DailyPlay – Portfolio Review – May 2, 2024

DailyPlay Portfolio Review

Investment Rationale

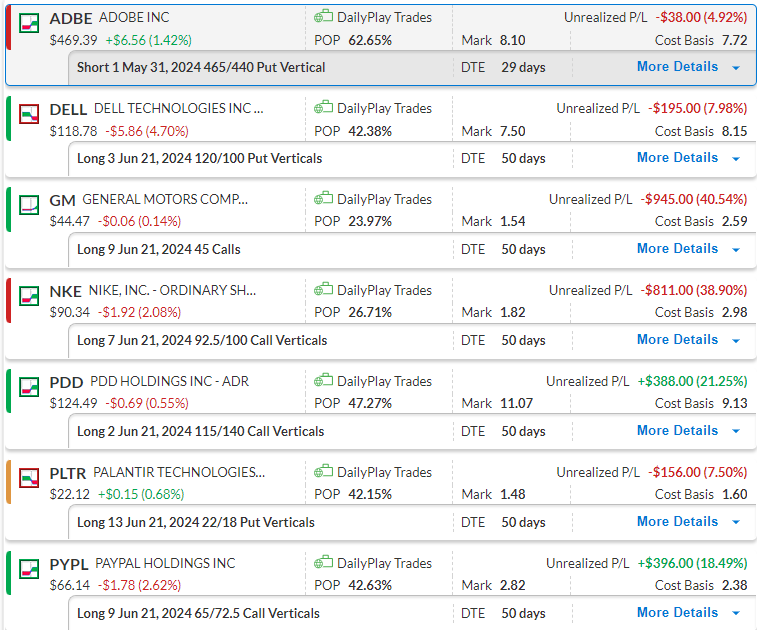

After yesterday’s FOMC meeting, we saw markets give up all intraday gains by the end of the session. We are opening up today higher, as markets seem to shrug off “high for longer” rates. In this environment, our base case remains very cautious as we continue to trade below the 50D SMA on the S&P 500 and will maintain our current positions in the portfolio.

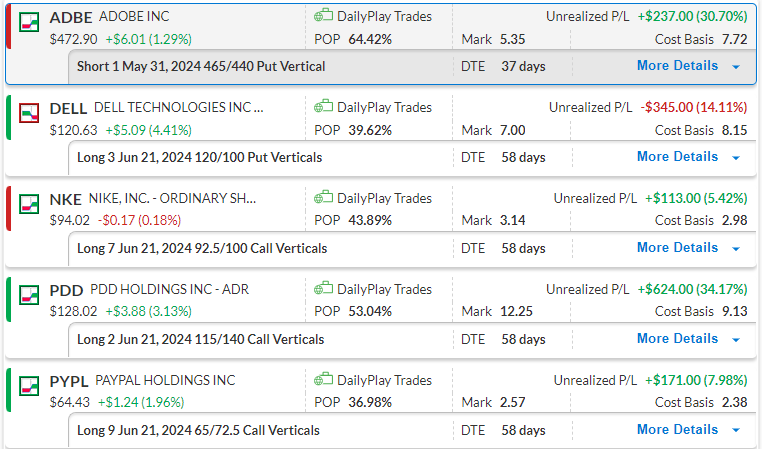

Our Trades

ADBE – 29 DTE

Bullish Credit Spread – ADBE is still holding onto support and a bounce off the level is expected.

DELL – 50 DTE

Bearish Debit Spread – Dell corrected to the downside yesterday and our bearish thesis on this trade is standing

GM 50 DTE

Bullish Calls – GM pulled back from recent highs and we will therefore monitor this trade to see if it again breaks above $45.

NKE 50 DTE

Bullish Debit Spread – NKE pulled back yesterday. We will keep an eye on this position as support at $88 should be respected.

PDD 50 DTE

Bullish Debit Spread – A break above $130 will confirm our bullish thesis on this trade and indicate that the next target is at around $140.

PLTR 50 DTE

Bearish Debit Spread – We recently opened this position and resistance at $23 still holds.

PYPL 50 DTE

Bullish Debit Spread – PYPL attempted a break above $67 resistance yesterday. We will continue to monitor this position.

