$LYFT

DailyPlay – Opening Trade (LYFT) Partial Closing Trade (BROS) – April 17, 2023

Partial Closing Trade

- BROS – 64.10% Gain: Buy to Close 2 Contracts (or 50% of your remaining Contracts) April 28th $30/$28 Put Vertical Spreads @ $0.28 Debit. DailyPlay Portfolio: By Closing 2 of the remaining 4 Contracts, we will be paying $56.

LYFT Bullish Opening Trade Signal

View LYFT Trade

Strategy Details

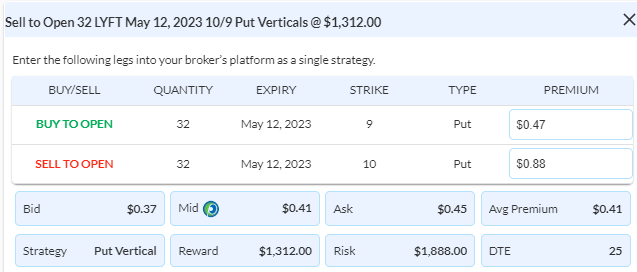

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 32 Contracts May 12th $10/$9 Put Vertical Spreads @ $0.41 Credit per contract.

Total Risk: This trade has a max risk of $1,888 (32 Contracts x $59) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $59 to select the # contracts for your portfolio.

Trend Continuation Signal: This stock has recently turned mildly bullish, which is expected to continue this trend.

1M/6M Trends: Mildly Bullish/Bearish

Technical Score: 3/10

OptionsPlay Score: 92

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

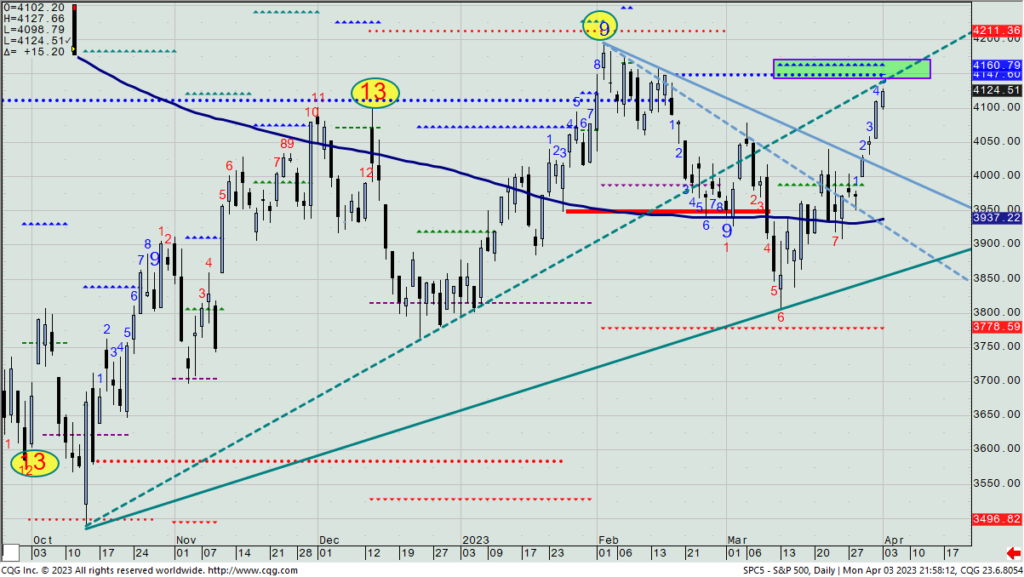

Bulls like that the market continues to hold up in the face of macro news that still isn’t justifiably strong, but that in their opinion, is already “priced in”. Data from the biggest mutual fund managers don’t agree. To me, I can’t pretend that I didn’t see the weekly SPY cloud chart get an upside breach of its cloud last week, but, the SPX did NOT get a similar upside breakout above its weekly cloud top (at 4155 from now through most of May). Seeing the SPX do so this Friday (or in any of the next several Friday closes) has to make me take some degree of bearishness away. That’s the logical way to play the market and this particular indicator. (The Dow has already broken above its weekly cloud top; the QQQ still has a few percent to go to do the same.)

SPY – Weekly

Before I get into any position updates, there is something that I want to tell you that is not a standard option rule, or a Tony rule, but frankly – a Rick “guideline”. It has to do with opening gaps and playing ideas that we put out in Daily Plays. Here’s one that came into play last week, and is an example of a trade that I would not have necessarily entered myself near 10am because the change in the option price by 10am (when we mark our positions) was by 8+ percent lower than where it was on the prior day’s close. Honestly, that’s just above the 7% change in price I’m generally willing to put a trade on from how I first analyzed it the night before.

