Trade: Sell to Open the FANG Apr 17, 2026 170/160 Put Vertical @ $3.55 Credit.

- 🟢 BUY TO OPEN Apr 17, 2026 160 Put @ $4.15

- 🔴 SELL TO OPEN Apr 17, 2026 170 Put @ $7.70

- Trade Metrics: POP: 60.13% | Collect $355.00 per contract vs. a Max Risk of $645.00 (1.8:1).

- The Why: Diamondback Energy is demonstrating solid operational execution in the Permian Basin, generating substantial free cash flow, and prioritizing shareholder returns with a recently increased base dividend.

- The Technicals: Exhibiting solid Relative Strength (8/10) within a confirmed Bullish Trend (1M & 6M), the stock is offering a classic CCI dip entry near the $170 level before challenging overhead resistance at $177.25.

- Management:

- Stop Loss: Buy back the spread at $7.10 (100% of credit received).

- Take Profit: Buy back the spread at $1.78 (50% of max gain).

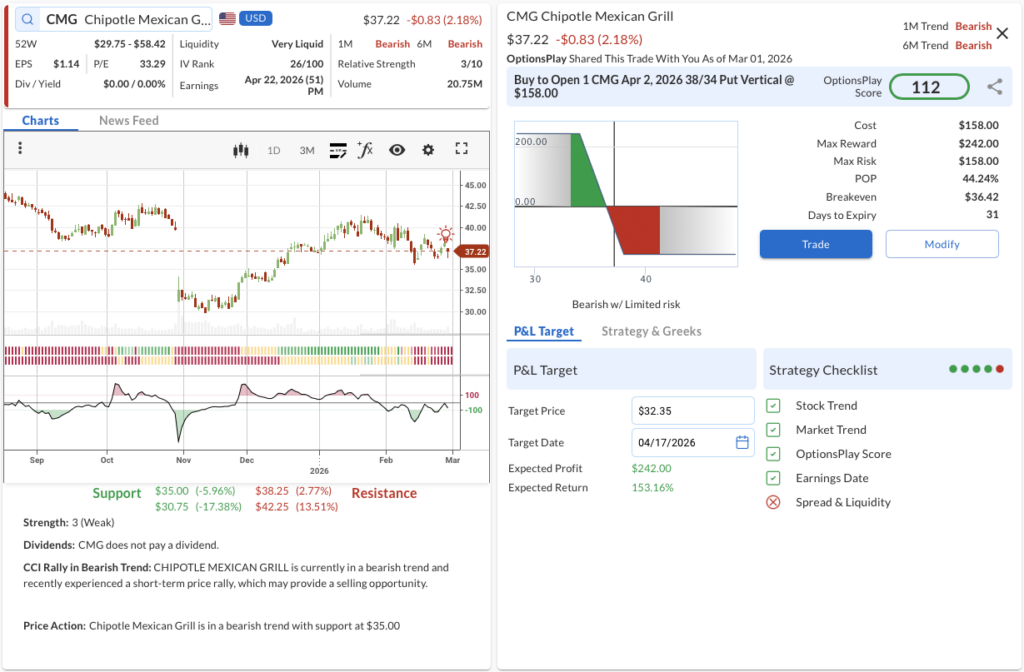

3. CMG ($37.22) – Fading the Fast Casual

- The Trade: Buy to Open the CMG Apr 2, 2026 38/34 Put Vertical @ $1.58 Debit.

- 🔴 SELL TO OPEN Apr 02, 2026 34 Put @ $0.46

- 🟢 BUY TO OPEN Apr 02, 2026 38 Put @ $2.04

- Trade Metrics: POP: 44.24% | Pay $158.00 per contract vs. a Max Reward of $242.00 (1.5:1).

- The Why: Despite historical outperformance, Chipotle is facing margin pressures and a decline in comparable restaurant transactions, prompting a bearish stance as consumer discretionary spending shows signs of fatigue.

- The Technicals: CMG is mired in a dual Bearish Trend (1M & 6M) with weak Relative Strength (3/10), presenting a compelling short setup via a CCI rally that is failing at the $38.25 resistance level, eyeing a retest of $35.00 support.

- Management:

- Stop Loss: Sell the spread at $0.79 (50% loss on premium).

- Take Profit: Sell the spread at $2.77 (75% gain on premium).

The AI Infrastructure Inversion: Our New Macro Research Is Live

By Tony Zhang | Chief Strategist, OptionsPlay | March 2026

Today we are publishing the most ambitious piece of thematic research in OptionsPlay’s history: The AI Infrastructure Inversion.

