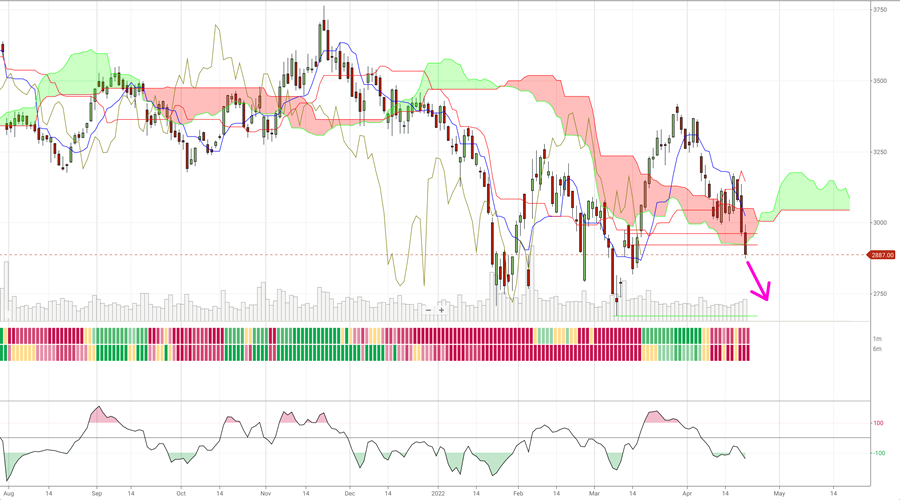

$QQQ

DailyPlay Opening Trade Signal (QQQ) – April 28, 2022

View QQQ Trade

QQQ Bullish Opening Trade Signal

Strategy Details

Strategy: Call Debit Spread

Strategy Direction: Bullish

Details: Buy 1 Contract May 20 $320/$344 Call Vertical @ $9.45 Debit

Total Risk: This trade has a max risk of $945 (1 contract x $945 per contract).

Counter Trend Signal: This is a bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 77

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

8 am Update:

With futures now up significantly more than they were last night, I would NOT chase after the QQQ trade UNTIL the QQQ gets back down to the $320 area so that the $320 call is the at-the-money call

Investment Rationale

Let’s start by looking at the technology market, of which the QQQ is a good proxy (as is XLK, even more specifically). The “Qs”, as they are known, saw its rally fail yesterday and actually close a bit beneath its open. In Japanese candle terms, that open and close at virtually the same price is known as a “doji”, and it usually suggests “indecision” when it shows up in a strongly trending market.

When we look at recent QQQ history, we see that a doji also showed up in early March – one that led to a 10% rally the balance of the month. Now we see one again – virtually at the same level and also following a large down day the prior day. (See the two cyan-colored ellipses in the below chart.)

Given that some major tech name earnings were better than expected yesterday, as I write this at 7pm Wednesday evening, it would appear as if the market will open decently higher on Thursday (Nasdaq futures are up 155 right now; ~+1.2%).

Bulls clearly want to see yesterday’s low hold, as it was also the same low made back in May 2021. Wednesday also happened to have marked a daily Aggressive Combo -13 signal. So, let’s buy a one-half position (i.e., theoretical $1000 amount) in the QQQ May 20 $320/$344 call spread for about $10 based upon Wednesday’s closing mid price. (That’s 1 contract.) If we see any major break of yesterday’s lows, we’ll exit.

$WFC

DailyPlay Closing Trade (WFC) – April 27, 2022

Closing Trade

- WFC: 92.12% Loss: Buy to close 10 Contracts May 13, 2022 $45/$48 Put Verticals @ $0.57 Credit. $2.00 Debit. Despite outperforming the market and its sector after earnings, WFC’s decline below its major support level at $46 warrants closing out our long exposure in this weak bearish market. We are closing this position out completely. DailyPlay Portfolio: By closing 10 Contracts, we will be paying $2,000.

$MET

DailyPlay Opening Trade (MET) – April 26, 2022

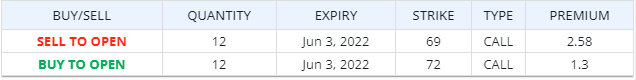

View MET Trade

MET Bearish Opening Trade Signal

Strategy Details

Strategy: Short Call Vertical Spread

Strategy Direction: Bearish

Details: Sell 12 Contracts June 3 $69/$72 Call Verticals @ $1.28 Credit

Total Risk: This trade has a max risk of $2,064 (12 contracts x $172 per contract).

