$ROKU

DailyPlay – Opening Trade (ROKU) Closing Trade (MGM) – December 11, 2023

Closing Trade

- MGM – 43.40% Loss: Buy to Close 10 Contracts (or 100% of your Contracts) Dec 29th $40/$43 Call Vertical Spreads @ $1.52 Debit. DailyPlay Portfolio: By Closing all 10 Contracts, we will pay $1,520. We initially opened these 10 Contracts on Nov 21 @ $1.20 Credit. Our average loss, therefore, is $32 per contract.

ROKU Bullish Opening Trade Signal

View ROKU Trade

Strategy Details

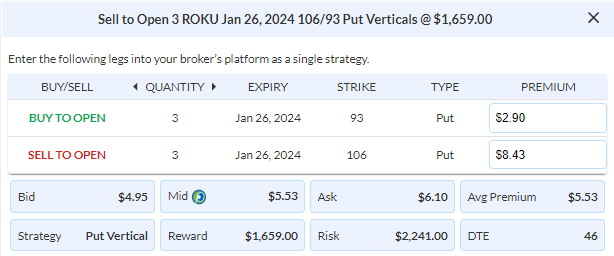

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 3 Contracts Jan 26th $106/$593 Put Vertical Spreads @ $5.53 Credit per contract.

Total Risk: This trade has a max risk of $2,241 (3 Contracts x $747) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $747 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is in a bullish trend.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 92

Stop Loss: @ $11.06 Debit. (100% loss on premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As tech stocks continue to outperform as the relative momentum starts to return to the Technology Sector. As such, ROKU broke out above a key price of $100. This was followed by a bounce higher which now confirms $100 as support for further upside.

We will look to Sell the Jan 26th $106/93 Put Vertical @ $5.53 Credit. With a hypothetical portfolio of $100,000, we recommend risking 2% of the portfolio’s value to this trade, which is 3 Contracts for a risk of $2,241. We will set a stop loss on the put spread at around 100% of the premium paid @ $11.06 Debit.

ROKU – Daily

DailyPlay Update – December 8, 2023

Today is the release of the Non-Farm Payrolls figure where analysts’ expectations sit at 180K. Last month saw a downside surprise which had provided a tailwind for equities to rally through November. Another figure below expectations could very well prove to be the catalyst for a continuation of the rally that has slowed down in recent weeks. Next week’s Fed meeting will also be closely followed as Jerome Powell is expected to provide more clues regarding interest rate trajectory. Fed futures are pricing in a 97% probability that rates stay the same next week, which has been largely priced into markets already. Markets are pricing in a rate cut in March 2024, which depending on the data, and next week’s Fed meeting, could be brought forward if the Fed believes inflation is declining better than expected. This will provide an additional boost to equities.

Due to the jobs data being released today and the Fed meeting next week, we will be holding off on adding new positions. The current DailyPlay portfolio is well-balanced with 4 bullish, and 4 bearish setups. While our overall outlook remains bullish as the Fed pivots to a dovish tone, we will wait for additional confirmation from today’s data before entering new positions.

$KRE

DailyPlay – Opening Trade (KRE) Closing Trade (HAL) – December 7, 2023

Closing Trade

- HAL – 72.96% Gain: Sell to Close 29 Contracts (or 100% of your Contracts) Jan 19th $38/$34 Put Vertical Spreads @ $2.36 Credit. DailyPlay Portfolio: By Closing all 29 Contracts, we will be receiving $6,844. We initially opened 16 Contracts on Nov 13 @ $1.22 Debit, and then another 13 Contracts on Nov 13 @ $1.53 Debit. Our average gain, therefore, is $100 per contract.

KRE Bearish Opening Trade Signal

View KRE Trade

Strategy Details

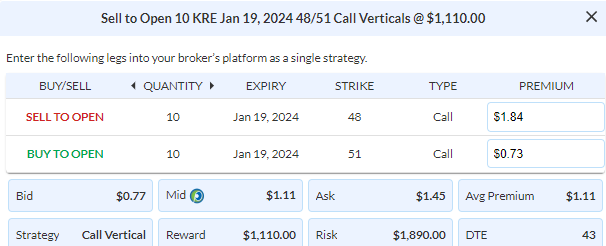

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 10 Contracts Jan 19th $48/$51 Call Vertical Spreads @ $1.11 Credit per contract.

