$C

DailyPlay – Closing Trade (C) – March 15, 2024

Closing Trade

- C – 64.69% Gain: Sell to Close 11 Contracts (or 100% of your Contracts) April 19th $52.50 Calls @ $5.33 Credit. DailyPlay Portfolio: By Closing all 11 Contracts, we will receive $5,863. We initially opened 7 Contracts on February 14 @ $2.80 Debit, and then 4 Contracts on February 16 @ $4.00 Debit. Our average gain, therefore, is $209 per contract.

Investment Rationale

Banking stocks are starting to show signs of underperformance as 10-year yields rise to 4.3% and C’s momentum continues to deteriorate as it prints new relative highs. This increases the risk of a larger pullback and I believe it is time to take profits on this C trade.

C – Daily

$GOOGL

DailyPlay – Opening Trade (GOOGL) – March 14, 2024

GOOGL Bullish Opening Trade Signal

Investment Rationale

With equity markets continuing to march higher, our GOOGL position has continued to work well. We are going to take this opportunity to add another 2% of our portfolio’s value in exposure to this trade. This is following our DailyPlay methodology to help you become a profitable trader by focusing on turning small wins into potentially much larger winners. We achieve this by adding exposure when it turns out that our market thesis is correct.

GOOGL – Daily

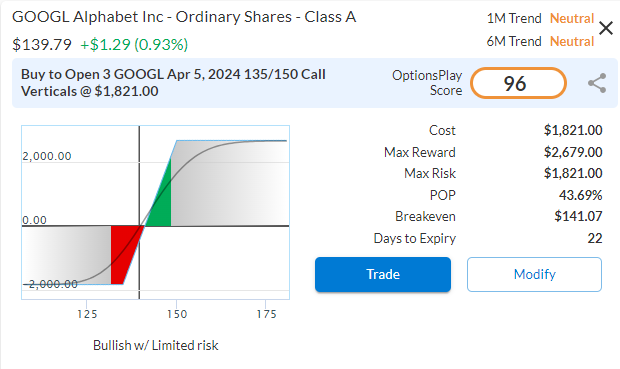

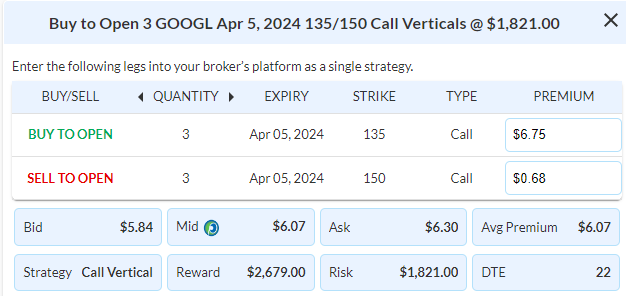

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 3 Contracts April 5th $135/$150 Call Vertical Spreads @ $6.07 Debit.

Total Risk: This trade has a max risk of $1,821 (2 Contracts x $607) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $607 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that has recently bounced higher off support.

1M/6M Trends: Neutral/Neutral

Relative Strength: 3/10

OptionsPlay Score: 96

Stop Loss: @ $3.04 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$AAPL

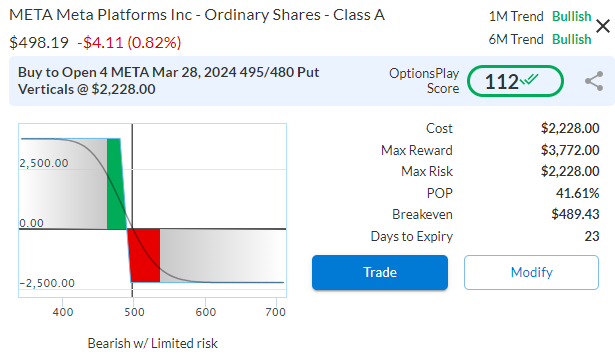

DailyPlay – Opening Trade (AAPL) Closing Trade (META) – March 13, 2024

Closing Trade

- META – 11.35% Loss: Sell to Close 4 Contracts (or 100% of your Contracts) March 28th $495/$480 Put Vertical Spreads @ $5.47 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $2,188. We initially opened these 4 Contracts on March 5 @ $6.17 Debit. Our average loss, therefore, is $70 per contract.