Counter Trend Signal: This is a bearish trade on a stock that is experiencing a sideways trend.

1M/6M Trends: Mildly Bearish/Bullish

Technical Score: 9/10

OptionsPlay Score: 104

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Yesterday’s reversal higher has bulls lickin’ their chops that the bottom is in. I say that one day does not make a bottom – despite how oversold the market was or how bearish the individual investor is. It’s a single data point that would need to prove itself out days from now and a couple of weeks from now to be valid.

When I look for a name that looks weak but perhaps not at its logical low, I see that Metlife Inc. (MET) has been in a trading range all year, with last Wednesday’s/Thursday’s peak at the top of the range that was also accompanied by an Aggressive Sequential +13 signal and a new completed Setup +9 count. Though yesterday made a potential “hammer” bottom (depending upon what happens today and tomorrow), the $69.50 to $70.50 zone should be decent resistance as it was where all the lows were the past month.

Let’s look for this to shortly stall on any continued rally, and still make its way down to the bottom of the range (~$62) before we see a better bottom. Therefore, we are going to sell a June 3rd $69/$72 call spread for $1.27 based upon yesterday’s closing mid prices. That credit spread will take in about 42% of the spread differential – in line with many credit spreads we put on. MET does report earnings early next week (on May 4th), and that should be the main catalyst for its price movement after its release (besides any major market movement).

$AMZN

DailyPlay Opening Trade (AMZN) Closing Trades (LLY, LOW, SYY, UNH, XLU) – April 25, 2022

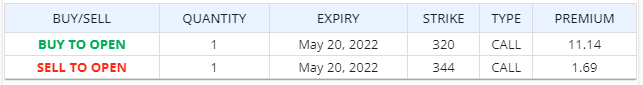

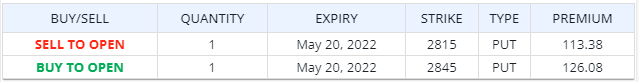

View AMZN Trade

AMZN Bearish Earnings Trade Signal

Strategy Details

Strategy: Put Debit Spread

Strategy Direction: Bearish

Details: Buy to Open 1 Contract May 20, 2022 $2845/$2815 Put Vertical @ $12.70 Debit

Trend Continuation Signal: This is a bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 113

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

With Amazon reporting earnings this week, the risks are skewed to the downside. With consumer spending seeing the first year over year decline, wage inflating remaining stubbornly high, profit margins are at risk of seeing declines for AMZN earnings. While AWS revenues are expected to remain strong, guidance for Q2 and the rest of the year may provide a larger driver of the stock’s price after the report. With AMZN underperforming both the market and its sector, the rangebound price action is at risk of breaking down and revisiting $2700 lows and $2000 extended targets to the downside.

Closing Trades

- LLY: 58.15% Loss: Buy to close 2 May 6, 2022 $285/$292.5 Put Verticals @ $4.40 Debit. DailyPlay Portfolio: Closing the remaining 2 contracts of this trade, we will pay $880.

- LOW: 49.00% Loss: Sell to close 2 May 13, 2022 $205/$220 Call Verticals @ $2.56 Credit. DailyPlay Portfolio: Closing the remaining 2 contracts of this trade, we will receive $512.

- SYY: 45.45% Loss: Buy to close 8 May 6, 2022 $86/$90 Call Verticals @ $2.40 Debit. DailyPlay Portfolio: Closing the remaining 8 contracts of this trade, we will pay $1920.

- UNH: 53.67% Loss: Sell to close 1 May 20, 2022 $540/$570 Call Vertical @ $5.62 Credit. DailyPlay Portfolio: Closing the remaining 1 contract of this trade, we will receive $562.

- XLU: 23.08% Gain: Sell to close 7 May 20, 2022 $73/$78 Call Verticals @ $1.76 Credit. DailyPlay Portfolio: Closing the remaining 7 contracts of this trade, we will receive $1232.

