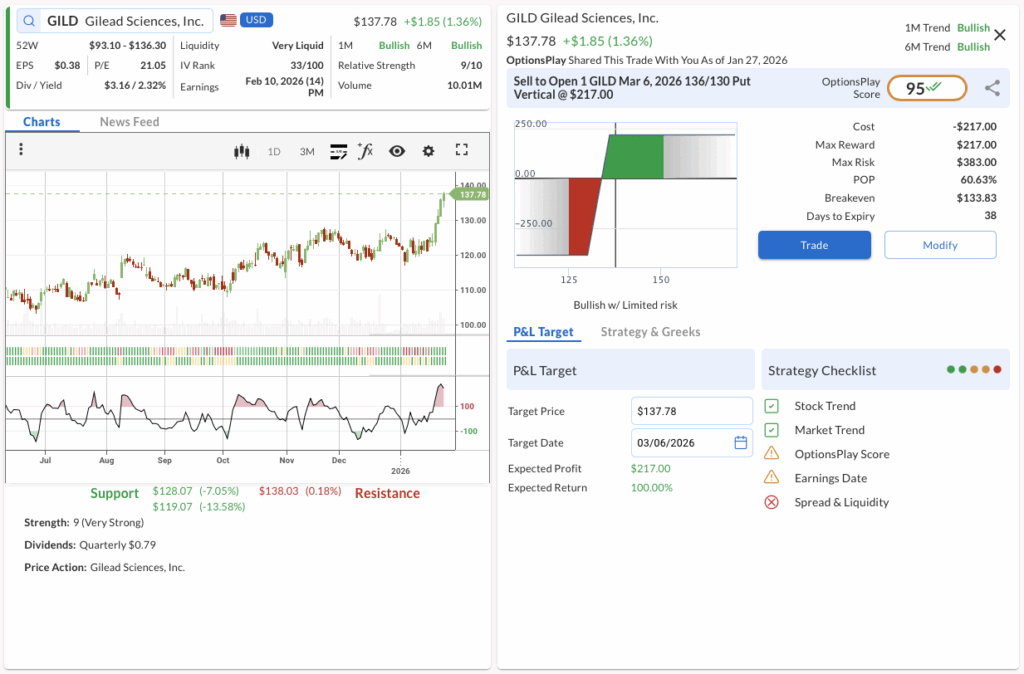

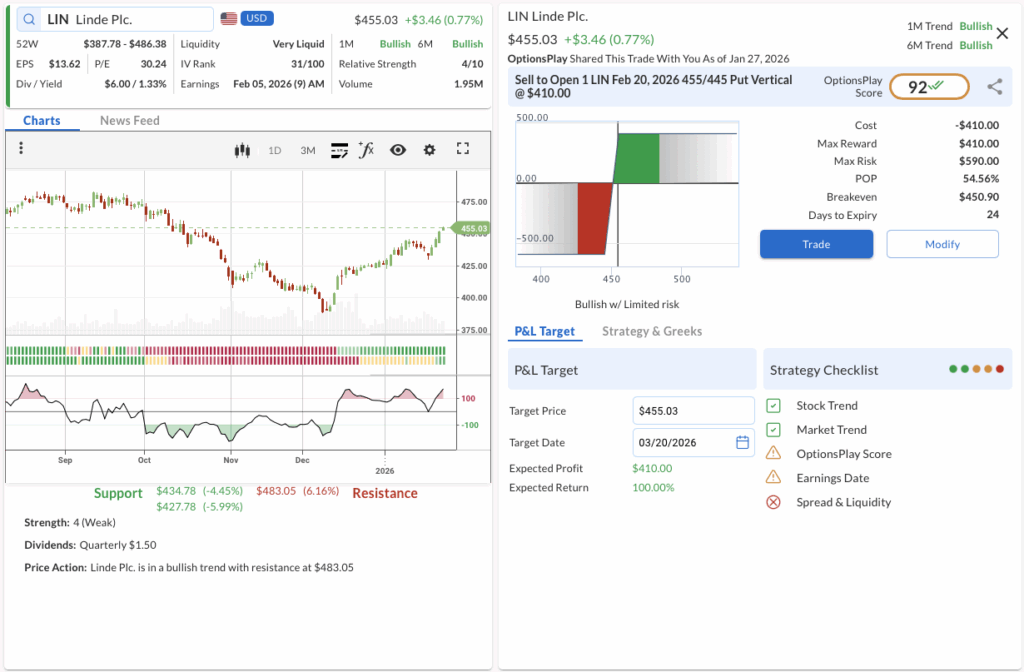

GILD, LIN, HUM

OptionsPlay DailyPlay Ideas Menu – Jan 27th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- GILD: Bull Put Spread – Strong HIV franchise stability and oncology growth support a defensive income play.

- LIN: Bull Put Spread – Pricing power in industrial gases offers a high-probability floor for income generation.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- HUM: Bull Call Spread – Medicare Advantage rate stabilization provides a tactical entry point following the recent pullback.

1. GILD ($137.78) – Bio-Pharma Defensive Income

- The Trade:Sell to Open the GILD Mar 6 2026 136/130 Put Vertical @ $2.17 Credit.

- 🔴 SELL TO OPEN Mar 06 2026 136 Put @ $4.38

- 🟢 BUY TO OPEN Mar 06 2026 130 Put @ $2.21

- Trade Metrics: POP: 60.63% | Collect $217 per contract vs. a Max Risk of $383 (1.76:1).

- The Why: Gilead remains a robust defensive play with consistent cash flows from its HIV portfolio and expanding opportunities in oncology, making this dip an attractive setup for income generation.

- The Technicals: GILD is in a confirmed bullish trend across both 1M and 6M timeframes, currently consolidating near the $137 level; holding this support zone opens the path toward the $138.03 resistance level.

- Management:⚠️ Warning: Earnings is scheduled for Feb 10, 2026, which may require active management.

- Stop Loss: Buy to Close the trade at $4.34 (100% of credit received).

- Take Profit: Buy to Close the trade at $1.09 (50% gain).

2. LIN ($455.03) – Industrial Resilience

- The Trade:Sell to Open the LIN Feb 20 2026 455/445 Put Vertical @ $4.10 Credit.

- 🔴 SELL TO OPEN Feb 20 2026 455 Put @ $11.30

- 🟢 BUY TO OPEN Feb 20 2026 445 Put @ $7.20

- Trade Metrics: POP: 54.56% | Collect $410 per contract vs. a Max Risk of $590 (1.44:1).

- The Why: Linde’s dominant position in industrial gases allows it to pass through costs effectively, creating a stable fundamental backdrop that supports a high-probability credit strategy.

- The Technicals: The stock maintains a strong bullish trend and is currently hovering just above key support at $450; a successful defense of this level suggests a move back toward the $483 resistance.

- Management:⚠️ Warning: Earnings is scheduled for Feb 05, 2026, which may require active management.

- Stop Loss: Buy to Close the trade at $8.20 (100% of credit received).

- Take Profit: Buy to Close the trade at $2.05 (50% gain).

3. HUM ($263.63) – Trend Following Pullback

- The Trade:Buy to Open the HUM Feb 27 2026 260/305 Call Vertical @ $13.65 Debit.

- 🟢 BUY TO OPEN Feb 27 2026 260 Call @ $19.95

- 🔴 SELL TO OPEN Feb 27 2026 305 Call @ $6.30

- Trade Metrics: POP: 37.62% | Pay $1,365 per contract vs. a Max Reward of $3,135 (2.3:1).

- The Why: While the sector faces regulatory noise, the fundamental long-term thesis for managed care remains intact, and the current valuation compression offers a favorable risk/reward for a recovery rally.

- The Technicals: Despite a recent mildly bearish 1M trend, the 6M trend remains bullish; the “Bullish Trend Following” signal identifies the current pullback to the $260 support zone as a prime buying opportunity.

- Management:⚠️ Warning: Earnings is scheduled for Feb 11, 2026, which may require active management.

- Stop Loss: Sell to Close the trade at $6.83 (50% loss).

- Take Profit: Sell to Close the trade at $23.89 (75% gain).

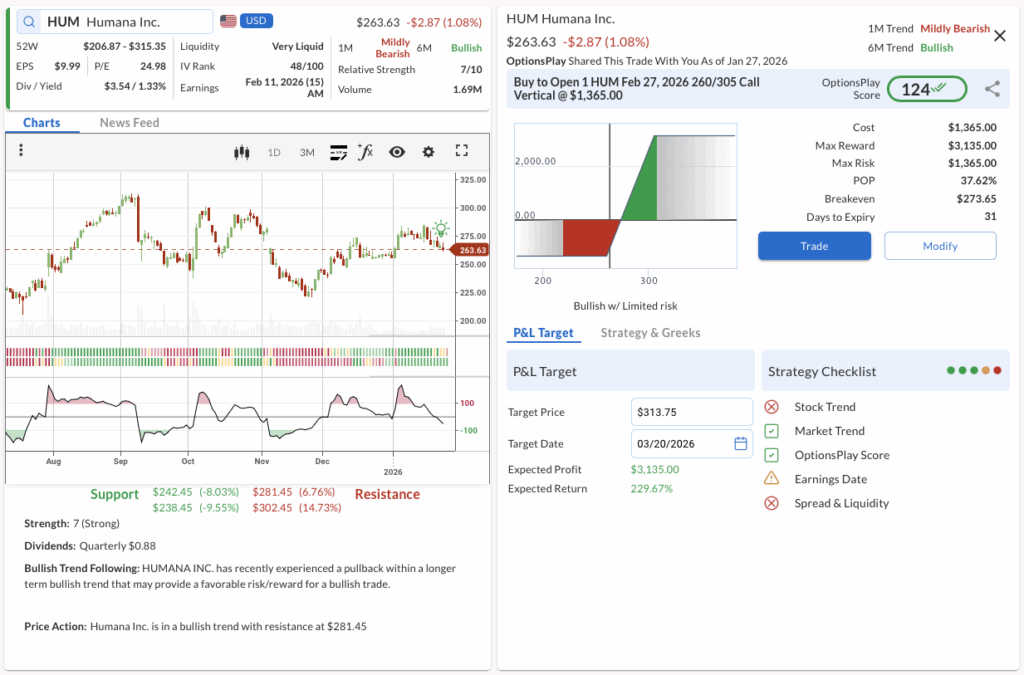

AKAM, AMGN, BUD

OptionsPlay DailyPlay Ideas Menu – Jan 26th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- AKAM: Bull Put Spread – Superior profitability suggests upside embedded in discounted valuation.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- AMGN: Bull Call Spread – Robust pipeline and defensive characteristics support continued momentum.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- BUD: Bear Put Spread – Valuation headwinds and technical exhaustion point to a mean-reversion pullback.