Now, we are making money on this trade because vol has come lower and the stock price is lower than where we sold this call spread. But be careful putting on spreads where the move is more than about 7% from where it was when I priced the idea. Sometimes, it is better to do the trade at a different time in the day, when price may adjust back more towards the prior day’s closing price. And sometimes, I just won’t put the trade on because the numbers no longer work out for me the way they had the night before, making, for example, perhaps a lesser percent of strike differential than I’m willing to accept.

Position-wise, we are long 2 BSX $48 calls that expire on Friday. The stock closed last Friday at $51.77, and we are up 157% on the two calls we have left. If any day this week, that premium percentage comes down to close less than 125%, exit the two calls. If not, we’ll try to hold this till Thursday.

We’re still short 4 BROS April 28th $30/$28 put spreads. When I put the trade on, the upside target I had in mind was the TDST line at $33.60, which has now been near two daily highs since then. As such, let’s take 2 of 4 spreads off today, giving us the flexibility to play with the last two but locking in a 64% gain on these two.

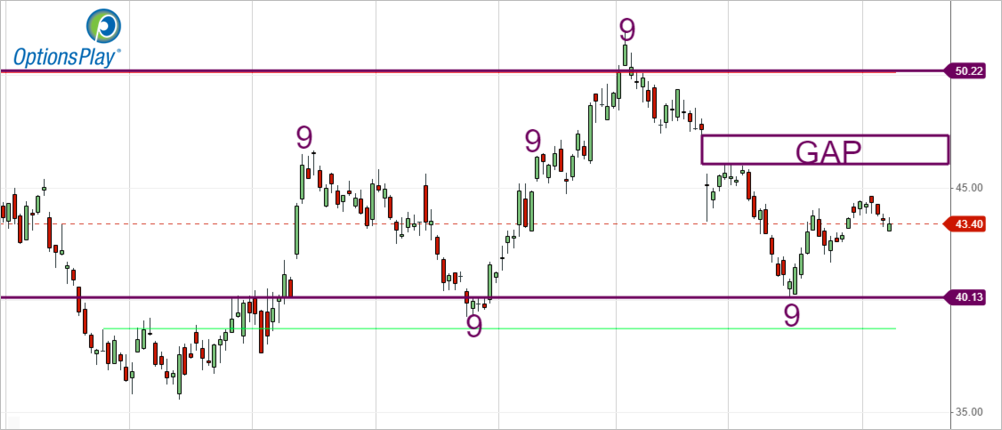

BROS – Daily

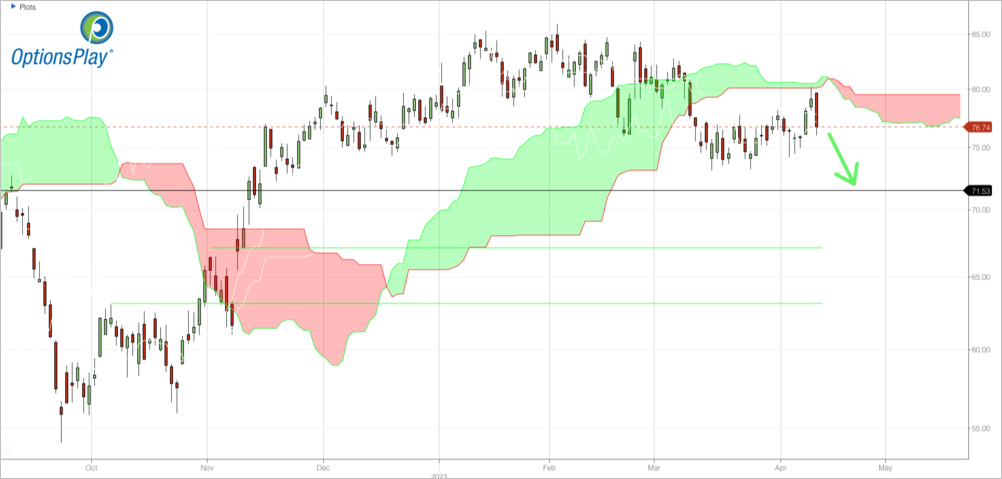

Lastly, for a new play, let’s revisit the bullish LYFT idea we had played earlier this year. With the stock two weeks ago again having bounced right on the -13s Risk level ($8.63), let’s look to this time to sell the May 12th $10/$9 put spread. (Earnings do come out on May 2nd.) We can collect $0.41 on this, which is 41% of the strike differential, and effectively brings our cost down to $9.59 if exercised. We know that we don’t want to be long on Friday closes beneath $8.63.

