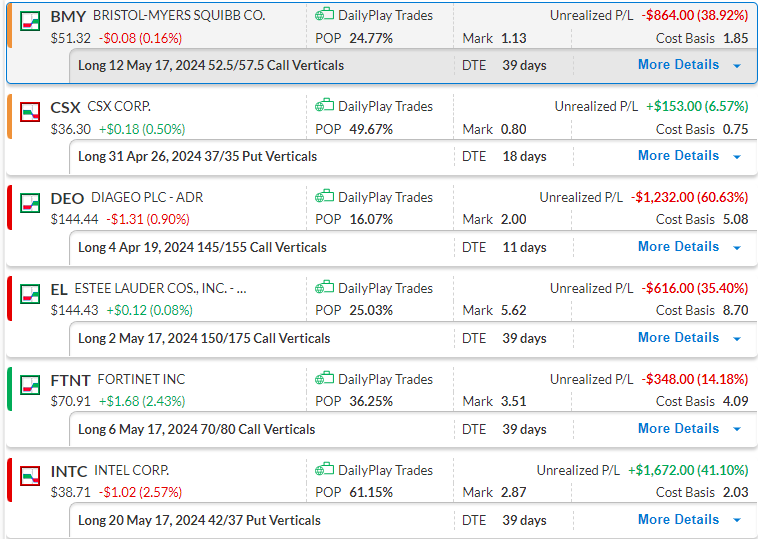

$CSX, $FTNT

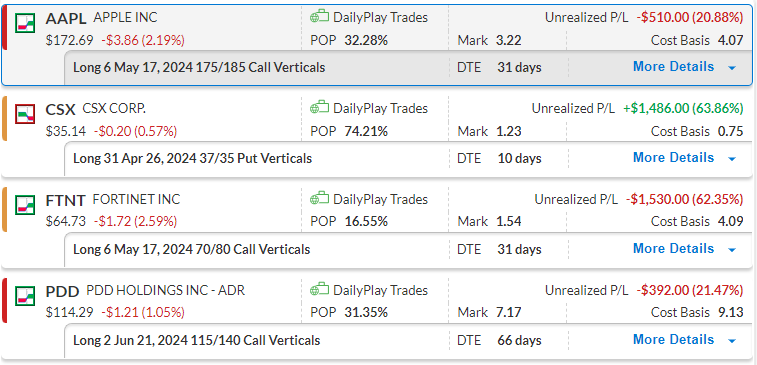

DailyPlay – Portfolio Review & Closing Trades (CSX, FTNT) – April 16, 2024

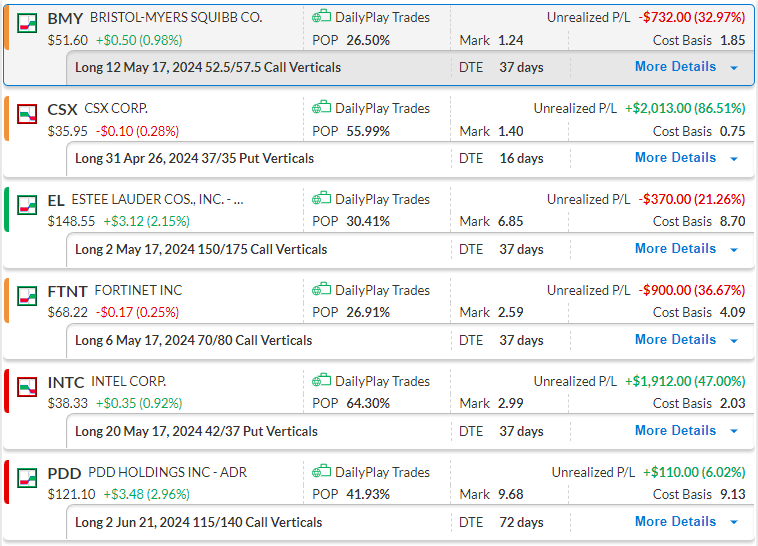

Closing Trades

- CSX- 63.86% Gain: Sell to Close 31 Contracts (or 100% of your Contracts) April 26th $37/$35 Put Vertical Spreads @ $1.23 Credit. DailyPlay Portfolio: By Closing all 31 Contracts, we will receive $3,813. We opened these 31 Contracts on March 26 @ $0.75 Debit. The average gain, therefore, is $48 per contract, with a total gain of around 1.5% of our Portfolio.