1. AKAM ($95.08) – Discounted Valuation Play

- The Trade:Sell to Open the AKAM Feb 20 2026 95/90 Put Vertical @ $2.40 Credit.

- 🔴 SELL TO OPEN Feb 20 2026 95 Put @ $5.45

- 🟢 BUY TO OPEN Feb 20 2026 90 Put @ $3.05

- Trade Metrics: POP: 54% | Collect $240 per contract vs. a Max Risk of $260 (1.08:1).

- The Why: While AKAM is not expected to grow as fast as its peers, its superior profitability suggests that there remains significant upside embedded in its discounted valuation.

- The Technicals: AKAM recently broke out above its $85 resistance level while outperforming the S&P 500, and its recent behavior confirms this level as support, providing a foundation for a move toward the $102 target.

- Management:⚠️ Warning: Earnings is scheduled for Feb 19, 2026, which may require active management.

- Stop Loss: Buy to Close the trade at $4.80 (200% of credit received).

- Take Profit: Buy to Close the trade at $1.20 (50% gain).

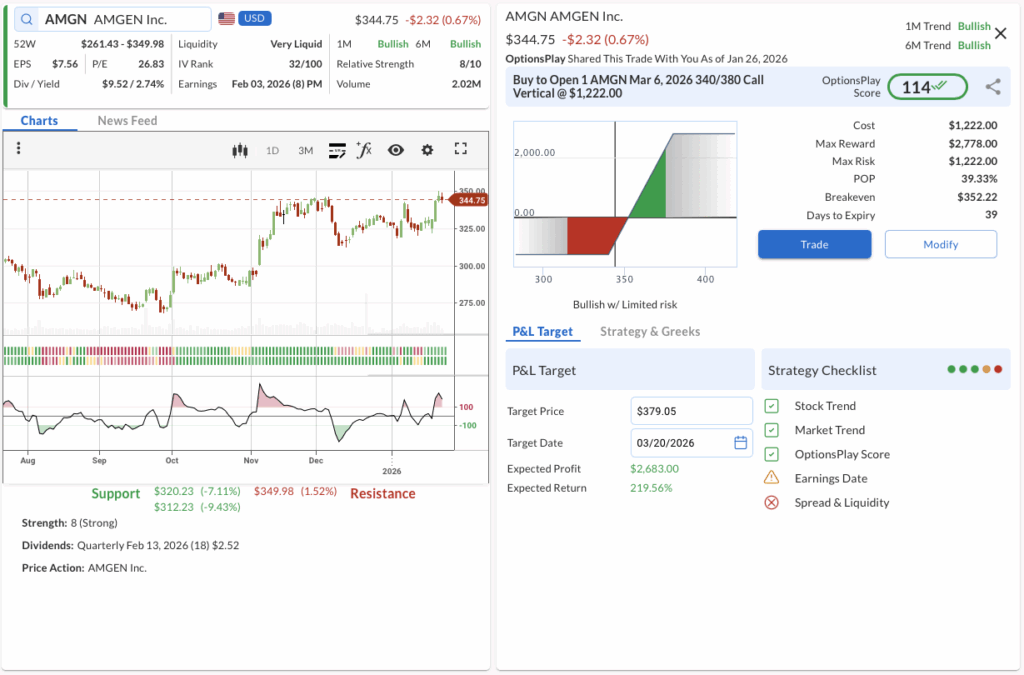

2. AMGN ($344.75) – Defensive Growth Breakout

- The Trade:Buy to Open the AMGN Mar 6 2026 340/380 Call Vertical @ $12.22 Debit.

- 🟢 BUY TO OPEN Mar 06 2026 340 Call @ $14.48

- 🔴 SELL TO OPEN Mar 06 2026 380 Call @ $2.26

- Trade Metrics: POP: 39% | Pay $1,222 per contract vs. a Max Reward of $2,778 (2.27:1).

- The Why: With a robust pipeline and strong cash flows, Amgen remains a defensive growth favorite, offering resilience and upside potential in the current market environment.

- The Technicals: The stock has established a strong uptrend, breaking above the $325 level and holding support, with the price action consolidating near highs ($344.75), signaling potential for a continuation run toward the $380 strike.

- Management:⚠️ Warning: Earnings is scheduled for Feb 03, 2026, which may require active management.

- Stop Loss: Sell to Close the trade at $6.11 (50% loss).

- Take Profit: Sell to Close the trade at $21.39 (175% gain).

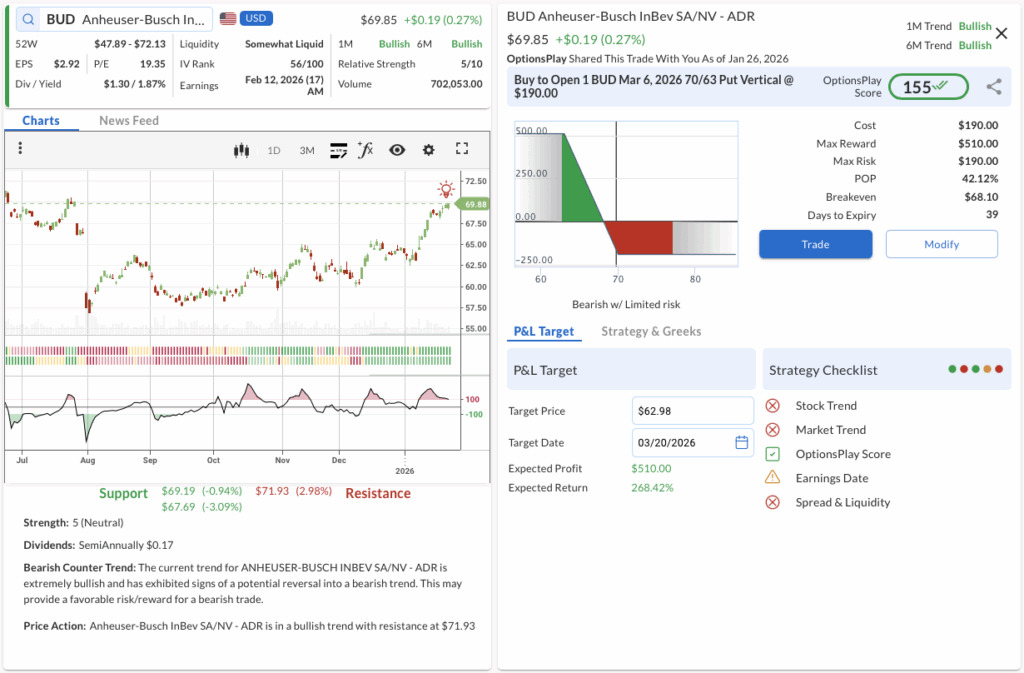

3. BUD ($69.85) – Bearish Counter-Trend Reversal

- The Trade:Buy to Open the BUD Mar 6 2026 70/63 Put Vertical @ $1.90 Debit.

- 🟢 BUY TO OPEN Mar 06 2026 70 Put @ $2.60

- 🔴 SELL TO OPEN Mar 06 2026 63 Put @ $0.70

- Trade Metrics: POP: 42% | Pay $190 per contract vs. a Max Reward of $510 (2.68:1).

- The Why: Valuation headwinds and slowing volume growth suggest the recent rally is overextended, creating a compelling fundamental setup for a mean-reversion trade.

- The Technicals: BUD price action is stalling near the $71.93 resistance level, and with the “Bearish Counter Trend” signal active, the failure to break higher suggests a likely pullback toward the $63 support zone.

- Management:⚠️ Warning: Earnings is scheduled for Feb 12, 2026, which may require active management.

- Stop Loss: Sell to Close the trade at $0.95 (50% loss).

- Take Profit: Sell to Close the trade at $3.33 (175% gain).

C, NFLX

OptionsPlay DailyPlay Ideas Menu – Jan 23rd, 2026

💰 The Income Generators (High Probability, Cash Flow)

- C: Bullish Put Spread capitalizing on a pullback to support as Citigroup’s restructuring efforts continue to drive efficiency gains.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- NFLX: Long Call betting on a contrarian reversal as the stock stabilizes at deep value levels following a prolonged downtrend.

