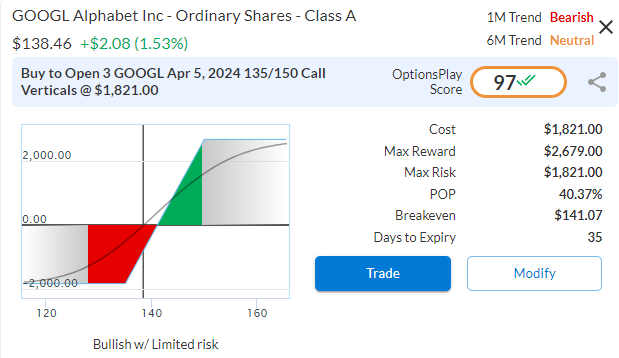

DailyPlay – Opening Trade (GOOGL) – March 1, 2024

GOOG Bullish Opening Trade Signal

Investment Rationale

It’s been hard to ignore the AI theme over the past year where AI-related stocks have seemingly riding a one-way rocket ship. Most stocks that have AI exposure are currently trading at relatively rich valuations and near all-time highs. But GOOGL has a high amount of exposure to the AI theme yet still trades at a reasonable valuation. With its recent selloff, the current risk/reward looks favorable to add some bullish exposure as an AI theme for your portfolio.

Technical Analysis

GOOGL recently broke out above its $140 trading range in mid-January to a new all-time high and recently sold off back towards the $138-140 level as support. I believe that the risk/reward to add long exposure here is favorable with an initial target of $151.50 gap fill level.

GOOGL – Daily

Fundamental Analysis

GOOGL trades at a very reasonable 20x forward earnings despite analysts expecting nearly 16% EPS growth and a fairly strong potential to accelerate revenues with its investments in AI. Essentially we can purchase GOOGL for the same multiple as the S&P 500 average, while expecting nearly triple the EPS growth rate.

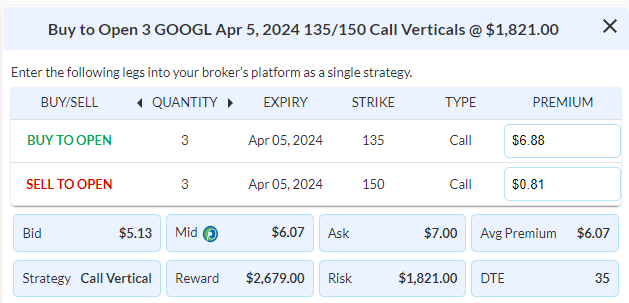

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 3 Contracts April 5th $135/$150 Call Vertical Spreads @ $6.07 Debit.

Total Risk: This trade has a max risk of $1,821 (3 Contract x $607) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $607 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that pulled back but is expected to bounce higher off support.

1M/6M Trends: Bearish/Neutral

Relative Strength: 4/10

OptionsPlay Score: 97

Stop Loss: @ $3.04 Credit. (50% loss of the premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

