DailyPlay Updates – May 16, 2024

Yesterday’s retail sales numbers that disappointed and CPI print that came in line with expectations kept the door open for a rate cut in September. This was the boost that equities required to breakout to new all-time highs.

Our portfolio is positioned for a continuation higher in equities and we simply have to exercise some patience for your trades to come to fruition. With 7 open positions, we will not look to add additional exposure to our portfolio today.

DailyPlay Updates – May 15, 2024

All eyes are on the CPI print this morning. Yesterday’s PPI print gave us a glimpse into what might be coming down the line with healthcare and airline costs moderating. There are hopes that today’s CPI print will come in line and not surprise to the upside and provide the support equities need to break out to new all-time highs.

With our portfolio positioned for further upside in equities, we will not add any new positions until after the CPI print. If inflation does surprise toward the upside, we will likely cut our NKE position.

DailyPlay – Portfolio Review – May 14, 2024

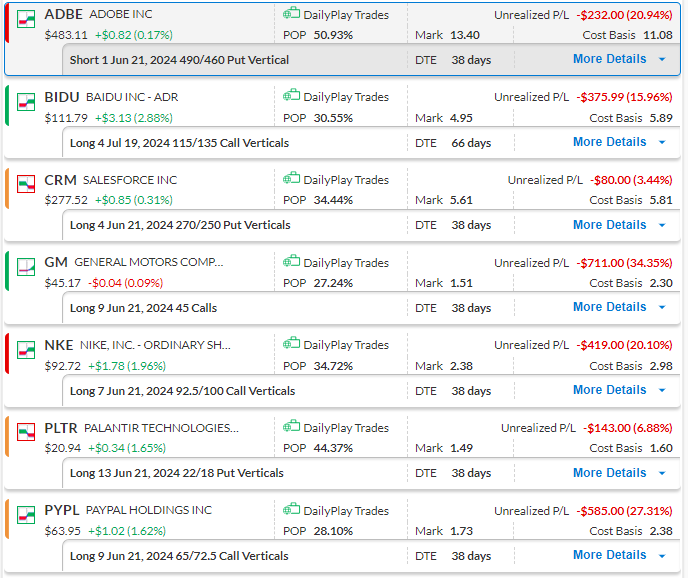

DailyPlay Portfolio Review

Investment Rationale

Despite markets ending flat on the day, our long positions all improved as we head into tomorrow’s all-important CPI print. With 5 long positions and 2 short positions, we do not feel that we need to add further exposure into tomorrow’s CPI print. Please review our Monday Morning Macro Research Webinar if you missed that session as we covered the CPI’s impact on our outlook and a review of our DailyPlay positions.

Our Trades

ADBE – 38 DTE

Bullish Credit Spread – ADBE is still holding onto support at around $475. A break above $490 would confirm our bullish bias on this trade.

BIDU – 66 DTE

Bullish Debit Spread – Had a strong move higher yesterday and a break above $115 would target $125.

CRM – 38 DTE

Bearish Debit Spread – Resistance at $280 is holding. A break below $270 would target a price of $250 – $260.

GM – 38 DTE

Bullish Calls – GM is currently consolidating but trends remain constructive for a breakout above $46.

NKE – 38 DTE

Bullish Debit Spread – Despite reversing since our entry, it continues to make higher lows and targets a break above $95.

PLTR – 38 DTE

Bearish Debit Spread – Trends remain bearish and we’re looking for a continuation lower toward our $18 target.

PYPL – 38 DTE

Bullish Debit Spread – The trend has deteriorated since our entry, a close below $63 would warrant looking at closing at a loss.

DailyPlay – Opening Trade (CRM) – May 13, 2024

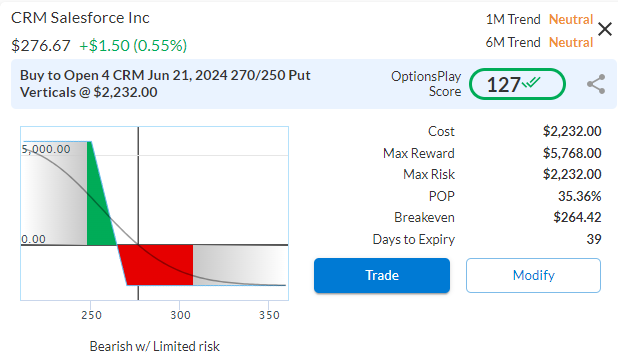

CRM Bearish Opening Trade Signal

Investment Rationale

Once a darling of the tech industry, Salesforce fell out of favor until recently when it hit a new all-time high earlier this year. However, since then, investors have continued to shy away from this cloud computing stock as they focus on more pure AI-related companies and Salesforce is at risk of turning lower again. As CRM matures and growth rates moderate, it simply cannot continue to command the industry-leading valuations it once did and has to face the reality of its fundamentals.