LYFT – Weekly

$MDT

DailyPlay – Opening Trade ( MDT) – April 14, 2023

MDT Bullish Opening Trade Signal

View MDT Trade

Strategy Details

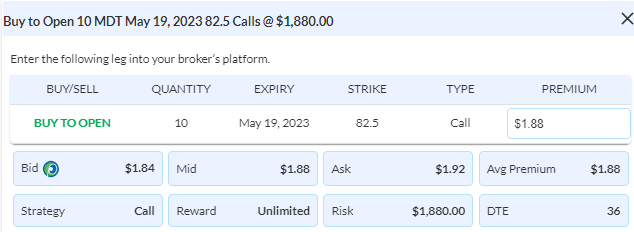

Strategy: Long Call

Direction: Bullish

Details: Buy to Open 10 Contracts May 19th $82.50 Calls @ $1.88 Debit per contract.

Total Risk: This trade has a max risk of $1,880 (10 Contracts x $188) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $188 to select the # contracts for your portfolio.

Trend Continuation Signal: This stock has recently turned bullish and a continued bounce higher is expected.

1M/6M Trends: Bullish/Mildly Bullish

Technical Score: 5/10

OptionsPlay Score: 76

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

With better-than-expected PPI numbers yesterday, the SPX surged higher and is now playing with a potential qualified upside breakout on a close above 4155 today. That level is 7 points above the bullish Propulsion Momentum level, as well as being the top of the weekly cloud. Doing so would set up next week to confirm the move, which would start by needing to see a higher open on Monday/a higher intra-week high sometime next week vs. this week’s high/and a Friday close next week above today’s close. Seeing that ups the odds for a move to fill the gap just north of 4200, and could then potentially get more follow-through buying as shorts get squeezed out (simply adding to the buying scenario).

With yesterday seeing PLNT up on the day going into the close, we did NOT enter Thursday’s Daily Play trade. The idea is canceled.

Here’s a new idea for today: Let’s get long the Medtronic (MDT) May 19th $82.5 call, which went out at $1.88 last night. (Based on the chart below, I would have bought the $82.5/$92.5 call spread, but selling that $92.5 only takes in 4 cents. It’s not worth it to cap the trade for that.) So, let’s just buy the call, given the trend line breakout against multiple prior lows.

MDT – Weekly

You know that I don’t like buying calls on a Friday, but if the SPX moves higher tomorrow, then I think it pays to lose the theta over the weekend and get long today.

$PLNT

DailyPlay – Closing Trades (ARCH, EBAY) Partial Closing Trade (BROS) – April 13, 2023

Closing Trades

- ARCH – 76.62% Loss: Buy to Close 3 Contracts (or 100% of your remaining Contracts) April 21st $135/$130 Put Vertical Spreads @ $3.45 Debit. DailyPlay Portfolio: By Closing the remaining 3 Contracts, we will pay $1,035. We partially closed this trade on April 11 when we closed 3 of the 6 contracts @ $3.15 Debit. Our average cost basis to exit this trade is therefore $3.30 Debit and our average loss on this trade is 68.94%.

- EBAY – 52.60% Loss: Sell to Close 3 Contracts (or 100% of your remaining Contracts) April 21st Call Vertical Spreads @ $0.91 Credit. DailyPlay Portfolio: By Closing the remaining 3 Contracts, we will receive $273. We partially closed this trade on April 4 when we closed 1 of the 6 contracts @ $2.14 Credit. Then again on April 11 when we closed 2 contracts @ $1.42 Credit. Our average cost basis to exit this trade is therefore $1.29 Credit and our average loss on this trade is 32.64%.

Partial Closing Trade

- BROS – 61.540% Gain: Buy to Close 5 Contracts (or 55% of your remaining Contracts) April 28th $30/$28 Put Vertical Spreads @ $0.30 Debit. DailyPlay Portfolio: By Closing 5 of the remaining 9 Contracts, we will be paying $150.

PLNT Bearish Opening Trade Signal

View PLNT Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 6 Contracts May 19th $77.50/$82.50 Call Vertical Spreads @ $2.00 Credit per contract.

Total Risk: his trade has a max risk of $1,800 (6 Contracts x $300) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $300 to select the # contracts for your portfolio.

Trend Continuation Signal: This stock is trading sideways to bearish, and we expect that it would not turn bullish over the duration of this trade.

1M/6M Trends: Neutral/Neutral

Technical Score: 9/10

OptionsPlay Score: 105

Condition: If the stock is trading lower at the end of today.

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. As this is a Conditional trade, the prices of this trade will be slightly different from what we list in this email.

Investment Rationale

Stocks see-sawed throughout most of yesterday’s session, but in the end, all four major US indexes fell, with the SPX down 17 pts. to 4092. The Nasdaq’s loss was its 6th in the past 7 sessions, and the Info Technology sector continues to underperform this month after having rocked higher in the first quarter. (I mentioned right at the start of this month that I believed that Tech would not hold up like it had vs. the SPX.)

