$USO

DailyPlay – Opening Trade (USO) – May 1, 2023

USO Bullish Opening Trade Signal

View USO Trade

Strategy Details

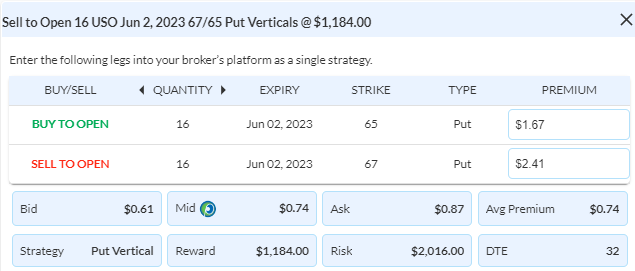

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 16 Contracts June 2nd $67/$65 Put Vertical Spreads @ $0.74 Credit per contract.

Total Risk: This trade has a max risk of $2,016 (16 Contracts x $126) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $126 to select the # contracts for your portfolio.

Counter Trend Signal: This ETF is currently neutral but expected to trade higher over the duration of this trade.

1M/6M Trends: Neutral/Neutral

Technical Score: 3/10

OptionsPlay Score: 88

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

We finally saw the SPX close above its weekly cloud top on Friday, as did the SPY and the S&P futures. This doesn’t make me bullish, per se, but from a risk management perspective does make me less bearish, and it did take us out of the long SPY put trade on last Friday’s close (as previously written as our buy-stop).

I still see lots of issues going forward – the obvious and the not so obvious. For instance, if you take away the performance of the 7 biggest SPX names, there’d be very little reason to be an equity market bull. Breadth is poor, and frankly, the SPX is up 19.5% from the October low while the far broader and more “average stock” Russell 2000 index is down 7%. Since the Feb. ’23 peak, the SPX is flat and the Russell is down 11.7%. That’s not exactly a bull market environment.

Here’s a monthly chart of the SPY/IWM. There’s resistance around here, and should this chart start heading lower, it’s not particularly bullish, too. (The weekly chart of this pair comes in on a Combo +12 from last week, too.)

SPY/IWM – Monthly

So, the main point I’m making is that the likelihood of a mega bull market kicking in here on the SPX cloud chart breakout last week is just not likely.

For a new trade idea, let’s play for a bounce in crude oil after a potential trading bottom was made last week. As calls are way too pricey (yes, even with a VIX at 16, this is a commodity-related ETF and not your typical stock), we can receive very close to our standard desired credit intake of 40% by selling the USO June 2nd $67/$65 put spread. (I’m seeing USO decline by about $0.50 on Sunday night right to $67, so based upon Friday seeing where the $67.50/$65.50 theoretical value was, it collected 39% of the strike differential.)

USO – Daily

$IEF

DailyPlay – Opening Trade (IEF) – April 28, 2023

IEF Bearish Opening Trade Signal

View IEF Trade

Strategy Details

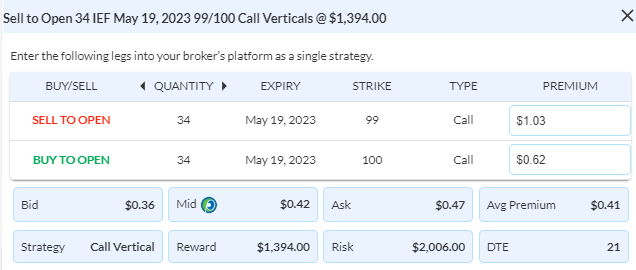

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 34 Contracts May 19th $99/$100 Call Vertical Spreads @ $0.42 Credit per contract.

Total Risk: This trade has a max risk of $2,006 (34 Contracts x $59) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $59 to select the # contracts for your portfolio.

Counter Trend Signal: This stock is bullish and is expected to pull back from a level of resistance.

1M/6M Trends: Neutral/Bullish

Technical Score: 6/10

OptionsPlay Score: 91

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks surged on Thursday after solid big cap tech results on Wednesday after the bell, and then Amazon beating last after yesterday’s close has certainly given tech a nice run to end a month that they’ve underperformed by about 200 bps. going into the last day of April. Furthermore, today certainly sets itself up to be a day that could finally see the SPX close above the 4155 level, and potentially force many shorts to run for the hills next week.

Yesterday we covered 2 of 6 short SPY spreads to lock in some profit. By the end of the day, the other four turned into a losing position given the 2% gain in the market. We’ll exit the other four late in the day today should the SPX and SPY be trading above their weekly cloud tops going into the close.