Total Risk: This trade has a max risk of $1,890 (10 Contracts x $189) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $189 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is bullish and overbought and, therefore expected to pull back.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 100

Stop Loss: @ $2.22 Debit. (100% loss on premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Another ETF that is overbought is KRE, which recently formed a double top at $49. KRE has already shown signs of exhaustion as the last two days have seen a pullback developing. As we believe that KRE will not trade higher throughout this trade, we will use this opportunity to collect a premium by selling a Credit Spread. We will collect a premium of 37% over the width of this trade, which is an excellent risk/reward ratio.

We will look to Sell the Jan 19th $48/$51 Call Vertical @ $1.11 Credit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 10 Contracts for a risk of $1,890. We will set a stop loss on the put spread at around 100% of the premium received @ $2.22 Debit.

KRE – Daily

$ALL

DailyPlay – Opening Trade (ALL) – December 6, 2023

ALL Bearish Opening Trade Signal

View ALL Trade

Strategy Details

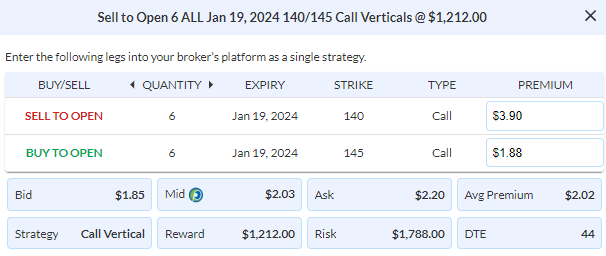

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 6 Contracts Jan 19th $140/$145 Call Vertical Spreads @ $2.02 Credit per contract.

Total Risk: This trade has a max risk of $1,788 (6 Contracts x $298) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $298 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is bullish and overbought and, therefore expected to pull back.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 104

Stop Loss: @ $4.04 Debit. (100% loss on premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As equities continued to rally over the last few weeks, we saw The Allstate Corporation (ALL) following suit and is now trading at a major area of resistance of around $140. With a five-week bullish run, the S&P500 has also entered an overbought condition as it formed a double top at 4,600. With a pullback developing, we expect to see overbought equities to follow, of which ALL is one.

We will look to Sell the Jan 19th $140/145 Call Vertical @ $2.02 Credit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 6 Contracts for a risk of $1,788. We will set a stop loss on the put spread at around 100% of the premium received @ $4.04 Debit.

ALL – Daily

DailyPlay – Closing Trade (FDX) – December 5, 2023

Closing Trade

- FDX – 64.37% Loss: Sell to Close 4 Contracts (or 100% of your Contracts) Jan 19th $240/$220 Put Vertical Spreads @ $1.86 Credit. DailyPlay Portfolio: By Closing all 4 Contracts, we will receive $744. We initially opened these 4 Contracts on Nov 6 @ $5.18 Debit. Our average loss, therefore, is $332 per contract.

Investment Rationale

As equities continued to rally, FDX hit our stop loss level of 50% loss to the premium paid. As such, we will close this position and continue to monitor the market for other opportunities. As the S&P500 has hit a major area of resistance, we will see if a pullback to lower levels will open up new trading opportunities.

$BMY

DailyPlay – Opening Trade (BMY) – December 4 2023

BMY Bullish Opening Trade Signal

View BMY Trade

Strategy Details

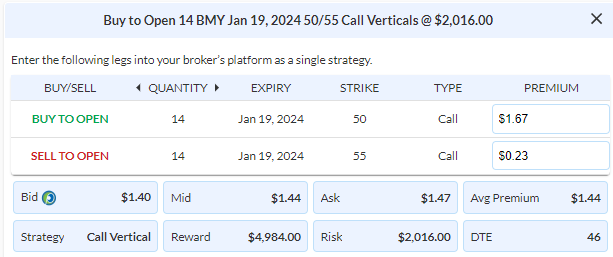

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 14 Contracts Jan 19th $50/$55 Call Vertical Spreads @ $1.44 Debit per contract.

Total Risk: This trade has a max risk of $2,016 (14 Contracts x $144) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $144 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 121

Stop Loss: @ $0.72 Credit. (50% loss on premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Our BMY trade has started to break higher and is currently at about 10% gains. With our bullish thesis proving to be correct, we will add another 2% risk to this trade.