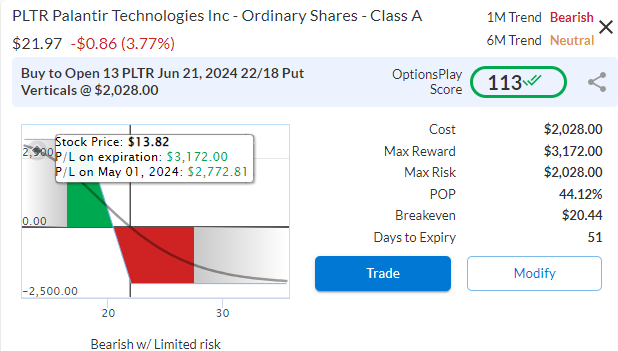

$PLTR

DailyPlay – Opening Trade (PLTR) – May 1, 2024

PLTR Bearish Opening Trade Signal

Investment Rationale

Investors have grappled with how to value an AI-focused company based on its future revenue potential against its current spend to develop the product. We saw the downside to high Capex spending without a clear path to revenue growth in META. And while PLTR is not a direct parallel, it is a AI-focused company that trades at a very high valuation. These types of valuations continue to be at risk as we grapple with the notion of potentially even higher rates from the Fed.

Technical Analysis

After gapping higher above $21, PLTR has failed to see any follow through on the initial momentum. Moreover, momentum has now turned negative and testing its $21 level as support alongside a series of lower lows and lower highs. This suggests that we could break below the $21 support and target the $17.70 gap level underneath.

PLTR – Daily

Fundamental Analysis

Since PLTR barely turns a profit, using EV to Sales is a better valuation to measure PLTR, which trades at over 21x. This is extremely high given that analysts only expect revenue to grow by a modest 13% over the next few years. This puts PLTR in the same valuations as the fastest-growing tech companies with growth numbers that are half as fast. There is a substantial risk that companies with such rich valuations will get cut as interest rates potentially rise even further.

Trade Details

Strategy Details

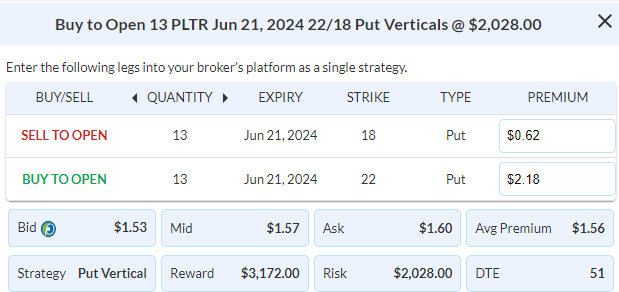

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 13 June 21st $22/$18 Put Vertical Spreads @ $1.56 Debit per Contract.

Total Risk: This trade has a max risk of $2,028 (13 Contracts x $156) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $156 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is pulling back to lower levels.