- FTNT – 62.35% loss: Sell to Close 6 Contracts (or 100% of your Contracts) May 17th $70/$80 Call Vertical Spreads @ $1.54 Credit. DailyPlay Portfolio: By Closing all 6 Contracts, we will receive $924. We opened these 6 Contracts on April 4 @ $4.09 Debit. The average loss, therefore, is $255 per contract, with a total loss of around 1.5% of our Portfolio.

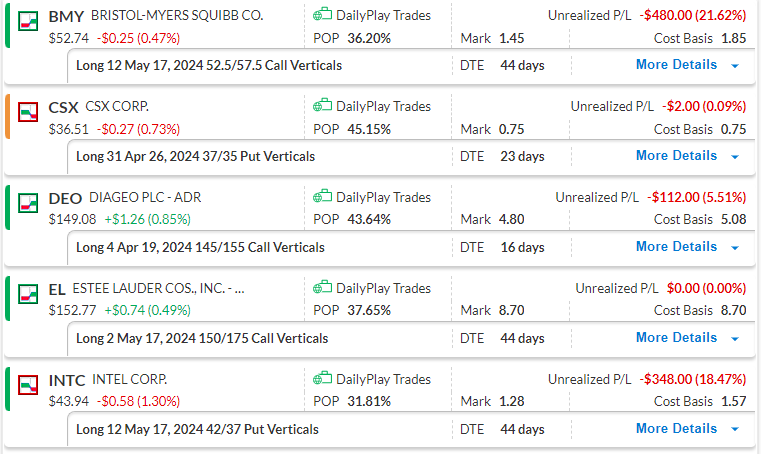

DailyPlay Portfolio Review

Investment Rationale

As a reminder, the goal of our DailyPlay signals is to teach the best practices for maximizing every idea for profitability. We strive to exemplify how professional traders reach profitability through these ideas. Because even the best ideas will underperform if losses are not cut quickly and profits are taken too soon. As I review the DailyPlay portfolio there are multiple positions that require managing today. As CSX approaches our $35 lower strike price, it is time to start taking profits with only 10 days left to expiration. We are also going to close FTNT, which has triggered a stop loss level.

Our Trades

AAPL – 31 DTE

Bullish Debit Spread – Uptrend remains intact with support at $169. If we break below $169, we will look to cut losses, otherwise we are targeting $185 initially to the upside.

CSX – 10 DTE

Bearish Debit Spread – We are closing this trade today to gain 1.5% on our Portfolio.

FTNT – 31 DTE

Bullish Debit Spread – FTNT broke below a level of support which invalidates our bullish thesis on this trade. As such we are closing this position today.

PDD – 66 DTE

Bullish Debit Spread – Still holding onto support at around $114. We will continue to monitor this trade over the next few days.