This report represents weeks of work, analyzing hyperscaler capital expenditure, modeling AI compute demand curves, mapping the physical infrastructure supply chain, and identifying the companies positioned on both sides of what we believe is a generational structural shift in technology markets.

If you have been watching the tech selloff and wondering what is actually happening, this is the answer.

The Core Thesis

Wall Street is making a historic miscalculation. Analysts are projecting AI compute demand based on chatbot usage patterns, single-turn conversations that consume a few hundred tokens. But the products that are defining the AI market right now are not chatbots. They are autonomous agents.

AI agents like Claude Code, OpenAI Codex, and Microsoft Copilot Agents do not ask one question and stop. They plan, execute, iterate, and verify. A single agentic task can consume 100 to 3,000 times the compute of a chatbot query. And these are not prototypes. They are the fastest-growing products in the AI ecosystem today.

The result: Wall Street is modeling linear growth for a technology that scales exponentially. And that miscalculation has created one of the most asymmetric investment opportunities in a generation.

| The $675+ billion that hyperscalers have committed to AI infrastructure in 2026 is not reckless overspending. It is not enough. Our research explains why, and identifies exactly where the money is flowing. |

What Is in the Report

The AI Infrastructure Inversion is a full macro research report covering:

- The overspending myth: Why the bear case for AI infrastructure falls apart under scrutiny, and what the hyperscalers see that Wall Street does not.

- Exponential blindness: The cognitive bias causing analysts to underestimate compute demand — and the math that proves it.

- The inference inflection: Why the shift from training to inference changes the entire economics of AI infrastructure.

- The agentic AI revolution: How autonomous agents are replacing entire categories of enterprise software and compounding compute demand in the process.

- The 8-industry infrastructure map: A comprehensive framework spanning silicon, memory, power, cooling, networking, physical infrastructure, platforms, and the short side.

- Our anchor investment thesis: One company that sits at the intersection of every critical AI infrastructure layer, self-funds its entire buildout, and we believe is among the most mispriced in the market.

Why Now

Every major infrastructure cycle in history has followed the same pattern: massive build-out, widespread skepticism, and then explosive adoption that rewarded the early movers. But each cycle has been faster than the last. Railroads took 20 years. Cloud computing took 6 years. We believe the AI infrastructure investment window is measured in months.

The current selloff in tech stocks is not a sign that AI is failing. It is a sign that the market has not yet caught up to what is actually happening. The capital is not disappearing, it is transferring. And the companies on the right side of that transfer are building the foundation of the next era of computing.

That is what this report is about. Not hype. Not prediction. The structural math that says the infrastructure being built today is not enough, and the specific investments positioned to benefit.