We’re up 382% on the four remaining MDT calls we own. If the stock isn’t trading above $91.70 going into today’s close, we’ll take one more contract off then.

Lastly, here’s a new idea that is pure tactical trading and simply leaning on a resistance level with a tight stop. Consider shorting the May 19th IEF $99/$100 call spread. It went out yesterday at $0.415 mid, representing us collecting ~41% of the strike differential. Should the IEF close any day above the recent high point of $100.78, we exit.

IEF – Weekly

$BROS, $SPY

DailyPlay – Closing Trade (BROS) Partial Closing Trade (SPY) – April 27, 2023

Closing Trade

- BROS – 87.18% Gain: Buy to Close 1 Contract (or 100% of your remaining Contracts) April 28th $30/$28 Put Vertical Spread @ $0.10 Debit. DailyPlay Portfolio: By Closing the last Contract, we will be paying $10. We took partial profit when we closed 1 Contract on April 25 @ $0.10 Debit, on April 17 when we closed 2 Contracts @ $0.28 Debit, on April 13 when we closed 5 Contracts @ $0.30 Debit, on April 12 when we closed 3 Contracts @ $0.28 Debit and on April 4 when we closed 4 Contracts @ $0.48 Debit. Our average cost basis to exit this trade is therefore $0.31 Debit and our average gain on this trade is 59.78%.

Partial Closing Trade

- SPY – 64.94% Gain: Sell to Close 2 Contracts (or 1/3 of your Contracts) May 12th $411/$395 Put Vertical Spreads @ $5.74 Credit. DailyPlay Portfolio: By Closing 2 of the 6 Contracts, we will receive $1,148.

Investment Rationale

Yesterday was an interesting session, as several key markets turned around from how they started the day (some then even flipped the flips around). To witness, the SPX gapped higher but closed down almost 40 bps. The TNX opened a few bps. higher; then sold off to take out yesterday’s low; and then rallied to close up above their open. Bitcoin futures opened about $700 higher; then significantly rallied to a gain of as much as $2400; but the settled up only $300. That’s some funky trading.

Futures are decently higher after earnings reports. Today there’s still a slew of earnings coming out both before the open and after the close, including Amazon’s. Things will quiet down a bit tomorrow after several of the biggest tech names having reported.

Today we’ll take off our last BROS short puts spread. It’s up 87% and we basically got long at the bottom of the stock’s move, and have scaled out since.

Yesterday, we also sold out of half of our long GILD call spread and took a quick loss on that partial exit. Wednesday’s low came right at its weekly Base Line, so perhaps it can bounce from here and continue upward as I had expected it to.

Our SPY put trade is up ~65%. Let’s take 2 of 6 off today.

EBAY reported yesterday after the close; the stock is trading up about 2.25% this morning. IF going into today’s close the stock is above its bullish Propulsion Momentum level of $44.21, we’ll then sell a June 2nd $44/$41 put spread. It went out yesterday at $1.19, or 40% of the strike differential.

EBAY – Daily

$CSX

DailyPlay – Opening Trade (CSX) Partial Closing Trade (MDT) – April 26, 2023

CSX Bearish Opening Trade Signal

View CSX Trade

Strategy Details

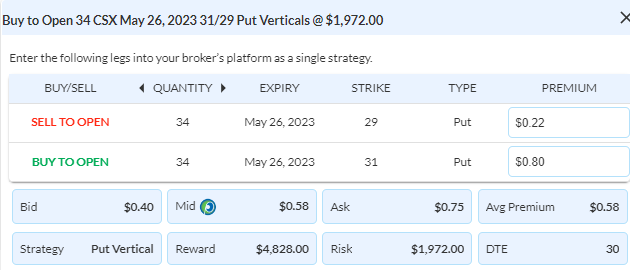

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 34 Contracts May 26th $31/$29 Put Vertical Spreads @ $0.58 Debit per contract.

Total Risk: This trade has a max risk of $1,972 (34 Contracts x $58) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $58 to select the # contracts for your portfolio.

Counter Trend Signal: This stock is bullish and is expected to pull back as it has reached a point of exhaustion.