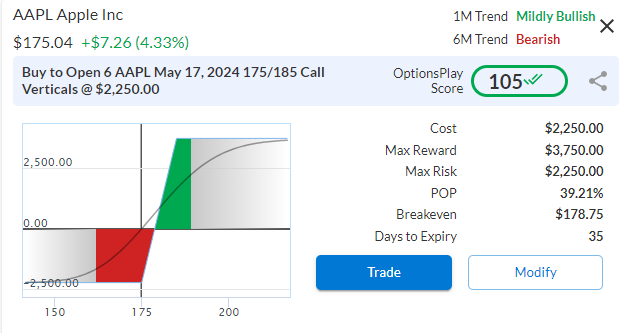

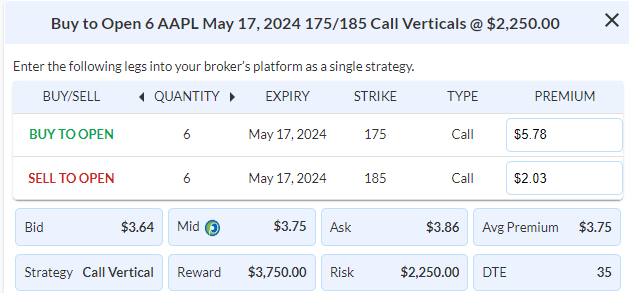

$AAPL

DailyPlay – Opening Trade (AAPL) – April 12, 2024

AAPL Bullish Opening Trade Signal

Investment Rationale

After lagging behind the market since July of last year, AAPL’s underperformance is starting to emerge as an opportunity. With its recent announcements of integrating AI into its iPhone and Mac lines, there is a thesis for AAPL to start playing catchup with the rest of the tech sector.

Technical Analysis

AAPL has been rangebound between $165 and $200 for the past year and just bounced off the major support level yesterday. This creates a favorable risk/reward ratio for long exposure with stops below $165 and an upside target of $200.

AAPL – Daily

Fundamental Analysis

AAPL now trades at only 25x forward earnings as its price declines while analysts revised its EPS growth up to 13% YoY on the back of strong sales and gains in its subscriptions business. These valuations are starting to become more attractive, especially with their AI-focused chips in the upcoming generation of ARM-based silicon.

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 6 Contracts May 17th $175/$185 Call Vertical Spreads @ $3.75 Debit.

Total Risk: This trade has a max risk of $2,250 (6 Contracts x $375) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $375 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is bouncing higher off support.

1M/6M Trends: Mildly Bullish/ Bearish

Relative Strength: 3/10

OptionsPlay Score: 105

Stop Loss: @ $1.88 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

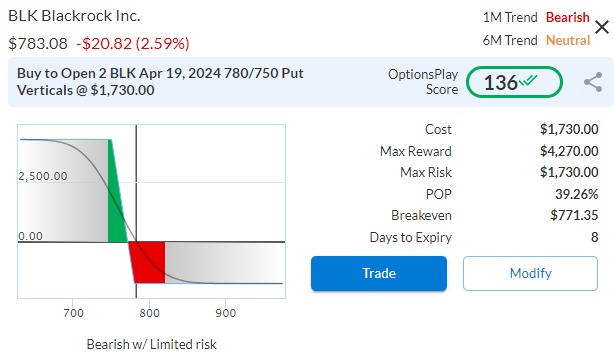

$BLK

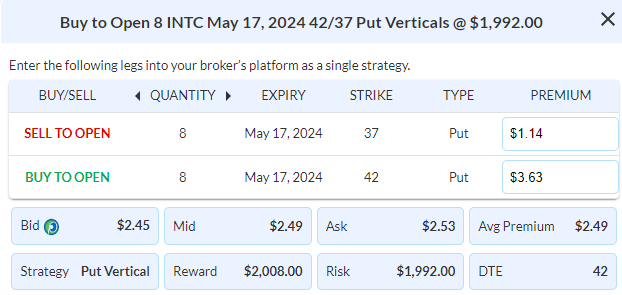

DailyPlay – Opening Trade (BLK) Closing Trades (BMY, INTC) – April 11, 2024

Closing Trades

- BMY – 57.84% loss: Sell to Close 12 Contracts (or 100% of your Contracts) May 17th $52.50/$57.50 Call Vertical Spreads @ $0.78 Credit. DailyPlay Portfolio: By Closing all 12 Contracts, we will receive $936. We opened these 12 Contracts on March 28 @ $1.85 Debit. The average loss, therefore, is $107 per contract, with a total loss of around 1% of our Portfolio.