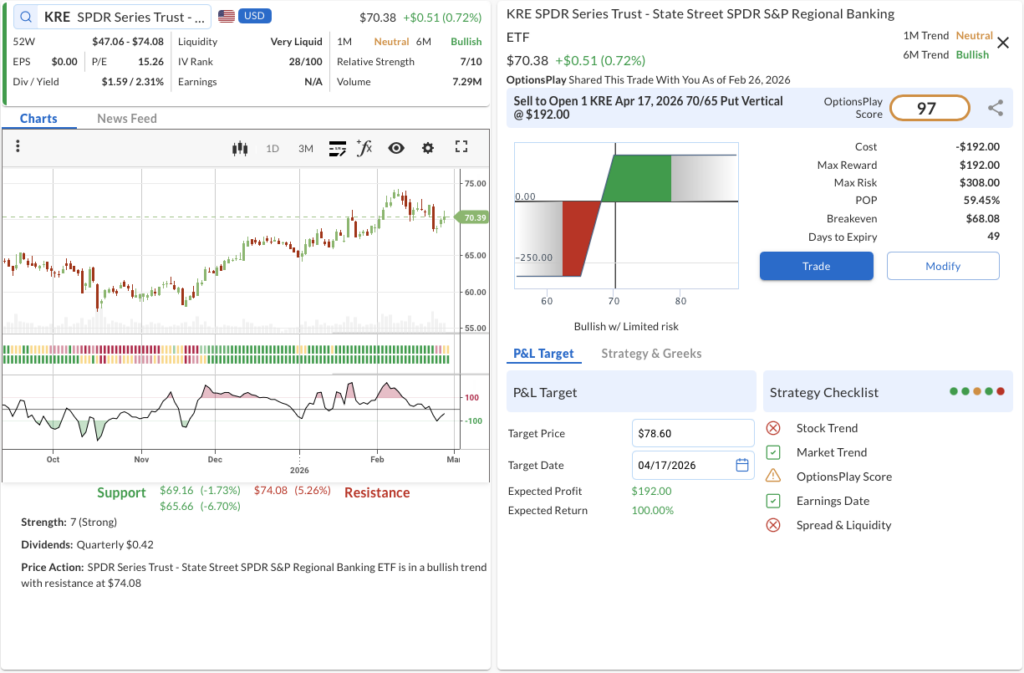

KRE, PHM

OptionsPlay DailyPlay Ideas Menu – February 27th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- KRE: Bullish Put Spread capitalizing on a technical pullback as stabilizing net interest margins and deregulation tailwinds provide a strong fundamental floor for regional banks.

- PHM: Bullish Put Spread leveraging a dip in a high-quality homebuilder, supported by a structural housing shortage and robust margins amidst stabilizing mortgage rates.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- (No trades in this category today)

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- (No trades in this category today)

1. KRE ($70.38) – Regional Bank Resilience

- The Trade: Sell to Open the KRE Apr 17, 2026 70/65 Put Vertical @ $1.92 Credit.

- 🟢 BUY TO OPEN Apr 17, 2026 65 Put @ $1.26

- 🔴 SELL TO OPEN Apr 17, 2026 70 Put @ $3.18

- Trade Metrics: POP: 59.45% | Collect $192.00 per contract vs. a Max Risk of $308.00 (1.6:1).

- The Why: Stabilizing net interest margins and potential deregulation tailwinds provide a strong fundamental floor for regional banks, making this pullback an attractive opportunity to generate premium.

- The Technicals: KRE remains in a solid longer-term Bullish Trend (6M) with a Relative Strength of 7/10, currently offering a buying opportunity on a CCI dip as it pulls back to test near-term support around $69.16, with resistance overhead at $74.08.

- Management:

- Stop Loss: Buy back the spread at $3.84 (100% of credit received).

- Take Profit: Buy back the spread at $0.96 (50% of max gain).

2. PHM ($135.66) – Building a Base

- The Trade: Sell to Open the PHM Apr 10, 2026 135/125 Put Vertical @ $3.50 Credit.

- 🟢 BUY TO OPEN Apr 10, 2026 125 Put @ $2.60

- 🔴 SELL TO OPEN Apr 10, 2026 135 Put @ $6.10

- Trade Metrics: POP: 58.51% | Collect $350.00 per contract vs. a Max Risk of $650.00 (1.9:1).

- The Why: PulteGroup continues to benefit from a structural housing shortage and robust margins, making technical pullbacks attractive entry points as mortgage rates stabilize and demographic demand remains strong.

- The Technicals: Despite a recent 4.46% pullback below $138.06 (which now acts as resistance), PHM maintains a 6M Bullish Trend with a Relative Strength of 6/10, presenting a classic CCI dip buying opportunity near current levels with lower support at $122.06.

- Management:

- Stop Loss: Buy back the spread at $7.00 (100% of credit received).

- Take Profit: Buy back the spread at $1.75 (50% of max gain).