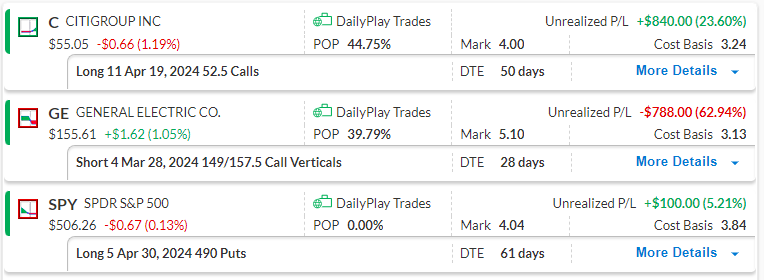

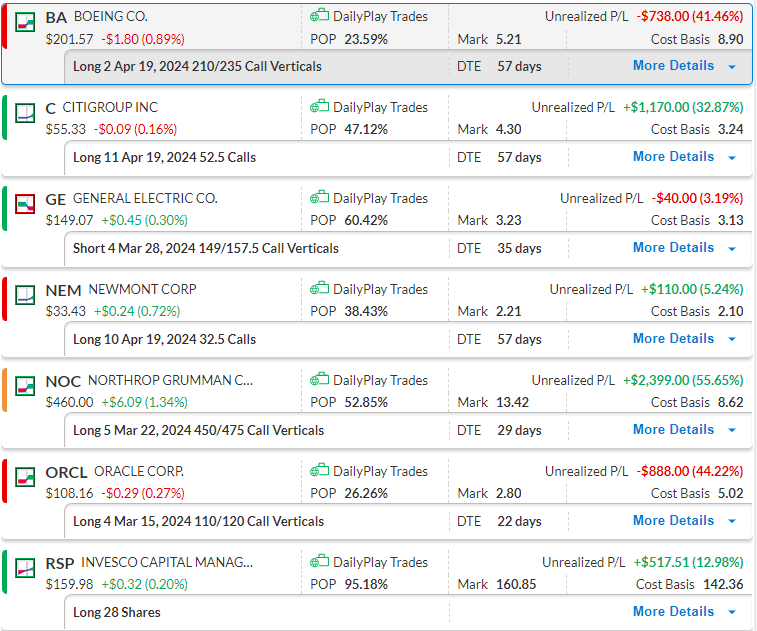

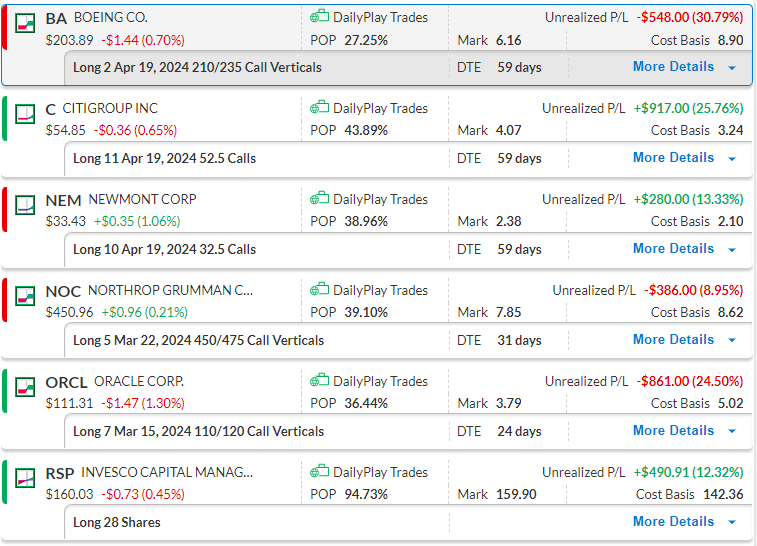

DailyPlay – Portfolio Review – February 29, 2024

DailyPlay Portfolio Review

Investment Rationale

As we head into this morning’s PCE inflation print, we are going to hold off on add any further positions until the markets have digested the Fed’s preferred inflation number. We currently have a short GE position that we are monitoring and a SPY put that we put on yesterday as a hedge against volatility over the next couple of months.

Our Trades

C

Bullish Calls. With $55 as support, we expect to see a bounce higher, aiming at $58.

GE

Bearish Credit Spread. GE continues to be extremely overbought and we expect to see a pullback to lower levels within the next few trading days.

SPY

Bearish Puts. We opened this position to hedge our long positions in our Portfolio. A break below $500 would place this trade in a favorable position.

$ORCL, $NOC

DailyPlay – Closing Trades (ORCL, NOC) – February 28, 2024

Closing Trades

- ORCL – 25.90% Loss: Sell to Close 4 Contracts (or 100% of your Contracts) March 15th $110/$120 Call Vertical Spreads @ $3.72 Credit per contract. DailyPlay Portfolio: By selling all 4 Contracts, we will receive $1,488. We initially opened these 4 Contracts on Jan 24 @ $5.02 Debit. Our average loss, therefore, is $130 per Contract.