- INTC – 67.65% Gain: Sell to Close 20 Contracts (or 100% of your Contracts) May 17th $42/$37 Put Vertical Spreads @ $3.41 Credit. DailyPlay Portfolio: By Closing all 20 Contracts, we will receive $6,820. We opened 12 of the 20 Contracts on March 28 @ $1.57 Debit, and then another 8 Contracts on April 5 @ $2.72 Debit. The average gain, therefore, is $138 per contract, with a total gain of around 2.8% of our Portfolio.

BLK Bearish Opening Trade Signal

Investment Rationale

As we start another earnings season, financials will kick things off at the end of this week. Blackrock reports Friday morning and has recently started to show some cracks in their business and I have concerns of a weakening outlook for the world’s largest asset manager.

Technical Analysis

If we start with a longer term chart, we see that after spending 2 years trading below its key $750 resistance level, it finally broke out at the end of last year. But so far, the breakout has not carried higher and momentum is starting to show exhaustion with the negative divergence. This leads me to believe that in the short run, it’s more likely to revisit $750 than continue higher. And if we Zoom in, we see that the $790 short term support was just broken along with underperformance relative to the S&P 500 and momentum has turned negative (MACD). This weakness going into earnings is more likely a signal for further downside.

BLK – Daily

Fundamental Analysis

And if we dive into the business, growth rates for both top and bottom line are nominal. Revenue and EPS has both grown by only 5-6% per year over the past 5 years and analysts aren’t expecting a significant uptick going forward. This is reflected in the valuation of 22x earnings, which isn’t significantly over or undervalued now. So, I anticipate this to trade more on the outlook for asset prices going forward since BLK’s model is based on assessing fees for AUM. If assets were to decrease, so does revenue. With yields rising and rate cut expectations declining, I expect their asset growth projections to also slow.

Trade Details

Strategy Details

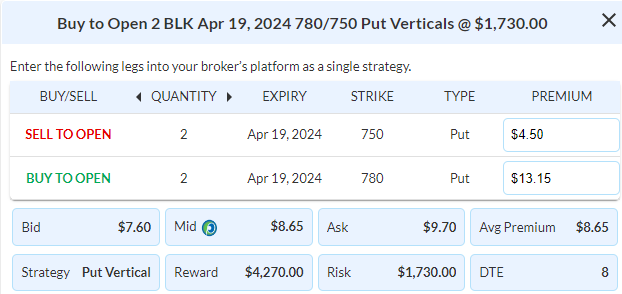

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 2 Contracts April 19th $780/$750 Put Vertical Spreads @ $8.65 Debit.

Total Risk: This trade has a max risk of $1,730 (2 Contracts x $865) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $865 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that failed to break higher, and is expected to pull back.

1M/6M Trends: Bearish/Neutral

Relative Strength: 8/10

OptionsPlay Score: 136

Stop Loss: @ $4.33 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay – Portfolio Review – April 10, 2024

DailyPlay Portfolio Review

Investment Rationale

All eyes are on the CPI print today, with bond traders starting to pare back some of the hawkish bets that we’ve seen over the past few weeks. Until we have more clarity from the CPI print, we are going to do without adding additional exposure to our portfolio.

Our Trades

BMY – 37 DTE

Bullish Debit Spread – We’re just trading around our $51.50 stop loss level, however, it has held this support level and with 38 days left, we intend on holding on to this position for now.

CSX – 16 DTE

Bearish Debit Spread – Trade has continued to work in our favor towards our $33.50 target price, but is starting to show signs of exhaustion on this selloff and we are on watch for potential Take Profit opportunities.

EL – 37 DTE

Bullish Debit Spread – After a poor start, EL is starting to outperform the markets again, and with 38 days left, we will continue to hold onto this position.

FTNT – 37 DTE

Bullish Debit Spread – Still holding its $67 support level and with 38 days left to expiration, we will continue to hold and monitor this position.

INTC – 37 DTE

Bearish Debit Spread – This trade is working well and we have already added exposure to this position, our downside target is $34.50, and look to take profits around that area.

PDD – 72 DTE

Bullish Debit Spread – We just entered this trade yesterday and working well as Chinese internet stocks are showing strength and momentum.

