$AMZN

DailyPlay – Opening Trade (AMZN) – February 1, 2024

AMZN Bearish Opening Trade Signal

Investment Rationale

With the equity markets reaching all-time highs on the back of a tech-led A.I. rally, it’s hard not to draw parallels to the dotcom bubble and bust. We’ve started to see a little bit of the air taken out of the bubble. And AMZN’s earnings this afternoon present an opportunity to fade these extremes. While almost all of today’s tech and semiconductor companies generate significant revenue and profits — unlike the shells of the dot-com boom — the tech sector’s performance has many parallels to the late 90′s.

Additionally, as valuations continue to outpace revenue and EPS growth, the market seems to have reached a breaking point with. The recent negative reactions to Microsoft, AMD, and Alphabet earnings suggest that investors are no longer accepting valuations that are clearly well ahead of actual corporate earnings growth. In my opinion, while this AI revolution is well on its way, we are still in the early days of a disruptive technology. In the short run, there are opportunities to seek downside exposure during these times of excess, and as valuations pull back towards more realistic levels, it will ultimately provide a better buying opportunity in the long run.

Technical Analysis

While AMZN is technically a consumer discretionary stock, a large part of its valuation is derived from its cloud services business. As we see AMZN’s stock nearly double over the past year, it’s starting to look stretched to the upside and showing signs of exhaustion. We’ve seen high prices that are no longer coupled with momentum. Additionally, the relative performance of AMZN to the tech sector has no longer made new highs along with the absolute chart, suggesting distribution of the stock going into earnings. This increases the probability of a pullback rather than a breakout on earnings this week.

AMZN – Daily

Fundamental Analysis

The valuation of AMZN is another concerning factor, trading at 43x forward earnings, it trades at over a 100% premium to the market and its peers. While a premium valuation is expected with a 35% EPS growth that is expected for FY24, my concern is that there is a lot of room for downside. Especially if we consider how the market has reacted to UPS and MSFT earnings, which respectively provide a preview into AMZN’s eCommerce and Cloud businesses.

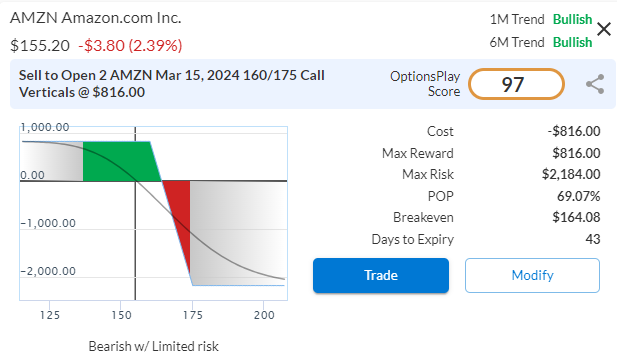

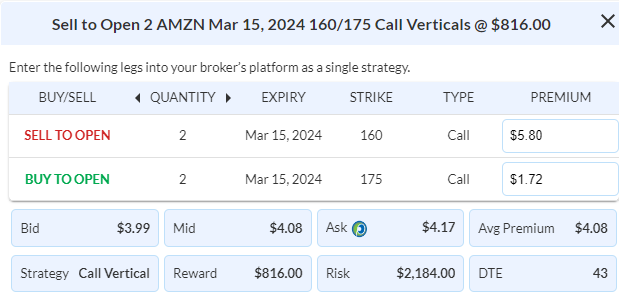

AMZN Trade Details

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 2 Contracts March 15th $160/$175 Call Vertical Spreads @ $4.08 Credit per contract.

Total Risk: This trade has a max risk of $2,184 (2 Contracts x $1,092) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,092 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is currently bullish but overbought.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 97

Stop Loss: @ $8.16 Debit. (100% loss to the value of premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

$GE

DailyPlay – Closing Trade (GE) – January 31, 2024

Closing Trade

- GE – 63.88% Loss: Buy to Close 6 Contracts (or 100% of your Contracts) Feb 16th $130/$135 Call Vertical Spreads @ $3.10 Debit. DailyPlay Portfolio: By Closing all 6 Contracts, we will be paying $1,860. We initially opened these 6 Contracts on Jan 2 @ $1.89 Credit. Our average loss, therefore, is $121 per contract.