1M/6M Trends: Bearish/Neutral

Relative Strength: 9/10

OptionsPlay Score: 113

Stop Loss: @ $0.78 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

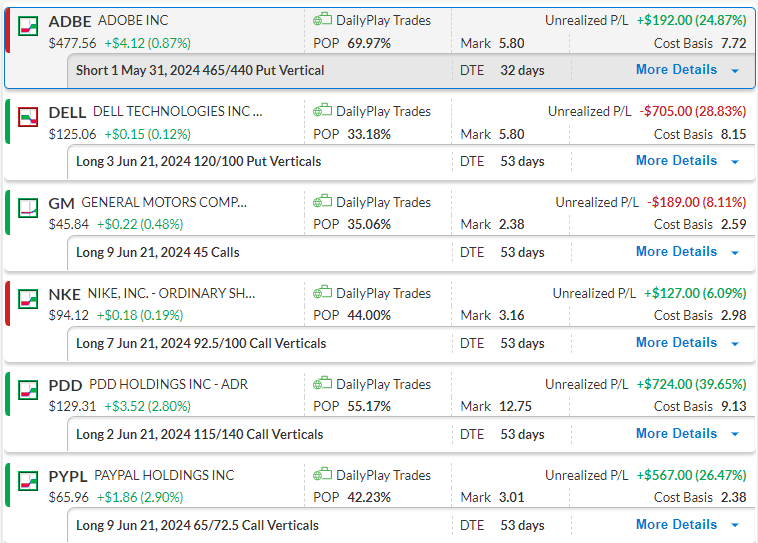

DailyPlay – Portfolio Review – April 29, 2024

DailyPlay Portfolio Review

Investment Rationale

As equity markets stabilize last week after a couple of weeks of pulling back, we find ourselves at a major intersection of buyers and sellers. As we retest the 50D SMA as resistance going into this week, we are closely watching Fed speak and earnings to set the tone for equities. Can markets push back above these levels and continue its rise, or do sellers step back in this week with even heavier volume? We will hold off on adding new positions today to see how the market responds to these levels.

Our Trades

ADBE – 32 DTE

Bullish Credit Spread – ADBE held onto support and started to bounce higher, as expected.

DELL – 53 DTE

Bearish Debit Spread – Resistance at $130 is still holding and we will therefore keep an eye on this trade over the next few days.

GM 53 DTE

Bullish Calls – GM is aiming higher and a break above $46 resistance will confirm our bullish thesis on this trade.

NKE 53 DTE

Bullish Debit Spread – Support at $90 held up, from where NKE bounced higher, with the target at $100.

PDD 53 DTE

Bullish Debit Spread – The last two trading sessions have seen some strong moves higher and its next target is at around $140.

PYPL 53 DTE

Bullish Debit Spread – A break above $67 resistance would likely close the gap towards $77, with further upside potential.

$GM

DailyPlay – Opening Trade (GM) – April 26, 2024

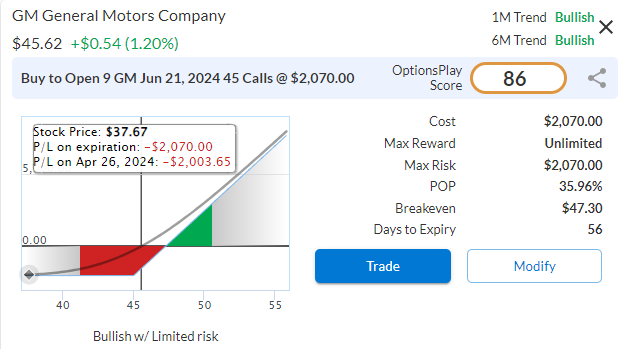

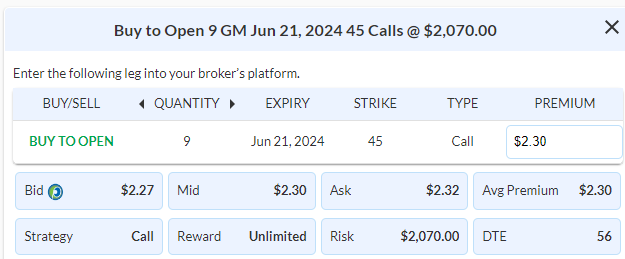

GM Bullish Opening Trade Signal

Investment Rationale

The future of GM looks exciting with the restart of its autonomous driving unit and its recent price performance. Investors seem to be paying attention to this once-hot EV stock that is on the verge of a big upside breakout. Valuations are also compelling which makes seeking long exposure lower in risk.

Technical Analysis

After rallying from its $26 lows at the end of last year, GM recently broke out from its multi-year base of $42. It has since retested this level as support and started to trade higher. Additionally, this strength is coupled with outperformance relative to the market, suggesting a potential breakout above its $46 double top, which puts $60 as an extended upside target.

GM – Daily

Fundamental Analysis

GM trades at less than 5x forward earnings. This is despite analysts expecting 11% EPS growth next year. This represents a 30% discount to its biggest competitor Ford (F). This is despite higher margins and expected top and bottom-like growth relative to Ford.

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

Details: Buy to Open June 21st $45 Calls @ $2.30 Debit per Contract.

Total Risk: This trade has a max risk of $2,070 (9 Contracts x $230) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $230 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a strong bullish trend.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 86

Stop Loss: @ $1.15 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Updates – April 25, 2024

DailyPlay Update

On the back of META’s earnings this morning, it is best to take a bit of time for markets to digest the news. On the surface the reaction looks a bit overdone and could potentially offer more buying opportunities, but it’s a bit too early to tell. Let’s stay with our current positions for today and hold off on adding new exposure going into today’s open.