1M/6M Trends: Bullish/Bullish

Technical Score: 8/10

OptionsPlay Score: 141

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Investors didn’t take kindly to First Republic’s news on Tuesday, and along with some earnings disappointments before the open, the SPX sold off 65 points (1.58%) to close at 4072, the lowest close since March 30th. With the general theme I’ve espoused of “Do what worked in the past (until it doesn’t)”, we’ve substantially lightened overall long exposure over the past two weeks, as the significant SPX resistance at 4148/4155 continues to cap the rallies.

However, after the close we got some big tech earnings beats, so as I write this Tuesday evening, I see S&P futures up ~ 18 points from where they closed at 5pm.

There is still much to move the market over the balance of the week, with both economic releases and lots more earnings reports. As I mentioned earlier this week, yesterday through tomorrow has 35% of all SPX companies reporting, so even if we think we know which way the market is going to move based upon where it is now, the reality is that we still could see a rally that hurdles 4155 by Friday. At this point, it’s all data dependent because there really isn’t an overall trend to lean on.

A few portfolio notes/changes:

- Yesterday I wrote that if any day this week we see MDT trade above $90.50, we’d take another long call off the table. It did that yesterday with an intraday high of $91.00, so if you sold it around when the stock hit $90.50 you exited that contract at about $8.30. (We’re long from $1.92.) That now cuts us down to still holding 4 contracts, with those remaining ones up 322%.

- On Monday, we went long a GILD call spread. We have plenty of time on these, but IF it is trading today beneath $85.47 (the channel line it broke out from) going into the close, I then want to get out of 4 of 8 long spreads on the close to minimize a loss on what could turn out to be a bearish evening star pattern.

- We have on 1 last short BROS $30/$28 put spread that expires on Friday. IF today is trading lower on the day going into the closing bell, we will exit that last spread we have on. Otherwise, we will get out of it tomorrow morning.

GILD – Daily

Finally, here’s a new bearish play in one of the big Dow Transport names: CSX. For the 4th time since last August, it has stalled right at either the bottom or top of its weekly cloud. It did it again a week ago, so let’s look to buy the May 26th $31/$29 put spread. Yesterday it went out at 57.5 cents, or about 29% of its strike differential. Any Friday close above $32.5 will stop us out of this trade.

CSX – Weekly

$BROS

DailyPlay – Partial Closing Trade (BROS) – April 25, 2023

Partial Closing Trade

- BROS – 87.18% Gain: Buy to Close 1 Contract (or 50% of your remaining Contracts) April 28th $30/$28 Put Vertical Spread @ $0.10 Debit. DailyPlay Portfolio: By Closing 1 of the 2 Contracts, we will be paying $10.

Investment Rationale

A fairly insignificant day for stocks on Monday, as the SPX added but 3.5 pts. to 4137 as investors wait for a whopping 35% of all S&P 500 companies reporting earnings today through Thursday (including several mega-cap tech names). These three days could finally create the impetus for a breakout move higher or a several percent move down if we see disappointing results. We’re all anxiously waiting for something to happen to get us out of the choppy range funk we’ve been in this year.

In our portfolio, we still have on 2 short BROS $30/$28 put spread that expires this Friday. The stock closed yesterday at $31.42. We’re up 87% on these, so let’s kick out one of these today. And should today go into the close with the stock trading under $30.05, we’ll sell the other one on the close.

BROS – Daily

We’re also short 3 MCK May 19th $370/$380 put spreads. With the stock at just shy of $362, we’re up 23% (although it feels like we should be up more). But earnings come out on May 8th, and until that report is out of the way, we’re not going to see the vol component of the spread price really come in. Considering the stock has not properly broken beneath its bearish Propulsion Momentum level at $358.68, let’s cover one of those 3 spreads today IF the stock is trading above that level going into today’s close.

MCK – Daily

Our long MDT call trade has been a homerun, now up 303% on the remaining 5 contracts. (We took 5 off yesterday.) On any day this week that the stock first trades above $90.50, we’ll take off another one contract.

MDT – Daily

$GILD

DailyPlay – Opening Trade (GILD) Partial Closing Trades (LIT, MDT) – April 24, 2023

Partial Closing Trades

- LIT – 86.59% Loss: Sell to Close 7 Contracts (or 50% of your Contracts) May 19th $64/$69 Call Vertical Spreads @ $0.22 Credit. DailyPlay Portfolio: By Closing 7 of the 14 Contracts, we will receive $154.

- MDT – 131.77% Gain: Sell to Close 5 Contracts (or 50% of your Contracts) May 19th $82.50 Calls @ $4.45 Credit. DailyPlay Portfolio: By Closing 5 of the 10 Contracts, we will receive $2,225.