$PDD

DailyPlay – Opening Trade (PDD) – April 9, 2024

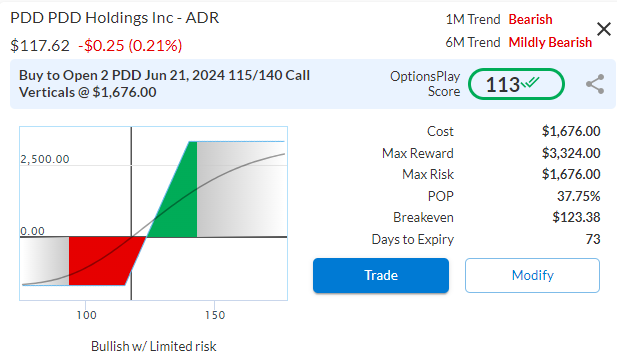

PDD Bullish Opening Trade Signal

Investment Rationale

A few weeks ago, FDX reported better-than-expected earnings, showing both the resilience and uptick in shipping volumes for 2024. As PDD’s Temu competes with Amazon and Walmart on price, FDX’s earnings confirm that the strategy is working. Despite slower shipping times, Temu offers pricing that is substantially lower and looks to continue growing its market share globally. With its recent underperformance, PDD’s price represents an opportunity to add long exposure with a favorable risk/reward ratio.

Technical Analysis

After breaking out above $113 resistance level in Nov of last year, PDD gapped higher but has recently pulled back to this important support level. This provides a favorable entry point from a risk/reward ratio. A break below $109 would suggest that our thesis is incorrect, but the upside is well into the $140’s as our initial upside target.

PDD – Daily

Fundamental Analysis

With lofty analyst expectations of over 50% annual Revenue Growth and 25%+ EPS growth, PDD is downright cheap at only 13x forward earnings. Despite the growth rate, PDD remains very profitable with strong operating margins and FCF generation. This significantly reduces the downside risk of long exposure and aligns the technicals with strong fundamentals.

Trade Details

Strategy Details

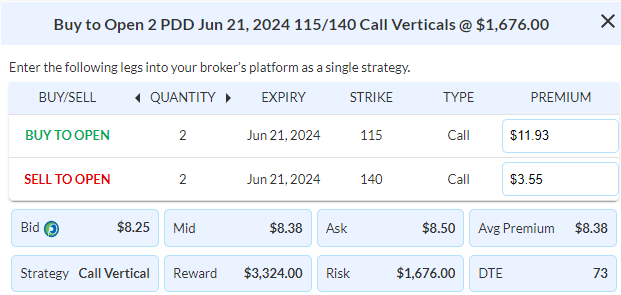

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 Contracts June 21st $115/$140 Call Vertical Spreads @ $8.38 Debit.

Total Risk: This trade has a max risk of $1,676 (2 Contracts x $838) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $838 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a bearish stock that found support and is expected to bounce higher.

1M/6M Trends: Bearish/Mildly Bearish

Relative Strength: 5/10

OptionsPlay Score: 113

Stop Loss: @ $4.19 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$DEO

DailyPlay – Portfolio Review & Closing Trade (DEO) – April 8, 2024

Closing Trade

- DEO – 60.63% loss: Sell to Close 4 Contracts (or 100% of your Contracts) April 19th $145/$155 Call Vertical Spreads @ $2.00 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $800. We opened these 4 Contracts on March 8 @ $5.08 Debit. The average loss, therefore, is $308 per contract, with a total loss of just over 1% of our Portfolio.

DailyPlay Portfolio Review

Our Trades

BMY – 39 DTE

Bullish Debit Spread – Our key level is $53, if this level fails over the next few trading days, we will likely look to cut our position.

CSX – 18 DTE

Bearish Debit Spread – This trade is moving in our direction and we will closely monitor it over the next few days, to potentially add more exposure.

DEO – 11 DTE

Bullish Debit Spread – We are closing this position today as it has hit our stop loss level of 50% loss.