DailyPlay – Portfolio Review – April 24, 2024

DailyPlay Portfolio Review

Investment Rationale

With equities and bonds both rally this week, we have seen the fear that crept into the markets last week recede. VIX is now below 16% and 10-year yields retreat below 4.6%. The question remains if this rally has legs or if sellers will start regaining control as we approach the $5100-$5150 area. As a result, we will not add additional positions to our portfolio today and review the outstanding positions and how we’re managing each one.

Our Trades

ADBE – 37 DTE

Bullish Credit Spread – Nice bounce since we’ve entered the trade, with a lot more room to our upside targets, we will look to roll this as ADBE continues higher.

DELL – 58 DTE

Bearish Debit Spread – After an initial selloff, it has returned to our breakdown level of $120. We are monitoring this position for an opportunity to close if our thesis does not prove to be correct.

NKE – 58 DTE

Bullish Debit Spread – Small move in the direction of our trade so far, with 58 days left, we will continue to hold and look for upside.

PDD – 58 DTE

Bullish Debit Spread – Big rally over the last 2 trading sessions has put this position back in the green, our upside target remains $140. Pullbacks on this rally are opportunities to add more exposure to this trade.

PYPL – 58 DTE

Bullish Debit Spread – We just entered this trade yesterday, with 58 days left to go, we have a lot of time left for this trade to potentially work out.

$PYPL

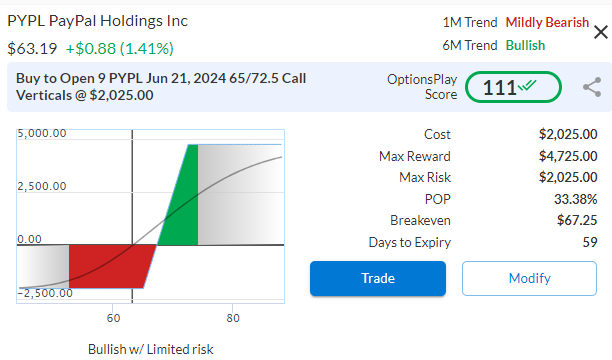

DailyPlay – Opening Trade (PYPL) – April 23, 2024

PYPL Bullish Opening Trade Signal

Investment Rationale

PayPal has lost the vast majority of its market value over the past 3 years and isn’t likely on a lot of watchlists for investors. However, recent strength and performance warrant a second look, especially when the fundamentals look quite strong and the risk to reward is favorable.

Technical Analysis

PYPL has shed 80% of its value in the past 3 years, but recently in the past 6 months has started to form a bottom with a series of higher highs and high lows. It has the potential to break out higher from its $68 resistance level, which would target the $73 gap-fill level above.

PYPL – Daily

Fundamental Analysis

After spinning off from eBay, PYPL has continued to innovate within the payments space and returned impressive growth numbers each and every year. Averaging nearly 15% EPS growth over the past few years and improving operating margins of over 16%, it is outright cheap at only 12x forward earnings. Especially when analysts expect 13% EPS growth over the next few years. With very little debt and strong cash flows, the risks are low when investing in PYPL at these valuations.

Trade Details

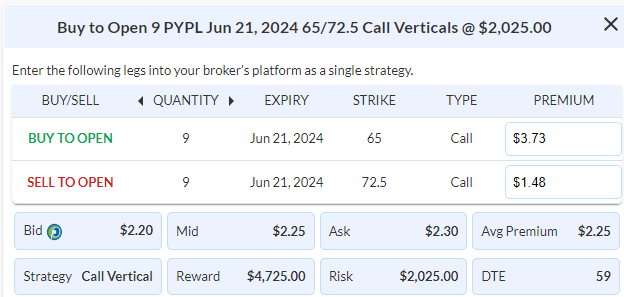

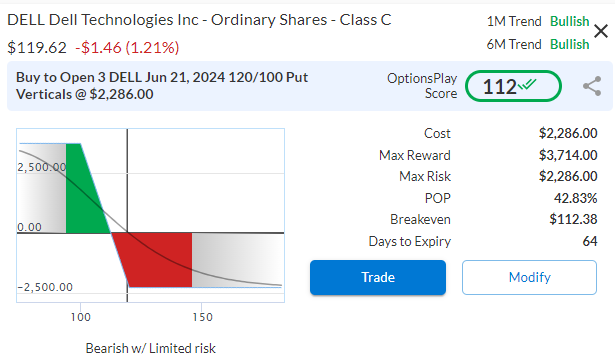

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 9 Contracts June 21st $65/$72.50 Call Vertical Spreads @ $2.25 Debit.