We will look to Buy the Jan 19th $50/55 Call Vertical @ $1.44 Debit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 14 Contracts for a risk of $2,016. We will set a stop loss on the put spread at around 50% of the premium paid @ $0.72 Credit.

BMY – Daily

$PSX

DailyPlay – Closing Trade (PSX) – December 1, 2023

Closing Trade

- PSX – 165.96% Loss: Buy to Close 6 Contracts (or 100% of your Contracts) Dec 15th $115/$120 Call Vertical Spreads @ $5.00 Debit. DailyPlay Portfolio: By Closing all 6 Contracts, we will be paying $3,000. We initially opened these 6 Contracts on Nov 1 @ $1.88 Credit. Our average loss, therefore, is $312 per contract.

Investment Rationale

The stock has rallied unexpectedly due to the activist investor acquiring a stake in PSX. With this news, we need to close out this trade as the bearish thesis has changed. We will continue to monitor existing positions for opportunities to exit or adjust trades in our Portfolio.

DailyPlay – Opening Trade (CSCO) – November 30, 2023

CSCO Bullish Opening Trade Signal

View CSCO Trade

Strategy Details

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 14 Contracts Jan 19th $47.50 Calls @ $1.46 Debit per contract.

Total Risk: This trade has a max risk of $2,044 (14 Contract x $146) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $146 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is oversold and expected to bounce higher.

1M/6M Trends: Bearish/Bearish

Relative Strength: 3/10

OptionsPlay Score: 99

Stop Loss: @ $0.73 Credit. (50% loss to the premium paid)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

CSCO had a sharp selloff recently and found support at the $48 mark, which is a long-term area of support. A bullish technical view as well as positive news coming from CSCO could drive price higher as it launched new business metrics for managing modern applications on Amazon Web Services.

CSCO currently trades at 12x forward earnings which is quite inexpensive. We will, therefore, look to Buy the Jan 19 $47.50 Calls @ $1.46 Debit per Contract. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 14 Contracts for a risk of $2,044 We will set a stop loss on this spread at around 50% of the premium paid @ $0.73 Credit.

CSCO – Daily

$ACN

DailyPlay – Opening Trade (ACN) – November 29, 2023

ACN Bearish Opening Trade Signal

View ACN Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 1 Contract Jan 19th $335/$355 Call Vertical Spread @ $7.30 Credit per contract.

Total Risk: This trade has a max risk of $1,270 (1 Contract x $1,270) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,270 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is overbought and expected to pull back.

1M/6M Trends: Bullish/Bullish

Relative Strength: 8/10

OptionsPlay Score: 99

Stop Loss: @ $14.60 Debit. (100% loss to the value of premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

With the equity market being bullish but also trading at major areas of resistance, we believe that a pullback can be expected. Some equities have also seen recent rallies, of which ACN is one. ACN is currently trading around resistance at $335, from where a pullback can be expected.

We will make use of this opportunity to collect a premium. We will, therefore, play a Credit Spread which collects 36.5% of the width of this spread. Let’s Sell to Open a Jan 19th $335/$355 Call Vertical Spread at $7.30 Credit per contract. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 1 Contract for a risk of $1,270 We will set a stop loss on this spread at around 100% of the value of the premium received @ $14.60 Debit.

ACN – Daily

$PLTR

DailyPlay – Opening Trade (PLTR) – November 28, 2023

PLTR Bullish Opening Trade Signal

View PLTR Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 12 Contracts Jan 19th $20/$17 Put Vertical Spreads @ $1.33 Credit per share.

Total Risk: This trade has a max risk of $2,004 (12 Contracts x $167) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $167 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is bullish and is expected to continue higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 91

Stop Loss: @ $2.66 Debit. (100% loss of the value of premium received)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Bulls point to artificial intelligence software as a driver for ongoing Palantir growth. Palantir announced its newest offering, the “Artificial Intelligence Platform,” early this year. As of mid-September, Palantir says the AIP now has 150 users, up 50% within the last month with exponential growth thereafter.

With the $18 mark acting as support followed by a recent bounce higher, we believe that PLTR will continue this bullish trajectory over the duration of this trade. We will look to Sell the Jan 19th Put Vertical Spread at $1.34 Credit per share. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 12 Contracts for a risk of $2,004. We will set a stop loss on the put spread at around 100% of the value of the premium received @ $2.68 Debit.

PLTR – Daily