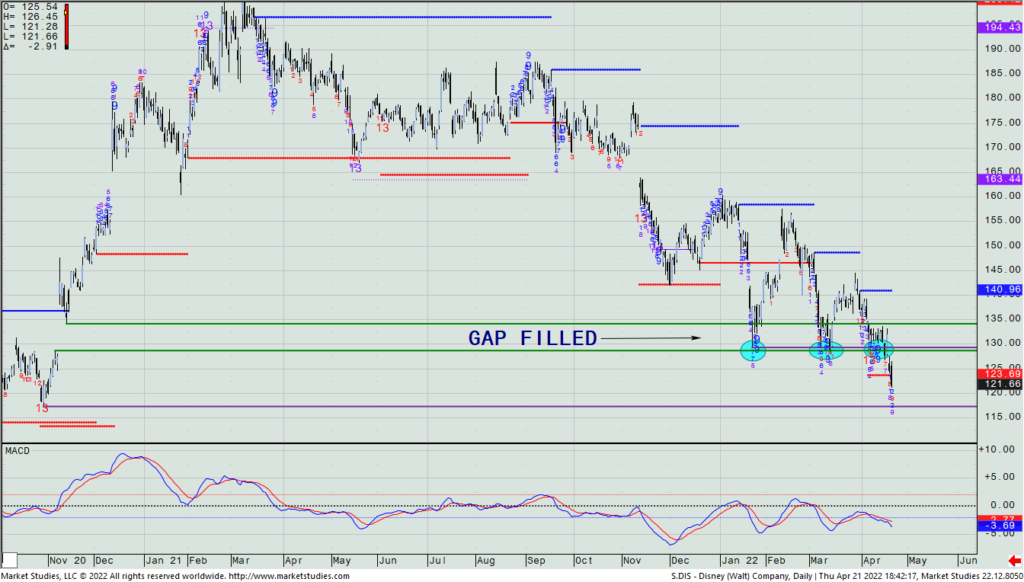

$DIS, $LLY, $NKE

DailyPlay Closing Trade (DIS) Partial Closing Trades (LLY, NKE) – April 22, 2022

Closing Trade

- DIS: 79.64% Loss: Sell to close 8 May 6, 2022 $131/$139 Call Verticals @ $0.57 Credit. Let’s start with our long DIS May 6 $131/$139 call spreads. With the triple bottom now having given way – and both the NFLX news and the Florida governor proposing taking beneficial tax status away from Disneyland – the stock is not likely going to find a lot of fans, now. We will officially take the position off today. DailyPlay Portfolio: By closing 8 contracts, we will be receiving $456.

Partial Closing Trades

- LLY: 12.42% Loss: Buy to close 2 May 6 $292.50/$285 Put Verticals @ $3.53 Debit. Next, we put on a bullish LLY put spread yesterday (i.e., short the May 6th $292.5/$285 put spread). The support area we were looking to hold did not hold, and as such, I want to cover back half of this trade today. (I’m hoping the Propulsion Exhaustion level at yesterday’s low will in fact hold, but there’s no reason to hold the full position.) DailyPlay Portfolio: By closing 2 contracts, we will be paying $706.

- NKE: 65.54% Gain: Sell to close 3 May 27, 2022 $128/$140 Call Verticals @ $6.87 Credit. Lastly, we will exit half of our long NKE May 27th $128/$140 near spread near today’s close IF it is trading beneath $135.28 late in the day (i.e., ~ 3:45pm ET). If it’s above there, we will remain long in the full position. (I recognize that you may not be used to trading like this, but it is the way the pros trade.) DailyPlay Portfolio: By closing 3 contracts, we will be receiving $2,061 (based on yesterday’s closing price. However, this is dependent on the closing conditions mentioned above).

Investment Rationale

With the market making it difficult to figure out which way it wants to move for longer than 48 hrs., we are going to use today to clean up several positions we have on. Of note, one of the things I will try to do going forward is to lighten up on trades that aren’t going our way fairly quickly after putting them on. To me, as a technically-oriented trading strategist, if your trade idea doesn’t work after a few days, then your entry reason has probably been partially or completely nullified. If that’s the case, it then makes sense that one does not hold onto the full position, if at all. So here are some positions we have on that I want to trim today at some point before the close. (If I had to guess (and I’m writing this Thursday evening with futures flat), Friday could see a rally — offsetting some of Thursday’s losses which seem overdone, given that Fed Chair Powell’s saying that “50 bp. hike is on the table for the May FOMC meeting” was not different than what the Street already expected. Thus, if I’m going to sell out of a losing long position tomorrow, I’d probably think of doing it closer to the end of the day than doing it right after the open.

