DailyPlay Updates – May 26, 2022

I don’t know about you, but yesterday seeing the market move up post-Fed statement made me feel as if we may finally get a rally that can last beyond 24 hrs. Then, after the close, Nvidia’s earnings report/guidance didn’t give investors happy news, and the stock was quickly off 10%, making a hopeful bull move scenario get tossed down, again. (NVDA is just another one of the bellwether names that has really disappointed investors post-earnings, and keeps the see-saw market very much at play.)

When a market can toy with your emotions as easily as this one is doing right now, it is also actually sending some important messages – the most important of which is that what has worked in the past is not yet ready to work again. Our desire to “buy the dip” and to quickly get rewarded for it – as one could have done anytime in 2021 – is not yet an apparent successful strategy to employ. In fact, this year could still easily be much more about “selling the rally” as the more constant and successful way of approaching the 2022 market. (Now, if we could just get some rallies to sell.)

Several prominent bullish equity strategists and economists have eaten crow this year – unable to synthesize the macro changes that very quickly occurred. They’re still thinking that the 2021 market is this year’s market. It’s not. It’s not going to be. And their reticence to have made changes to their 2022 outlooks have cost their clients who followed them significant capital. (Even yesterday, one of the well-known popular economists lowered his forward earnings estimates and year-end forecast. But frankly, it’s too little and too late.) As a theoretical example, it’s like an analyst –after Netflix blew up in April – lowering their price target from $480 to $440 (with the stock at $225) – because they simply couldn’t come to terms with the fact that their analysis (and the fact that they are supposed experts on the name) completely missed what the real story was. Instead of making the target a far more realistic number that investors can make reason with, we are still often given an unrealistic and unlikely reachable target because they simply can’t face the music of a name and sector that they completely missed the boat on.

Though rallies can happen at any time, we haven’t yet seen what I call “Analyst White Flag Day” – when droves of sell-side analysts finally throw in the towel on their unrealistic upside price target. Until that happens, I’d still think we all need manage our portfolios to lower risk exposure, as well as raise cash to be able to buy when we can get a better sense that we’ve finally seen the lows.