Investment Rationale

We are closing GE at a loss of 63% as our thesis for this bearish trade has been invalidated when GE continued higher. While our rule is to close Credit Spreads at 100% loss, GE broke above the $133 minor resistance level yesterday and has therefore invalidated our bearish thesis on this trade, which is why we will be closing this early to limit further losses.

$AAPL

DailyPlay – Opening Trade (AAPL) – January 30, 2024

AAPL Bearish Opening Trade Signal

Investment Rationale

We have taken a neutral to bearish stance on AAPL for 3 Earnings cycles already, and the upcoming one this week is no exception. The fundamentals are decoupled from reality and the relative performance of the stock tells us everything that we need to know. AAPL simply cannot keep up with its sector and continues to be distributed by investors. Perhaps an end of an era at least for now, for what has been a bulletproof stock for investors over the past 15 years.

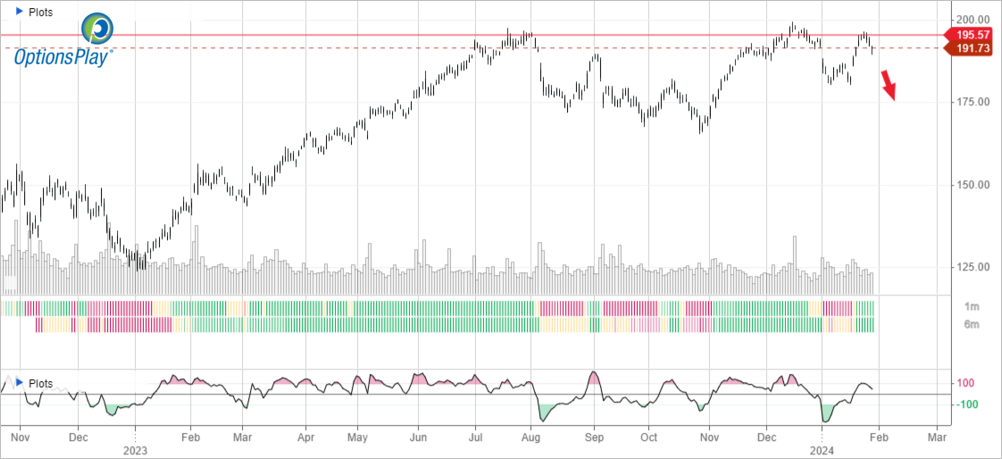

Technical Analysis

After failing twice at its $200 major resistance level, it recently mustered a rally up into its $195 range and once again failed as tech rallies higher. However, the most important chart that tells us everything we need to know going into earnings is the relative performance to its sector. AAPL just printed a two-year low relative to its sector, showing how much it has fallen out of season and favor with investors. This is concerning, as we are going into an important Earnings this Thursday and does not set up for a breakout, but more likely a breakdown.

AAPL – Daily

Fundamental Analysis

The fundamentals look even worse, trading at roughly 27-28x forward earnings, AAPL is expensive considering it is only expected to grow revenues by 4% and EPS by 8% over the next fiscal year. This is a 40% premium relative to the market while expecting growth rates roughly in line with the market. AAPL’s walled garden which has forged its dominance is starting to create rifts within the tech sector.

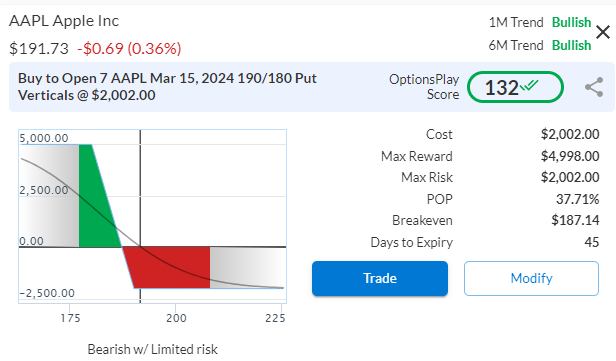

AAPL Trade Details

Strategy Details

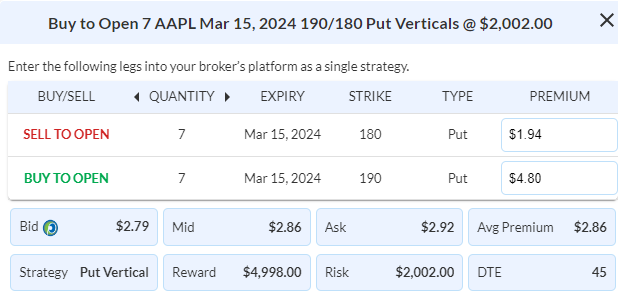

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 7 Contracts March 15th $190/$180 Put Vertical Spreads @ $2.86 Debit per contract.

