$RCL

DailyPlay – Opening Trade (RCL) – May 12, 2022

Special Notice

This is a conditional trade idea and the trade should not be taken immediately. Please read the Investment Rationale for more information on this trade. Also, keep in mind that the Credit received, the Max Risk, the Max Reward, as well as the OptionsPlay Score, will be different than what you see in this email, as we are waiting for the price to move more favorably before we enter the trade.

View RCL Trade

Strategy Details

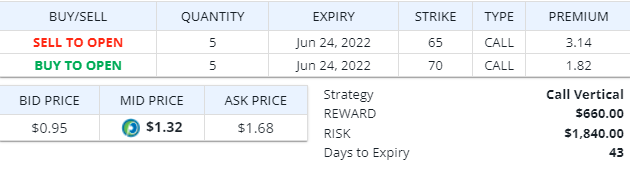

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell 5 Contracts June 24 $65/$70 Call Vertical @ $1.32 Credit.

Total Risk: This trade has a max risk of $1,840 (5 contracts x $368 per contract). As this is a conditional order, the number of Contracts could change depending on the Total Risk at the time of opening the trade. We will base the numbers of Contracts on roughly $2,000 of Risk.

Trend Continuation Signal: This is a Bearish strategy on an ETF that is experiencing bearish 1M and 6M trends.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 99

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Learn how to size this trade for your portfolio size

Investment Rationale

With the market unable to hold gains and again getting slammed yesterday, more support levels have been taken out as sellers continue to overwhelm any short-term buying that comes in. SPYs gave up another 6+ points yesterday, breaking the $396 level (which was a place I had just bought back a small amount of the SPYs I had sold out of earlier this year). We may very well get down to the SPX 3617 target that I went out with a few weeks back, and possibly even sooner than I expected.

In general, because I tend to be a seller at extremely high prices in bull moves and at extremely low prices in bearish moves, it behooves me to simply sell names now that have already been crushed. Sure, they could still go lower, but more importantly, it makes it much harder to control risk when you play the direction of the trend when the stock is already well into that trend. So for me to do so, I need to see a pretty clear reason that there’s likely a good amount to go in that trend AND I can control my risk in a logical way.

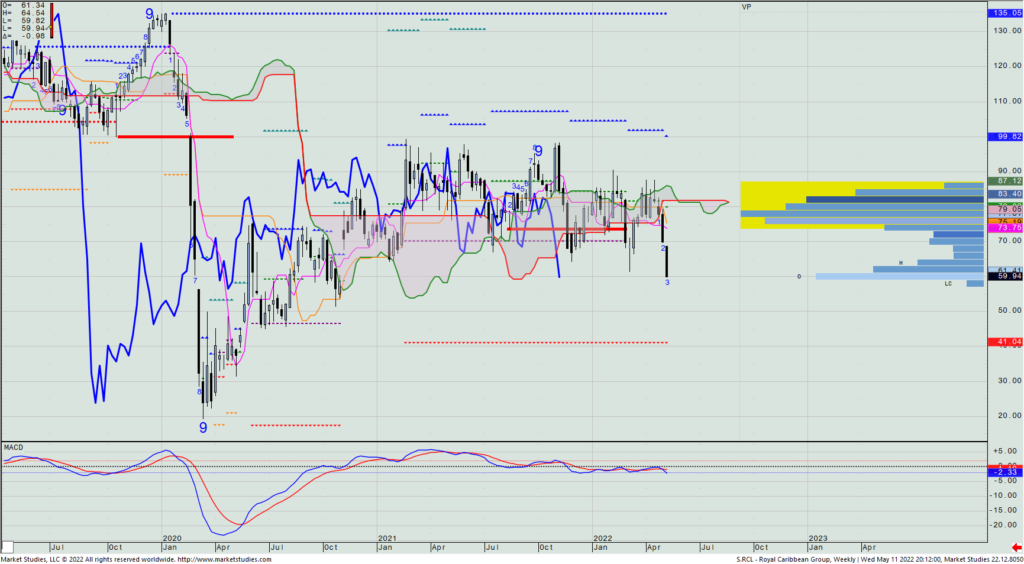

This leads me to the chart of Royal Caribbean Group (RCL), which last week reported earnings that the Street did not like. In its large decline from the upper-$70s to the current $60 in the pasts two weeks, the one thing that stands out to me is that the weekly cloud’s Lagging Line has broken beneath the bottom of its cloud for the first time on the whole bullish move that’s been in place since the Covid 2020 low.