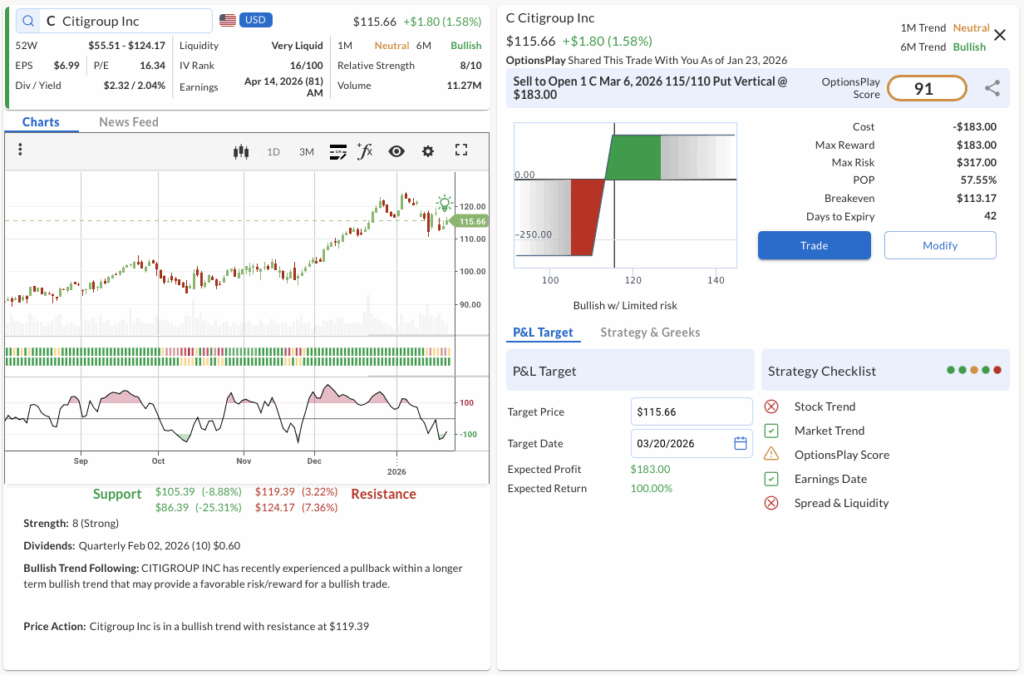

1. C ($115.66) – Buying the Dip on Transformation

- The Trade: Sell to Open the C Mar 06, 2026 115/110 Put Vertical @ $183.00 Credit.

- 🔴 SELL TO OPEN Mar 06, 2026 115 Put @ $4.14

- 🟢 BUY TO OPEN Mar 06, 2026 110 Put @ $2.31

- Trade Metrics: POP: 57.55% | Collect $183.00 per contract vs. a Max Risk of $317.00 (1.7:1).

- The Why: Citigroup’s ongoing “strategic reset” and organizational simplification are expected to unlock tangible book value, making the current pullback a compelling entry point for income generation.

- The Technicals: The stock remains in a long-term Bullish Trend (6M) despite a Neutral 1M trend; price action shows a constructive pullback testing support near $105-$110, while resistance looms overhead at $119.39.

- Management:

- Stop Loss: Buy back the spread at $3.66 (100% of credit received).

- Take Profit: Buy back the spread at $0.92 (50% of max gain).

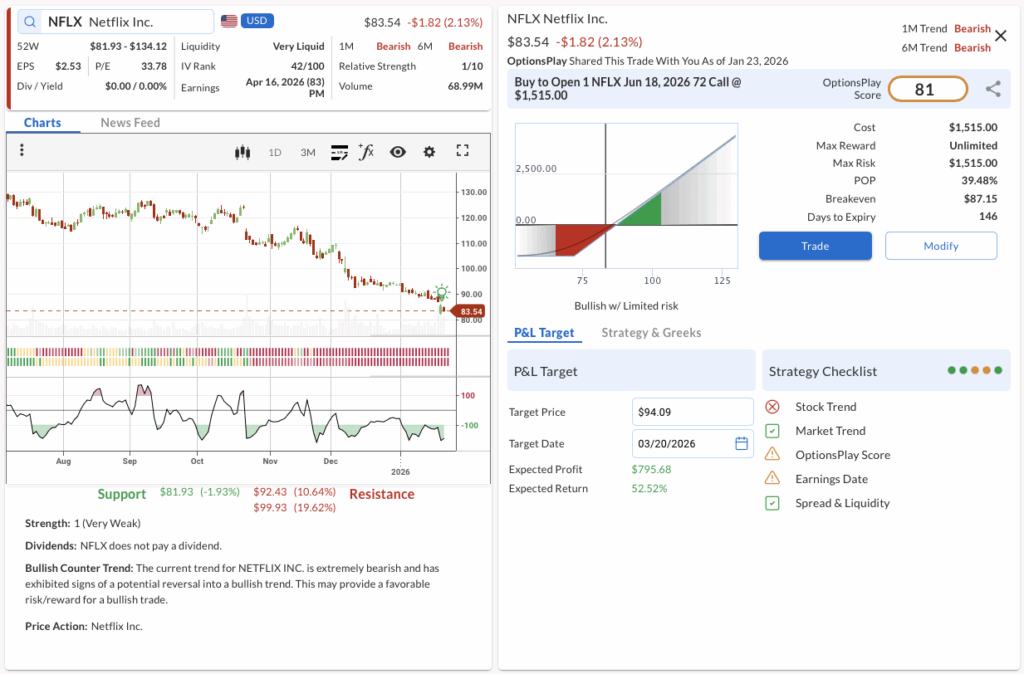

2. NFLX ($83.54) – A Contrarian Reversal Play

- The Trade: Buy to Open the NFLX Jun 18, 2026 72 Call @ $1,515.00 Debit.

- 🟢 BUY TO OPEN Jun 18, 2026 72 Call @ $15.15

- Trade Metrics: POP: 39.48% | Pay $1,515.00 per contract vs. a Max Reward of Unlimited.

- The Why: Despite negative sentiment, Netflix’s valuation has reset to attractive levels, and we view the stabilization near $80 as a potential floor ahead of renewed ad-tier monetization growth.

- The Technicals: While the trend remains Bearish (1M & 6M), the stock is showing signs of a “Bullish Counter Trend” potential, stabilizing near $82 support with indicators suggesting an oversold bounce is due.

- Management:

⚠️ Warning: Earnings is scheduled for Apr 16, which may require active management.- Stop Loss: Sell the call at $7.58 (50% loss on premium).

- Take Profit: Sell the call at $26.51 (75% gain on premium).

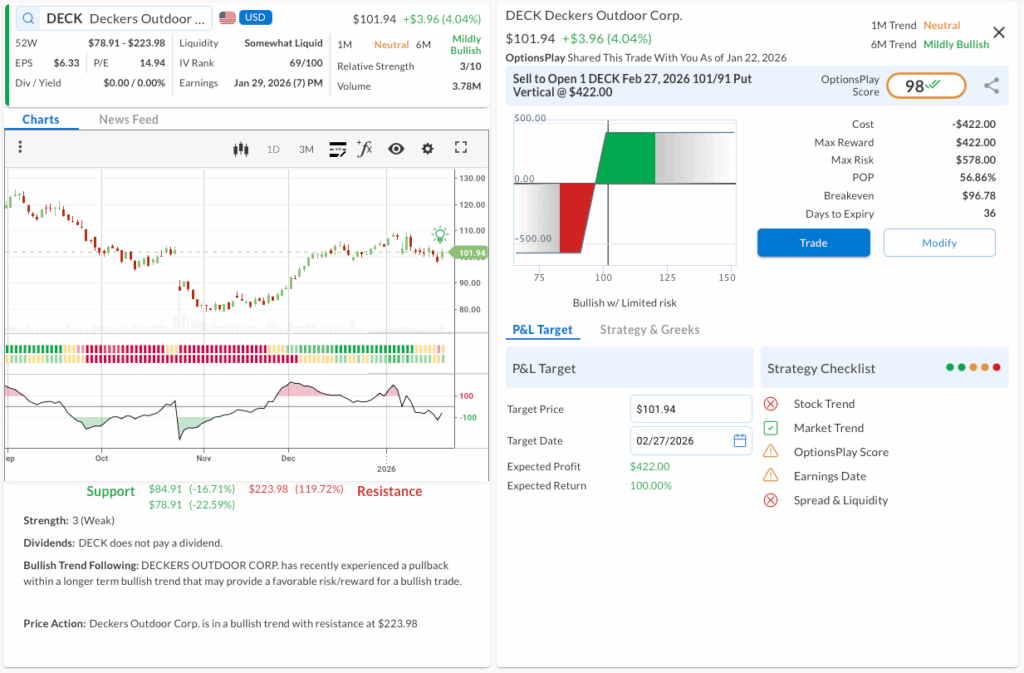

DECK, RJF

OptionsPlay DailyPlay Ideas Menu – Jan 22nd, 2026

💰 The Income Generators (High Probability, Cash Flow)

- DECK: Bullish Put Vertical – HOKA’s continued momentum in the running category and UGG’s brand resilience drive strong direct-to-consumer growth, supporting premium valuations.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- RJF: Bullish Call Vertical – Strong client asset retention and growth in the Capital Markets division position the firm to capitalize on improving investment banking activity.

1. DECK Deckers Outdoor Corp. ($101.94) – HOKA & UGG Brand Momentum

- The Trade:Sell to Open the DECK Feb 27, 2026 101/91 Put Vertical @ $4.22 Credit.

- SELL TO OPEN Feb 27, 2026 101 Put @ $7.50

- BUY TO OPEN Feb 27, 2026 91 Put @ $3.28

- Trade Metrics: 56.86% POP | Collect $422.00 per contract with Max Risk of $578.00 | [Reward/Risk: 0.7 to 1].

- The Why: HOKA’s continued momentum in the running category and UGG’s brand resilience drive strong direct-to-consumer growth, supporting premium valuations.

- The Technicals: The stock is in a Neutral 1M Trend but has a Mildly Bullish 6M Trend with a Relative Strength of 3/10. It is currently testing Support at $84.91, while major Resistance sits at $223.98.

- Management:

- ⚠️ Warning: Earnings is scheduled for Jan 29, 2026, which may require active management.

- Stop Loss: Buy to Close at $8.44 (100% of credit received).

- Take Profit: Buy to Close at $2.11 (50% of max gain).

2. RJF Raymond James Financial, Inc. ($170.06) – Capital Markets Recovery

- The Trade:Buy to Open the RJF Feb 20, 2026 170/180 Call Vertical @ $3.90 Debit.

- BUY TO OPEN Feb 20, 2026 170 Call @ $5.65

- SELL TO OPEN Feb 20, 2026 180 Call @ $1.75

- Trade Metrics: 37.66% POP | Pay $390.00 per contract with Max Reward of $610.00 | Reward/Risk: 1.56].

- The Why: Strong client asset retention and growth in the Capital Markets division position the firm to capitalize on improving investment banking activity.

