$CAH

DailyPlay – Closing Trade (CAH) – June 13, 2023

Closing Trade

- CAH – 56.42% Loss: Sell to Close 10 Contracts (or 100% of your Contracts) July 21st $82.50 Puts @ $0.73 Credit. DailyPlay Portfolio: By Closing all 10 Contracts, we will receive $730.

Investment Rationale

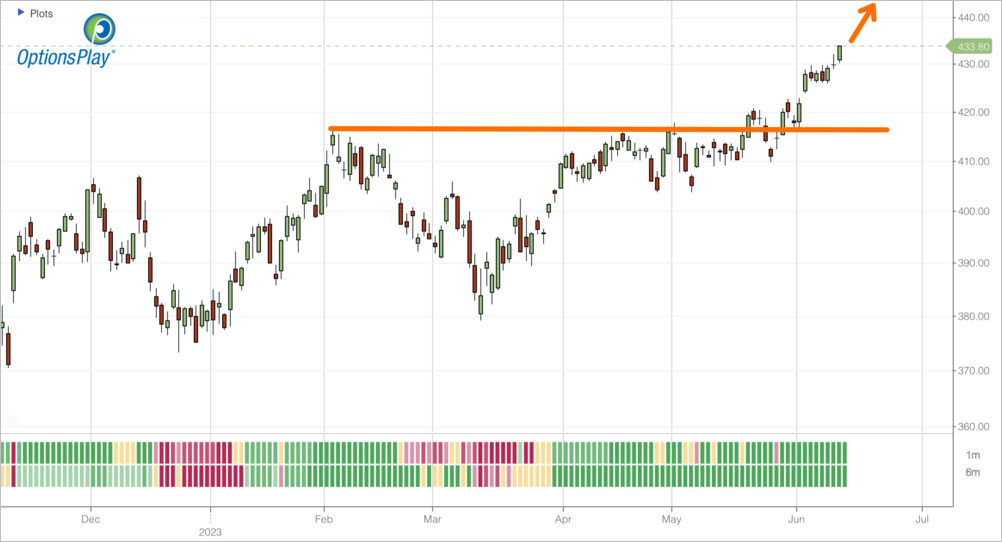

Equity markets have continued its bullish trend from last week during yesterday’s session with Tech leading the charge. SPY has broken out above last week’s $430 resistance and +9 Sell Setup. Weekly Charts on SPY, QQQ, IWM and RSP all look constructive for further upside. All eyes are now on this morning’s CPI print this morning and the Fed meeting on Wednesday. Pay attention to the language around the July meeting and whether a rate hike is on the table. For now, we maintain our bullish views and continue to position for further upside and look to cut our losses on short positions. CAH has reversed back to its 52-week highs and proven that our bearish thesis is no longer holding, warranting closing out the full position here. Despite catching the ORCL trade after the gap higher, earnings came out better than expected and we will monitor this today for an opportunity to adjust for further upside.

CAH – Daily

$ORCL

DailyPlay – Opening Trade (ORCL) Closing Trade (TSLA) – June 12, 2023

Closing Trade

- TSLA – 43.70% Loss: Sell to Close 2 Contracts (or 100% of your Contracts) Aug 18th $210/$170 Put Vertical Spreads @ $6.39 Credit. DailyPlay Portfolio: By Closing the 2 Contracts, we will receive $1,278.

ORCL Bullish Opening Trade Signal

View ORCL Trade

Strategy Details

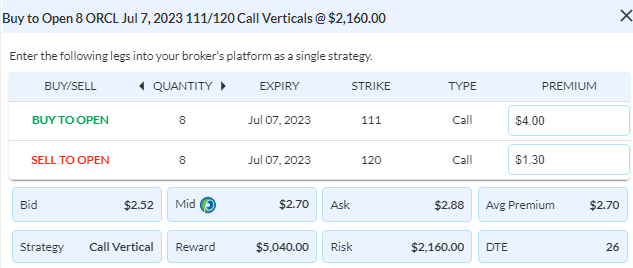

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 8 Contracts July 7th $111/$120 Call Vertical Spreads @ $2.70 Debit per contract.

Total Risk: This trade has a max risk of $2,160 (8 Contracts x $270) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $270 to select the # shares for your portfolio.

Trend Continuation Signal: This stock has in a bullish trend, which is expected to continue higher.

