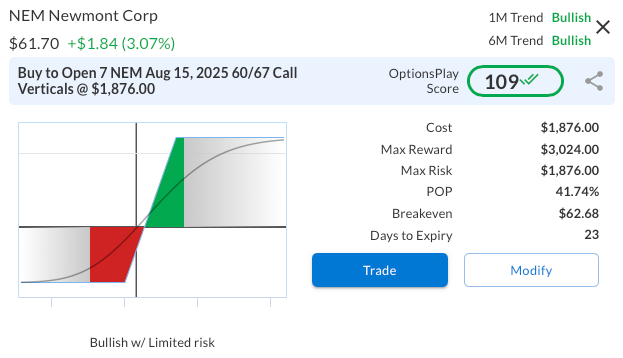

DailyPlay – Opening Trade (NEM) – July 23, 2025

NEM Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Newmont Corporation (NEM) presents a timely bullish opportunity heading into its upcoming earnings report on Thursday, July 24th, after the close. The company stands to benefit from recent strength in gold prices alongside improving operational efficiency, potentially setting the stage for a positive earnings surprise. With the stock demonstrating firm technical momentum and attractive valuation metrics relative to peers, a defined risk/reward call vertical structure positions traders to capture near-term upside if earnings results or guidance exceed conservative market expectations.

Technical Analysis

NEM has been in a strong uptrend since bottoming in early December 2024, with price action now firmly above its 20-day, 50-day, and 200-day moving averages. The recent close at $61.70 marks a breakout above prior near-term resistance at $59, reinforcing the bullish continuation. An RSI reading of 61.87 suggests there is still room for further upside without immediate overbought risk. Additionally, the stock is showing notable relative strength versus both the Materials sector and broader equity indices, as traders position ahead of potential catalysts from earnings and sustained gold market momentum.

Fundamental Analysis

Newmont Corporation continues to trade at a valuation discount while maintaining sector-leading profitability metrics. Key comparative fundamentals include:

- Forward PE Ratio: 13.25x vs. Industry Median 22.23x

- Expected EPS Growth: 10.23% vs. Industry Median 13.83%

- Expected Revenue Growth: 0% vs. Industry Median 4.29%

- Net Margins: 25.77% vs. Industry Median 16.44%

Although revenue growth remains flat versus the industry, strong net margins and earnings growth potential, combined with gold market upside, reinforce the attractiveness of NEM ahead of earnings.

Options Trade

The proposed trade is to buy the NEM Aug 15, 2025, 60/67 call vertical for $268.00. This spread involves buying the $60 call and selling the $67 call for a net debit of $2.68, with a maximum potential reward of $432. The strategy offers a defined risk with approximately 1.6x reward-to-risk ratio if NEM closes at or above $67 by expiry in 23 days. The trade structure capitalizes on bullish momentum while mitigating cost versus buying outright calls, positioning for a continuation of the uptrend driven by earnings strength or a positive macro gold environment.

NEM – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

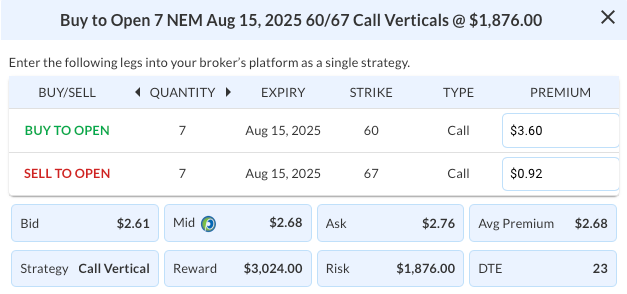

Details: Buy to Open 7 NEM Aug 15 $60/$67 Call Vertical Spreads @ $2.68 Debit per Contract.

Total Risk: This trade has a max risk of $1,876 (7 Contracts x $268) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $268 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 109

Stop Loss: @ $1.34 (50% loss of premium)

View NEM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View NEM Trade

More DailyPlay

DailyPlay – Opening Trade (MU) – December 04, 2025

MU Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Adjusting Trade (META) – December 02, 2025

META Bullish Trade Adjustment Signal Investment...

Read More

Share this on