EL – 39 DTE

Bullish Debit Spread – A break and close above $150 would confirm our bullish thesis on this trade, so the next few days will be decisive.

FTNT – 39 DTE

Bullish Debit Spread – A break and close above $72 would confirm our bullish thesis for this trade. We will keep a close eye on this position.

INTC – 39 DTE

Bearish Debit Spread – We recently added more exposure to this trade and we are up over 40%. As it is a Debit Spread, we will aim to close this position at around 100% gain.

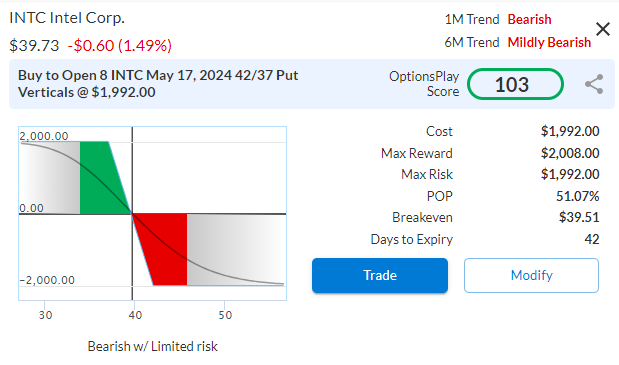

$INTC

DailyPlay – Opening Trade (INTC) – April 5, 2024

INTC Bearish Opening Trade Signal

Investment Rationale

INTC broke below support at $42 after it gapped lower on Tuesday. This has come after news from INTC about job cuts and a reorganization within the company.

As Price Action has confirmed our bearish thesis on this trade, we are therefore adding to our existing INTC position to extend our gains. We expect to see a continuation of this trend. The next area of support is at $37 where we will re-evaluate these positions.

INTC – Daily

Trade Details

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 8 Contracts May 17th $42/$37 Put Vertical Spreads @ $2.49 Debit.

Total Risk: This trade has a max risk of $1,992 (8 Contracts x $249) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $249 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that broke below support in a confirmed bearish trend.

1M/6M Trends: Bearish/Mildly Bearish

Relative Strength: 3/10

OptionsPlay Score: 103

Stop Loss: @ $1.25 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

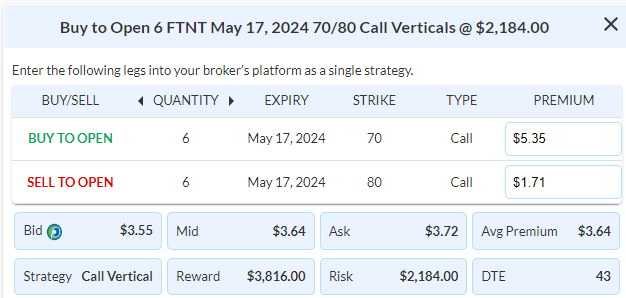

$FTNT

DailyPlay – Opening Trade (FTNT) – April 4, 2024

FTNT Bullish Opening Trade Signal

Investment Rationale

With major cybersecurity hacks seemingly occurring every week, cybersecurity as a sector remains an incredibly strong industry for investors. And as a leader in cybersecurity subscriptions and support, FTNT not only has a competitive edge but also exhibits strong fundamentals that align with its recent relative strength.

Technical Analysis

After gapping lower nearly 3 quarters ago below its key $74 support level, FTNT has rallied back up to this important resistance and is potentially ready to break out higher. Recent volume near its $67 support level has been encouraging and providing me with more confidence that FTNT has the relative strength and momentum to break out above $74 back towards its $80 52-week highs.

FTNT – Daily

Fundamental Analysis

FTNT currently trades at 40x forward earnings, which may seem high, but is on the lower end of its historical valuation. And we have to factor in the 22% EPS growth that analysts expect for this year and its incredibly strong financial position. With operating margins exceeding 23% and its low debt, FTNT is built for growth but has the balance sheet to whether any uncertainty.