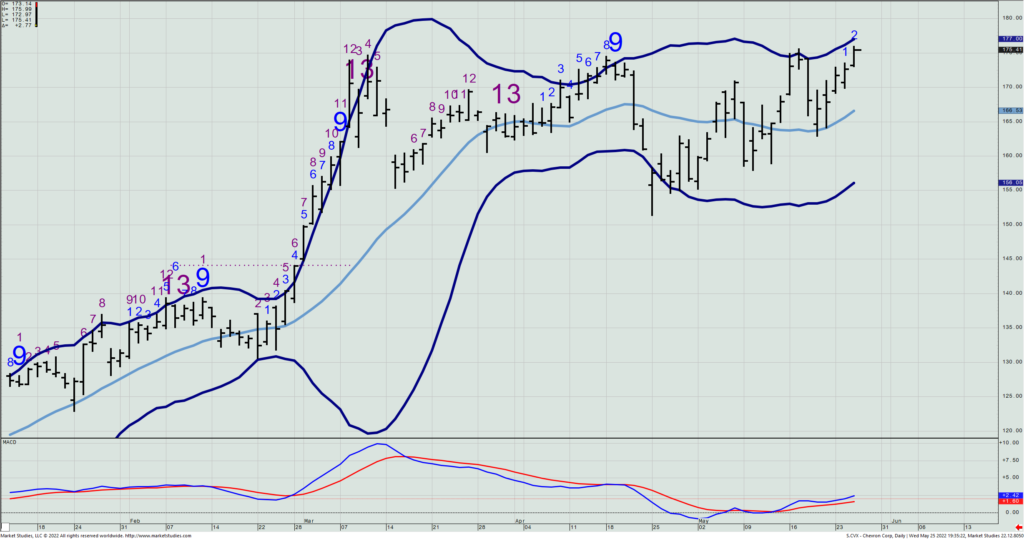

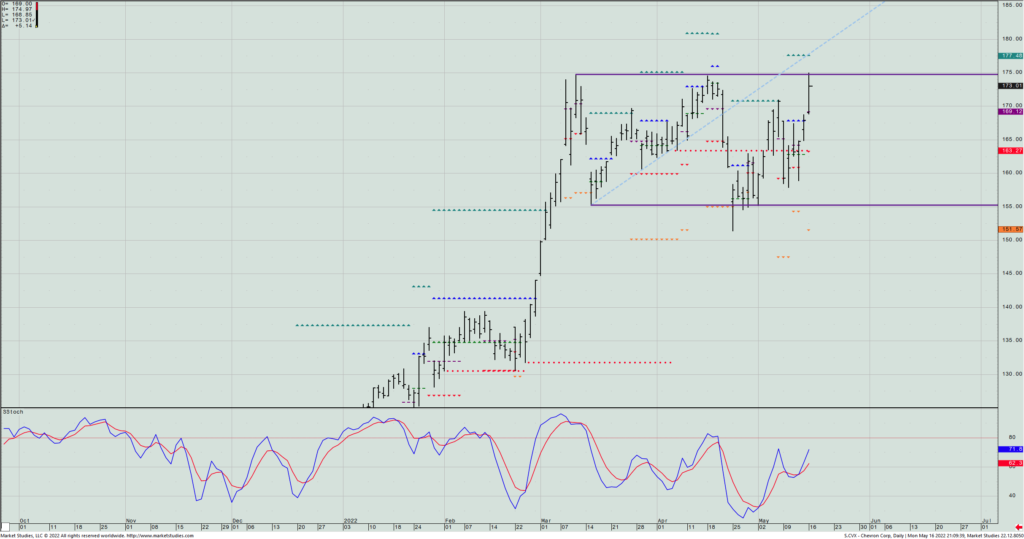

CVX – Daily

An update on our CVX long June 3 $160/$170 call vertical spread: We’ve already taken half off, and with the stock closing yesterday at $175.41, we are in good place with just over a week to go to expiration. However, if we see any close between now and June 2 beneath $166.94, we will exit the remaining contracts we still have on.

– Rick Bensignor

Chief Market Strategist

$UUP

DailyPlay Updates – May 25, 2022

When I spend two hours looking at many dozens of charts, and I can’t find a single trade idea that I’m comfortable putting on, it says a lot about the market location right now. Too many charts are approaching support against old lows from sometime over the past few years, while also seemingly incapable of holding a rally that lasts more than a day. It makes it very tough to put on a new high-confidence level trade. And thus, there are times – and this is one of them – that I simply don’t want to add a new long or short position with prices where they currently are located.

However, I’ve been pretty vocal that I am not a US Dollar fan (making me one of the very few). Looking at the PowerShares DB US Dollar Bullish ETF (UUP), we see that the recent high from two weeks ago was precisely against the highest weekly close in March 2020 (and actually, since this ETF started back in 2008).

So, if we see this rally back up to the $27.40 to $27.70 level, we’ll then look to put on some type of bearish play. I’m not even going to show you the possible strikes just yet as the deltas drop dramatically at even the smallest strike differential. (At current quoted prices, selling a late-June $27.50/$28.50 call spread would only take in a very small percent of the strike differential.) Therefore, we will watch and monitor this and alert you via email should we get the chance to put this on sometime in the next week or two at our preferred entry zone.

UUP – Weekly

Lastly, we continue to see very significant intra-day swings. That’s professional money managers – along with individual investors – being made mince-meat by computers that are trying to play in what’s becoming an even more illiquid environment. If the big guys and gals aren’t getting it right, then it’s even harder for individuals to align with what they’re doing because the pros are as confounded as anyone else.

The bottom line: Keep your powder dry for when better opportunities present themselves.