Technical Analysis

CRM has traded in a wide range of $130 to $310 over the past 5 years. Earlier this year it revisited the upper bound of the range and attempted to breakout higher to a new all-time high. This quickly failed and the stock has reversed back into the range with momentum recently turning negative after gapping lower. Now $280 resistance level looks like it will hold and suggests that CRM will likely continue to trade towards the midpoint of the range in the $210-220 area.

CRM – Daily

Fundamental Analysis

CRM currently trades at over 28x forward earnings, which flies in the face of the growth rates that have moderated significantly over the past 12 months. After averaging EPS growth of over 45% over the past 3 years, future EPS growth is expected to slow to just a third of that of that at 16%. And Revenue growth is expected to slow to under 10%. This makes a valuation that is 40% higher than the S&P 500 harder to justify when growth rates are slowing down significantly.

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 4 Contracts June 21st $270/$250 Put Vertical Spreads @ $5.58 Debit per Contract.

Total Risk: This trade has a max risk of $2,232 (4 Contracts x $558) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $558 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is currently neutral.

1M/6M Trends: Neutral/Neutral

Relative Strength: 8/10

OptionsPlay Score: 127

Stop Loss: @ $2.79 Credit. (50% loss of premium paid)

View CRM Trade

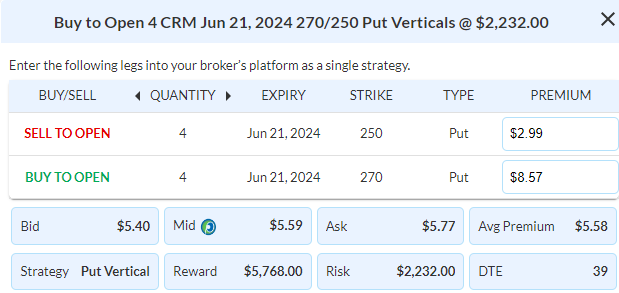

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View CRM Trade

DailyPlay – Portfolio Review – May 10, 2024

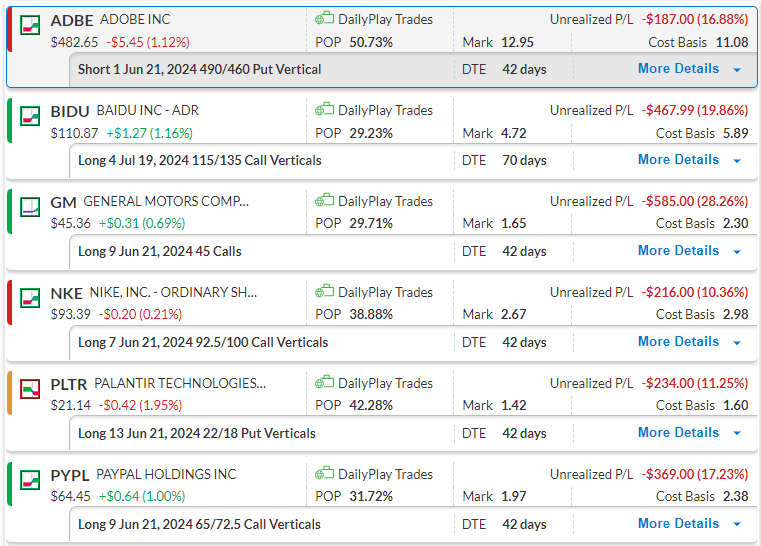

DailyPlay Portfolio Review

Investment Rationale

As buyers seemingly take back control of the equity markets, $5250 is the upside target on the S&P 500. With 5 out of our 6 DailyPlay positions with long exposure, we will take a pause from adding new positions and wait for those to start performing. Most of our positions are within a couple of percentage points of breakeven and we are going to hold them going into next week’s CPI print.