Total Risk: This trade has a max risk of $2,025 (9 Contracts x $225) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $225 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is turning from mildly bearish to bullish.

1M/6M Trends: Mildly Bearish/ Bullish

Relative Strength: 7/10

OptionsPlay Score: 111

Stop Loss: @ $1.13 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$ADBE

DailyPlay – Opening Trade (ADBE) – April 22, 2024

ADBE Bullish Opening Trade Signal

Investment Rationale

As a market leader in graphics and video editing for the past decade, ADBE’s business model was at risk with the rush of AI over the past year. However, their investment in AI tools for the creative industry has become a leader. Adobe has built a sizable moat around its business and remains one of the best-performing businesses in the tech sector. With its recent underperformance, now is an opportunity to purchase ADBE at a much more reasonable valuation.

Technical Analysis

ADBE has shed about 22% of its market value in the past two months and approaching its $450 support level. It broke out from this level last year in June on the back of the AI hype and now it’s returned back with negative divergence and signs of exhaustion on the selloff. The risk/reward favors long exposure now as we start to reach these major support areas.

ADBE – Daily

Fundamental Analysis

ADBE currently trades at only 25x forward earnings, which is inexpensive considering the 13% EPS growth that analysts are expecting over the next couple of years and its industry leading 35% operating margins. ADBE has continued to stay at the forefront of the AI revolution for the creative industry and will look to consolidate its leadership.

Trade Details

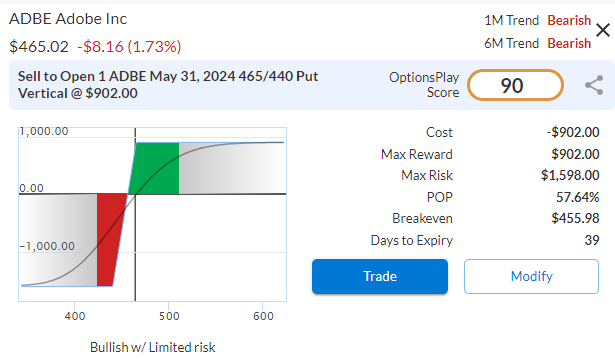

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 1 Contract May 31st $465/440 Put Vertical Spread @ $9.02 Credit.

Total Risk: This trade has a max risk of $1,598 (1 Contract x $1,598) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,598 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is bearish and expected to bounce off support.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 90

Stop Loss: @ $18.04 Debit. (100% loss to the value of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$DELL

DailyPlay – Opening Trade (DELL) – April 18, 2024

DELL Bearish Opening Trade Signal

Investment Rationale

DELL has taken off on the back of AI hype over the past year and trades at its all-time highs both in terms of price and valuation. The question is, are these justified given their future potential? My concern is that the fundamentals just do not seem to add up and the chart is starting to show signs of exhaustion. This warrants a potential pullback as investors rethink equity valuations as 10-year yields shoot towards 5%.

Technical Analysis

DELL recently gapped higher and formed a double top at $130 with signs of exhaustion from the negative divergence. It currently leaves a gap of $95 that remains unfilled and is our downside target after its $105 support level.

DELL – Daily

Fundamental Analysis

While DELL may seem cheap at only 16x forward earnings with AI as a tailwind, EPS growth is only expected in the single digits and for revenues to be flat. When we couple such underwhelming growth rates with Net margins of only 5%, 16x earnings no longer seems cheap. On the contrary, DELL traded at only 6x forward earnings just 2 years ago, with its historical 10-year average just under 9x. By all other accounts, DELL looks expensive now that it has been inflated by AI hype.