AAPL Bullish Opening Trade Signal

Investment Rationale

With only 15 days to expiration and the trade just sitting at breakeven, let’s look to close out META, and the markets shrug off the inflation print and continue to march on higher. Let’s focus our attention on our winning trades such as AAPL and GOOGL and manage those to be large winners.

AAPL has completed a bounce off its $170 support level and trades at a relative discount to its historical valuation, making our $180 upside target now within reach. I’m taking this opportunity to add another 2% of our portfolio’s exposure to this trade, which is another 4 contracts based on our hypothetical $100,000 sized portfolio. This is following our methodology to help you become a profitable trader by focusing on turning a small win into a potentially much larger winner. We achieve this by adding exposure when we’re correct (AAPL) and reducing exposure where we are incorrect in our market thesis (META).

AAPL – Daily

Trade Details

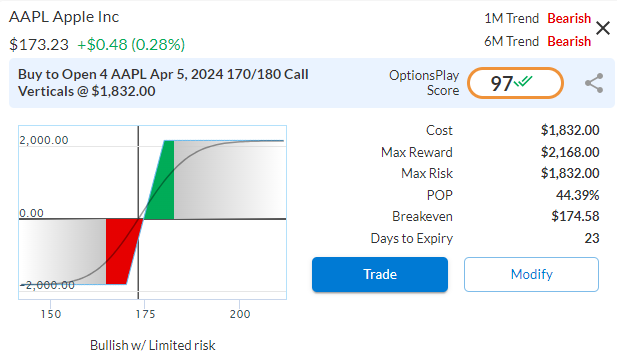

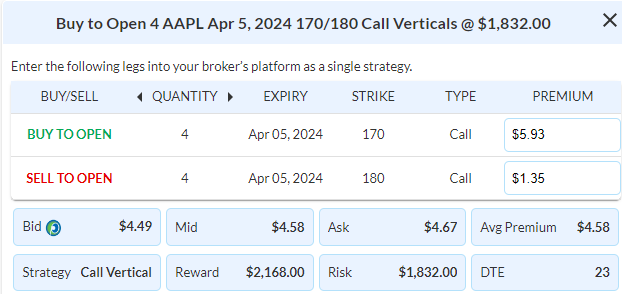

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 4 Contracts April 5th $170/$180 Call Vertical Spreads @ $4.58 Debit.

Total Risk: This trade has a max risk of $1,832 (4 Contracts x $458) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $458 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that has recently bounced higher off support.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 97