- NOC – 38.78% Gain: Sell to Close 6 Contracts (or 100% of your Contracts) March 22nd $450/$475 Call Vertical Spreads @ $12.62 Credit per contract. DailyPlay Portfolio: By selling all 6 Contracts, we will receive $7,572. We initially opened 3 Contracts on Feb 5 @ $7.67 Debit, 2 Contracts on Feb 8 @ $10.45 Debit, and another 1 Contract on Feb 23 @ $10.50 Debit. Our average gain, therefore, is $355 per Contract.

Investment Rationale

As equity valuations continue to stretch and market internals show a deterioration of market breadth, we added a portfolio protection put on the DailyPlay portfolio yesterday. I now believe that it is time to reduce some of our bullish exposure in the markets by locking in gains on profitable trades and closing out small losers at this time. The metrics are starting to skew against our directional view in NOC and ORCL.

ORCL – Oracle is approaching expiration and we discussed closing out this trade during our Monday Morning outlook session and now is a good time to do so.

NOC – The momentum on NOC is slowing down with only 24 days to expiration, this is one that I believe we should take profits on and potentially reenter at a better price in the future as I still believe in the longer-term thesis of this trade.

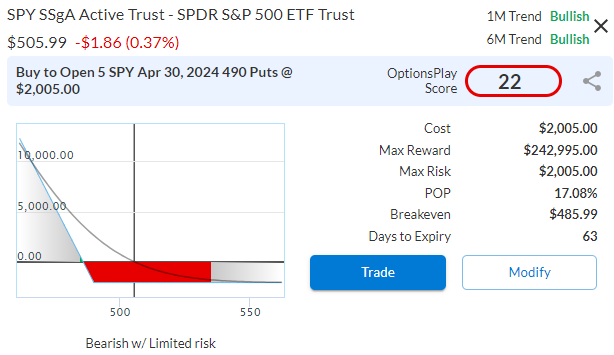

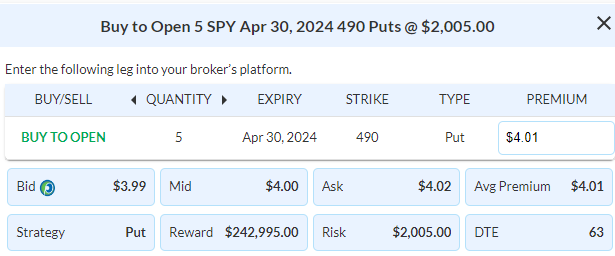

$SPY

DailyPlay – Opening Trade (SPY) – February 27, 2027

SPY Portfolio Hedge Signal

Investment Rationale

I hope that many of you caught the Open Mike LiveStream yesterday afternoon with Michael Khouw, as he discussed hedging a long portfolio with options in the current market environment. With the VIX below 14% and the SPX within a few points of the all-time highs, it might be prudent to have some protection on a long portfolio such as our DailyPlay portfolio going into this week’s PCE Inflation numbers. Let’s look at buying an Out of the Money April 30 $490 Put to offer downside protection on our portfolio through the April expiration in the event of a violent selloff. The Open Mike LiveStream will be every week on Monday and Wednesday @ 4:15PM EST and we hope that you’re enjoying it.

SPY – Daily

Trade Details

Strategy Details

Strategy: Long Puts

Direction: Bearish Puts

Details: Buy to Open 5 Contracts April 30th $490 Puts @ 4.01 Debit.

Total Risk: This trade has a max risk of $2,005 (5 Contract x $401) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $401 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is bullish but expected to pull back from recent highs.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 22

Stop Loss: @ $2.00 Credit. (50% loss of the premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$BA

DailyPlay – Closing Trade (BA) – February 26, 2024

Closing Trade

- BA – 47.53% Loss: Sell to Close 2 Contracts (or 100% of your Contracts) April 19th $210/$235 Call Vertical Spreads @ $4.67 Credit per contract. DailyPlay Portfolio: By selling both Contracts, we will receive $934. We initially opened these 2 Contracts on Feb 2 @ $8.90 Debit. Our average loss on these shares is $423 per Contract.