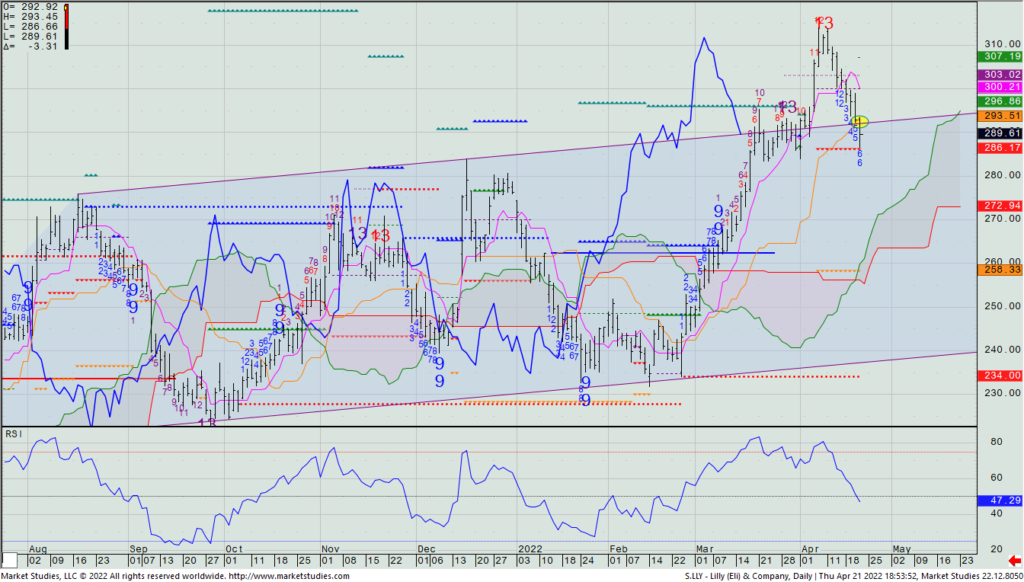

$LLY

DailyPlay Opening Trade (LLY) – April 21, 2022

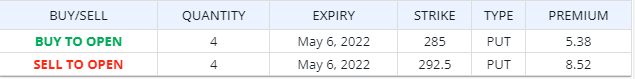

View LLY Trade

Strategy Details

Strategy & Direction: Short Put Vertical Spread – Bullish

Details: Sell 4 May 6 $292.50/$285 Put Verticals @ $3.14 Credit

Total Risk: This trade has a max risk of $1,744(4 contracts x $436 per contract).

Trend Continuation Signal: This is a Bullish strategy on a stock or ETF that is experiencing a bullish trend.