Stop Loss: @ $2.29 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

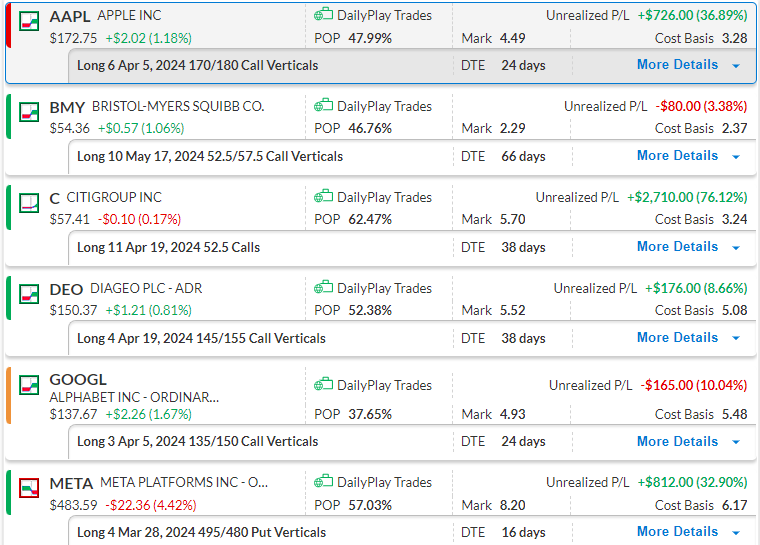

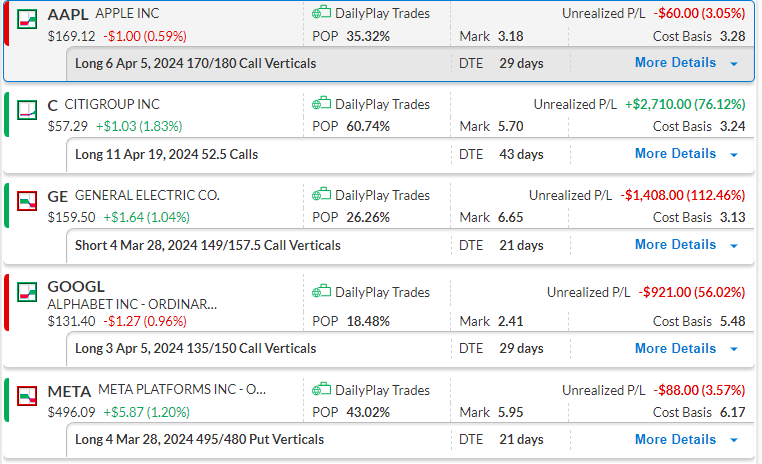

DailyPlay – Portfolio Review – March 12, 2024

DailyPlay Portfolio Review

Investment Rationale

Our current open trades are in good shape with a good mixture of early positions. We are going to hold off on adding further exposure in the portfolio today and provide an overview of our outstanding positions.

Our Trades

AAPL – 24 days DTE

Bullish Debit Spread. Our thesis that $170 was a bottom is holding so far, looking for a continuation higher toward our $180 upside target.

BMY – 66 days DTE

Bullish Debit Spread. A position that we entered yesterday after BMY completing a bottom formation and broke out above its $53 resistance level.

C – 38 days DTE

Bullish Calls. Holding above $57 resistance level so far and we are looking for a push higher towards our $65 target before taking profits.

DEO – 38 days DTE

Bullish Debit Spread. Our thesis that $145 support would hold onto its $155 target is working so far, and will continue to hold onto position.

GOOGL – 24 days DTE

Bullish Debit Spread. Has broken back above our initial $135 support area after breaking lower, we will look for opportunities to take profits as this trade grinds back to breakevens as we approach 24 DTE.

META – 16 days DTE

Bearish Debit Spread. Big move yesterday has pushed our trade back into the green and we’re just off the $480 downside target. Looking to hold this towards expiration for take profit opportunities.

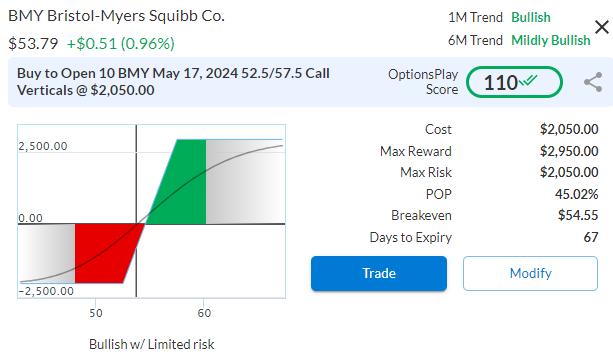

$BMY

DailyPlay – Opening Trade (BMY) – March 11, 2024

BMY Bullish Opening Trade Signal

Investment Rationale

We took a stab at BMY at its very lows in Nov of last year and now that we have the confirmed bottom, it’s time to step back in. After underperforming for nearly a decade, BMY’s drug pipeline and fundamentals are starting to align for investors again. On the back of multiple FDA approvals and acquisitions, BMY is starting to show that it can generate growth again.

