DailyPlay – Closing Trade (XYZ) & Portfolio Review – July 21, 2025

Closing Trade DailyPlay Portfolio Review Our Trades GOOGL...

Read MoreStrategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 6 Contracts May 19th $77.50/$82.50 Call Vertical Spreads @ $2.00 Credit per contract.

Total Risk: his trade has a max risk of $1,800 (6 Contracts x $300) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $300 to select the # contracts for your portfolio.

Trend Continuation Signal: This stock is trading sideways to bearish, and we expect that it would not turn bullish over the duration of this trade.

1M/6M Trends: Neutral/Neutral

Technical Score: 9/10

OptionsPlay Score: 105

Condition: If the stock is trading lower at the end of today.

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. As this is a Conditional trade, the prices of this trade will be slightly different from what we list in this email.

Investment Rationale

Stocks see-sawed throughout most of yesterday’s session, but in the end, all four major US indexes fell, with the SPX down 17 pts. to 4092. The Nasdaq’s loss was its 6th in the past 7 sessions, and the Info Technology sector continues to underperform this month after having rocked higher in the first quarter. (I mentioned right at the start of this month that I believed that Tech would not hold up like it had vs. the SPX.)

I generally like to see a big data day like yesterday give us a better clue as to what we might expect over the short-term, but we didn’t get any real clarity to the next bigger move. With two trading days left for this week, a Friday close north of 4155 would likely lead to more gains – most especially if next week would also open higher on Monday/trade higher than this week’s high/close above this Friday’s close. A strong decline from today and tomorrow would be mildly bearish. Barring either of these two scenarios panning out, then we haven’t really learned much at all this week.

I don’t like the way both EBAY and ARCH are trading for our long spread positions. Let’s exit each of the last three spreads today in both names. Let’s also take off 5 of 9 BROS short put spreads as yesterday was the second time that the daily TDST line was the high in the past week.

BROS – Daily

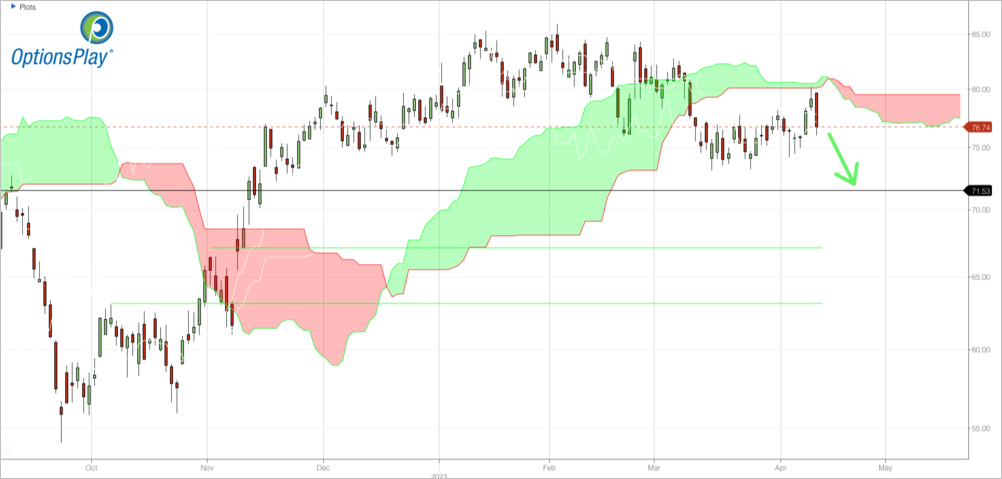

Here’s a new idea on a consumer discretionary name that looks like it’s having trouble holding its recent rally. Planet Fitness (PLNT) just failed at its cloud, and it is just barely having its Lagging Line come out through the bottom of its cloud. A rally today would stop that Lagging Line break, but IF going into today’s close the stock is down on the day, let’s then sell a May 19th $77.5/$82.5 call spread. Yesterday this went out at $2, or 40% of the strike differential. It wouldn’t surprise me to see this get down to $71.50.

PLNT – Daily

Closing Trade DailyPlay Portfolio Review Our Trades GOOGL...

Read More

TSLA Bearish Trade Adjustment Signal Investment Rationale...

Read More

QCOM Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read More

Share this on