- The Technicals: The stock is in a Bullish 1M Trend and retains a Bullish 6M Trend with a Relative Strength of 6/10. It is currently testing Support at $153.95, while major Resistance sits at $176.55.

- Management:

- ⚠️ Warning: Earnings is scheduled for Jan 28, 2026, which may require active management.

- Stop Loss: Sell to Close at $1.95 (50% loss on premium).

- Take Profit: Sell to Close at $6.83 (75% gain on premium).

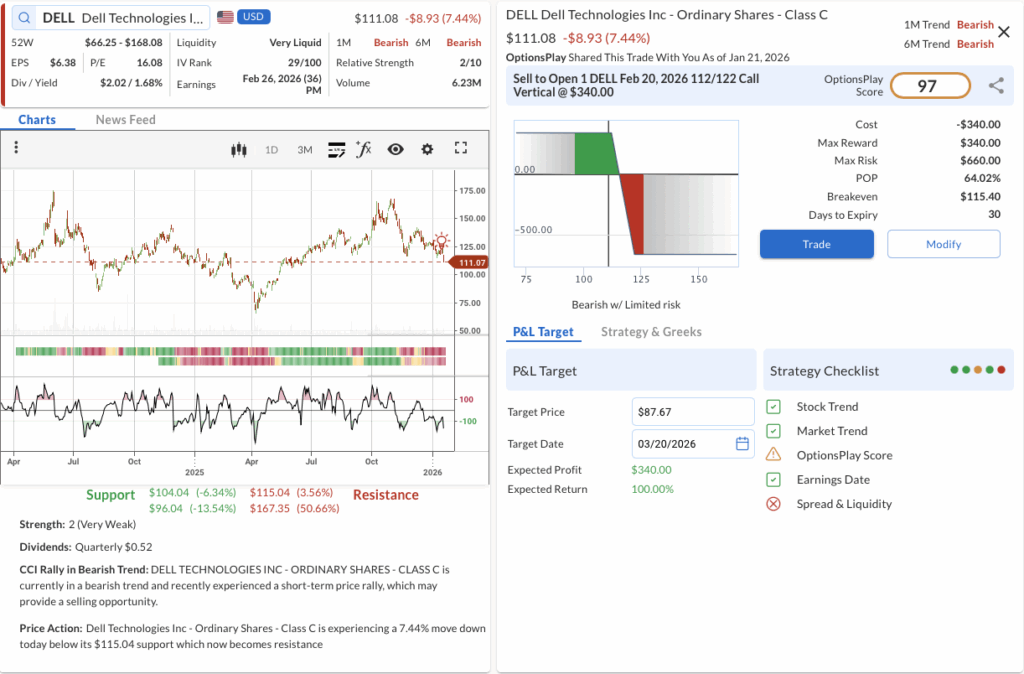

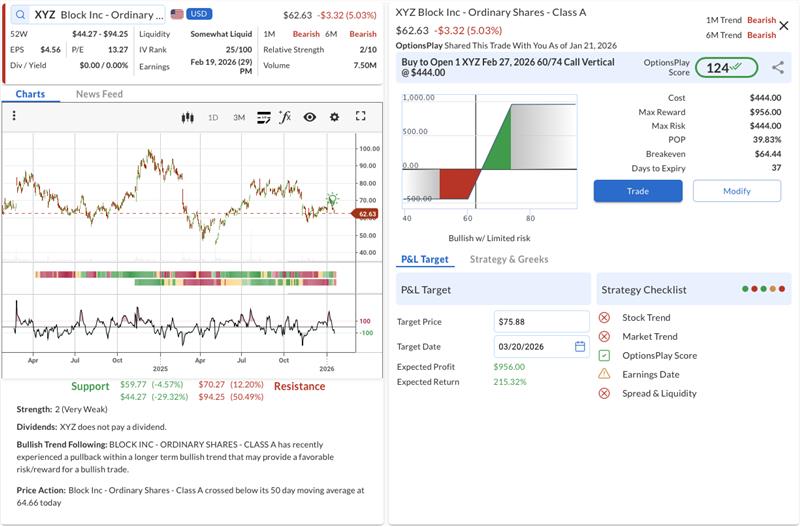

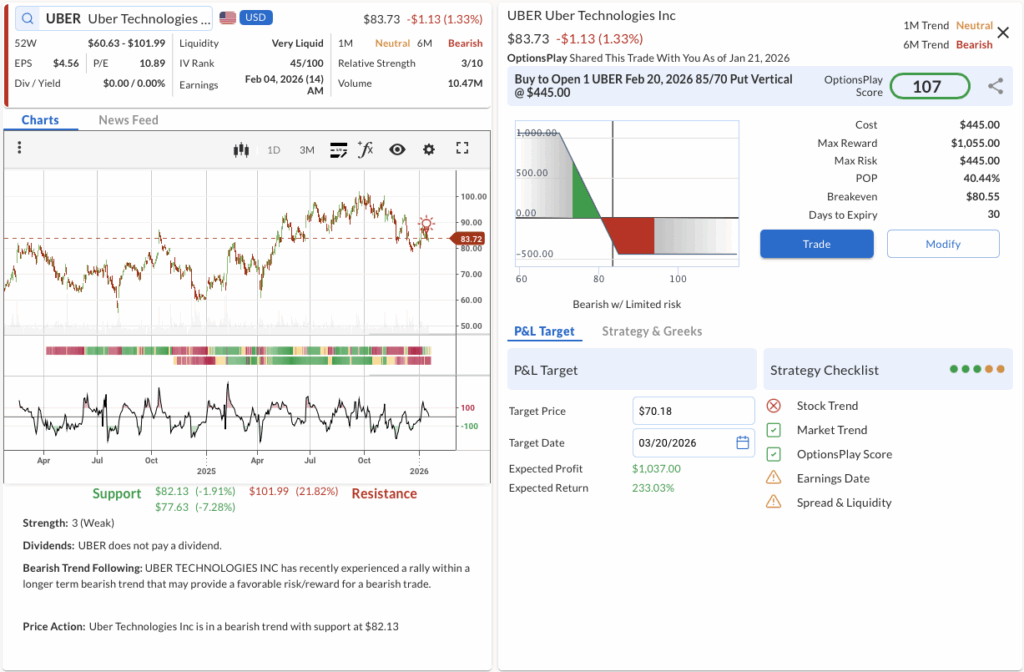

DELL, XYZ, UBER

OptionsPlay DailyPlay Ideas Menu – Jan 21st, 2026

💰 The Income Generators (High Probability, Cash Flow)

- DELL: Bear Call Spread hedging against margin compression fears as the enterprise hardware refresh cycle shows signs of peaking.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- XYZ: Debit Call Spread betting on a profitability inflection point as Cash App engagement drives a renewed growth narrative.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- UBER: Bear Put Spread hedging against regulatory headwinds and signs of consumer fatigue in high-frequency rideshare usage.

1. DELL ($111.08) – Fading the Hardware Cycle

- The Trade: Sell to Open the DELL Feb 20, 2026 112/122 Call Vertical @ $3.40 Credit.

SELL TO OPEN Feb 20, 2026 $112 Call @ $5.60

BUY TO OPEN Feb 20, 2026 $122 Call @ $2.20 - Trade Metrics: POP: 64.02% | Collect $340.00 per contract vs. a Max Risk of $660.00 (1.9:1).

- The Why: While Dell remains a key AI infrastructure player, recent channel checks suggest the PC refresh cycle is plateauing, and analysts are becoming cautious on near-term margin expansion capabilities.

- The Technicals: The stock is in a confirmed Bearish Trend (1M & 6M) with a Relative Strength of 2/10. It is currently testing Resistance at $115.04, while major Support sits at $104.04.

- Management:

- Stop Loss: Buy back the spread at $6.80 (100% of credit received).

- Take Profit: Buy back the spread at $1.70 (50% of max gain).

2. XYZ ($62.63) – The FinTech Pivot

- The Trade: Buy to Open the XYZ Feb 27, 2026 60/74 Call Vertical @ $4.44 Debit.

BUY TO OPEN Feb 27, 2026 $60 Call @ $5.90

SELL TO OPEN Feb 27, 2026 $74 Call @ $1.46 - Trade Metrics: POP: 39.83% | Pay $444.00 per contract vs. a Max Reward of $956.00 (2.2:1).

- The Why: Block Inc is successfully executing its “Bank of the Future” strategy with Cash App monetization improving; we view the recent pullback as a disconnection from its improving fundamental profitability profile.

- The Technicals: The stock is in a Bearish Trend (1M & 6M) with a Relative Strength of 2/10. It is currently testing Support at $59.77, while major Resistance sits at $70.27.

- Management:⚠️ Warning: Earnings is scheduled for Feb 19, which may require active management.

- Stop Loss: Sell the spread at $2.22 (50% loss on premium).

- Take Profit: Sell the spread at $7.77 (75% gain on premium).

3. UBER ($83.73) – Regulatory Roadblocks

- The Trade: Buy to Open the UBER Feb 20, 2026 85/70 Put Vertical @ $4.45 Debit.

BUY TO OPEN Feb 20, 2026 $85 Put @ $4.95

SELL TO OPEN Feb 20, 2026 $70 Put @ $0.50 - Trade Metrics: POP: 40.44% | Pay $445.00 per contract vs. a Max Reward of $1,055.00 (2.4:1).

- The Why: Increasing scrutiny on gig-worker classification combined with softer consumer discretionary spending data presents a tangible risk to Uber’s booking volumes in the coming quarter.

- The Technicals: The stock is in a Neutral Trend (1M) but a Bearish Trend (6M) with a Relative Strength of 3/10. It is currently testing Support at $82.13, while major Resistance sits at $101.99.

- Management:⚠️ Warning: Earnings is scheduled for Feb 04, which may require active management.

- Stop Loss: Sell the spread at $2.23 (50% loss on premium).

- Take Profit: Sell the spread at $7.79 (75% gain on premium).