1M/6M Trends: Neutral/Bullish

Technical Score: 10/10

OptionsPlay Score: 93

Learn how to size this trade for your portfolio size

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

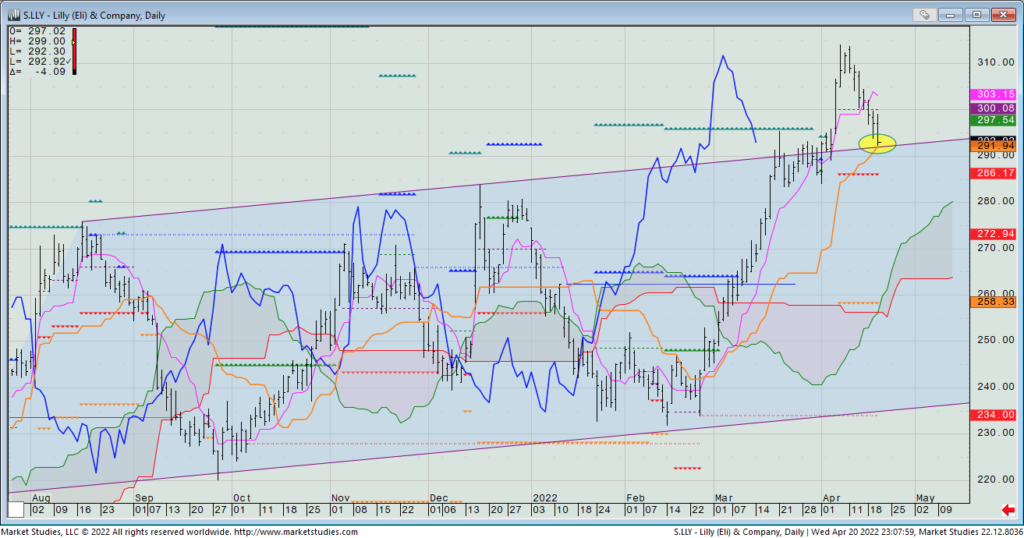

When we look at the chart of Eli Lilly & Co. (LLY), we see that it had been trading in a perfect channel since last summer (the blue shaded zone) that then broke out upside in early April, only to see the last week or so come right back off. However, now it’s right by its cloud model’s Base Line (in orange) and the top of the channel it broke out from. Thus, this is an important support area, and one that should hold if it was a good breakout. With earnings due a week from today, we can play a fairly short-dated option that limits our risk if earnings disappoint, but gives us a worthwhile reward if they don’t. So, let’s look to short the May 6th $392.5/$385 put spread, which closed at $3.16 yesterday based upon mid prices.

$MTCH

DailyPlay Taking Profits (MTCH) – April 20, 2022

Taking Profits

- MTCH: 108.57% Gain: Sell to close May 20, 2022 $105/$95 Put Vertical @ $6.57 Credit. As I write this after 1 AM ET early Wednesday morning, S&P futures are down ~20 points suggesting a lower open later this morning. Let’s take advantage of that weakness to exit the remaining position we have on in the Long MTCH May 20th $105/$95 put spread. (We took the first half off on April 6th when MTCH traded beneath $95, the hedge strike price,) The spread closed on Tuesday at about $6.60, and it should be worth a bit more than that if we get a lower open. The average gain on this trade was 105.87% and the average cost basis to exit this trade is $6.49 credit. DailyPlay Portfolio: By closing 3 contracts, we will be receiving $1,971.

$SYY

DailyPlay Opening Trade (SYY) – April 19, 2022

View SYY Trade

Strategy Details

Strategy & Direction: Short Call Spread – Bearish

Details: Sell 8 May 6 $90/$86 Call Vertical @ $1.65 Credit

Total Risk: This trade has a max risk of $1,880 (8 contracts x $235 per contract).

Counter Trend Signal: This is a bearish strategy on a stock or ETF that is experiencing a bullish trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 9/10

OptionsPlay Score: 109

Learn how to size this trade for your portfolio size

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Yesterday did little to help us figure out if last Tuesday’s SPX Setup -9 count is going to lead to a rally, or not. The market can really go either way right now, and I don’t have high conviction either way, or at least, not yet. So, I am more apt to do nothing right now or play for a near-term option play with a name like Sysco Corp. (SYY) that reports quarterly earnings in just two weeks and is up against resistance and has some upside exhaustion signals that have just appeared.

The weekly chart shows a line (in green) connecting prior all-time highs coming in just above the current price.

The daily chart shows an Aggressive Sequential +13 signal from last Thursday and then a likely Setup +9 today. Thus, this may stall here and meander into earnings on May 3.

As such, we’ll look to sell a SYY May 6th $86/$90 call spread for $1.65, having us take in a credit that is about 41% of the spread differential based upon yesterday’s closing mid prices. Be aware that this trade idea likely turns into an all or none type proposition, meaning we will either make the full $1.65 credit or lose the max $2.35 we can.

$UNH, $CL $XBI

DailyPlay Updates (UNH, CL, XBI) – April 18, 2022

Partial Closing Trades

- UNH: 28.44% Loss: Sell to close May 20, 2022 $570/$540 Call Vertical @ $8.68 Credit. Thursday made a new high and immediately sold off hard. Given no progress in price since we’ve put this on, we’re taking off half today. As of last Thursday’s close, we were down 28% on this trade. DailyPlay Portfolio: By closing 1 contract of this trade, we will receive $868.