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 6 Contracts May 17th $70/$80 Call Vertical Spreads @ $3.64 Debit.

Total Risk: This trade has a max risk of $2,184 (6 Contracts x $364) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $364 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that recently broke higher off a level of support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 108

Stop Loss: @ $1.82 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay – Portfolio Review – April 3, 2024

DailyPlay Portfolio Review

Investment Rationale

Markets are off to a risk-off tone with back-to-back days where sellers maintained control throughout the entire session with strong volume. We saw a similar start last week before buyers stepped back in with an even stronger volume. However, this week’s selloff has been coupled with 10-year bond yields surging above 4.3%. At this time we are going to hold off on establishing new positions and managing our long and short positions. If we see further momentum to the downside, AMGN, PLTR, COST, and INTU are prime candidates to start adding short exposure.

Our Trades

BMY – 44 DTE

Bullish Debit Spread – Started to pull back slightly, our thesis remains intact as the stock continues to make higher highs and higher lower. We will stop out of BMY closes below $51.50, otherwise, we are holding onto this for further upside.

CSX – 23 DTE

Bearish Debit Spread – Downtrend remains intact and we’re looking for further downside from stops just above $37. If CSX is closed lower at the end of this week, we will be adding more exposure to this position into the weekend.

DEO – 16 DTE

Bullish Debit Spread – Slowly but surely the trade thesis still remains solid, stops below $145 and we are less than $1 away from our breakeven.

EL – 44 DTE

Bullish Debit Spread – We just initiated this trade yesterday. Encouraged that EL is up nearly 1% despite a heavy day of selling.

INTC – 44 DTE

Bearish Debit Spread – With 44 days still left, INTC is trading sideways and printing lower highs. Holding onto this and looking for further downside.

$EL

DailyPlay – Opening Trade (EL) – April 2, 2024

EL Bullish Opening Trade Signal

Investment Rationale

We’ve seen a noticeable uptick in volume and interest in EL, after struggling significantly for the last two years to formulate a turnaround. Has EL finally bottomed and proven that its business is investable again? In my opinion with its strong expected future growth and high margins, EL is quite undervalued and offers an attractive risk/reward for bullish exposure.

Technical Analysis

After peaking at the end of 2021 around $375, EL has had a hard fall from grace, down over 70%, to just shy of $100 at the end of last year. Since then, the stock has continued to complete a bottoming formation and has now printed 3 successful higher lows. This suggests that the downtrend has completed and is now a potential candidate to reverse back into a bullish trend. The stock has made multiple attempts to break out above $160. If the stock can break above $160, it would start to target the low $200’s and a $235 gap fill with a stop just below $140.

EL – Daily

Fundamental Analysis

While EL’s forward earnings ratio may seem high initially at 36x, we have to consider the over 20% EPS growth rate that is expected for this year and nearly 88% expected for next year. Couple that with gross margins that stand at 70%, EL stands heads and shoulders above its peers and trades at a relative discount to its own history. If we use average historical valuations of 46x forward earnings, EL’s fair value sits around the $235 gap-fill area.

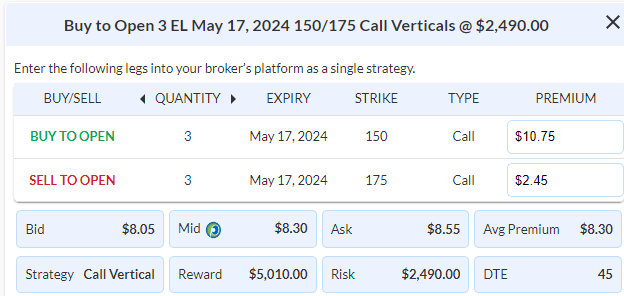

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 Contracts May 17th $150/$175 Call Vertical Spreads @ $8.30 Debit.

Total Risk: This trade has a max risk of $1,660 (2 Contracts x $830) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $830 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that recently broke higher off a level of support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 112

Stop Loss: @ $4.15 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.