Total Risk: This trade has a max risk of $2,002 (7 Contracts x $286) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $286 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is currently bullish but overbought.

1M/6M Trends: Bullish/Bullish

Relative Strength: 4/10

OptionsPlay Score: 132

Stop Loss: @ $1.43 Credit. (50% loss of premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay – Portfolio Review – January 29, 2024

DailyPlay Portfolio Review

DailyPlay Update

Welcome to our new DailyPlay service which includes regular portfolio updates, detailed trade thesis, and updated trading scans. Based on today’s scans, we are monitoring two potential short positions in technology names that report this week. As part of our improved service, we will ONLY establish new positions when all technical, fundamental, and liquidity criteria are met. As of this morning, the technical levels have not yet been triggered so we are not entering a new position this morning while we are providing an overview of the existing portfolio.

Our Trades

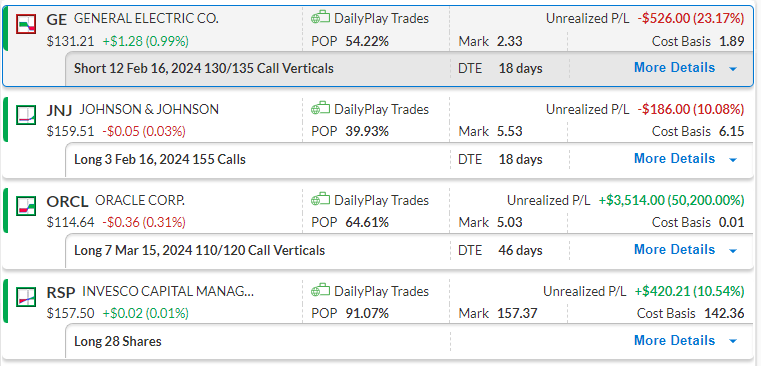

GE

Bearish credit spread. As this is a credit spread, time decay is working in our favor. Price very close to the $130 short strike so we will continue to keep this open. If price remains neutral, we will look to close this trade near breakeven.

JNJ

Long call (bullish). JNJ dipped below $160 on Friday and we will continue to monitor this position to see if it breaks over this level. We do see signs of a reversal higher with price finding support at the $158 level. This trade will likely be closed this week.

ORCL

Bullish debit spread. We rolled ORCL last week to extend our gains on this trade. We expect to see a continuation of its bullish trend. With 46 DTE, we will be keeping this trade open for now. Please note that the unusually high profit % is based off of a cost basis of $0.01 as we rolled the previous ORCL trade and used the profits generated to fund the new ORCL debit spread.

RSP

Long-term play on the S&P Equal Weighted Index. Price consolidated in the last 2 weeks but showing bullish price action at the $155 level. We will continue to hold this position.

DailyPlay Updates – January 26, 2024

An Update to our DailyPlay Service

Thanks to all of you who have provided feedback on our DailyPlay. Many of you have missed the DailyPlay for the last few weeks, but it was time to grow. Based on your feedback, a new DailyPlay will be coming very soon which represents more of your needs. Also, our mission will forever remain the same, to educate every investor on the path to long-term profitability.

Our DailyPlay newsletter will provide stock and options ideas based on both speculative trade ideas and income opportunities. You will receive it at 8:30 AM EST each morning in your inbox and is intended for investors of all experience levels:

- Our research team and AI-generated algorithms will find opportunities to enter a trend before the rest of the market.

- We will utilize a wider variety of options and strategies to trade.

- We will monitor all open positions for roll, taking profit and downside protection.

- Our webinars will be enhanced to review our DailyPlay portfolios.

- We will keep all the elements of weekly webinars and DailyPlays that you’ve become accustomed to relying on.

- Introducing a new Senior Strategist and Technology partnership.

Our commitment to you each day will include:

- Trade Entry Opportunities will only be presented when 3 factors are all met:

- Technical Setup – Our AI algorithm that identifies an Early Trend Reversal Opportunity.

- Fundamentals – Company valuations that support our directional thesis.