Our Trades

ADBE – 42 DTE

Bullish Credit Spread – A recent pullback to its $480 support level should see it stabilize and start to resume its bullish trend.

BIDU – 70 DTE

Bullish Debit Spread – Look for a retest of its $114 resistance level and for it to continue higher after bouncing off its $108 support.

GM 42 DTE

Bullish Calls – Consolidating just below its key $46 resistance level, we are positioned for a breakout higher.

NKE 42 DTE

Bullish Debit Spread – We are positioned for the break above $94.30 and targeting $100 to the upside gap fill.

PLTR 42 DTE

Bearish Debit Spread – Our bearish thesis for this trade has been confirmed and it seems likely that the gap towards $18 could be filled.

PYPL 42 DTE

Bullish Debit Spread – As PYPL bounced off a key level of $63, a continued upside is still on the table. We will keep a close eye on this position.

$DELL

DailyPlay – Closing Trade (DELL) – May 9, 2024

Investment Rationale

As AI-related stocks such as META, ARM, and PLTR fall on the back of investor concerns, DELL continues to buck this trend and we must admit that our thesis and timing were off on this trade. We are going to take this opportunity to close this out at our Stop Loss level and ensure that we keep our losses in check.

Closing Trade

- DELL – 53.62% loss: Sell to Close 3 Contracts (or 100% of your Contracts) June 21st $120/$100 Put Vertical Spreads @ $3.78 Credit. DailyPlay Portfolio: By Closing all 3 Contracts, we will receive $1,134. We opened these 3 Contracts on April 18 @ $8.15 Debit. The average loss, therefore, is $437.

$PDD

DailyPlay – Closing Trade (PDD) – May 8, 2024

Investment Rationale

As equity markets rally back above its 50D SMA, momentum has slowed and leading sectors have lacked participation. We are taking this opportunity to close out some of our long exposure with PDD on this rally as concerns of a pullback are elevated.

Closing Trade

- PDD – 77.22% gain: Sell to Close 2 Contracts (or 100% of your Contracts) June 21st $115/$140 Call Vertical Spreads @ $16.18 Credit. DailyPlay Portfolio: By Closing both Contracts, we will receive $3,236. We opened these 2 Contracts on April 9 @ $9.13 Debit. The gain, therefore, is $1,410. This translates to a gain of almost 1.5% on our Portfolio.

$ADBE

DailyPlay – Rolling Trade (ADBE) – May 7, 2024

Investment Rationale

With ADBE rallying 6% from its $465 level since we entered the trade, it is time to take profits on our original credit spread and look to roll this up and out to collect more premium. Our immediate upside target is $525 with extended targets of $570. We will look to continue to collect yield on ADBE as our thesis plays out.

Closing Trade

- ADBE – 69.43% gain: Buy to Close 1 Contract (or 100% of your Contracts) May 31st $465/440 Put Vertical Spread @ $2.36 Debit. DailyPlay Portfolio: By Closing this Contract, we will pay $236. We opened this Contract on April 22 @ $7.72 Credit. The gain, therefore, is $536.

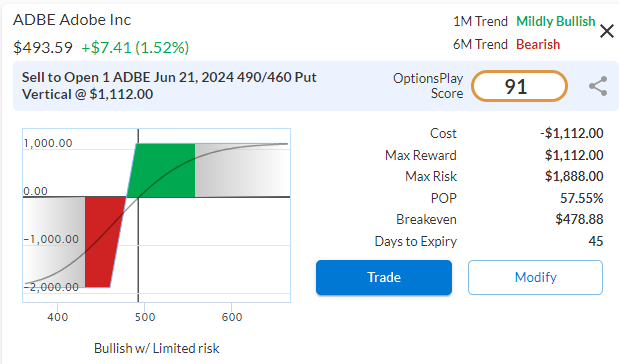

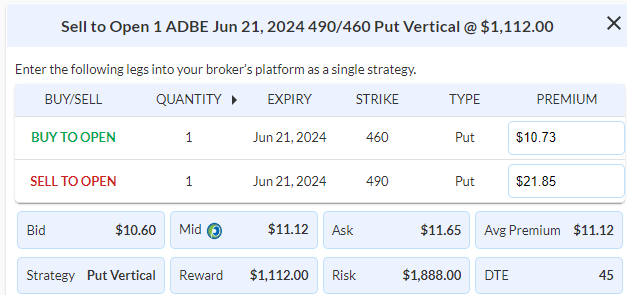

ADBE Bullish Rolling Trade Signal

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 1 Contract June 21st $460/490 Put Vertical Spread @ $11.12 Credit.