Investment Rationale

Boeing was absent this weekend’s airshow in Singapore and China’s COMAC stole the limelight and aspires to break the duopoly. This has put further pressure on BA’s stock price over the weekend and potentially pushes it below our key $200 support. We are going to cut our losses and keep the small and focus on adding to our positions that are working out such as NOC and C.

DaiyPlay – Opening Trade (NOC) Closing Trade (NEM) – February 23, 2024

Closing Trade

- NEM – 55.24% Loss: Sell to Close 10 Contracts (or 100% of your Contracts) April 19th $32.50 Calls @ $0.94 Credit. DailyPlay Portfolio: By Closing all 10 Contracts, we will receive $940 Credit. We initially opened these 10 Contracts on Feb 12 @ $2.00 Debit. Our average loss, therefore, is $106 per contract.

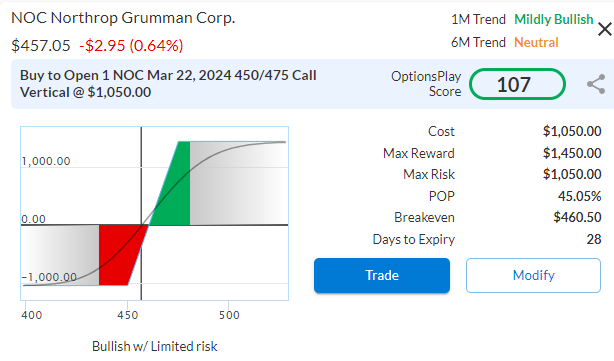

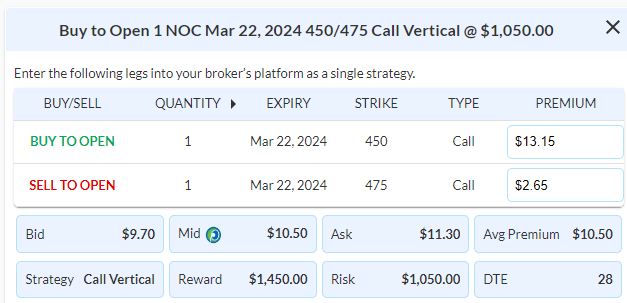

NOC Bullish Opening Trade Signal

Investment Rationale

After NEM reported disappointing earnings and crashed over 7%, it triggered our stop loss level and warrants closing out the trade with a roughly 1% loss of our overall portfolio.

Price action on NOC (Northrup) continues to look positive. We are taking this opportunity to add another 1% of our total portfolio’s value to this trade, which is to buy 1 more contract. We have a $463 initial target with an extended target of $475.

NOC – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 1 Contract March 22nd $450/$475 Call Vertical Spread @ $10.50 Debit.

Total Risk: This trade has a max risk of $1,050 (1 Contract x $1,050) based on a hypothetical $100,000 portfolio risking 1%. We suggest using 1% of your portfolio value and divide it by $1,050 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is mildly bullish and expected to continue higher.

1M/6M Trends: Mildly Bullish/ Neutral

Relative Strength: 5/10

OptionsPlay Score: 107

Stop Loss: @ $5.25 Credit. (50% loss to the premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$RSP

DailyPlay – Closing Trade & Portfolio Review – February 22, 2024

Closing Trade

- RSP – 12.98% Gain: Sell to Close 28 Shares (or 100% of your Shares) @ $160.85 Credit per share. DailyPlay Portfolio: By selling all 28 shares, we will receive $4,503. Our average gain on these shares is $18.49 per share.

Investment Rationale

RSP broke out above its key resistance at $158.50 but a breakout has not been confirmed by momentum. Let’s take this opportunity to close out this equity trade.