1M/6M Trends:Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 116

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As equity markets continue to improve with small caps and the equal-weight S&P 500 starting to play catchup, we enter a big week with a potential Fed pause on Wednesday. The S&P did print a Daily -9 Sell Signal on Thursday but the overall picture is improving in favor of the bulls. As we look towards next week, ORCL reports earnings after the closing bell today. Despite trading at 52-week highs, ORCL trades at a relative discount to its “AI peers” at only 21x forward earnings. This valuation is expected given ORCL’s modest expected EPS growth rate of only 3%, but guidance could accelerate those expectations on the back of their AI-focused deals in the past quarter. We are taking this opportunity to play for upside by buying a July 7 $111/120 Call Vertical @ $2.70 Debit.

ORCL – Daily

$JPM

DailyPlay – Opening Trade (JPM) – June 9, 2023

JPM Bullish Opening Trade Signal

View JPM Trade

Strategy Details

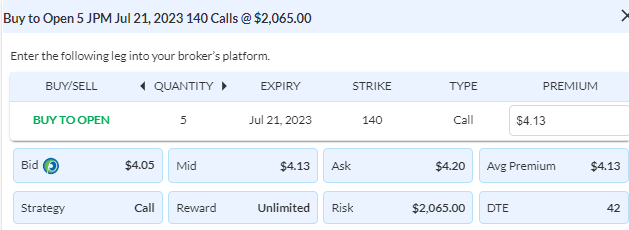

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 5 Contracts July 21st $140 Calls @ $4.13 Debit per contract.

Total Risk: This trade has a max risk of $2,065 (5 Contracts x $413) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $413 to select the # shares for your portfolio.

Trend Continuation Signal: This stock has been bullish and is expected to break out above an area of resistance.

1M/6M Trends:Bullish/Bullish

Technical Score: 7/10

OptionsPlay Score: 95

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Despite tech names leading another rally (QQQ) and leaving the rest of the market (RSP) behind market breadth does continue to improve. 53% of S&P 500 stocks are now trading above its 200 D SMA, vs 35% a couple of weeks ago. This adds support to confirm the break above $4200 on the S&P 500 can hold. Tomorrow’s close will be an important milestone in solidifying the bullish trend that was kicked off this week. For adding to our long exposure we look to financials. JPM has been leading the pack within financials, the only major bank that has outperformed its sector over the past 9 months. Trading just below its $143 resistance level, JPM is primed for a potential breakout. We are positioning for the breakout above this key resistance level up to its $163 resistance area. With IV Rank under 5% options are inexpensive so I’m looking to Buy the July $140 Calls @ $4.13 Debit.

TSLA is on watch to potentially cut losses as our initial thesis that the $205-210 resistance area as a turning point has not held.

JPM – Daily

$CAH

DailyPlay – Opening Trade (CAH) – June 8, 2023

CAH Bearish Opening Trade Signal

View CAH Trade

Strategy Details

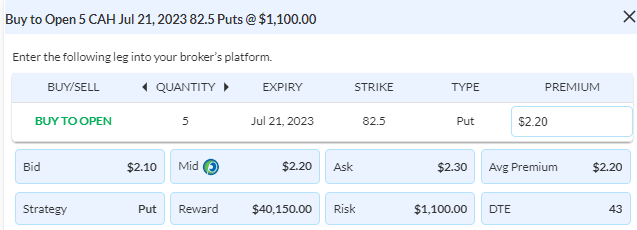

Strategy: Long Put

Direction: Bearish

Details: Buy to Open 5 Contracts July 21st $82.50 Puts @ $2.20 Debit per contract.

Total Risk: This trade has a max risk of $1,100 (5 Contracts x $220) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $220 to select the # shares for your portfolio.

Counter Trend Signal: This stock has recently turned from bullish to neutral as it found resistance, while we expect to see a pullback from this level.

1M/6M Trends: Neutral/Bullish

Technical Score: 6/10

OptionsPlay Score: 80

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Yesterday’s market saw both scenarios that we outlined earlier this week start to play out. Both overbought AI tech names saw a pullback and the broader market started to play catchup. The RSP chart is starting to poke out above the weekly cloud with the lagging line now inside the cloud. We will see if this strength can sustain through Friday’s close, if so, we have the foundations for a bullish trend and potentially continue to add to our RSP position. One trade that I want to revisit is our short position on CAH which was initiated a couple of weeks ago. We were able to take early profits with half the position, and now that CAH has rallied back to resistance and confirmed another rejection, I advocate that we add back another 1% of the portfolio’s capital on this trade for increased downside exposure. Buy to Open 5 Contracts July $82.50 Puts @ $2.20 Debit.