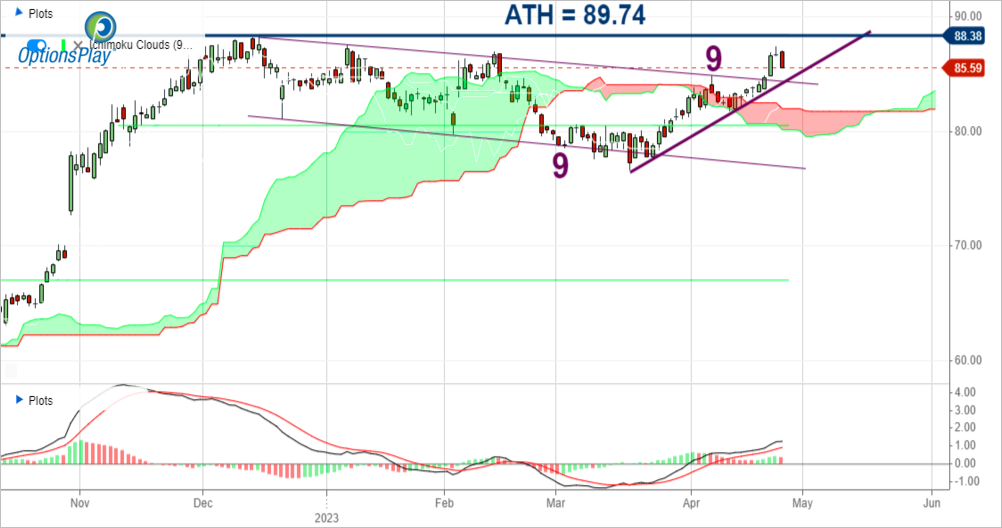

GILD Bullish Opening Trade Signal

View GILD Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 8 Contracts June 16th $87.5/$95 Call Vertical Spreads @ $2.30 Debit per contract.

Total Risk: This trade has a max risk of $1,848 (8 Contracts x $231) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $231 to select the # contracts for your portfolio.

Trend Continuation Signal: This stock is bullish and is expected to continue higher.

1M/6M Trends: Bullish/Bullish

Technical Score: 10/10

OptionsPlay Score: 113

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

The SPX ended last week down just a few points on the week, again showing its inability to hurdle the 4148/4155 major resistance area I have highlighted for a few months.

First things first: Right after we got long lithium (via the LIT ETF), a negative story came out on the space and all lithium-related stocks got mushed. We quickly have lost 87% of our long premium paid. I make no excuses. It was bad luck and we should exit at least half our trade now (that’s 7 of 14 long spreads) and hope to perhaps recover some of it in coming days.

With the bad we have plenty of good, too. Let’s remove 5 of 10 long MDT May 19th $82.50 calls we have on, up 131% on them.

And here’s a new idea that we’re going to play through their earnings report on May 3rd. Let’s look to buy the GILD June 16th $87.5/$95 call spread, as I suspect the breakout of both the flag pattern and the Lagging Line breaking out above its cloud should lead to a test of (or even a breakout above) all-time highs. Friday saw this go out at $2.305, or just shy of 31% of the strike differential. With a good earnings report we’ll keep this on; with a bad one we’ll say bye-bye.

GILD – Daily

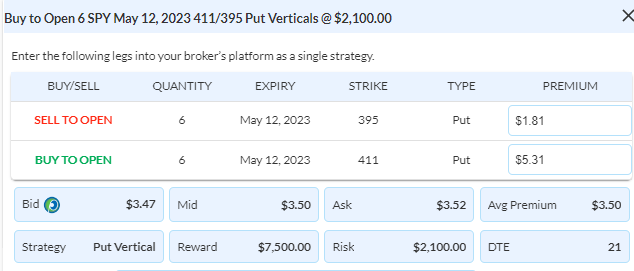

$SPY

DailyPlay – Opening Trade (SPY) – April 21, 2023

SPY Bearish Opening Trade Signal

View SPY Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 6 Contracts May 12th $411/$395 Put Vertical Spreads @ $3.50 Debit per contract.

Total Risk: This trade has a max risk of $2,100 (6 Contracts x $350) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $350 to select the # contracts for your portfolio.

Counter Trend Signal: This stock has traded into an area of resistance and is expected to pull back lower.