DailyPlay Portfolio Review

Our Trades

BA

Bullish Debit Spread. Still managing to hold onto $200 support level, but approaching a 50% loss stop-loss level. Keep a close eye on this one today for a potential trigger to close out at stop loss.

C

Bullish Calls. Looking for the breakout above $55.50 towards $58 initial upside targets, we may get the follow-through today and start realizing some profits on this trade in the next few trading sessions.

GE

Bearish Credit Spread. Just established this yesterday as a fade to its recent strength as GE is extremely overbought and overvalued.

NEM

Bullish Calls. Waiting on earnings this morning and looking for a breakout towards $35 and beyond.

NOC

Bullish Debit Spread. Nice rally above recent trading range, $463 gap fill looks very likely over the next few trading sessions, where we will be taking profits on this trade.

ORCL

Bullish Debit Spread. Opening higher today on the back of NVDA earnings, but approaching expiration, and will be looking to close this out over the next couple of trading sessions.

RSP

Long-term play on the S&P Equal Weighted Index. We are closing this position today. Please refer to the Closing Trade section at the top of the email as well as the Investment Rationale.

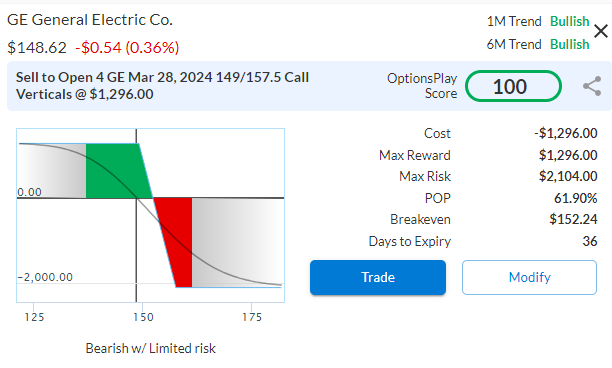

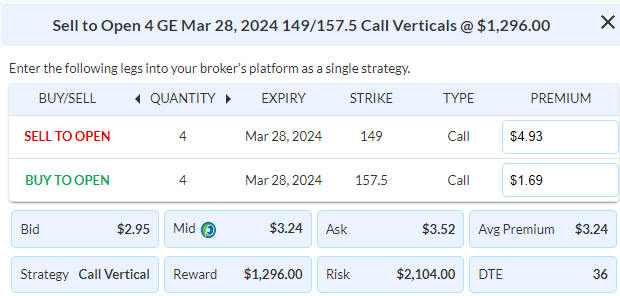

$GE

DailyPlay – Opening Trade (GE) – February 21, 2024

GE Bearish Opening Trade Signal

Investment Rationale

As equity markets recently printed all-time highs, stocks that have been bid up beyond their historical valuations are at risk of a pullback. One stock that fits this criteria is GE. It’s reached prices we haven’t seen since 2017 and currently trades at the highest end of its historical valuation. In my opinion, this rally is overdone and an opportunity to fade this strength.

Technical Analysis

If we look at the 20-Year Chart of GE, it rallied nearly 200% over the past 18 months and reached a major bearish trendline that started in 2007-2008. We’re just trading up against this trendline and at a potential stopping point for this rally. Additionally, all momentum indicators have reached severely overbought conditions that statistically point to a potential pullback in the short run.

GE – Daily

Fundamental Analysis

The most glaring issue is the fundamentals. GE now trades at 32x forward earnings, which is the highest it’s ever traded for over the past 10 years by nearly 20%. GE is trading at the same price as in 2017 when it was earning nearly three times in profits. Analysts are forecasting GE is expected to return its 2017 EPS sometime in 2026-2027. I feel that investors are being overly optimistic about its prospects.

Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Buy to Open 4 Contracts April 19th $52.50 Calls @ $4.35 Debit per contract.