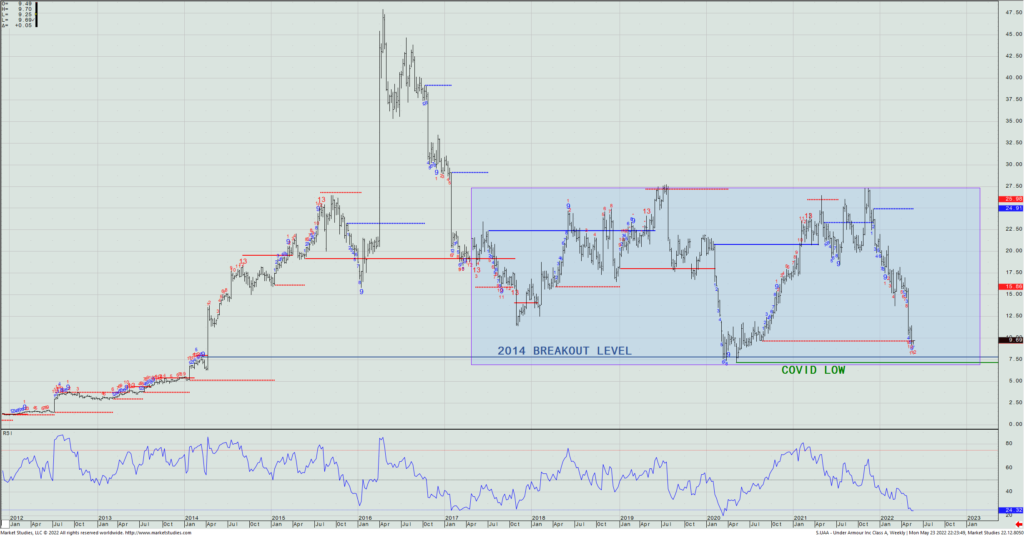

$UAA

DailyPlay Opening Trade (UAA) May 24, 2022

View UAA Trade

Strategy Details

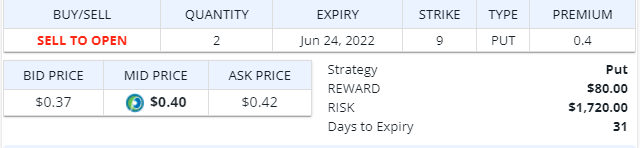

Strategy: Short Cash Secured Put

Direction: Bullish

Details: Sell to Open 2 Contracts June 24, 2022 $9 Cash Secured Puts @ $0.40 Credit.

Total Risk: This trade has a max risk of $1,720 (2 contracts x $860 per contract).

Counter Trend Signal: This is a Bullish strategy on a stock that is experiencing Bearish 1M and 6M trends.

1M/6M Trends: Bearish/Bearish

Technical Score: 1/10

OptionsPlay Score: N/A

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Here’s a bit of a different play idea than I’ve given you in the past, and it involves selling a Cash Secured Put with my willingness to purchase and hold the shares of stock if exercised. (If your brokerage account doesn’t let you sell Cash Secured naked Puts, then pass on this trade idea for now, but I’d suggest looking around for another firm that does allow it; most do.)

I’m looking at shorting the Under Armour (UAA) June 24th $9 puts for $0.395 based on Monday’s mid-closing price. (SPX futures are down over 30 points as I write this, so we could easily get more than this amount of premium tomorrow after the open.) Earnings are out of the way till August so that’s not going to be an issue. This comes down to playing the range we’ve seen for the bulk of the past four years (mid-$20s to high-single digits). With the weekly Setup on a -7 and the Sequential Countdown on a -12, I’m game to sell the $9 puts to make my effective cost if exercised ~ $8.60.

That’s not a bad entry for a buy-and-hold strategy near the bottom of the range. Again, only do this Daily Play idea if you are willing and able to buy at least 100 shares of stock for every put option you short. If you use our theoretical $100K account to size your trades and don’t want to risk more than the typical 2% on any single trade, then you’d sell 2 of these put options (representing $1800 worth of potential stock purchase at expiration). If the stock holds here or rallies and you don’t get exercised, you collect about $80 total premium on the 2 puts. So, we’re getting paid to watch and wait to see if we could buy the stock at $9. I’m totally fine either pocketing the premium or getting exercised.

UAA – Weekly

$TSLA

DailyPlay – Opening Trade (TSLA) – May 23, 2022

View TSLA Trade

Strategy Details

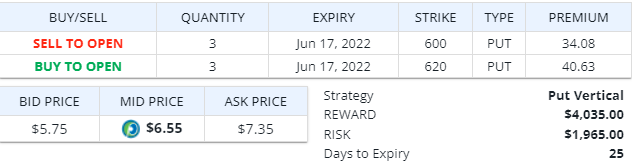

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 3 Contracts June 17, 2022 $620/$600 Put Verticals @ $6.55 Debit.

Total Risk: This trade has a max risk of $1,965 (3 Contracts x $655 per contract).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 127

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Our bearish trade idea for today is Tesla Inc. (TSLA) which is driven by concerns around inflationary pressure as well as consumer slowdowns. As a key level of $700 has been broken to the downside, while it also failed to close above this level on Friday, we are taking a bearish stand on TSLA. We will only be paying about 1/3 of the vertical width for this out-of-the-money (OTM) Put Debit Spread and we will be risking about 1% of the stock’s value per contract.

