DailyPlay – Adjusting Trade (TSLA) – July 18, 2025

TSLA Bearish Trade Adjustment Signal Investment Rationale...

Read MoreDailyPlay Portfolio Review

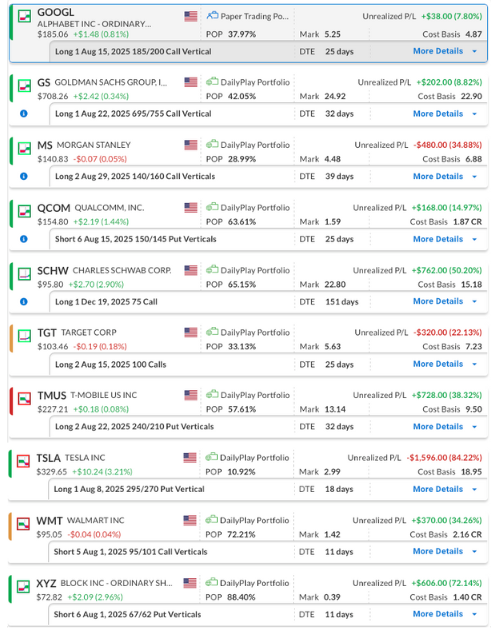

Our Trades

GOOGL – 25 DTE

Bullish Debit Spread – Alphabet Inc. (GOOGL) – We recently established this position and plan to stay the course for now. The company is scheduled to report earnings on Wednesday, July 23, after the market closes.

GS – 32 DTE

Bullish Debit Spread – Goldman Sachs Group, Inc. (GS) – The position is showing a modest gain following a strong earnings report from Goldman Sachs. We adjusted the position and realized a gain on the adjustment. With time remaining until expiration, we plan to continue holding the trade.

MS – 39 DTE

Bullish Debit Spread – Morgan Stanley (MS) – Similar to GS, Morgan Stanley delivered a solid quarterly earnings report. However, the stock sold off afterward, and the position is showing a modest loss. With time remaining until expiration, we plan to continue holding the position for now.

QCOM – 25 DTE

Bullish Credit Spread – Qualcomm Inc. (QCOM) – We recently established this position, which is currently showing a modest gain, and we plan to stay the course for now. The company is set to report earnings on Wednesday, July 30, after the market closes.

SCHW – 151 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We maintain a positive outlook, driven by solid company fundamentals and ongoing strength across SCHW and the broader financial sector. The company reported solid earnings, and the stock made a strong upside move following the announcement. We will stay the course for now.

TGT – 25 DTE

Bullish Long Call, Target Corporation (TGT), The position is currently showing a small loss. After breaking through resistance at the 100 level, the stock has been range-bound. A move above 106 would be encouraging, while a close below 100 would be concerning. With decent time until expiration, we’ll maintain the position for now.

TMUS – 32 DTE

Bearish Debit Spread – T-Mobile US, Inc. (TMUS) – We currently have a decent gain on the position, and the company is scheduled to report earnings on Wednesday, July 23, after the market closes. We’ll need to decide whether to close the position before earnings, so we’ll be keeping a close watch at the beginning of the week.

TSLA – 18 DTE

Bearish Debit Spread – Tesla, Inc. (TSLA) – We have a bearish position on TSLA, which is currently down. We adjusted the position, bringing in a net credit and a net gain on the short option we rolled. Price is consolidating in a tight range with light trading volume, indicating a wait for earnings. Tesla’s earnings report, scheduled for Wednesday, July 23, after the close, will be a key catalyst. We plan to stay the course, keep a close eye as the event approaches, and may ride the position through the earnings report.

WMT – 11 DTE

Bearish Credit Spread – Walmart Inc. (WMT) – This bearish position is currently up. The stock built downside momentum last week, closing below both the 20- and 50-day moving averages. For now, we plan to hold steady.

XYZ – 11 DTE

Closing the position at the open.

TSLA Bearish Trade Adjustment Signal Investment Rationale...

Read More

QCOM Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read More

MS Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on