- Liquidity – Options that can be executed at or near the midpoint with a limit order.

- Trade Management Opportunities will be presented as soon as they are triggered:

- Stop loss – Immediate signal to close out losing trades to keep losses small.

- Take Profits & Adjustments – Walkthrough how to adjust and manage winning trades to turn small wins into potential home runs.

- Weekly DailyPlay Portfolio reviews of all open positions and our thought process for managing each one.

- A published track record of all Trade Idea examples.

$ORCL

DailyPlay – Rolling Trade (ORCL) – January 24, 2024

DailyPlay Update – Roll ORCL

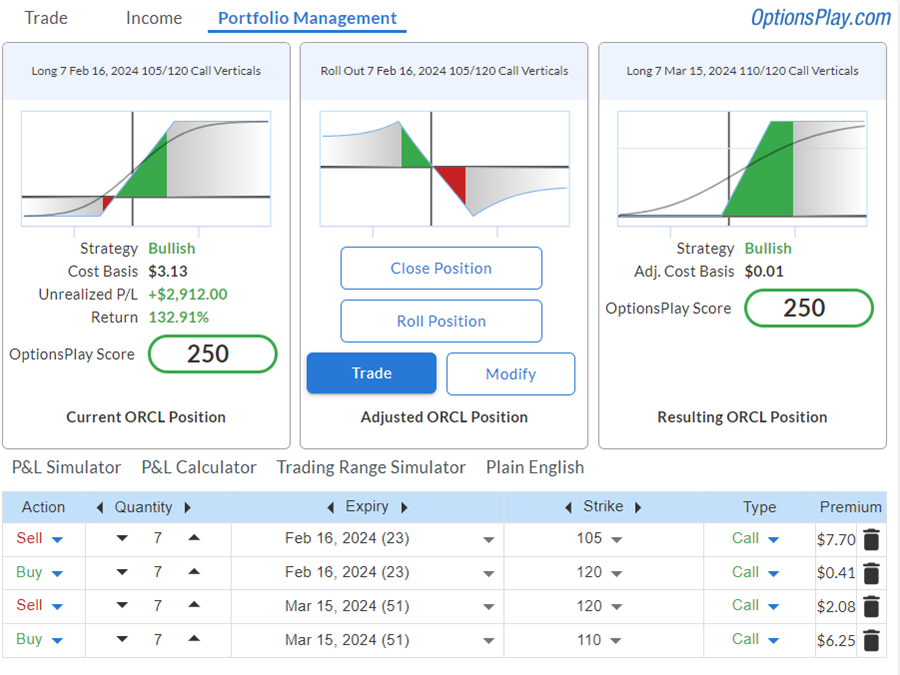

Our ORCL Feb 16 $105/$120 call vertical is currently up 132.9%. This provides us with an opportunity to roll this trade. By rolling this debit spread, we can use the proceeds from this trade to fund a new ORCL trade at minimal cost. Rolling simply involves 2 steps:

- Closing the current trade for a 132.9% gain. This provides us with a profit of $4.16 (per share) for this trade (current market price $7.29 – cost basis of $3.13)

- Opening a new ORCL trade with the trade details below. The original cost basis for the new ORCL position is $4.17. By using the profit from the original trade of $4.16, the resulting cost basis is $0.01. This means that we can gain further upside exposure in ORCL for a risk of only $0.01 per share (essentially a free debit spread)

Closing Trade

- ORCL – 132.91% Gain: Sell to Close 7 Contracts (or 100% of your Contracts) Feb 16th $105/$120 Call Vertical Spreads @ $7.29 Credit. DailyPlay Portfolio: By Closing all 7 Contracts, we will be receiving $5,103. We initially opened these 7 Contracts on Dec 18 @ $3.13 Debit. Our average gain is $416 per contract.