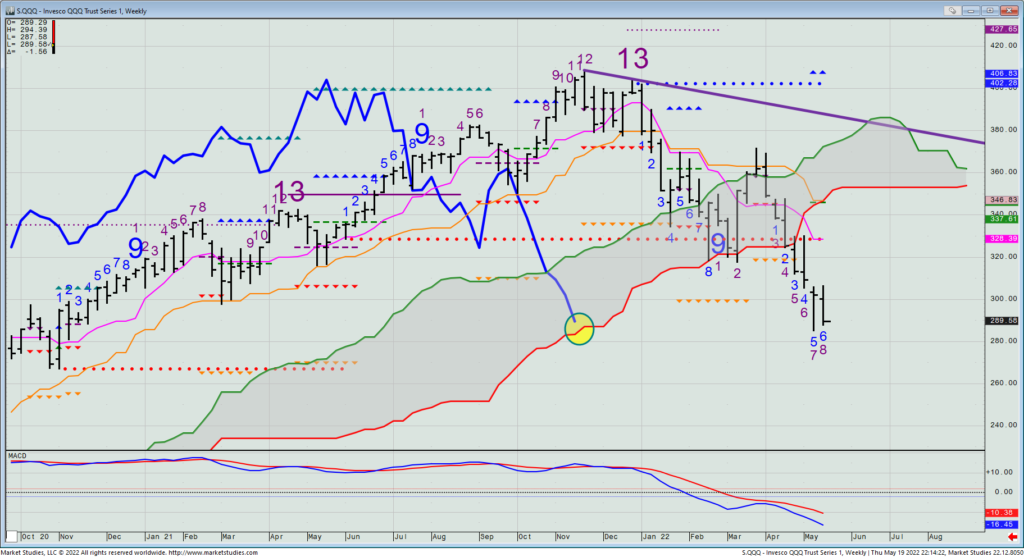

DailyPlay Update – May 20th, 2022

As we head into Friday’s action, bullish traders can cling to the fact that the weekly QQQ chart’s Lagging Line still has not breached the cloud bottom beneath it (highlighted in the below chart in a yellow ellipse). From a trader’s perspective, this last place a structural bull market lies before it turns into a bearish one is also the lowest risk (i.e., tightest sell-stop) place you can buy. (Think about it: almost anytime else that you’d be buying in an upward moving market, your sell-stop would have to risk far more money than what it would need to here and now.)

QQQ – Weekly

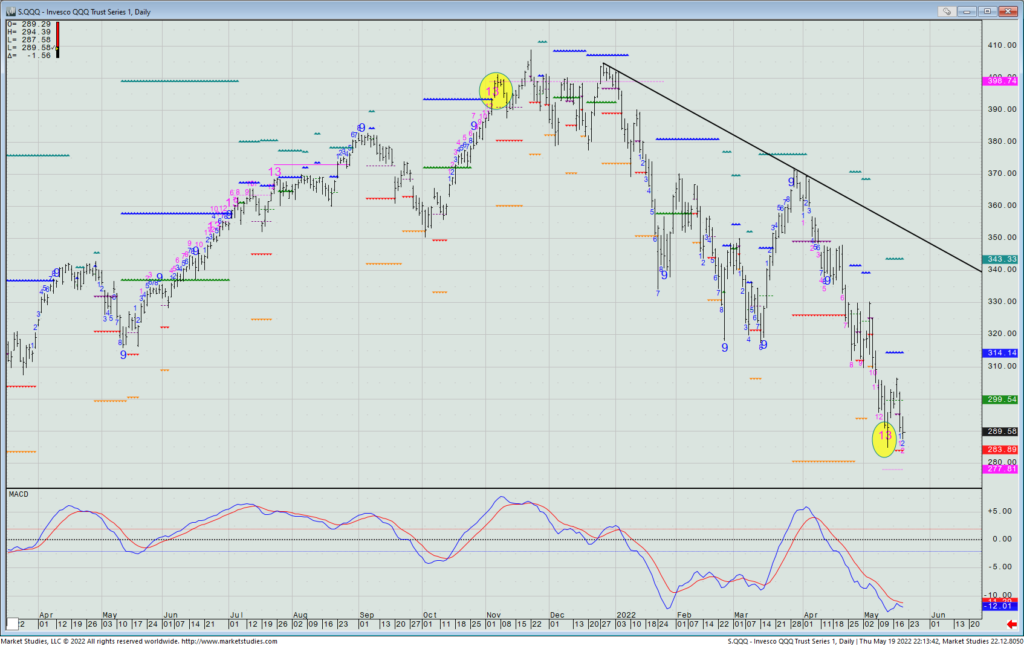

Moreover, the daily QQQ chart is still within the context of its first and only Combo -13 signal of the whole 2022 decline, also suggesting downside exhaustion is at hand if the price keeps above $277.81.