There is someone (or a group) of large players buying near this $60 level, based upon the Volume Profile distribution of prices (shown on the right side of the chart). Perhaps, it’s because ~$60 closes the gap from Q4 ’20. And if their buying creates a bounce, I wouldn’t mind selling a rally into the mid-$60s where very little volume has traded, allowing us to then sell a June 24th $65/$70 call spread. On Wednesday, that spread went out at $1.32 mid, but this will be different when/if the $65 becomes the ATM. (This is a conditional order, meaning that we aren’t going to put this on until/if we see a rally to the mid-$60s.)

Now that earnings are out of the way, and there is little significant catalyst for this to move much higher, the heaviness of this two-week move along with the cloud break makes me want to keep a bearish stance until this may very well mark a weekly Setup -9 some six weeks from now.

$NYCB

DailyPlay Closing Trade (NYCB) – May 11, 2022

- NYCB 95.83% Loss: Sell to Close 15 Contracts Jul 15, 2022 $13/$11 Call Verticals @ $0.03 Credit. DailyPlay Portfolio: By closing 15 Contracts, we will be receiving $45.

DailyPlay Update – May 10, 2022

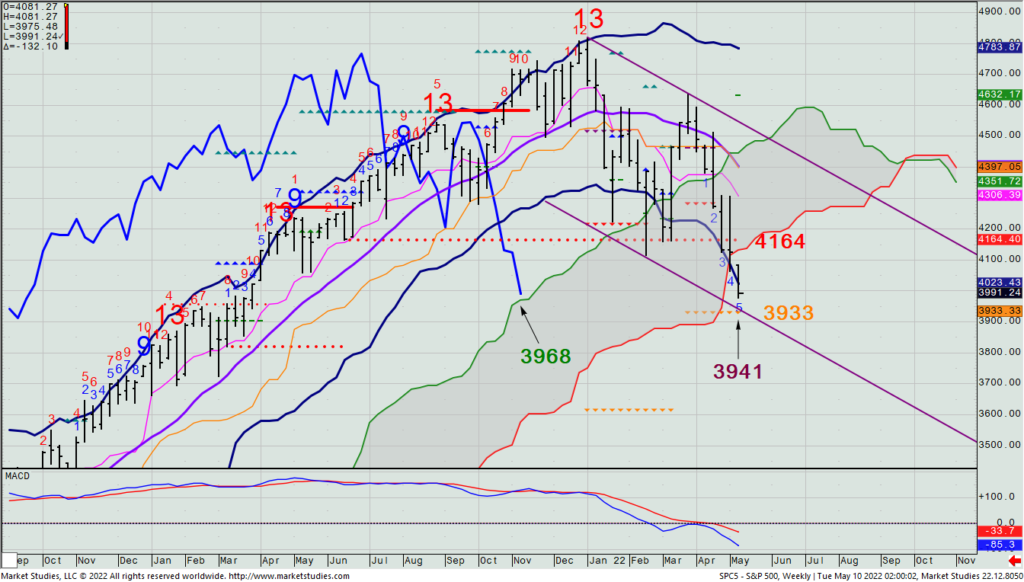

The SPX finally cracked the weekly cloud bottom, suggesting a continued overall move lower to the next support zone, which given the speed of the decline, can arrive shortly. Where is that? Notice on the below weekly SPX chart that the Lagging Line would hit its cloud top at 3968; the price hitting its channel -bottom at 3941, and its price hitting the Propulsion Full Exhaustion level at 3933. That’s three unrelated targets all within 35 points of each other. It should be enough to see some buyers show up and potentially get a short-term lift from there.