CAH – Daily

$OIH

DailyPlay – Closing Trade (OIH) – June 7, 2023

Closing Trade

- OIH – 49.86% Gain: Buy to Close 2 Contracts (or 100% of your remaining Contracts) June 16th $265/$255 Put Vertical Spreads @ $2.25 Debit. DailyPlay Portfolio: By Closing the last 2 Contracts, we will pay $450. We partially closed this trade on May 31 @ $5.45 Debit. Our average cost basis to exit this trade is therefore @ $3.32 and our average gain on this trade is 25.29%.

Our DailyPlay Strategy

Whether you’ve been a member for years 📆, or just starting your free trial, I wanted to take an opportunity to explain how we strive to help you become a profitable trader 💰 with real trading examples every day ☀️.

My name is Tony Zhang 🙋♂️, the Chief Strategist at OptionsPlay. I have been a strategist for 17 years and have worked with thousands of retail and institutional traders over that time ⏰.

How we achieve this is summed up by a single sentence: We add to winning positions 📈 and we cut losers quickly 🏃♂️.

The reality is that no one knows what the markets will do tomorrow 🔮. We can’t control the direction of any stock 📉, we can only control where we choose to take risks 🎲.

We aim to be profitable by adding size to winning positions 🚀 and risk turning a winning trade into a small loss 💔 because it gives us the opportunity to hit big home runs ⚾️.

While cutting losses ruthlessly ensures that we never have huge blowups 💥. By being disciplined to these 2 rules, we ensure that in the long run, our winners outpace our losers and we are profitable 💸.

All of our trades start with initially risking 2% of our total portfolio value. We never add to a losing position ❌, and we only add another 1-2% of risk, if a trade becomes profitable and have the opportunity to ride the trend 🌊.

With 10 days left on our OIH trade and a 49% gain on the short put spread, this is time to take profits. The options are not favorable to sell another put spread and extend this trade, but we will monitor OIH for a pullback opportunity to gain bullish exposure over the next few trading sessions.

$RSP

DailyPlay – Opening Trade (RSP) – June 6, 2023

RSP Bullish Opening Trade Signal

View RSP Trade

Strategy Details

Strategy: Long Stock

Direction: Bullish

Details: Buy 14 RSP @ $143 Debit per Share.

Total Risk: This trade has a max risk of $2,001.93 (14 Contracts x $142.99) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $142.99 to select the # shares for your portfolio.

Trend Continuation Signal: This stock is in a bullish trend and is expected to break out higher.

1M/6M Trends: Bullish/Bullish

Technical Score: 5/10

OptionsPlay Score: 125

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Today’s price action in the markets left a lot to be desired. My biggest concern with our current breakout higher in the S&P above its key $4200 level is the lack of breadth. About 10 stocks are dragging the entire “market” higher while the rest of the market is flat. This type of extreme can only resolve itself in one of two possible ways. Either the AI tech stocks that are dragging the markets higher retrace, which would likely see the S&P 500 retest $3800, or the rest of the market starts to play catchup and the S&P continues this new bullish trend. Despite the economic headwinds, markets can stay irrational longer than you can stay solvent. At the moment, the bulls have more control so I’m going to take this opportunity to add to our position that was established last week, by adding to our RSP position by purchasing another 14 shares (for a hypothetical $100,000 portfolio). This would allow us to potentially profit if the broader market catches up with the AI stocks.

RSP – Daily

$TSLA

DailyPlay – Opening Trade (TSLA) – June 5, 2023

TSLA Bearish Opening Trade Signal

View TSLA Trade

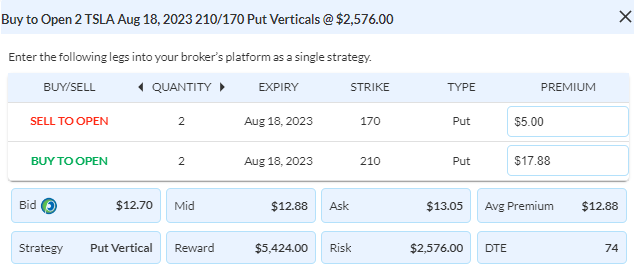

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 2 Contracts Aug 18th $210/$170 Put Vertical Spreads @ $12.88 Debit per contract.

Total Risk: This trade has a max risk of $2,576 (2 Contracts x $1,288) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,288 to select the # shares for your portfolio.

Counter Trend Signal: This stock has rallied into an area of resistance at $215 and is expected to pull back.

1M/6M Trends: Bullish/Bullish

Technical Score: 9/10

OptionsPlay Score: 128

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

DailyPlay for June 5th, 2023 is TSLA, which triggered bearish scan after rallying nearly 40% over the past month. The current bullish trend has reached an overbought level coupled with a major resistance level at $215, providing a low risk entry for bearish exposure. TSLA currently has a strong relative strength score of 9 out 10, which is optimal for a bearish counter trend opportunity.