Total Risk: This trade has a max risk of $1,888 (1 Contract x $1,888) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,888 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a mildly bullish trend.

1M/6M Trends: Mildly Bullish/ Bearish

Relative Strength: 2/10

OptionsPlay Score: 91

Stop Loss: @ $22.24 Debit. (100% loss to the value of premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$BIDU

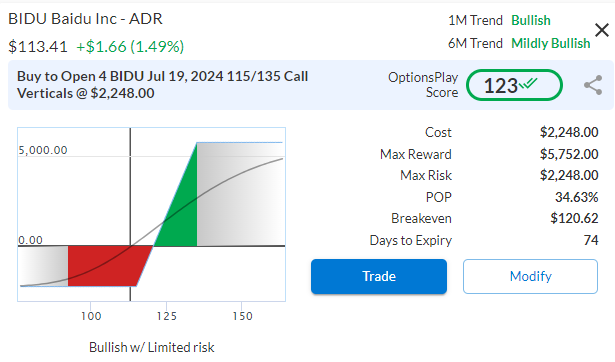

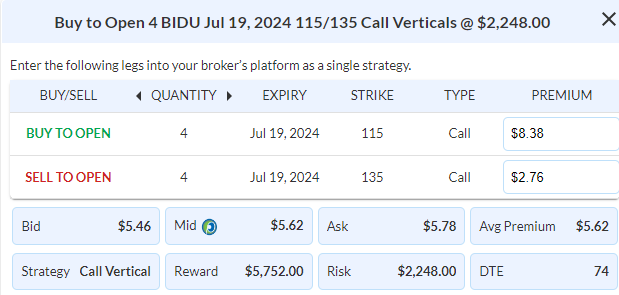

DailyPlay – Opening Trade (BIDU) – May 6, 2024

BIDU Bullish Opening Trade Signal

Investment Rationale

As China’s leader in AI, Baidu trades at a significant discount and presents a rare opportunity for investors to gain long exposure to AI at a bargain-basement valuation. Its LLM AI chatbot ERNIE recently surpassed 200M users which, which includes over 85,000 revenue-generating enterprise clients. We are using the multi-year underperformance of BIDU’s stock as an opportunity to enter an investment with a favorable risk to reward.

Technical Analysis

Since July of last year, BIDU has declined about 40% but just last week, momentum turned positive and BIDU broke out above its bearish trendline. The immediate upside target is only $117, but a break above that would target $135 and $150 as extended targets.

BIDU – Daily

Fundamental Analysis

BIDU trades at only 11x forward earnings, despite analysts expecting EPS to grow by 10% and Revenues by 12%. This is despite a very healthy net margin of 15% and an AI user base that has doubled in less than 6 months. As revenues from its AI business start to show up in earnings, I expect BIDU to start trading closer to its median valuation of 18x for its peers.

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 4 Contracts July 19th $115/$135 Call Vertical Spreads @ $5.62 Debit per contract.

Total Risk: This trade has a max risk of $2,248 (4 Contracts x $562) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $562 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a bullish trend.

1M/6M Trends: Bullish/ Mildly Bullish

Relative Strength: 5/10

OptionsPlay Score: 123

Stop Loss: @ $2.81 Debit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Update – May 3, 2024

Buyers stepped in and maintained control all sessions on Thursday after Chairman Powell alleviated concerns about rate hikes. The bond market has shifted its expectations for the first rate hike to November going into the jobs numbers this morning. 10-year yields continue to moderate and provide a tailwind for equities.

Despite this, equities remain below a key 50D SMA, which warrants caution on bullish positions and having some short exposure. Our DailyPlay Portfolio reflects this positioning and we will refrain from adding any new positions at this time.