Technical Analysis

BMY has traded between $50 and $75 for nearly 10 years and recently tested these lows where we took an initial position in Nov. Now that is has completed it base and broken out above its $53 resistance level, this is a lower-risk entry for further upside into the low $60’s initial target. This recent move has also been accompanied with outperformance relative to its sector and the overall market.

BMY – Daily

Fundamental Analysis

BMY trades at only 7.5x forward earnings despite flat EPS, Revenue and FCF. This is a significant discount to the market that warrants further research given the outlook for its drug pipeline. BMY has acquired multiple pharmaceutical companies with some starting to pay off with an FDA approval for their lung cancer drug Augtyro. Additionally, multiple drugs in their pipeline that have been approved this past year are starting to see strong QoQ sales growth. So, with analysts sour on BMY, I believe now is the best time to have an eye on this 136-year-old pharmaceutical company.

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

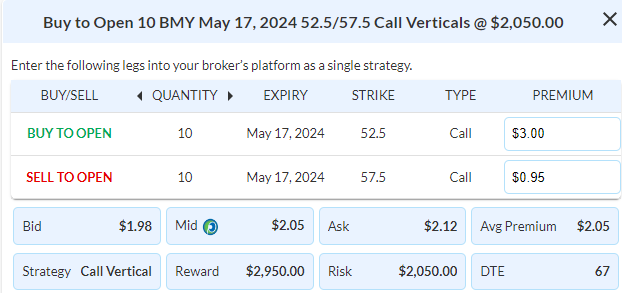

Details: Buy to Open 10 Contracts May 17th $52.50/$57.50 Call Vertical Spreads @ $2.05 Debit per contract.

Total Risk: This trade has a max risk of $2,050 (10 Contracts x $205) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $205 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is neutral and in a larger bullish trend.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 3/10

OptionsPlay Score: 110

Stop Loss: @ $1.03 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

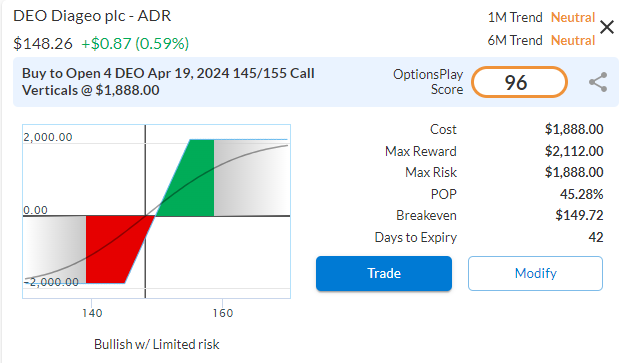

DailyPlay – Opening Trade (DEO) – March 8, 2024

DEO Bullish Opening Trade Signal

Investment Rationale

Alcohol sales have been under pressure for a few years and Diageo’s stock has underperformed with it. However, the world’s largest alcohol company has started to see a turnaround and has the potential to start a longer-term bullish uptrend.

Technical Analysis

Having shed about a third of its value from its peak in 2021, DEO has started to signs of bottoming around the $137 area. It has closed above its major $147 resistance level and continues to form higher lows and targets $160 where it will fill its gap.

DEO – Daily

Fundamental Analysis

While expecting about 11% EPS growth, DEO only trades at 16x forward earnings, making it significantly undervalued relative to the market and its peers. It also generates a large amount of free cash flow and has a strong history of returning cash back to investors in the form of dividends.

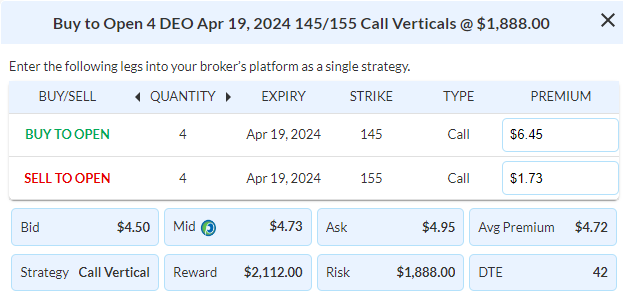

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 4 Contracts April 19th $145/$155 Call Vertical Spreads @ $4.72 Debit.