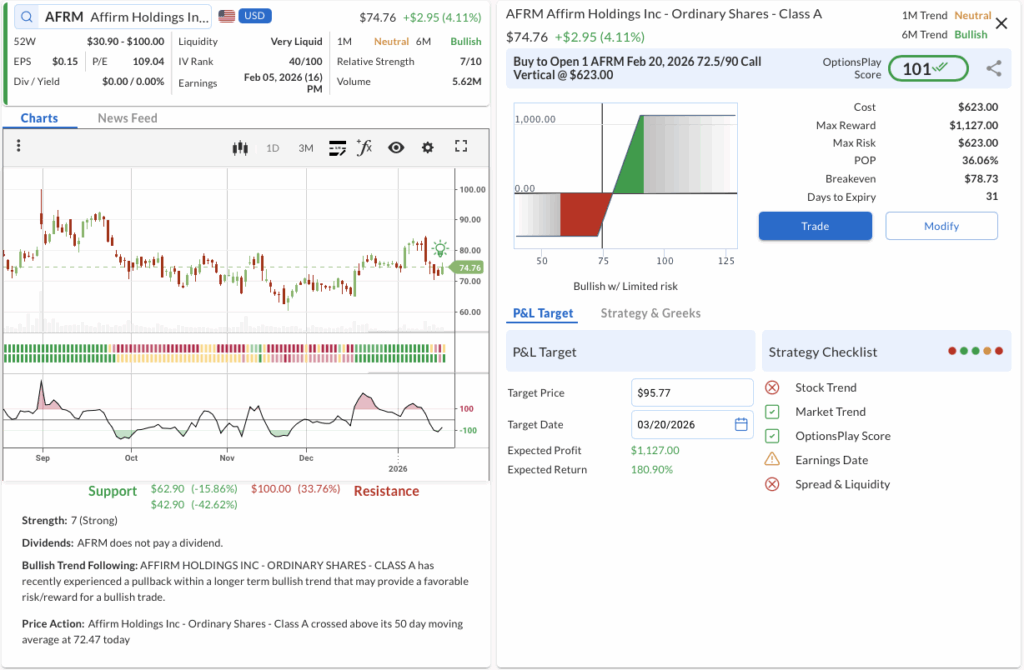

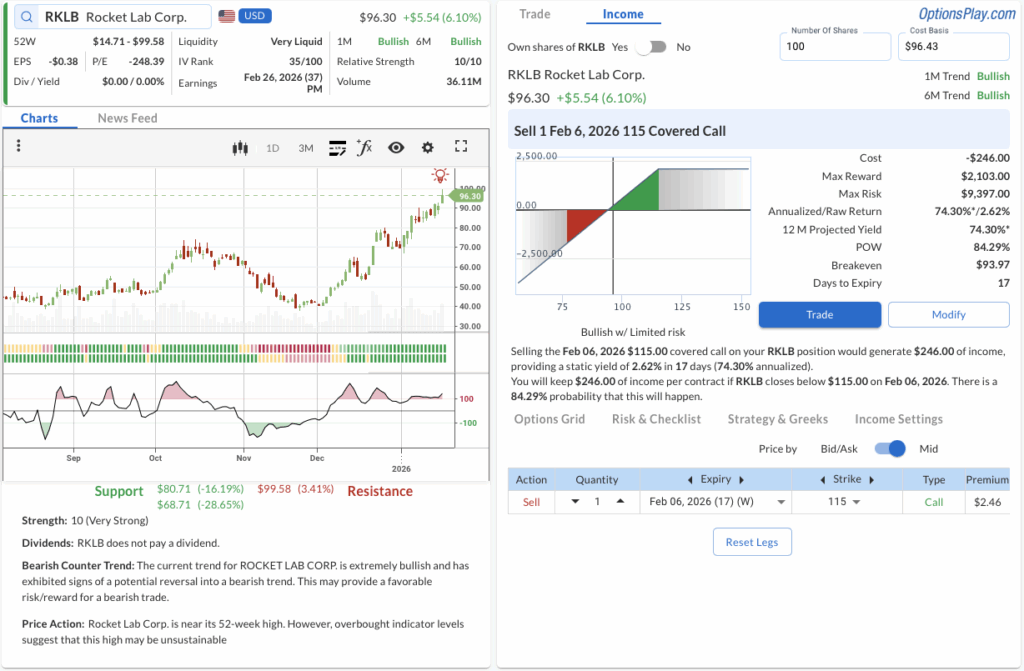

PM, AFRM, RKLB

OptionsPlay DailyPlay Ideas Menu – Jan 20th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- PM: Bear Call Spread capitalizing on overextended technicals and resistance near $175.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- AFRM: Debit Call Spread betting on continued momentum in the Buy Now, Pay Later sector as volumes surge.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- RKLB: Covered Call generating income to hedge against potential volatility after a massive 6% daily move.

1. PM ($173.62) – Fading the Highs

- The Trade: Sell to Open the PM Feb 20, 2026 175/185 Call Vertical @ $3.60 Credit. SELL TO OPEN Feb 20, 2026 $175 Call @ $6.00 BUY TO OPEN Feb 20, 2026 $185 Call @ $2.40

- Trade Metrics: POP: 63.64% | Collect $360.00 per contract vs. a Max Risk of $640.00 (1.8:1).

- The Why: Philip Morris is trading at historic highs; we are selling call premium against major resistance at $175 to generate income as momentum slows.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 5/10. It is currently testing Resistance at $181.91, while major Support sits at $172.05.

- Management:⚠️ Warning: Earnings is scheduled for Feb 06, which may require active management.

- Stop Loss: Buy back the spread at $7.20 (100% of credit received).

- Take Profit: Buy back the spread at $1.80 (50% of max gain).

2. AFRM ($74.76) – BNPL Breakout

- The Trade: Buy to Open the AFRM Feb 20, 2026 72.5/90 Call Vertical @ $6.23 Debit. BUY TO OPEN Feb 20, 2026 $72.5 Call @ $8.40 SELL TO OPEN Feb 20, 2026 $90 Call @ $2.17

- Trade Metrics: POP: 36.06% | Pay $623.00 per contract vs. a Max Reward of $1,127.00 (1.8:1).

- The Why: Affirm is showing renewed strength in the payments sector; we are positioning for a continued rally towards $90 ahead of the next earnings cycle.

- The Technicals: The stock is in a Neutral Trend (1M) but a Bullish Trend (6M) with a Relative Strength of 7/10. It is currently testing Support at $62.90, while major Resistance sits at $100.00.

- Management:⚠️ Warning: Earnings is scheduled for Feb 05, which may require active management.

- Stop Loss: Sell the spread at $3.12 (50% loss on premium).

- Take Profit: Sell the spread at $10.90 (75% gain on premium).

3. RKLB ($96.30) – Locking in Launch Gains

- The Trade: Sell 1 Feb 6, 2026 115 Covered Call @ $2.46 Credit.

- Trade Metrics: POW: 84.29% | Collect $246.00 per contract (74.30% Annualized Yield or 2.62% in 17 Days).

- The Why: After a parabolic move, Rocket Lab’s implied volatility is extremely high; selling upside calls allows us to capture rich premiums while retaining significant upside potential to $115.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 10/10. It is currently testing Resistance at $99.58, while major Support sits at $80.71.

- Management:Note: These management rules are optional. You may choose to hold to expiration if you are comfortable with the obligation to sell shares at the strike price.

- Stop Loss: Buy back the call at $4.92 (100% of credit received).

- Take Profit: Buy back the call at $1.23 (50% of max gain).