Total Risk: This trade has a max risk of $2,104 (4 Contracts x $526) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $526 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is overbought and likely to pull back to lower levels.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 100

Stop Loss: @ $6.48 Debit. (100% loss to the value of premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay – Portfolio Review – February 20, 2024

DailyPlay Portfolio Review

Investment Rationale

Following a recent double top in the S&P500 and Nasdaq, we are experiencing a pullback to lower levels. We should see, within the next few days, if the market finds support around its current levels, or if it will have a larger pullback. With the general market expecting to see rate cuts later this year, rather than in March, this has a partial impact on the larger market.

As we are monitoring the immediate direction of the market, there are no opening or closing trades for today.

Our Trades

BA

Bullish Debit Spread. Boeing continues to consolidate but stays within a trading range. Our trade is structured to profit from a potential breakout above this range towards its $240 gap fill. We are still waiting for the breakout and will monitor this position closely.

C

Bullish Calls. This trade trending well and we added further exposure to the initial trade. A break above $55 would likely indicate further upside.

NEM

Bullish Calls. This new trade was established as an attempt to call a bottom in Newmont. With this trade at 13% profit, we expect to see a continuation of this uptrend.

NOC

Bullish Debit Spread. We added another 2 contracts to our NOC trade as this trade was performing well as the price had broken above the $450 level. We expect NOC to continue higher and to close the gap towards $460.

ORCL

Bullish Debit Spread. This trade was essentially a free debit spread as we had rolled up and out from the previous ORCL trade. We will monitor this trade to see if any adjustments need to be made.

RSP

Long-term play on the S&P Equal Weighted Index. Price consolidated in the last 2 weeks but showing bullish price action at the $155 level. We will continue to hold this position.

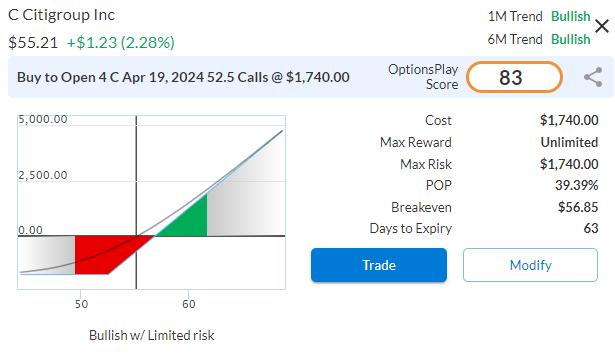

$C

DailyPlay – Opening Trade (C) – February 16, 2024

C Bullish Opening Trade Signal

Investment Rationale

After breaking out above its $55 resistance level that we were watching, C as a trade is performing nicely and up 55% after just two trading sessions. As a reminder, our goal with the DailyPlay service is to provide you with not just ideas, but walk you through how to outperform. In this scenario, you may be thinking it’s an opportunity to take some profits. Instead, I’m going to advocate that this is an opportunity to add more exposure. Our thesis that C was going to bounce off $52 has proven to be correct. If C were to continue towards its 52-week high and onto its $68 upside target, there is a lot more room for C to run. In order to potentially take advantage of this we are going to add another 2% of our portfolio’s exposure to this trade.

C – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

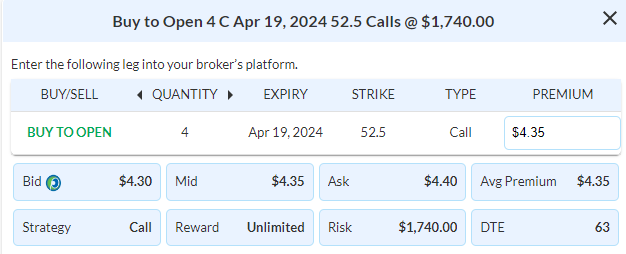

Details: Buy to Open 4 Contracts April 19th $52.50 Calls @ $4.35 Debit per contract.

Total Risk: This trade has a max risk of $1,740 (4 Contracts x $435) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $435 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is trading in a bullish trend and is expected to continue higher from this level.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 83

Stop Loss: @ $2.18 Credit. (50% loss of premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.