Total Risk: This trade has a max risk of $1,888 (4 Contracts x $472) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $472 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is neutral and in a larger bullish trend.

1M/6M Trends: Neutral/Neutral

Relative Strength: 3/10

OptionsPlay Score: 96

Stop Loss: @ $2.36 Credit. (50% loss of the premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay – Portfolio Review – March 7, 2024

Closing Trade

- GE – 112.46% Loss: Buy to Close 4 Contracts (or 100% of your Contracts) March 28th $149/$157.50 Call Vertical Spreads @ $6.65 Debit. DailyPlay Portfolio: By Closing all 4 Contracts, we will be paying $2,660. We initially opened these 4 Contracts on Feb 21 @ $3.13 Credit. Our average loss, therefore, is $352 per contract.

DailyPlay Portfolio Review

Our Trades

AAPL

Bullish Debit Spread. We entered this position yesterday on the back of a recent selloff and favorable risk/reward. If the outlook on China improves, expect to see AAPL shares recover from this selloff.

C

Bullish Calls. Citigroup continues to rally on the back of Chairman Powell’s testimony on rolling back proposed capital requirement changes for banks. Looking for a breakout above $57 to continue.

GE

Bearish Credit Spread. Triggered our stop loss and we are closing out this trade, momentum simply was too strong to fade the strength.

GOOGL

Bullish Debit Spread. Just at our stop loss level, will monitor this position for a potential opportunity to close out over the next couple of trading sessions.

META

Bearish Debit Spread. We just entered this trade to fade the strength in META currently near breakeven and will monitor this position.

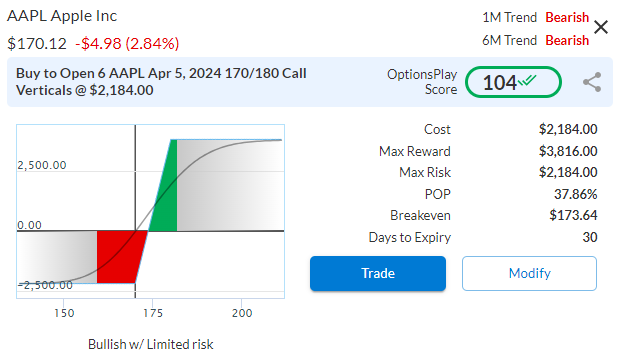

DailyPlay – Opening Trade (AAPL) – March 6, 2024

AAPL Bullish Opening Trade Signal

Investment Rationale

AAPL’s recent selloff provides a rare opportunity for investors to add long exposure with a favorable risk/reward ratio. We rarely see AAPL underperform the markets but the past few months have seen AAPL decline as a result of poor China sales. The recent stock price reflects this outlook, but the long-term prospects of AAPL remain both diverse and strong

Technical Analysis

AAPL has been trading in a range between $170 and $197, yesterday it sold off to the bottom end of this range and the risk/reward is now the most favorable for adding long exposure. RSI also dipped to the low 20’s, a level we have not seen since the beginning of 2019, which was followed by a 50% rally in the stock. Since META broke out above its $400 all-time high on its blowout earnings and dividend announcement, META has continued to grind higher, but momentum has slowed considerably and showing signs of exhaustion. This increases the risk of a pullback or at the very least a consolidation as it touches $500.

AAPL – Daily

Fundamental Analysis

AAPL remains on the more expensive side of 26x forward earnings, and EPS growth has been recently revised up to 11% on the back of strong Mac sales and gains in the subscriptions business.