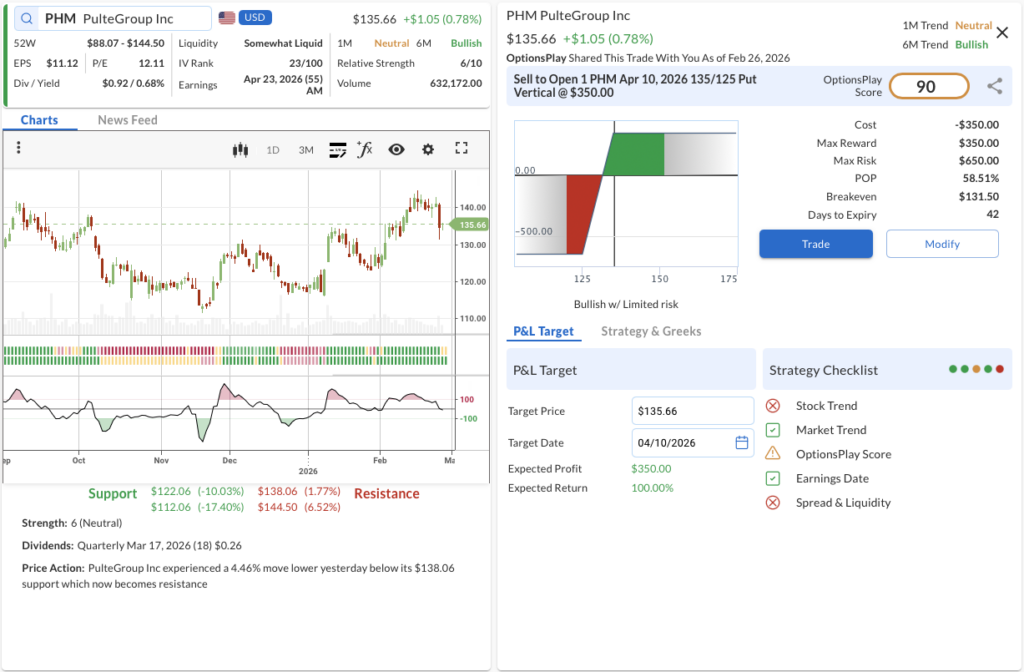

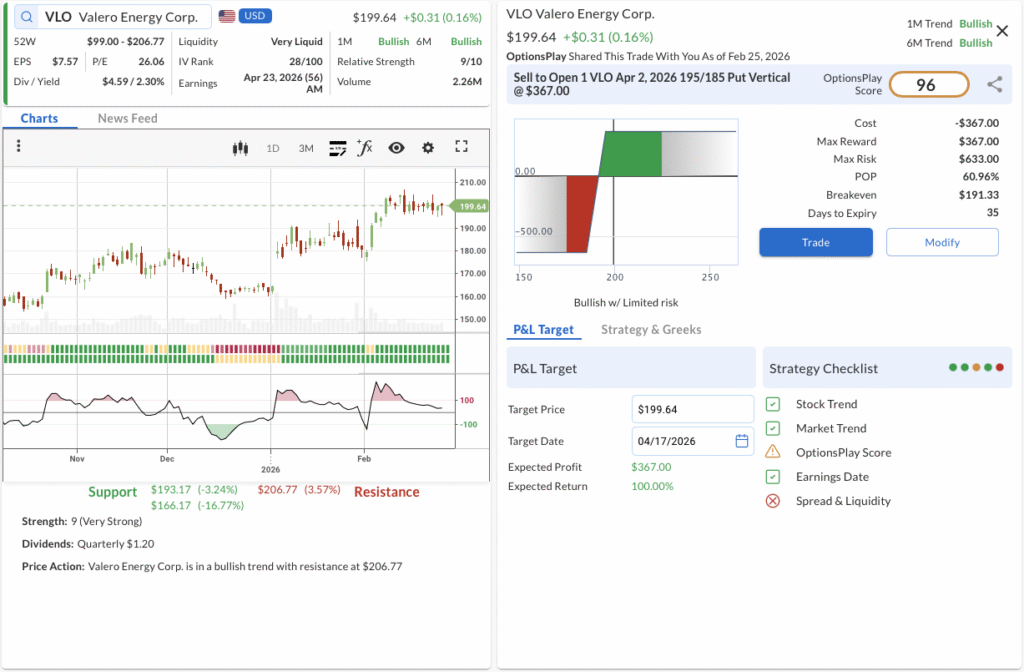

ETN, VLO, BUD

OptionsPlay DailyPlay Ideas Menu – February 26th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- ETN: Bullish Put Spread leveraging a technical dip in a high-conviction secular winner driven by data center and electrification tailwinds.

- VLO: Bullish Put Spread capitalizing on stabilizing refining margins and robust free cash flow generation during a technical consolidation.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- (No trades in this category today)

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- BUD: Bearish Put Spread betting on continued volume headwinds and shifting consumer preferences as the stock breaks below key technical support.

1. ETN ($373.53) – Buying the Electrification Dip

- The Trade: Sell to Open the ETN Apr 2, 2026 370/355 Put Vertical @ $4.90 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 355 Put @ $8.40

- 🔴 SELL TO OPEN Apr 02, 2026 370 Put @ $13.30

- Trade Metrics: POP: 56.72% | Collect $490.00 per contract vs. a Max Risk of $1,010.00 (2.1:1).

- The Why: Eaton remains a primary beneficiary of the multi-year data center and grid electrification supercycle, making this short-term pullback an attractive income-generation entry point on a structurally sound business.

- The Technicals: Eaton is in a confirmed Bullish Trend (1M & 6M) with a solid Relative Strength of 7/10, currently experiencing a CCI dip that offers a favorable short-term pullback opportunity while holding structural support levels, with resistance at $408.45.