Closing Trades

- CL: 171.43% Gain: Sell to close Apr 29, 2022 $78/$74 Call Vertical @ $3.80 Credit. With this stalling the past few days at a 62% retracement level up to the early-January high, we’re going to exit this trade. Based upon Friday’s mid-price close of the spread, we were up 171%. We’ll sell out today. Therefore, the average gain on this trade was 125.72% and the average cost basis to exit this trade is $3.16 credit. DailyPlay Portfolio: As we are closing 7 contracts of this trade, we will receive $2660.

- XBI: 44.15% Loss: Sell to close Apr 22, 2022 $88.5/$95 Call Vertical @ $1.48 Credit. I don’t like the price action, and we’ll exit today before this trades much lower than the bottom strike price. As of Thursday’s close, we were down 43%. Therefore, the average loss on this trade was -15.68% and the average cost basis to exit this trade is $2.24 credit. DailyPlay Portfolio: As we are closing 4 contracts of this trade, we will receive $896.

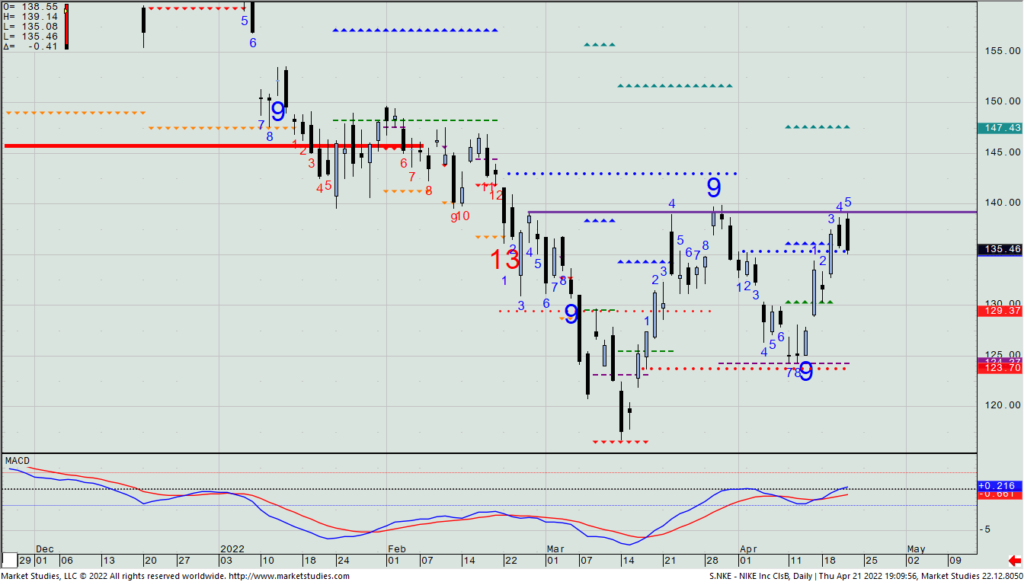

$NKE $CC

DailyPlay (NKE) & Closing Trade (CC) – April 14, 2022

View NKE Trade

Closing Trades

- CC: 34.31% Loss: Sell to close May 6, 2022 $29/$32 Put Vertical @ $0.67 Credit. Yesterday morning we covered half of our CC long put spread, and said that any subsequent close above $33.32 would have us exit the rest. It closed at $33.44 yesterday, and thus, I have no reason to hold this short, so we will cover the remainder of our long May 6th $29/$32 put spread this morning. The average loss on this trade was 24.05% and the average cost basis to exit this trade is $0.64 credit.

NKE Bullish Opening Trade Signal

Strategy Details

Strategy: Call Debit Spread

Strategy Direction: Bullish

Details: Buy May 27 $128/$140 Call Vertical @ $3.81 Debit

Counter Trend Signal: This is a bullish strategy on a stock or ETF that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 91

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Monday and Tuesday both showed “Doji” candles (i.e., indecision) after a two-week decline. That came right against the bearish Propulsion Momentum level ($124.27) and the TDST Line ($123.70) while then also marking a daily Setup -9 count yesterday. That’s enough for us to play that this is a trading bottom, with me proposing a subsequent move up to near the late-March high of $140. As such, we will buy the May 27th $128 call and sell the $140 against it for $3.81 debit based on last night’s mid-closing price. NKE doe not report earnings till late June so that’s not a factor for our holding period. We are laying out about 32% of the spread differential on a counter-trend play that we needn’t stick around very long for if support breaks.