1M/6M Trends: Bullish/Bullish

Technical Score: 7/10

OptionsPlay Score: 152

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

TSLA’s numbers and a non-rosy Beige Book report gave no reason for buyers to keep up their bidding on Thursday, and the SPX sold off 25 pts. to end the day at 4130 – precisely 25 pts. beneath the 4155 key resistance from the weekly cloud top that has continually rejected the advance this year.

Two quick things: 1) You should already be out of the long BSX call that expires today. 2) Yesterday the USO trade sold down to where we got in it, which I had said would be our stop-out. So, you should now be flat it. I will watch to see if support holds because I’d lean more on the bullish side than not, and if so, we’ll put another long spread back on next week.

I realized that I didn’t need to look far for a new play today, because it was virtually obvious to me: Let’s bet bearishly on the SPY, until it and the SPX close above their respective weekly cloud tops. (That could happen today, of course, but it seems worth the small risk for a potential reward that is probably 3-4x.)

As such – and with the VIX at 17 – let’s look to buy a SPY May 12th $411/$395 put spread. It went out yesterday at just about $3.50, costing a mere 22% of the strike differential.

SPY – Weekly

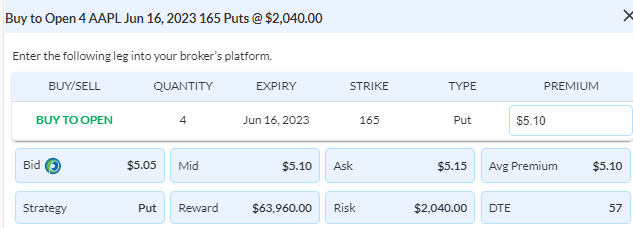

$AAPL

DailyPlay – Opening Trade (AAPL) Closing Trade (BSX) – April 20, 2023

Closing Trade

- BSX – 234.46% Gain: Sell to Close 1 Contract (or 100% of your remaining Contracts) April 21st $48 Calls @ $4.95 Credit. DailyPlay Portfolio: By Closing the remaining 1 Contract, we will receive $495. We took partial profit on March 29 when we closed 4 Contracts @ $1.45 Credit, then on April 6 when we closed 4 Contracts @ $2.83 Credit, then on April 11 when we close 2 Contracts @ $2.45 Credit, and on April 19 when we closed 1 Contract @ $3.65 Credit. Our average cost basis to exit this trade is therefore $2.55 Credit and our average gain on this trade is 72.41%.

AAPL Bearish Opening Trade Signal

View AAPL Trade

Strategy Details

Strategy: Long Put

Direction: Bearish

Details: Buy to Open 4 Contracts June 16th $165 Put @ $5.10 Debit per contract.

Total Risk: This trade has a max risk of $2,040 (4 Contracts x $510) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $510 to select the # contracts for your portfolio.

Counter Trend Signal: This stock has traded into an area of resistance and is expected to pull back lower.

1M/6M Trends: Bullish/Bullish

Technical Score: 8/10

OptionsPlay Score: 80

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

We don’t find an opportunity to trade AAPL based on valuations often, but I find today’s valuation difficult to get behind. Additionally the timing and risk/reward favors adding short exposure going into a tech heavy earnings week.

AAPL has rallied 35% over the past 4 months or so, which pushes its valuation north of 28x 2023FY estimated earnings. This is despite analysts expecting a 2.4% decline in EPS, inline with the S&P 500, but it represents a 55% premium relative to the market. Now, we all expect AAPL to trade at a premium, its profitability and product pipeline deserves it. But in the face of a weakening consumer, it’s hard to get behind a valuation that is priced to perfection.

Additionally, if we look at the Chart, AAPL has largely remained rangebound since the beginning of 2022 and a clear bearish resistance line has formed since. This level was just tested yesterday and I see it as a potential reversal point. We have also seen bearish divergence with MACD over the past 2 months, an additional sign of exhaustion.

As implied volatility (IV) for AAPL approaches 52-week lows, a unique opportunity arises to obtain unlimited downside exposure with a straight put at elevated valuations and against a significant resistance level with merely two weeks until earnings. Consequently, I am considering the purchase of the June $165 puts for $5.10 Debit. This put option entails risking 3% of the stock’s value, as we move into the earnings period in two weeks.

AAPL – Daily

$BSX

DailyPlay – Partial Closing Trade (BSX) – April 19, 2023

Partial Closing Trade

- BSX – 146.62% Gain: Sell to Close 1 Contract (or 50% of your remaining Contracts) April 21st $48 Calls @ $3.65 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 2 Contracts, we will receive $365.