- Management:

- Stop Loss: Buy back the spread at $9.80 (100% of credit received).

- Take Profit: Buy back the spread at $2.45 (50% of max gain).

2. VLO ($199.64) – Refining the Income Strategy

- The Trade: Sell to Open the VLO Apr 2, 2026 195/185 Put Vertical @ $3.67 Credit.

- 🟢 BUY TO OPEN Apr 02, 2026 185 Put @ $3.90

- 🔴 SELL TO OPEN Apr 02, 2026 195 Put @ $7.57

- Trade Metrics: POP: 60.96% | Collect $367.00 per contract vs. a Max Risk of $633.00 (1.7:1).

- The Why: Valero continues to demonstrate exceptional operational efficiency and strong free cash flow generation, supporting sustained shareholder returns even as energy markets stabilize.

- The Technicals: Valero remains in a strong Bullish Trend (1M & 6M) with excellent Relative Strength (9/10), consolidating in a tight range above major support at $193.17 with overhead resistance sitting at $206.77.

- Management:

- Stop Loss: Buy back the spread at $7.34 (100% of credit received).

- Take Profit: Buy back the spread at $1.84 (50% of max gain).

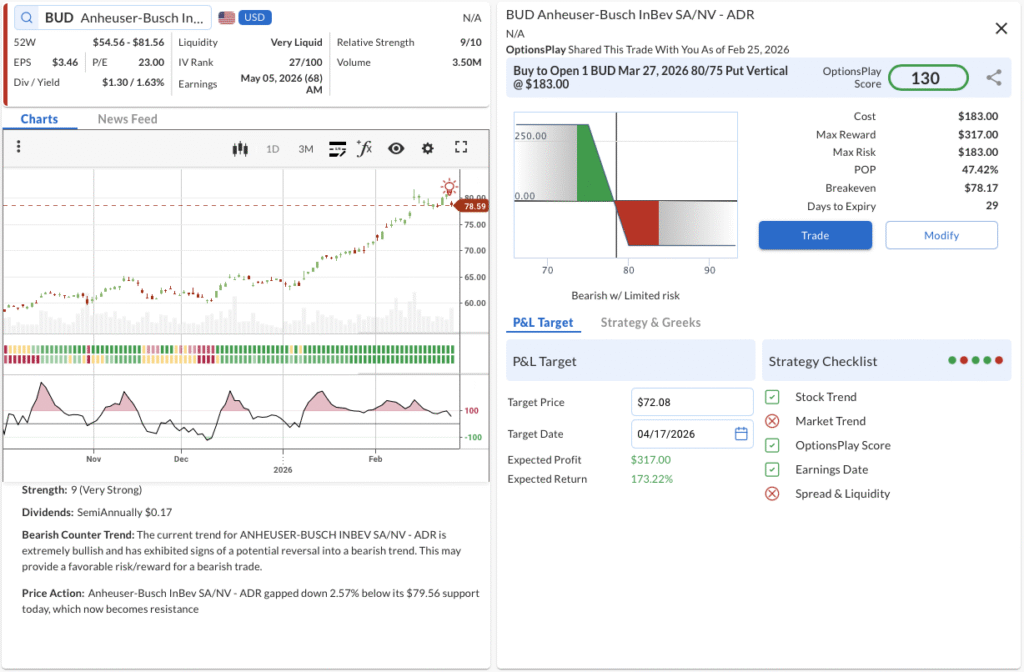

3. BUD ($78.59) – A Bitter Technical Breakdown

- The Trade: Buy to Open the BUD Mar 27, 2026 80/75 Put Vertical @ $1.83 Debit.

- 🔴 SELL TO OPEN Mar 27, 2026 75 Put @ $0.77

- 🟢 BUY TO OPEN Mar 27, 2026 80 Put @ $2.60

- Trade Metrics: POP: 47.42% | Pay $183.00 per contract vs. a Max Reward of $317.00 (1.7:1).

- The Why: Persistent volume pressures in key global markets and structural shifts in consumer preferences continue to create fundamental headwinds for Anheuser-Busch, justifying a bearish position following a technical breakdown.

- The Technicals: Despite a longer-term Bullish Trend (6M), the stock is exhibiting a Bearish Counter Trend and recently gapped down 2.57% below its $79.56 support level, which now acts as a firm resistance ceiling.

- Management:

- Stop Loss: Sell the spread at $0.92 (50% loss on premium).

- Take Profit: Sell the spread at $3.20 (75% gain on premium).