QQQ- Daily

So, today’s close becomes very important by telling us if the weekly cloud model can continue holding onto its last support level before it structurally turns pure bearish & into an even more defined “sell-on-rally” mode. I mentioned to you in Monday’s morning weekly outlook webinar that I had purchased some SPYs for myself at $391, knowing that right near there was a key area from its weekly cloud chart (and also knowing that the Qs Lagging Line was quickly nearing its last bullish support level). I’m hanging on to that trade for now, but also know that I’m out of it if these aforementioned levels give way.

None of us know which way the market is going to move in a single day, and based upon some of the recent price action, even the algos are getting as pummeled as anyone else who is playing the game. But what I can do and consistently alert you to are the most important levels that institutions care about and shift money against. (And as I said in my presentation last week in Las Vegas at The Money Show to the crowd who heard me speak, it’s not an oversold RSI, or a 20-day moving average, or a Fibonacci retracement, or the like that moves institutional money. It’s far more so than the models that I continually present to you each and every day at the core of the work we do. And believe me, it’s the institutional money flows that you want to be aligned with; not those of the individual investor.

Enjoy the weekend. We’re right back at it Monday morning at 8:45 am ET with next week’s Market Outlook webinar

$T

DailyPlay – Opening Trade (T) – May 19, 2022

View T Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy 56 Contracts June 10, 2022 $20/$18 Put Verticals @ $0.35 Debit.

Total Risk: This trade has a max risk of $1,960 (56 contracts x $35 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a Bullish trend.

1M/6M Trends: Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 118

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

AXP has traded down to near the low $150s four additional times since basically starting a run higher Even with the market getting trashed as it has been, there are some names that are rallying. One of them is AT&T (T), which on Tuesday posted a daily Sequential +13 signal (i.e., potential upside exhaustion) right by a clear resistance line (at $20.75) and a prior broken uptrend test (the green dashed line). With yesterday’s market weakness, the stock sold down to $20.23, presenting us an opportunity to consider buying the June 10th $20/$18 put spread for $0.395 based upon yesterday’s closing mid prices. (That cost is about 20% of the strike differential.) The huge unfilled gap is staring at us, so I think that any further market drubbing will likely take this name down, too, and could — in a washout — go and fill the gap.

$AXP

DailyPlay – Opening Trade (AXP) – May 18, 2022

View AXP Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell 3 Contracts June 24, 2022 $160/$150 Put Verticals @ $3.25 Credit.

Total Risk: This trade has a max risk of $2,025 (3 contracts x $675 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 6/10

OptionsPlay Score: 85

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

AXP has traded down to near the low $150s four additional times since basically starting a run higher earlier on in May 2021. (See the 5 yellow-colored ellipses and accompanying horizontal, purple-colored support line near $152.) We can certainly call that a “strong support” level.

With the SPX having made, what I deemed a trading bottom last week, and AXP marking a daily Setup -9 and a Sequential -13 counts, in the past 5 days, I think we can go ahead to play this stock bullishly by selling the $160/$150 put spread.

$CVX

DailyPlay – Partial Profits (CVX) – May 17, 2022

- CVX: 106.96% Gain: Sell to Close 4 Contracts Jun 3, 2022 $160/$170 Call Verticals @ $7.43 Credit.

With crude oil on verge of breaking out above long-term resistance at $114.83 (the 2011 reaction high that the monthly chart has not been close above since), our long CVX June 3rd $160/$170 call spread is now up over 100%, along with seeing the underlying’s price close ($173.01) above the higher “hedge” strike price. I will almost always remove half (or more) of a long call spread at that higher strike, and as such, today we will remove 4 of the 6 CVX options we are holding. Yesterday, the spread went out at $7.59 (mid-price) vs. our long entry at $3.59.

DailyPlay Portfolio: By closing 4 of the 6 Contracts, we will be receiving $2,972.

CVX Daily Chart

$F

DailyPlay – Opening Trade (F) – May 16, 2022

View F Trade

Strategy Details

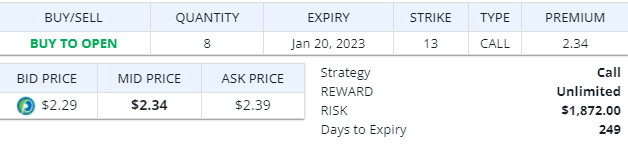

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 8 Contracts January 20, 2023 $13 Calls @ $2.34 Debit.