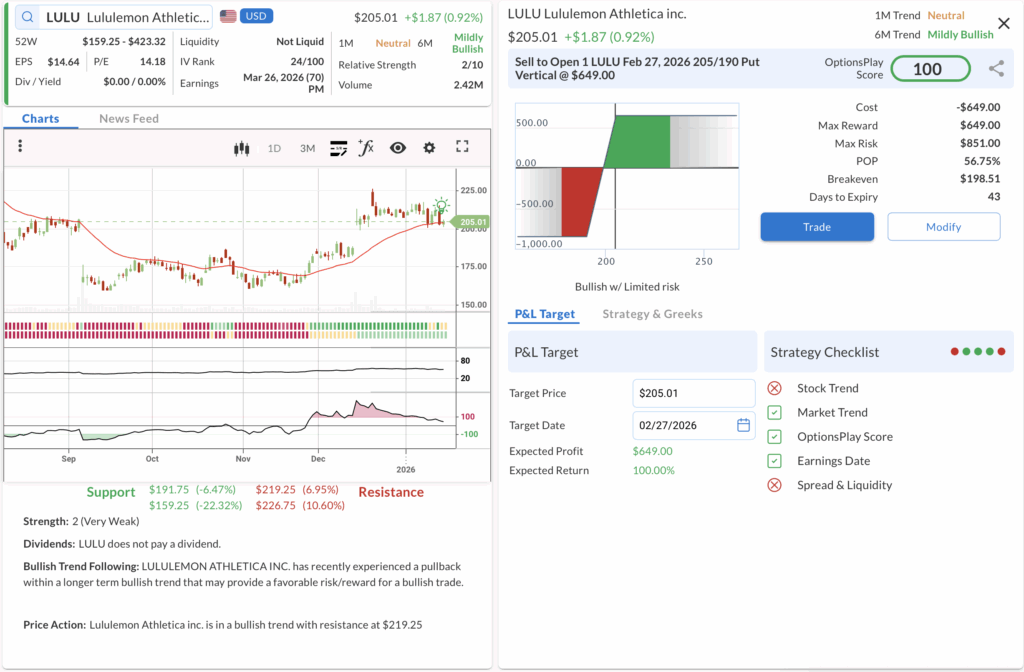

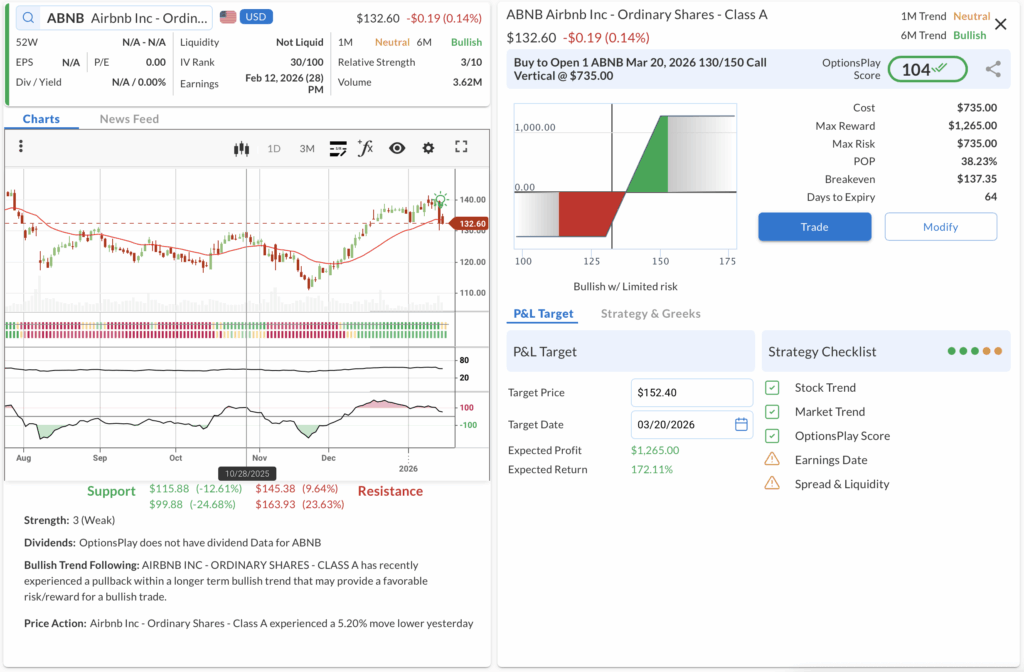

LULU, ABNB, TGT

OptionsPlay DailyPlay Ideas Menu – Jan 16th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- LULU: Credit Put Spread capitalizing on the pullback to major support as international growth starts to accelerate.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- ABNB: Debit Call Spread betting on a valuation rebound as travel demand stabilizes and margins expand.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- TGT: Covered Call generating income to hedge against lingering consumer discretionary headwinds after a strong rally.

1. LULU ($205.01) – The International Growth Play

- The Trade: Sell to Open the LULU Feb 27, 2026 205/190 Put Vertical @ $6.49 Credit.

- BUY TO OPEN Feb 27, 2026 $190 Put @ $4.04

- SELL TO OPEN Feb 27, 2026 $205 Put @ $10.53

- Trade Metrics: POP: 56.75% | Collect $649.00 per contract vs. a Max Risk of $851.00 (1.3:1).

- The Why: Despite recent U.S. softness, Lululemon’s holiday sales beat and international momentum suggest the pullback to the $200 level is an attractive entry point.

- The Technicals: The stock is in a Neutral Trend (1M) but retains a Mildly Bullish Trend (6M) with a Relative Strength of 2/10. It is currently testing Support at $192, while major Resistance sits at $219.

- Management:

- Stop Loss: Buy back the spread at $12.98 (100% of credit received).

- Take Profit: Buy back the spread at $3.25 (50% of max gain).

2. ABNB ($132.60) – The Travel Rebound

- The Trade: Buy to Open the ABNB Mar 20, 2026 130/150 Call Vertical @ $7.35 Debit.

- BUY TO OPEN Mar 20, 2026 $130 Call @ $9.73

- SELL TO OPEN Mar 20, 2026 $150 Call @ $2.38

- Trade Metrics: POP: 38.23% | Pay $735.00 per contract vs. a Max Reward of $1,265.00 (1.7:1).

- The Why: With valuation resetting and margins expanding from AI efficiencies, Airbnb is positioned for a recovery as it rolls out new inventory types to capture demand.

- The Technicals: The stock is in a Neutral Trend (1M) but a Bullish Trend (6M) with a Relative Strength of 3/10. It is currently testing Support at $116, while major Resistance sits at $145.

- Management:

- ⚠️ Warning: Earnings is scheduled for Feb 12, which may require active management.

- Stop Loss: Sell the spread at $3.68 (50% loss on premium).

- Take Profit: Sell the spread at $12.86 (75% gain on premium).

3. TGT ($111.13) – Hedging the Rally

- The Trade: Sell to Open the TGT Feb 27, 2026 121 Covered Call @ $1.81 Credit.

- Trade Metrics: POW: 77.76% | Collect $180.50 per contract (14.91% Annualized Yield or 1.65% in 43 Days).

- The Why: Target is stabilizing after a 22% rally, but we are using covered calls to hedge against lingering consumer discretionary headwinds and weak foot traffic.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 8/10. It is currently testing Resistance at $121, while major Support sits at $107.

- Management:

- Note: These management rules are optional. You may choose to hold to expiration if you are comfortable with the obligation to sell shares at the strike price.

- Stop Loss: Buy back the call at $3.62 (100% of credit received).

- Take Profit: Buy back the call at $0.91 (50% of max gain).

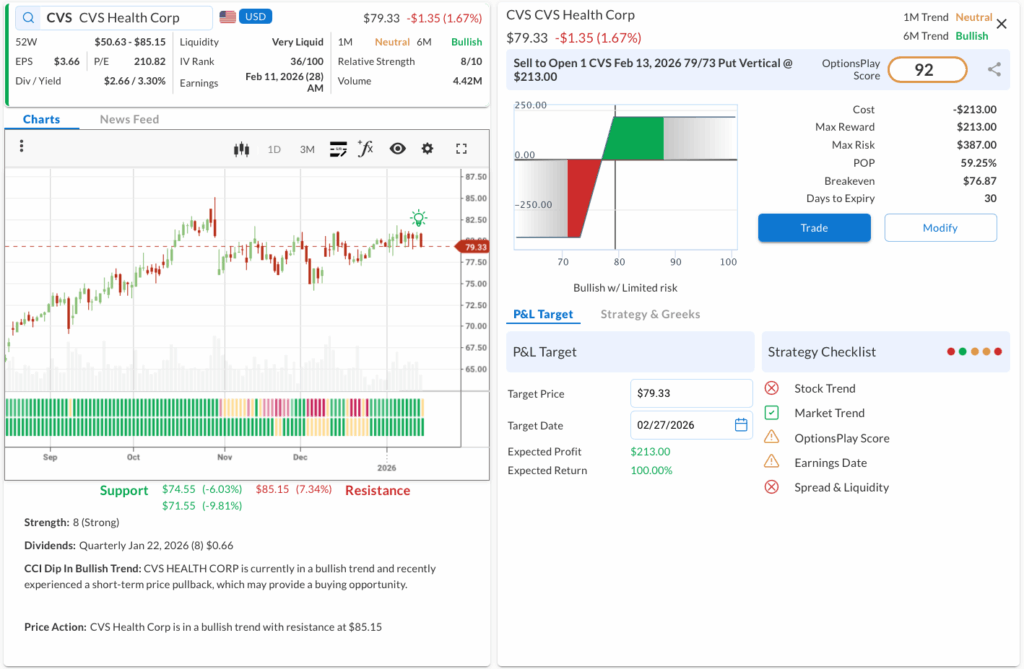

CVS, HD, XLF

OptionsPlay DailyPlay Ideas Menu – Jan 15th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- CVS: Credit Put Spread capitalizing on its “back to basics” strategy to stabilize the business and focus on growth in 2026.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- HD: Debit Call Spread positioning for a housing market recovery thesis ahead of the spring selling season.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- XLF: Bearish Put Spread hedging against regulatory headwinds as the White House targets credit card interest rates.

1. CVS ($79.33) – The Healthcare Value Play

- The Trade: Sell to Open the CVS Feb 13, 2026 79/73 Put Vertical @ $2.13 Credit.

- (Legs: Sell 79 Put, Buy 73 Put)

- Trade Metrics: POP: 59.25% | Collect $213.00 per contract vs. a Max Risk of $387.00 (1.8:1).

- The Why: The Investor Day (Dec 2025) provided the credibility Wall Street needed: 2026 is a growth year, not a reset year.

- The Technicals: The stock is in a Neutral Trend (1M) but retains a Bullish Trend (6M) with a Relative Strength of 8/10. It is currently testing Resistance at $85.15, while major Support sits at $74.55.

- Management:

- ⚠️ Warning: Earnings is scheduled for Feb 11, which may require active management.

- Stop Loss: Buy back the spread at $4.26 (100% of credit received).

- Take Profit: Buy back the spread at $1.07 (50% of max gain).

2. HD ($375.95) – Building a Base

- The Trade: Buy to Open the HD Mar 20, 2026 375/420 Call Vertical @ $14.83 Debit.

- (Legs: Buy 375 Call, Sell 420 Call)

- Trade Metrics: POP: 36.04% | Pay $1,483.00 per contract vs. a Max Reward of $3,017.00 (2.0:1).

- The Why: Despite recent rate volatility, Home Depot remains the primary beneficiary of a potential housing turnover recovery as we approach the critical spring season.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 5/10. It is currently testing Resistance at $410.39, while major Support sits at $320.39.

- Management:

- ⚠️ Warning: Earnings is scheduled for Feb 24, which may require active management.

- Stop Loss: Sell the spread at $7.42 (50% loss on premium).

- Take Profit: Sell the spread at $25.95 (75% gain on premium).

3. XLF ($54.15) – Financial Headwinds

- The Trade: Buy to Open the XLF Jan 30, 2026 55/52 Put Vertical @ $0.94 Debit.

- (Legs: Buy 55 Put, Sell 52 Put)

- Trade Metrics: POP: 48.14% | Pay $94.00 per contract vs. a Max Reward of $206.00 (2.2:1).