With declining car sales globally and interest rates back on the rise, TSLA has had to resort to deep price cuts to maintain delivery targets, which impact both top and bottom line. Currently trading at 40x next year’s earnings, TSLA’s valuation is heavily weighted on its 40% EPS growth and 20% gross margins that analysts are expecting. I suspect that is optimistic and there are downside risks to those assumptions. I’m using the rally to this important $215 resistance level as an opportunity to seek a low risk bearish exposure in TSLA. With IV Rank @ 11%, I’m buying the Aug $210/$170 Put Vertical @ $12.88 Debit.

TSLA – Weekly

Since our Alphabet trade has reached its upper strike price of $125, it’s time to roll our trade Up and Out to the July $125/$135 Call Vertical for a $0.06 Credit. This allows us to extend our upside bet in Alphabet while removing all risk from the table.

$UNG

DailyPlay – Closing Trade (UNG) – June 2, 2023

Closing Trade

- UNG – 73.81% Loss: Sell to Close 23 Contracts (or 100% of your remaining Contracts) June 30th $7/$8.50 Call Vertical Spreads @ $0.11 Credit. DailyPlay Portfolio: By Closing the final 23 Contracts, we will receive $253. We partially closed this trade on May 31 @ $0.20 Credit. Our average cost basis to exit this trade is therefore @ $0.15 and our average loss on this trade is 63.33%.

Investment Rationale

We are at a pivotal moment in equities. With the broader market severely lagging behind big tech and the S&P 500 flirting about its key $4200 resistance level, we are positioned for 2 possible outcomes. Either this AI lead tech rally fails to extend further and starts to retrace, we will likely see the S&P 500 back towards the $3800 level. However, if the broader market can rally from here, that will provide the support needed to begin a fresh bullish trend after more than a year of choppy sideways action. Currently, we have positions that would profit from either outcome and will take this opportunity to see where the market closes tomorrow afternoon. At this time, our UNG position has triggered our stop loss level of 50% loss on a debit spread so we are going to close out that position.

S&P 500 – Daily

$WBA

DailyPlay – Opening Trade (WBA) Closing Trades (AAPL, EBAY) – June 1, 2023

Closing Trades

- AAPL – 90.52% Loss: Sell to Close 2 Contracts (or 100% of your remaining Contracts) June 16th $165 Puts @ $0.51 Credit. DailyPlay Portfolio: By Closing the remaining 2 Contracts, we will receive $102. We partially closed this trade on May 22 when we closed 50% of our contracts @ $0.94 Credit. Our average cost basis to exit this trade is, therefore, $0.73 and our average loss on this trade is 86.53%.

- EBAY – 145.76% Loss: Buy to Close 8 Contracts (or 100% of your remaining Contracts) June 2nd $44/$41 Put Vertical Spreads @ $1.45 Debit. DailyPlay Portfolio: By Closing all 8 Contracts, we will be paying $1,160.

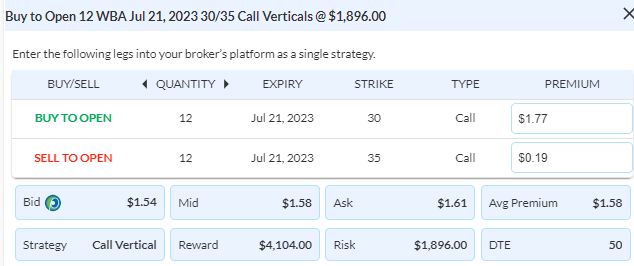

WBA Bullish Opening Trade Signal

View WBA Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 12 Contracts July 21st $30/$35Call Vertical Spreads @ $1.58 Debit per contract.

Total Risk: This trade has a max risk of $1,896 (12 Shares x $158) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $158 to select the # shares for your portfolio.