(However, I do think that 3617 is a logical bigger downside target to the 2022 move, and as such, we’ll still look to sell rallies up against resistance levels – especially if I see multiple ones appear in the same rough area.)

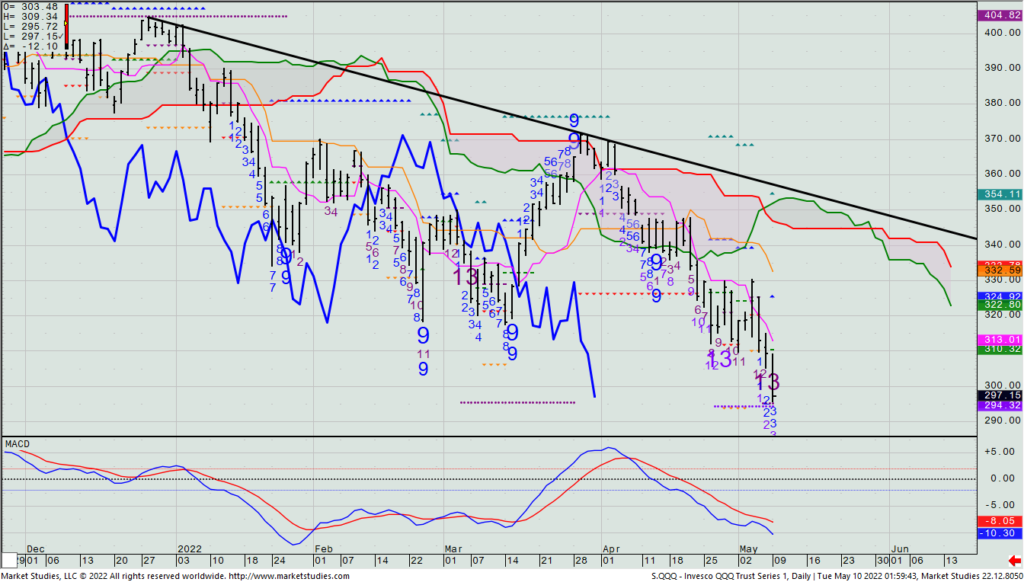

Given the breakdowns across the board in virtually all major US indexes, I’d be exiting our long QQQ trade. The only reason I’m holding it is because, right now it shows a daily Aggressive Sequential -13 that’s now right on the Risk level from the Aggressive Combo -13 from almost two weeks ago. Unrelated to that, a recent Propulsion Full Exhaustion level is right by Monday’s low, too. So, we’ll hold it another day or so to see if we can get a bounce going. If not, we’ll say bye-bye.

I’m not willing to put on a new short on what is the lows of the move, especially as the SPX and QQQ have support levels/signals right by the current price. We also have plenty of long trade exposure on, so right now I’m not looking to add more in that direction. Thus, we are not going to put on a new trade today, and we’ll see whether investors have any inclination to cover shorts into this support level.

$ASHR

DailyPlay – Opening Trade (ASHR) Closing Trade (NKE) – May 9, 2022

View ASHR Trade

Strategy Details

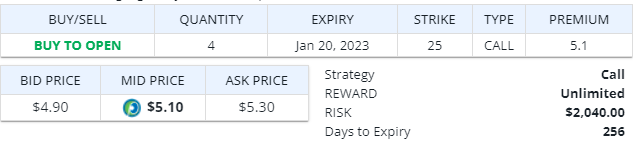

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 4 Contracts January 20, 2022 $25 Calls @ $5.10 Debit

Total Risk: This trade has a max risk of $2,040 (4 Contracts x $510 per contract)

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 79

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Our bullish idea today is the Xtrackers Hvst China ETF. This trade is based on gaining overseas exposure at a time when US equities are very volatile. Price has declined to a long-term ascending trend line which provides an ideal risk/reward bullish opportunity. From a fundamental perspective, China’s April economic numbers have been poor with significant hits to manufacturing and retail sales. However, there has been an uptick of factories coming back online as well as a resurgence in domestic travel and easing financial conditions.