- The Why: New regulatory pressure from the White House regarding credit card interest rate caps presents a significant earnings headwind for the banking sector components.

- The Technicals: The stock is in a Mildly Bearish Trend (1M) but retains a Bullish Trend (6M) with a Relative Strength of 3/10. It is currently testing Resistance at $56.52, while major Support sits at $49.38.

- Management:

- Stop Loss: Sell the spread at $0.47 (50% loss on premium).

- Take Profit: Sell the spread at $1.65 (75% gain on premium).

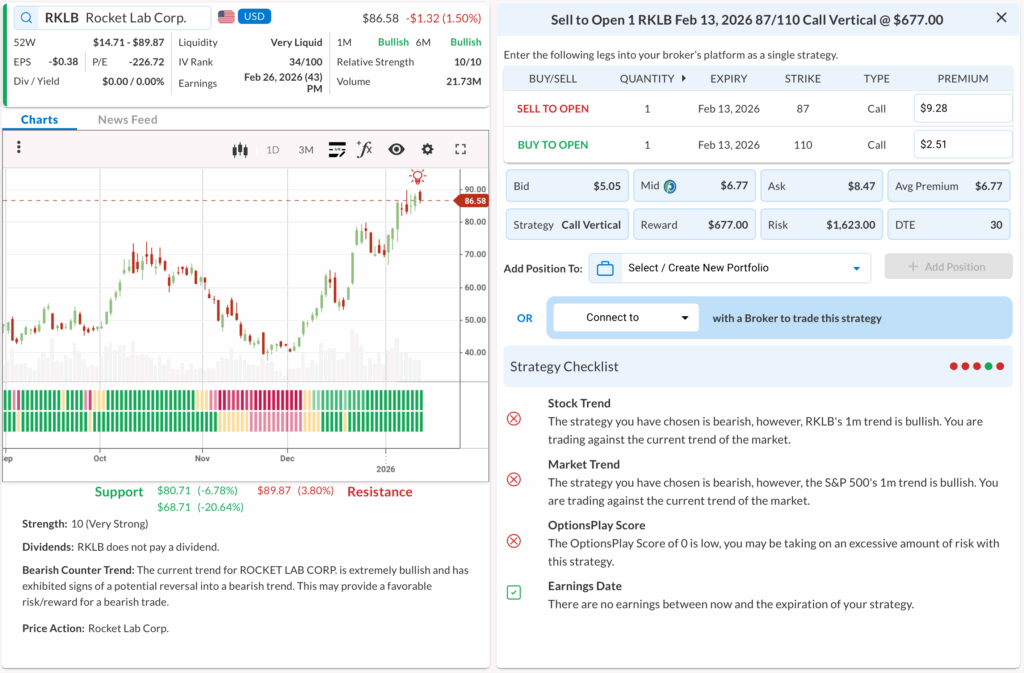

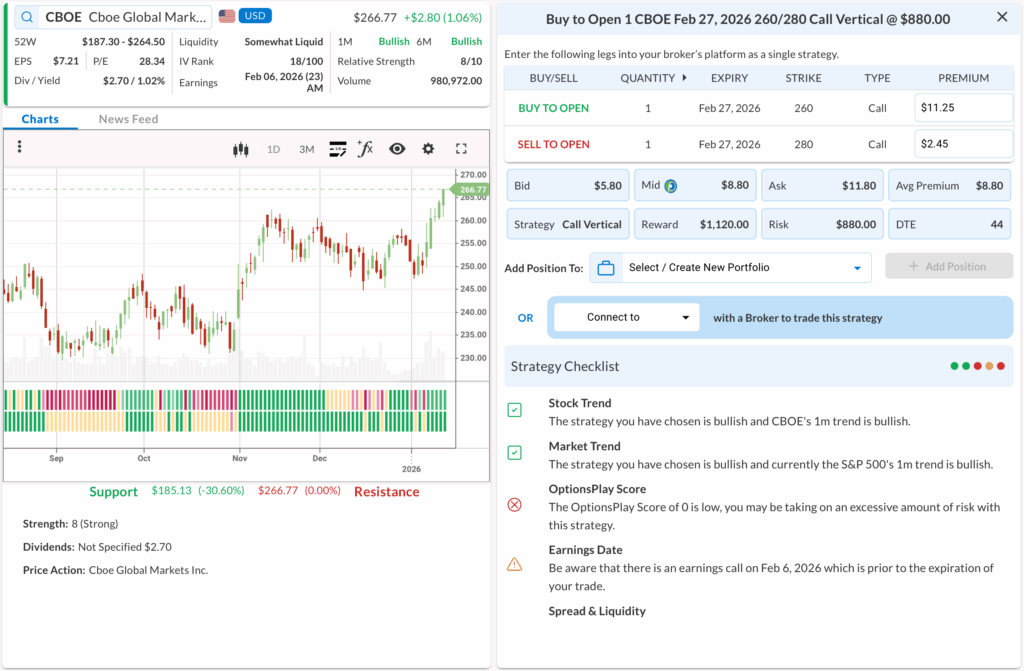

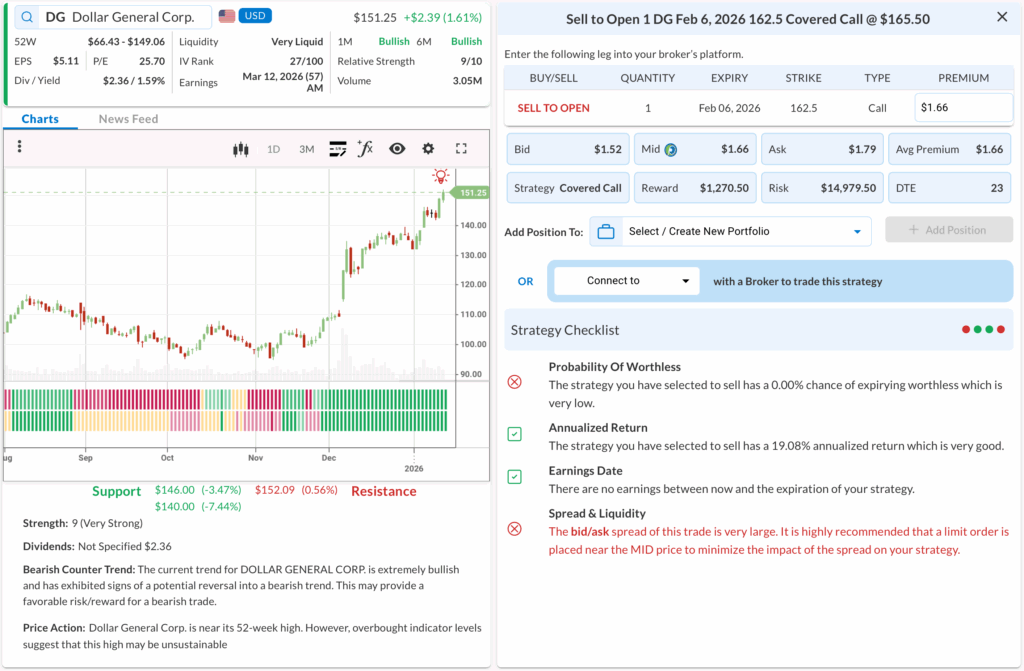

RKLB, CBOE, DG

OptionsPlay DailyPlay Ideas Menu – Jan 14th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- RKLB: Call Credit Spread capitalizing on extreme overbought conditions to generate income against resistance.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- CBOE: Debit Call Spread betting on sustained short dated trading volumes driving the exchange’s next leg higher.

🛡️ The Portfolio Protectors (Hedges & Bearish Bets)

- DG: Covered Call generating elevated premiums to hedge against potential consumer spending softness.

1. RKLB ($86.58) – Fading the Parabola

- The Trade: Sell to Open the RKLB Feb 13, 2026 87/110 Call Vertical @ $6.77 Credit.

- (Legs: Sell $87 Call, Buy $110 Call)

- Trade Metrics: POP: 67.54% | Collect $677.00 per contract vs. a Max Risk of $1,623.00 (2.4:1).

- The Why: After a massive run-up, Rocket Lab is hitting technical resistance; we are selling expensive call premiums to profit from a potential consolidation or pullback.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 10/10. It is currently testing Resistance at $89.87, while major Support sits at $80.71.

- Management:

- Stop Loss: Buy back the spread at $13.54 (Loss of 100% of credit received).

- Take Profit: Buy back the spread at $3.39 (50% of max gain).

2. CBOE ($266.77) – The Volatility Play

- The Trade: Buy to Open the CBOE Feb 27, 2026 260/280 Call Vertical @ $8.80 Debit.

- (Legs: Buy 260 Call, Sell 280 Call)

- Trade Metrics: POP: 45.65% | Pay $880.00 per contract vs. a Max Reward of $1,120.00 (1.3:1).

- The Why: With market volatility remaining a key theme for 2026, Cboe Global Markets is positioned to beat expectations as option volumes continue to expand.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 8/10. It is currently testing Resistance at $266.77, while major Support sits at $185.13.

- Management:

- ⚠️ Warning: Earnings is scheduled for Feb 06, which may require active management.

- Stop Loss: Sell the spread at $4.40 (50% loss on premium).

- Take Profit: Sell the spread at $15.40 (75% gain on premium).

3. DG ($151.25) – Defensive Income

- The Trade: Sell to Open Feb 6, 2026 162.5 Covered Call @ $1.66 Credit.

- Trade Metrics: POW: 80.12% | Collect $165.50 per contract (18.21% Annualized Yield or 1.11% in 24 Days).

- The Why: We are utilizing high implied volatility to generate income on Dollar General, creating a buffer against technical resistance and macro consumer headwinds.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 9/10. It is currently testing Resistance at $152.09, while major Support sits at $146.00.

- Management:

- Note: These management rules are optional. You may choose to hold to expiration if you are comfortable with the obligation to sell shares at the strike price.

- Stop Loss: Buy back the call at $3.32 (Loss of 100% of credit received).