Total Risk: This trade has a max risk of $1,872 (8 Contracts x $234 per contract).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 66

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Our bullish idea today is Ford (F). F has declined 53% since its all-time high in Jan 2022 and experienced a bounce higher from the $12 level last week. This decline means that F is now trading at roughly 13x earnings which is a significant discount from its historical average. Additionally, F’s fundamentals remain strong with solid EV demand, good EPS forecasts and having its new EV cars oversubscribed. The next clear resistance area is near the $16 level.

$ARKK

DailyPlay – Opening Trade (ARKK) – May 13, 2022

View ARKK Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell 20 Contracts June 10 $39/$37 Put Spread @ $1.02 Credit.

Total Risk: This trade has a max risk of $1,960 (20 contracts x $98 per contract).

Counter Trend Signal: This is a Bullish strategy on an ETF that is experiencing bearish 1M and 6M trends.

1M/6M Trends: Bearish/Bearish

Technical Score: 2/10

OptionsPlay Score: 98

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Learn how to size this trade for your portfolio size

Investment Rationale

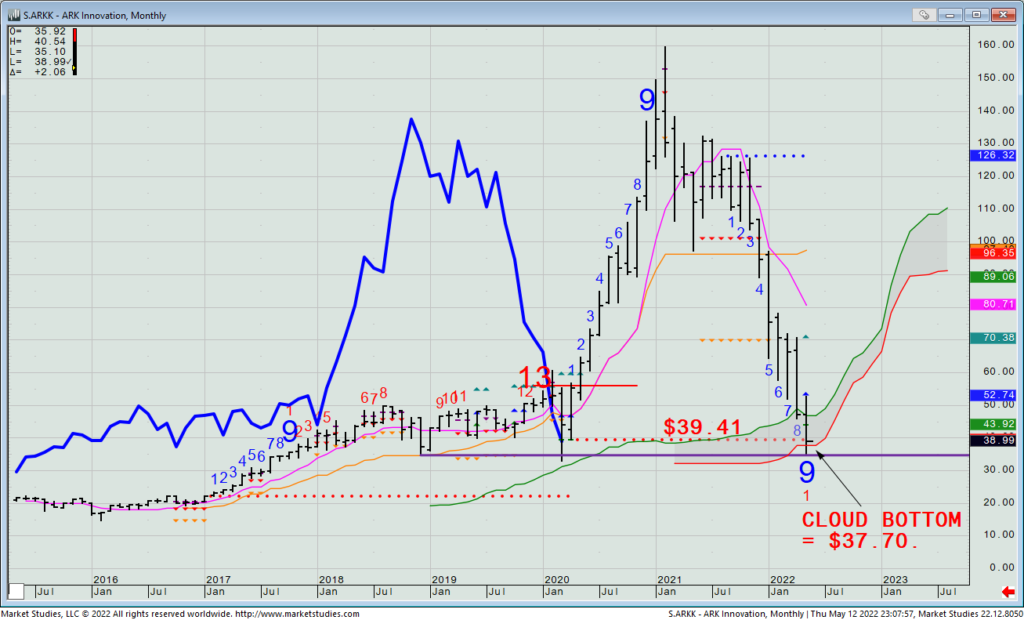

Here’s an idea for those who are willing to stab for a bottom in what has been one of the most trashed names we hear and read about daily. Of course, picking true falling-knife bottoms isn’t easy, but I’ll share with you that I’ve just purchased this stock myself for the same reason we’re going to look to sell a put spread in it today.

The name is none other than Cathy Woods’ ARKK fund ETF (ARKK). It has finally fallen to a level that I am a willing buyer of it in my own account, with my belief that Cathy’s long-term “innovation stocks” concept is right (but her complete misunderstanding of what investors would do to high multiple names cost her and her investors dearly). Down here, I have a whole different view of the ETF than I did at $100 +.

I have long waited and hoped for the opportunity to be a buyer down here, as it has sold down to both its monthly cloud zone and TDST Line ($39.41). As such, let’s look to sell a June 10 $39/$37 put spread for $1.02 (based upon yesterday’s closing mid-prices). That collects about 43% of the $2 spread differential, and is approx. a 26% return on an annualized basis. Clearly, this is a bet that we’ll see some bounce between now and June 10, about a month from now.

ARKK – Monthly