Investment Rationale

Yesterday saw all four major US stock indexes with very minor gains or losses. Notably, however, was that the SPX closed at 4155 – the level of the top of the weekly cloud. Three more trading days in the week: Will it be able to close above it or not? (And if it’s not materially above it, then we’d really need see how next week traded to see if it is a real upside breakout or not.)

Today is the weekly crude oil inventory number at 10:30am ET. If you have any oil-related names, you need to know that this weekly report can and usually does easily move them. For us, we still have on two long USO $71/$77 call spreads (as the remnants of what was originally a long condor spread). We are up 36% on these. If the bid/offer spread comes down to our only being up 25% on them, I want you to remove one of two spreads (and not wait for breakeven as I had suggested yesterday).

USO – Daily

Let’s also take off one of two long BSX $48 calls. We’re up 147% on these and they expire Friday. (We’ll take the other one off tomorrow.)

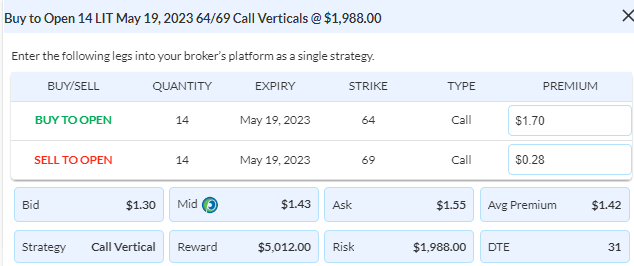

$LIT

DailyPlay – Closing Trade (FSLR) Partial Closing Trade (MCK) – April 18, 2023

Closing Trade

- FSLR – 60.96% Loss: Buy to Close 3 Contracts (or 100% of your Contracts) April 28th $210/$220 Call Vertical Spreads @ $5.73 Debit. DailyPlay Portfolio: By Closing all 3 Contracts, we will be paying $1,719.

Partial Closing Trade

- MCK – 18.24% Gain: Buy to Close 1 Contract (or 25% of your Contracts) May 19th $370/$380 Call Vertical Spreads @ $3.80 Debit. DailyPlay Portfolio: By Closing 1 of the 4 Contracts, we will be paying $380.

LIT Bullish Opening Trade Signal

View LIT Trade

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish

Details: Buy to Open 14 Contracts May 19th $64/$69 Call Vertical Spreads @ $1.43 Debit per contract.

Total Risk: This trade has a max risk of $1,988 (14 Contracts x $142) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $142 to select the # contracts for your portfolio.

Trend Continuation Signal: This stock has recently turned mildly bullish, and is expected to continue this trend.

1M/6M Trends: Mildly Bullish/Bearish

Technical Score: 4/10

OptionsPlay Score: 103

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

A second half of the day rally on Monday gave the SPX a close of 4151 – just four points beneath the key 4155 level that we’ve been focused on for Friday’s close. And the more above it that it hurdles that level, the more you’ll likely see shorts being forced to cover their positions.

Our portfolio positions have mostly done well, as we’ve got a more bullishly skewed one. However, FSLR has moved up sharply the past few days, taking it right back to the top of its range (and with a slightly higher high and the best close of the whole upmove). Let’s look to cover this trade today and take our loss.

FSLR – Daily

With MCK having gotten close or even traded down to the bearish Propulsion Momentum level of $358.68 but not being able to get beneath it, let’s take one 1 of four bearish call spreads off today, and now stop yourself out on the balance if this rallies back up to your entry price being the mid- price of the spread. For us that’s $4.65, but your’s may be different.

MCK – Daily

In our long USO $71/$77 call spread, we have plenty of time till expiration. However, if the mid- price gets back down to our entry price of $1.90, sell one of two remaining spreads. That stop is in effect for any day going forward. Tomorrow is the weekly oil inventory report. An unexpected bullish number could end up crushing shorts.

USO – Daily

Lastly, here’s a new play that I’d more prefer to do as a short put spread than a long call spread, but selling the put spread doesn’t yield enough credit for me to do it (i.e., 35% of the strike differential I was looking at). Therefore, let’s look to get long the LIT May 19th $64/$69 call spread for a cost of $1.43 based on yesterday’s closing mid, representing some 29% of the strike differential. Notice the effectiveness over the past six months on the daily chart of the DeMark 9s and 13s, as well as the recent low right near the bearish Propulsion Momentum level of $60.19 that could not be downside breached.

LIT – Daily