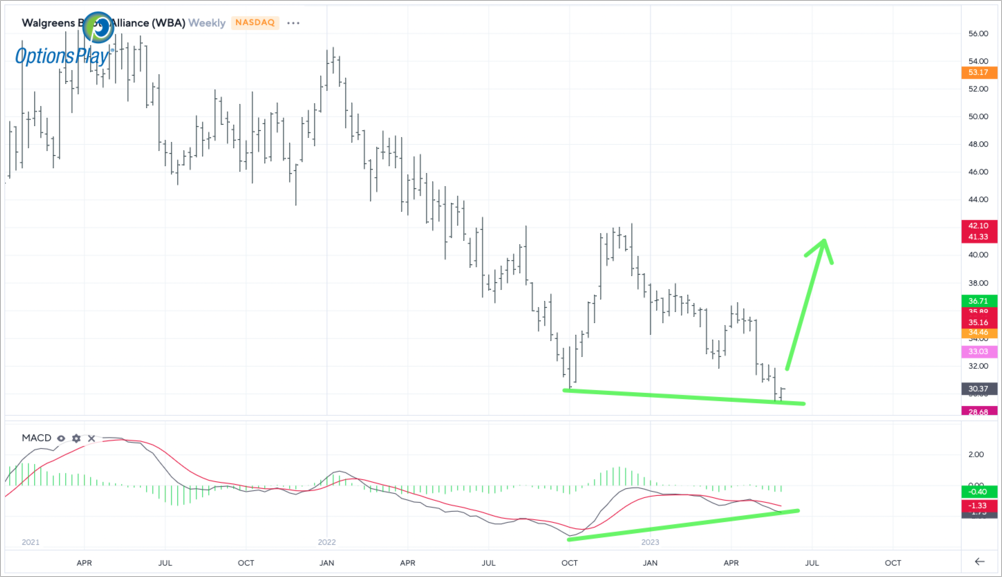

Counter Trend Signal: This stock has respected support and is expected to bounce higher from this point.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 93

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

The S&P 500 continues to flirt with the $4200 major resistance level. This week has been filled with positive news, debt ceiling, a possible pause to rate hikes, yet markets remain below $4200. At the moment, market breadth remains poor with AI stocks dragging it higher. For the market to break higher, the rest of the market needs to start pulling its weight. At this juncture, we are taking an opportunity to close out existing trades and waiting to see if bulls have enough control to breakout higher. Walgreens (WBA) recently made a new 52-week low with positive divergence on the Weekly Chart with a +13 setup. This sets up for a potential quick bounce higher on a counter trade and I’m looking to buy the July $30/$35 Call Vertical @ $1.58 Debit or about 5% of the stock’s value.

WBA – Daily

We are also taking this opportunity to close out our remaining AAPL Calls and EBAY positions.

$OIH, $UNG, $CAH

DailyPlay – Partial Closing Trades (OIH, UNG, CAH) – May 31, 2023

Partial Closing Trades

- OIH – 23.86% Loss: Buy to Close 1 Contract (or 1/3 of your Contracts) June 16th $265/$255 Put Vertical Spreads @ $5.45 Debit. DailyPlay Portfolio: By Closing 1 of the 3 Contracts, we will pay $545.

- UNG – 52.38% Loss: Sell to Close 22 Contracts (or 50% of your Contracts) June 30th $7/$8.50 Call Vertical Spreads @ $0.20 Credit. DailyPlay Portfolio: By Closing 22 of the 45 Contracts, we will receive $440.

- CAH – 64.29% Gain: Sell to Close 5 Contracts (or 50% of your Contracts) July 21st $82.50 Puts @ $3.45 Credit. DailyPlay Portfolio: By Closing 5 of the 10 Contracts, we will receive $1,725.

Investment Rationale

The broad market was flat yesterday, but tech continued to plow ahead with the QQQ adding another 45 bps. of performance. Interestingly, though, NVDA gapped well higher but closed beneath its open after running as high as $420. (I actually see daily and weekly +13 signals in it and looking more in-depth into the name after briefly talking about it in yesterday’s weekly Technical Outlook, the $417 level was an upside target that’s been in place on the monthly chart since the late-2018 decline pulled the stock down to $31. (So, no, I’m not buying it up here.)

Today is the last day of the month, so look for the first few days of June to potentially continue having some cyclical sectors seeing money taken out of them in favor of mega-cap tech. To me, some of those tech high-flyers could easily stall around current prices, but hell hath no fury like a scorned “missed the up move” investor who will now blindly buy the AI-related names, thinking they have an edge in doing so.

Looking at our portfolio, let’s lower some of the bullish bets in the energy space that haven’t worked yet. So, let’s take off 1 of 3 OIH short put spreads, and let’s reduce 22 of 45 UNG long call spreads. Both could be affected by the oil and Natgas inventory-related weekly data out on Thursday morning this week. (Usually, the oil inventory report comes out Wednesday mornings, but because of the Memorial Day holiday, it gets delayed this week until 11:00 am ET on Thursday – 30 minutes after the Natgas number is released.)

We are also long 10 CAH $82.5 puts, and with them up 64%, let’s take half off today to lock in some much-needed profit after a tough month of several losses.

CAH – Daily