ORCL Opening Trade Signal

View ORCL Trade

Strategy Details

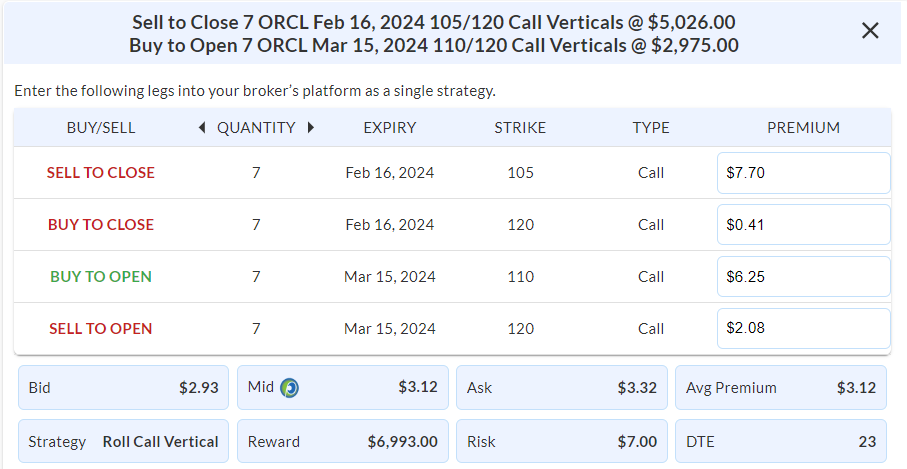

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 7 Contracts Mar 15th $110/$120 Call Vertical Spreads @ $4.17 Debit per contract. By using the proceeds from the closing trade of $4.16, the actual cost basis is now $0.01 per contract.

Total Risk: This trade has a max risk of $7 (7 Contracts x $1).

Trend Continuation Signal: This is a rolling trade on a stock that is currently experiencing a bullish trend.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 250

Stop Loss: There is no stop loss for this trade as it is essentially a free debit spread with a total risk of $1.00 per contract.

Entering the Trade

Please note – As this is a rolling trade and we have already made a profit of $4.16 on the previous ORCL trade, the actual cost basis is $0.01 as we are using the profit from the first ORCL trade to fund the new ORCL debit spread.

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As Semiconductor optimism has overshadowed earnings season so far with both the Nasdaq 100 and S&P 500 rallying further into all-time high territory. Rotation into the technology sector has been strong since Friday and has shifted market sentiment to “risk-on” despite the US 10-year yield moving higher. Fed futures are now only pricing in a 50% probability that the Fed will cut interest rates by 25 points in the March meeting, compared to the 75% probability one month ago. This may provide a headwind leading to the March Fed meeting but the short-term rally in the Technology Sector provides an opportunity to maximize our current open positions in the DailyPlay portfolio.

We will look to roll our existing ORCL Feb 16 $105/$120 Call Vertical up and out to the Mar 15 $110/$120 Call Vertical. By using the $4.16 net profit per contract on the original ORCL position to offset the cost basis of the new ORCL position on $4.17, the resulting net cost basis is now $0.01 per contract, which essentially provides us with a free debit spread to gain further upside with little to no risk should ORCL decline.

ORCL – Daily

$CSCO

DailyPlay – Closing Trade (CSCO) – January 8, 2024

Closing Trade

- CSCO – 56.98% Gain: Sell to Close 22 Contracts (or 100% of your Contracts) Jan 19th $47.50 Calls @ $2.76 Credit.

DailyPlay Portfolio: By Closing all 22 Contracts, we will receive $6,072 Credit. We initially opened 14 Contracts on Nov 30 $1.46 Debit and then 8 Contracts on Dec 12 @ $1.76 Debit. Our average gain, therefore, is $119 per contract.

$BMY, ZM

DailyPlay – Closing Trades (BMY, ZM) – January 5, 2024

Closing Trades

- BMY – 65.47% Gain: Sell to Close 14 Contracts (or 100% of your Contracts) Jan 19th $50/$55 Call Vertical Spreads @ $2.28 Credit. DailyPlay Portfolio: By Closing all 14 Contracts, we will receive $3,192 Credit. We initially opened these 14 Contracts on Dec 4 @ $1.44 Debit. Our average gain, therefore, is $84 per contract.

- ZM – 75.46% Gain: Buy to Close 6 Contracts (or 100% of your Contracts) Jan 26th $72/$77 Call Vertical Spreads @ $0.40 Debit. DailyPlay Portfolio: By Closing all 6 Contracts, we will be paying $240 Debit. We initially opened these 6 Contracts on Dec 19 @ $1.63 Credit. Our average gain, therefore, is $123 per contract.

Dear Valued Member

We hope you are having a great start to your new year. Starting January 5th, 2024, OptionsPlay will temporarily pause the distribution of DailyPlays until January 15th as we work diligently to enhance our trading strategy as we move into 2024. We will still manage our open trades so you may expect some of them to be closed during this period. We will also resume our webinars next week, starting with our Monday Macro Market Outlook webinar. There will be no Market Outlook webinar for today and you will receive a daily email with the Market Outlook during this period.