Closing Trade

$NKE 88.43% Loss: Sell to Close 6 Contracts May 27, 2022 $128/$140 Call Verticals @ $0.58 Credit. DailyPlay Portfolio: By selling 6 Contracts we will receive $348.

$PEP

DailyPlay Updates and Closing Trade (PEP) – May 6, 2022

We’re still short a PEP May 6 $165/$170 call spread that expires today. We will cover this spread on the open to avoid exercise issues. The spread closed yesterday at $4.13.

In my 40+ years of being in the market, I don’t recall seeing a 26-hour roller coaster as we saw since Powell’s Wednesday press conference. Certainly not in percentage price movements in the stock indexes. It’s been truly amazing, and it’s why I’ve urged you to cut down on how much trading you do and what your new trade size position is. Clearly, it’s treacherous out there and your focus needs to be on “long-term survivability”. It’s the only thing that matters in a super high-volatile environment.

The key weekly SPX cloud level I’m focusing on is 4115. In my view, any Friday close beneath there ups the odds that the pressure will continue for what could ultimately lead to my 2022 downside target of 3617. A QQQ close today beneath $309.62 likely leads it to a new leg down, for it too, especially if the SPX breaks its level, too.

No new trade idea today. Until we see where these two indexes close, we’re not looking to put on new exposure in either direction.

I’m glad it’s Friday, and am looking forward to a nice weekend which will end with me in Las Vegas on Sunday for me to speak there on Monday afternoon at the Money Show. If you plan on being there, stop by after my presentation and say hello. Happy Mother’s Day to all.

– Rick Bensignor

Chief Market Strategist

Closing Trade

- PEP: 79.57% Loss: Buy to Close 8 Contracts May 6, 2022 $165/$170 Call Verticals @ $4.13 Debit. We will cover this spread on the open to avoid exercise issues. The spread closed yesterday at $4.13. DailyPlay Portfolio: By closing 8 Contracts, we will be paying $3,304.

$ORCL

DailyPlay Opening Trade Signal (ORCL) – May 5, 2022

View ORCL Trade

Strategy Details

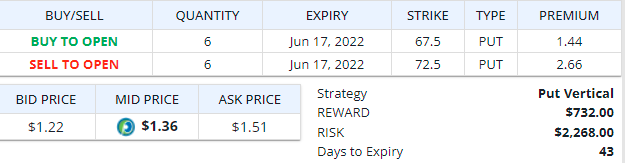

Strategy & Direction: Short Put Vertical Spread – Bullish

Details: Sell 6 Contracts June 17 72.50/67.50 Put Spread @ $1.36 Credit

Total Risk: This trade has a max risk of $2,268 (6 contracts x $378 per contract).

Counter Trend Signal: This is a Bullish strategy on an ETF that is experiencing bearish 1M and 6M trends.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 81

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Fed Chair Powell gave investors a pleasant surprise (i.e., not intending to raise rates by 75 bps. at any subsequent 2022 meeting), leading to the best-up day for the SPX in a couple of years. Add that to the SPX holding right against the bottom of its weekly cloud this week and we have a good line in the sand for now. (In the future, getting beneath this week’s low will likely lead to a bigger decline down to my 2022 worst-case scenario 3617 target.) But for now, the SPX and QQQ have both held precisely where they needed to.