Trade Details

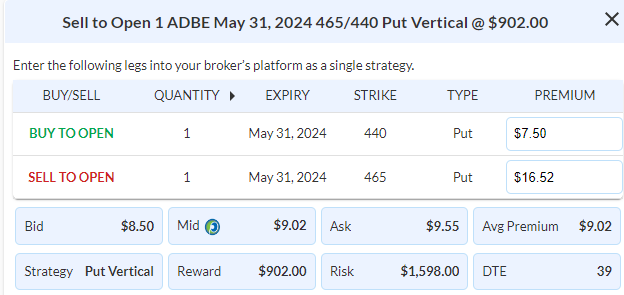

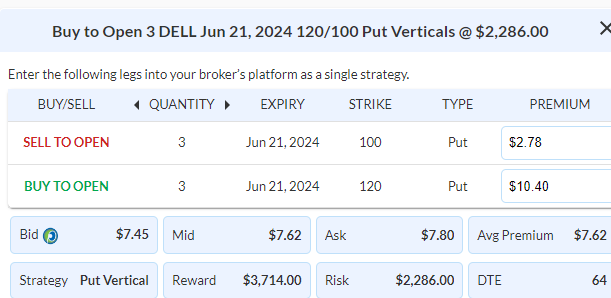

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 3 Contracts June 21st $120/$100 Put Vertical Spreads @ $7.62 Debit.

Total Risk: This trade has a max risk of $2,286 (3 Contracts x $762) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $762 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is overbought and expected to pull back.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 112

Stop Loss: @ $3.81 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$NKE

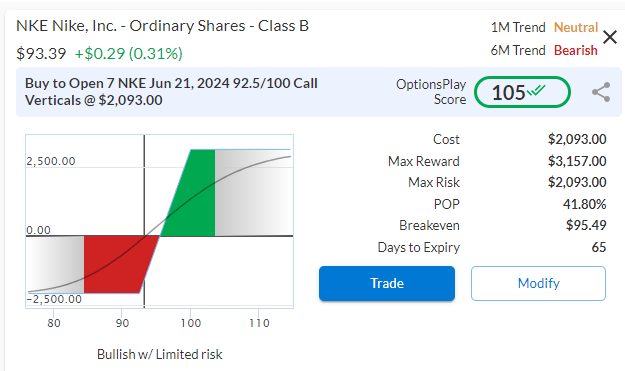

DailyPlay – Opening Trade (NKE) – April 17, 2024

NKE Bullish Opening Trade Signal

Investment Rationale

Nike has underperformed the market and its sector since mid 2021. We have recently seen growth expectations from analysts have bottomed and started to recover. And as China’s growth starts to rebound, valuations near its historical lows, it is time for investors to start paying attention to Nike again as it trades near its multi-year lows.

Technical Analysis

Nike has formed a triple bottom at the $90 support level over the past 3 years and recently it just bounced higher off this support. With a gap above at $100, our short-term upside target would be to fill that gap and $105 resistance level above that.

NKE – Daily

Fundamental Analysis

NKE currently trades at the lower end of its historical valuation at 24x forward earnings, which is a 20% discount to its historical average and well below the 30-40x it traded for the previous few years. With growth expectations starting to recover on the back of China growth and Olympics this year, NKE is looking at a second half recovery of sales declines.

Trade Details

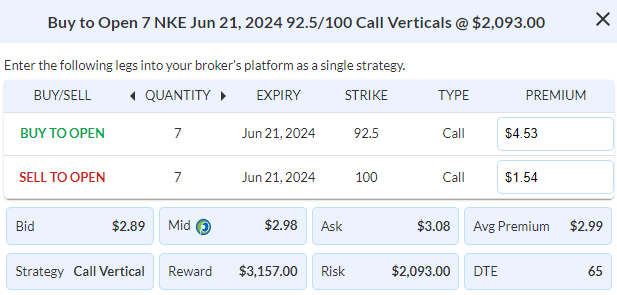

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 7 Contracts June 21st $92.50/$100 Call Vertical Spreads @ $2.99 Debit.

Total Risk: This trade has a max risk of $2,093 (7 Contracts x $299) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $299 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is in a bearish trend and bouncing higher off support.

1M/6M Trends: Neutral/ Bearish

Relative Strength: 3/10

OptionsPlay Score: 105

Stop Loss: @ $1.50 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.