Our team is committed to providing you with the best trade recommendations, and this short pause will allow us to refine our approach, analyze market trends, and implement advanced strategies to ensure you receive more accurate and valuable insights. We will keep you updated on our progress and look forward to resuming the DailyPlays service soon.

As we now have close to 100,000 subscribers, we thank everyone for your support. Please feel free to reach out to us via [email protected] or with the Ask Us button on the platform with any suggestions, questions, or concerns you may have. Your input will be greatly appreciated and carefully considered.

Thank you for your continued trust in OptionsPlay.

The OptionsPlay Team

$GE

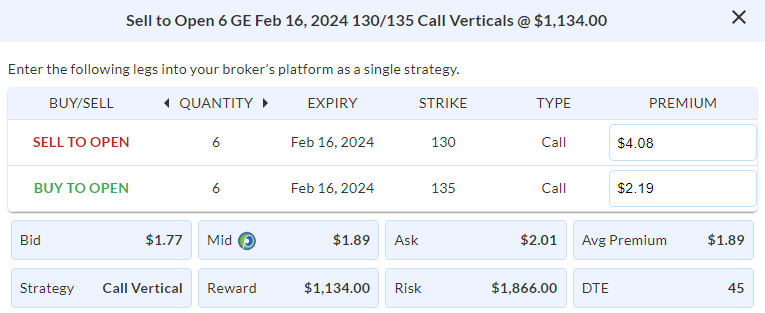

DailyPlay – Opening Trade (GE) – January 2, 2024

GE Bearish Opening Trade Signal

View GE Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish Credit Spread

Details: Sell to Open 6 Contracts Feb 16th $130/$135 Call Vertical Spreads @ $1.89 Credit per contract.

Total Risk: This trade has a max risk of $1,866 (6 Contracts x $311) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $311 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is currently bullish but at an overbought condition.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 103

Stop Loss: @ $3.78 Debit. (100% loss to the value of premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

The first trading day of 2024 looks like it may start off on a negative note with futures trading lower this morning. This comes after a very strong end to 2023 that saw equities rally significantly across the board. Market structure remains bullish, but the extended equity rally is at risk of a short-term retracement lower. Interest rates continue to act as the main theme, with investors now pricing in three rate cuts in 2024, however, this is still largely dependent on inflation and jobs/employment data with Nonfarm payrolls set to be released this Friday.

Our bearish DailyPlay for today is General Electric (GE). GE has shown negative divergence with momentum indicators making lower lows while price continues to make higher highs – a strong bearish signal. While price structure is bullish, the daily timeframe indicates that the current rally is over-extended which provides an opportunity to fade GE and take advantage of the higher probability of a retracement lower. From a fundamental perspective, GE’s price/forward earnings ratio currently sits at 53.76, significantly higher than where the price/forward earnings ratio was between 16 and 27 over the last 5 years.

We will look to Sell the Feb 16th $130/$135 Call Vertical @ $1.89 Credit. With a hypothetical portfolio of $100,000, we recommend risking 2% of the portfolio’s value to this trade, which is 6 Contracts for a risk of $1,866. We will set a stop loss on the put spread at around 100% loss to the value of the premium received @ $3.78 Debit.

GE – Daily

DailyPlay Updates – December 28, 2023

As the trading year shifts to a close, equities experienced some consolidation in recent weeks slowing down the momentum from early December. However, the risk-on sentiment remains strong in markets as the pricing in of a dovish Fed, and potentially up to 3 interest rate cuts in 2024, continues to provide a tailwind. Fed futures indicate that rates will hold steady for the next Fed meeting on January 31st. The first 25 point rate cut, based on Fed futures, looks set to go ahead in the March Fed meeting with a 73% probability of this occurring. Once again, it is almost time for another earnings season with Q4 earnings kicking off in the 2nd week of January lead by the banking giants. Analysts are expecting a 2.4% earnings growth rate for companies in the S&P.

Our DailyPlay portfolio weighs more to the bullish side with six bullish positions and one bearish position. This largely reflects our sentiment heading into 2024. We will continue to monitor for new positions and opportunities to close out existing positions once they reach our TP/SL thresholds.