- Take Profit: Buy back the call at $0.83 (50% of max gain).

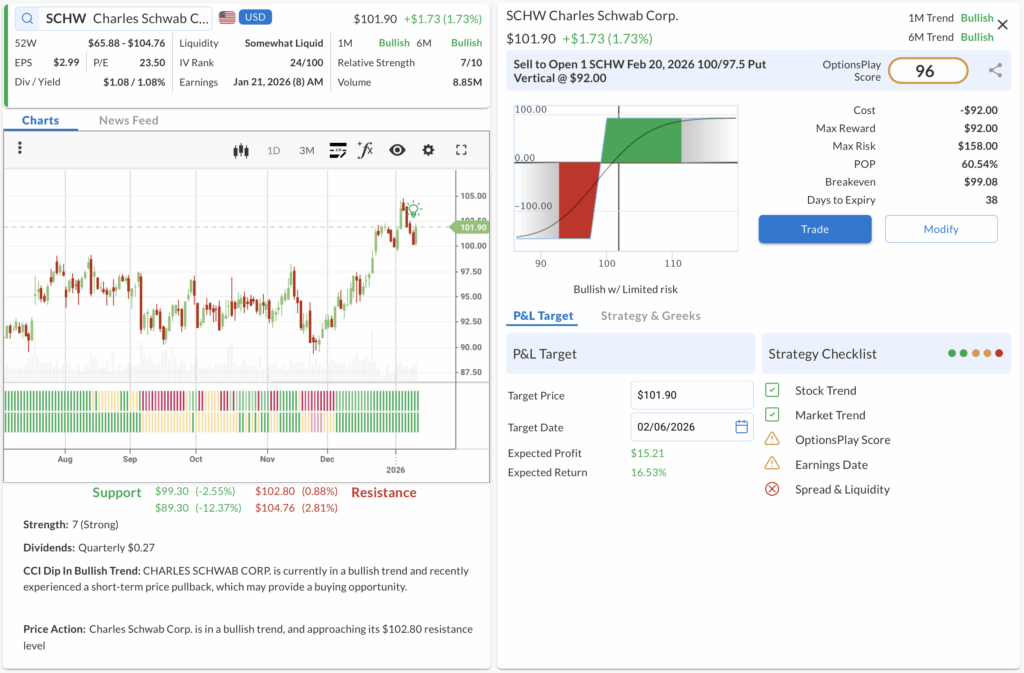

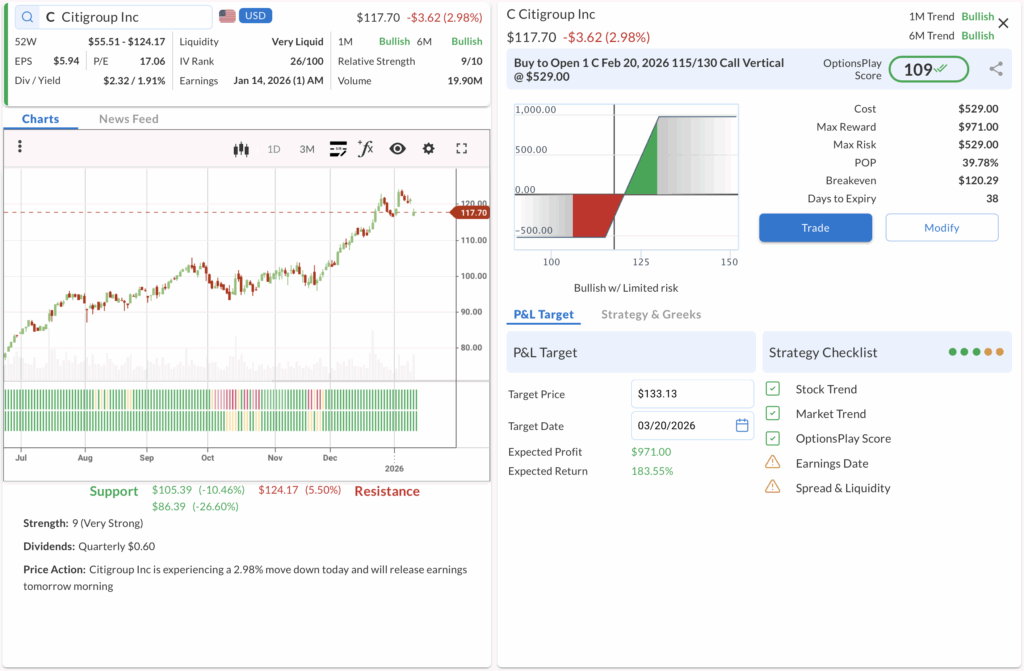

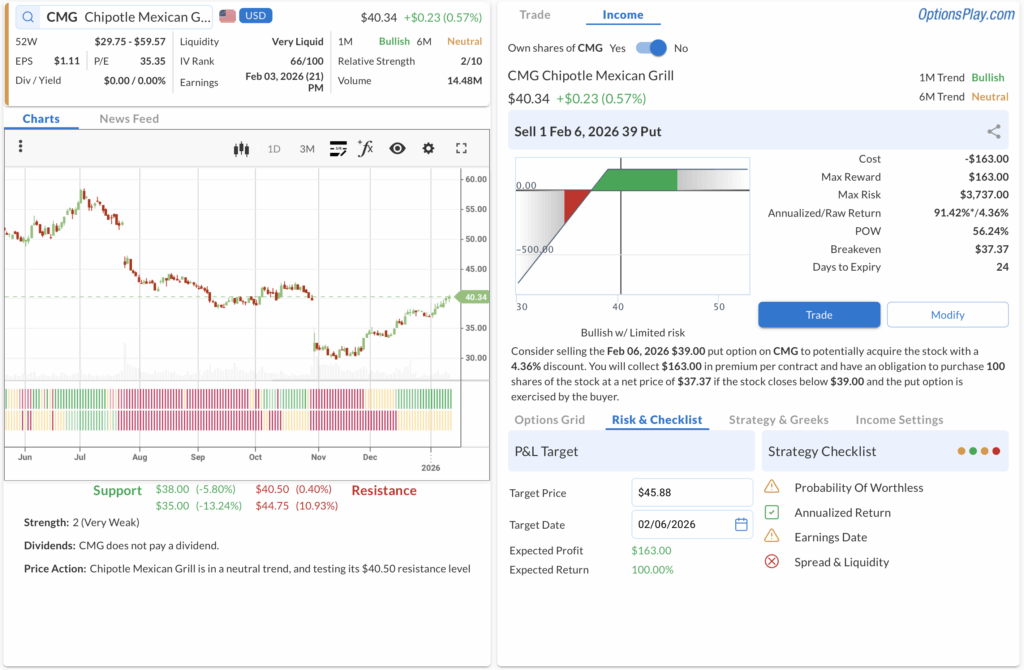

C, CMG, SCHW

OptionsPlay DailyPlay Ideas Menu – Jan 13th, 2026

💰 The Income Generators (High Probability, Cash Flow)

- SCHW: Credit Put Spread capitalizing on stabilizing deposit flows and expanding net interest margins.

- CMG: Short Put betting on operational efficiency and automation to defend margins despite consumer softness.

🚀 The Growth Seekers (Higher Risk, Max Reward)

- C: Debit Call Spread positioning for a restructuring-driven turnaround as valuation discounts narrow.

1. SCHW ($101.90) – The Deposit Stabilization Play

- The Trade: Sell to Open the SCHW Feb 20, 2026 100/97.5 Put Vertical @ $0.92 Credit.

- Trade Metrics: POP: 60.54% | Collect $92.00 per contract vs. a Max Risk of $158.00 (1.7:1).

- The Why: Analysts expect 2026 to bring a normalization of cash sorting headwinds, allowing Schwab’s net interest margin to expand as client assets hit record highs.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a Relative Strength of 7/10. It is currently testing Resistance at $102.80, while major Support sits at $99.30.

- Management:

- ⚠️ Warning: Earnings is scheduled for Jan 21, which may require active management.

- Stop Loss: Buy back the spread at $1.84 (100% of credit received).

- Take Profit: Buy back the spread at $0.46 (50% of max gain).

2. C ($117.70) – The Restructuring Turnaround

- The Trade: Buy to Open the C Feb 20, 2026 115/130 Call Vertical @ $5.29 Debit.

- Trade Metrics: POP: 39.78% | Pay $529.00 per contract vs. a Max Reward of $971.00 (1.8:1).

- The Why: Citigroup’s ongoing restructuring and focus on high-return services are expected to unlock value, with shares currently trading at a significant discount to tangible book value.

- The Technicals: The stock is in a confirmed Bullish Trend (1M & 6M) with a strong Relative Strength of 9/10. It is currently testing Resistance at $124, while major Support sits at $105.

- Management:

- ⚠️ Warning: Earnings is scheduled for Jan 14, which may require active management.

- Stop Loss: Sell the spread at $2.65 (50% loss on premium).

- Take Profit: Sell the spread at $9.26 (75% gain on premium).

3. CMG ($40.34) – Automated Efficiency

- The Trade: Sell 1 Feb 6, 2026 39 Put @ $1.63 Credit.

- Trade Metrics: POW: 56.24% | Collect $163.00 per contract (91.42% Annualized Yield or 4.36% in 24 Days).

- The Why: Despite softer transaction trends, Chipotle’s investment in automation (Autocado) and menu innovation positions it to defend margins better than fast-casual peers.

- The Technicals: The stock is in a Bullish Trend (1M) but a Neutral Trend (6M) with a weak Relative Strength of 2/10. It is currently testing Resistance at $40.50, while major Support sits at $38.00.

- Management:

- ⚠️ Warning: Earnings is scheduled for Feb 03, which may require active management.

- Note: These management rules are optional. You may choose to hold to expiration if you are comfortable with the obligation to buy shares at the strike price.

- Stop Loss: Buy back the put at $3.26 (100% of credit received).

- Take Profit: Buy back the put at $0.82 (50% of max gain).