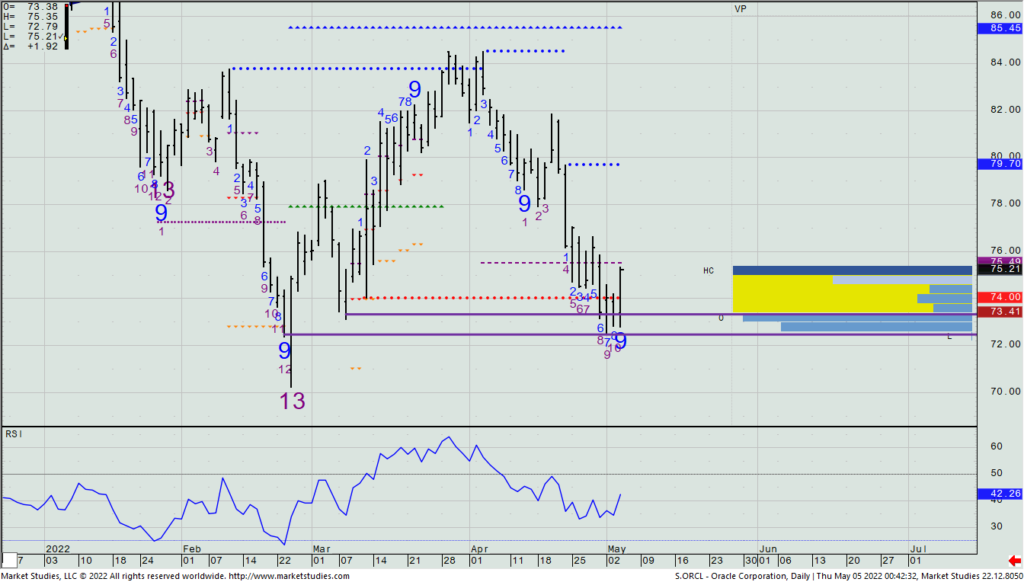

While looking for a new bullish Daily Play position to enter, I came across the Oracle (ORCL) chart, which looked interesting not only because it marked a daily Setup -9 yesterday, but it did so right into a support level made up of the two prior lowest closes of 2022 (i.e., the zone created by the two horizontal purple lines). I suspect that by week’s end, we should get a chance to see price come back down to the $74 to $73.50 area on an intraday basis, when I’d then look to sell a June 17th $72.50/$70 put spread (for whatever the mid-price is at that time).

So, yes, this is one of those “conditional” trade ideas Tony and I mentioned we’d be soon adding to the repertoire of Daily Play ideas we give to you. Yes, it means that you should set a price alert on whatever charting platform you use to signal you that it’s time to look to put on this idea. And yes, we will do our best to send you a timely email reminding you that it’s time to get into the trade.

DailyPlay Update – May 4, 2022

For now, the SPX and QQQ are both holding key weekly cloud model support (i.e., the SPX at the bottom of its cloud; the QQQ from the Lagging Line hitting the top of its cloud). I believe that seeing breaks of those levels – most especially on Friday closes – will start another downward leg that will make one glad that they had previously lightened exposure on rallies (from both earlier this year, and possibly even from the one that may be starting this week).

With today being the May FOMC rate announcement at 2pm ET, and Fed Chairman Powell holding his press conference shortly after, I am not looking to put on any new positions today. I expect some potential morning position-squaring to bring some volatile trading, and then a more muted 11:30am to 2pm lull into the announcement.

If the Fed gives the expected 50 bp. rate hike at 2:00, then it will all be about Chair Powell’s underlying tone in his comments that will drive the market the rest of the day. I suspect that only a 25 bp. hike would be a very pleasant surprise, with the market then likely ripping higher. And a surprise 75 bp. rate hike would not likely be taken kindly, with a potential swoon looking the opposite to what we saw on Monday from 3-3:30pm ET, when the SPX rallied 80 points.

More fun and games to come tomorrow after I decipher Wednesday’s action and closing price.

– Rick Bensignor

Chief Market Strategist

$CVX

CVX Bullish Opening Trade Signal

View CVX Trade

Strategy Details

Strategy & Direction: Long Call Vertical Spread – Bullish

Details: Buy 6 Contracts June 3 $160/$170 Call Vertical @ $3.59 Debit

Total Risk: This trade has a max risk of $2,154 (6 contract x $359 per contract).

Counter Trend Signal: This is a Bullish strategy on an ETF that is experiencing a bearish 1M trend.