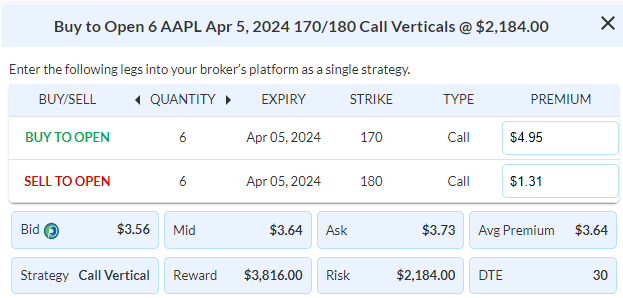

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 6 Contracts April 5th $170/$180 Call Vertical Spreads @ $3.64 Debit.

Total Risk: This trade has a max risk of $2,184 (6 Contracts x $364) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $364 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that pulled back and is expected to continue higher.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 104

Stop Loss: @ $1.82 Credit. (50% loss of the premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay – Opening Trade (META) – March 5, 2024

META Bearish Opening Trade Signal

Investment Rationale

The recent AI lead rally has many investors whispering the “B” word, “bubble”. But is it time to fade this move, or will you just get run over by the bulls? The parallels between the current rally and the dot com boom are there, but it’s vastly different this time. The companies that are leading with sky-high valuations are generating substantial profits, far from the shell companies of the 90’s. However, that doesn’t mean the market hasn’t started to overpay for these companies. Looking at META, which now trades at 25x forward earnings, is starting to look quite expensive and stretched.

Technical Analysis

Since META broke out above its $400 all-time highs on its blowout earnings and dividend announcement, META has continued to grind higher, but momentum has slowed considerably and showing signs of exhaustion. This increases the risk of a pullback or at the very least a consolidation as it touches $500.

META – Weekly

Fundamental Analysis

META currently trades at its upper bound of its historical valuation at 25x forward earnings over the past decade, about 20% more expensive than the beginning of the year. Trading at these multiples, investors need to see substantial earnings growth to recoup their investments, yet analysts are already expecting EPS declines starting next quarter. This presents a fairly substantial risk of nearly 20% downside from a valuation standpoint.

Trade Details

Strategy Details

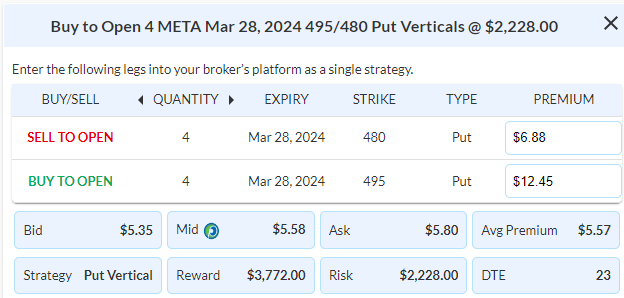

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 4 Contracts March 28th $495/$480 Put Vertical Spreads @ $5.57 Debit.

Total Risk: This trade has a max risk of $2,228 (4 Contract x $557) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $557 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is extremely overbought and expected to pull back.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 107

Stop Loss: @ $2.78 Credit. (50% loss of the premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$SPY

DailyPlay – Closing Trade (SPY) – March 4, 2024

Closing Trade

- SPY – 28.39% Loss: Sell to Close 5 Contracts (or 100% of your Contracts) April 30th $490 Puts @ $2.75 Credit per contract. DailyPlay Portfolio: By selling all 5 Contracts, we will receive $1,375. We initially opened these 5 Contracts on Feb 27 @ $4.01 Debit. Our average loss, therefore, is $126 per Contract.

Investment Rationale

Last week’s economic and corporate earnings reports solidified how investors view the trajectory of our 2024 outlook. Corporate earnings have continued to surprise to the upside and the Fed looks ready to make cuts in the middle of the year. This seems to be enough for investors to continue to push equities higher.

As the equity rally starts to broaden out, there is a growing thesis that despite the overbought conditions and stretched valuations, that this rally still has significant upside potential. Our SPY hedge was meant to protect us against a surprise inflation print and now that the uncertainty has been removed, we also should remove our SPY hedge for a small loss of around 0.5% of our portfolio value, well worth the cost.