1M/6M Trends: Bearish/Neutral

Technical Score: 10/10

OptionsPlay Score: 106

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

Here’s a pure trader’s trade in the energy space: Chevron (CVX) already reported quarterly earnings last week, and still has held onto the horizontal support against the March lows of $155.25. In fact, you can see that that same area has held on several days in the past week — never once closing beneath it. We also see a defined double-top near $175, with a new active Propulsion Full Exhaustion level at $170.64 (highlighted in yellow). Given the huge down move yesterday in the market that reversed to close higher, I’m thinking that the overall market (SPX and QQQ) has at least held (for now) their respective important weekly cloud model support that I showed and discussed in Monday’s Technical Market Outlook video.

With crude oil having recouped large early losses yesterday to also close up on the day, we are going to buy a short-dated CVX June 3 $160/$170 call spread for $3.59 based on Monday’s closing mid-prices. We will stop ourselves out of the long call spread if we see a single daily CVX close beneath $156.24 (last Wednesday’s low). Note: if in this volatile environment you are not comfortable risking the typical 2% of your portfolio on a trade (in this case, 6 contracts on a theoretical $100K portfolio, then do less. No one is suggesting you trade more than what your comfort level is.) Yesterday was a great example of how flaky the market can move right now, so I, too, have cut back size in my recent trading.

$CVS

DailyPlay – CVS Health Corp (CVS) – May 2, 2022

View CVS Trade

Strategy Details

Strategy: Put Debit Spread

Details: Buy to Open 7 Contracts June 17, 2022 $95/$85 Put Vertical @ $2.76 Debit

Total Risk: This trade has a max risk of $1,932.00 (7 contracts x $276 per contract)

Trend Continuation Signal: This is a bearish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 9/10

OptionsPlay Score: 145

Our trade idea for today is CVS Health Corporation (CVS). Please note that this is a bearish earnings play with CVS reporting earnings on Wednesday, May 4th. CVS is part of the Health Care sector (XLV) which it is currently underperforming on a relative basis heading into earnings. On an absolute basis, CVS has now broken below the major support level at $100 which provides evidence of further downside. Both 1M and 6M trends are now bearish and the breakdown below support provides a good risk/reward bearish opportunity.

DailyPlay Update – April 29, 2022

After our buying the QQQ call spread Thursday morning when it pulled back to our entry level of $320 (after opening even higher than that) we saw the Qs reach as high as $330 during the session, giving our Daily Play May 20th $320/$344 call spread trade a very solid Day 1 gain. However, the official 4pm QQQ close at $328.01 basically disappeared in after-hours trading, with the 8pm close at $322.75. Easy come, easy go. And that’s why – especially in this market – celebrating any “paper gains” before they’re actually booked is an exercise in futility, and almost assured disappointment.

Amazon blew up after earnings. Intel sank, too. Apple rallied but the subsequent analyst call stating “no more forward guidance” was not taken well by investors, so it abruptly turned around and fell some 4% to head into dinnertime with my thinking that, “Oh boy; Thursday’s rally was going to disappear on Friday. Wouldn’t that mess up a lot of heads.”

As I write this late Thursday night, SPX futures are now only down 17 points (they were down as much as ~60 points earlier this evening) while Nasdaq futures are down 146 points (having been down over 300 pts. earlier). Professional traders and investors are getting made to look foolish almost daily, so don’t worry that you might also be having a hard time with the market. I promise you that everyone is.

QQQ – Thursday 4/28 2-min. chart (including after-hours)

I will not put out a new trade idea for you today, because market movement is so erratic. Add that today is a Friday AND the last day of the month and I am very happy to simply watch today’s shenanigans from the sidelines. We’ll see if any new news comes out over the weekend to give investors a better chance of what’s coming next. Rest up for another rousing week next week.

Don’t forget to login on Monday at 8:45am ET for the weekly Options Play Macro Market Outlook.

– Rick Bensignor

Chief Market Strategist