I generally like to see a big data day like yesterday give us a better clue as to what we might expect over the short-term, but we didn’t get any real clarity to the next bigger move. With two trading days left for this week, a Friday close north of 4155 would likely lead to more gains – most especially if next week would also open higher on Monday/trade higher than this week’s high/close above this Friday’s close. A strong decline from today and tomorrow would be mildly bearish. Barring either of these two scenarios panning out, then we haven’t really learned much at all this week.

I don’t like the way both EBAY and ARCH are trading for our long spread positions. Let’s exit each of the last three spreads today in both names. Let’s also take off 5 of 9 BROS short put spreads as yesterday was the second time that the daily TDST line was the high in the past week.

BROS – Daily

Here’s a new idea on a consumer discretionary name that looks like it’s having trouble holding its recent rally. Planet Fitness (PLNT) just failed at its cloud, and it is just barely having its Lagging Line come out through the bottom of its cloud. A rally today would stop that Lagging Line break, but IF going into today’s close the stock is down on the day, let’s then sell a May 19th $77.5/$82.5 call spread. Yesterday this went out at $2, or 40% of the strike differential. It wouldn’t surprise me to see this get down to $71.50.

PLNT – Daily

$AKAM, $ADM, $CLX, $BROS

DailyPlay – Closing Trades (AKAM, ADM) Partial Closing Trades (CLX, BROS) – April 12, 2023

Closing Trades

- AKAM – 100% Gain: Sell to Close 2 Contracts (or 100% of your remaining Contracts) April 21st $75/$82.50 Call Vertical Spreads @ $5.45 Credit. DailyPlay Portfolio: By Closing the final 2 Contracts, we will receive $1,090. We partially closed this trade on March 29 when we closed 2 of the 4 contracts @ $2.68 Credit. Our average cost basis to exit this trade is therefore $4.07 Credit and our average gain on this trade is 49.27%.

- ADM – 92.63% Gain: Buy to Close 6 Contracts (or 100% of your remaining Contracts) April 21st $77.50/$75 Put Vertical Spreads @ $0.07 Debit. DailyPlay Portfolio: By Closing the final 6 Contracts, we will be paying $42. We partially closed this trade on March 30 when we closed 4 contracts @ $0.58 Debit, then again on April 4 when we closed 2 contracts @ $0.30 Debit, then on April 5 when we closed another 2 contracts @ $0.40 Debit. Our average cost basis to exit this trade is therefore $0.30 Debit and our average gain on this trade is 68.87%.

Partial Closing Trades

- CLX – 82.88% Loss: Sell to Close 3 Contracts (or 50% of your remaining Contracts) Apr 21st $155/$145 Put Vertical Spreads @ $0.50 Credit. DailyPlay Portfolio: By Closing 3 of the remaining 6 Contracts, we will receive $150. Please remember to close the final 3 Contracts, as described below.

- BROS – 64.10% Gain: Buy to Close 3 Contracts (or 25% of your Contracts) April 28th $30/$28 Put Vertical Spreads @ $0.28 Debit. DailyPlay Portfolio: By Closing 3 of the remaining 12 Contracts, we will be paying $84.

Investment Rationale

As traders were awaiting today’s CPI number and FOMC minutes, they were pretty sleep on Tuesday, as the SPX closed flat on the day, the NDX closed down again (that’s 5 of the last 6 sessions), and the Dow finished up by 30 bps. If you’re a bull, at least the NDX has traded and held the daily Conversion Line (in magenta) for the past three days.

NDX – Daily

With those key economic data points coming out today, I’m not going to put a new trade on this morning. (I like to put trades on when I think we have an edge, and there’s no way we can know which way to play today until both CPI (8:30am ET) and the FOMC minutes (2pm ET) are released.

I do want to exit the CLX trade – not because its price has moved well away from us – but because too much time is passing and expiration is coming closer and closer (i.e., a week from Friday) without it getting itself into-the-money. Personally, what I would do is exit 3 of the 6 this morning, and unless the market is getting sharply knocked to the downside after the FOMC figures come out, exit the other 3 by the close. (As of yesterday’s close, we are down 83% on these remaining 6 contracts.

But with bad comes some good: Our long AKAM call spread is up 100% on the last two we have on. Let’s take that off today and pocket that solid gain.

We are also having a good time of it with our short ADM put spread. With 10 days to go, we are up 93%. Let’s say goodbye to that trade today, too.

We are also up 64% on our short BROS put spread, expiring in 17 days. We’ve got 12 of these on, so let’s cut that down to 9 today. Moreover, should we see the stock trade up to $35.50 +/- 30 cents any day this week, take another 2 more off.

Lastly, our OP team generally marks the pricing of our “cost basis” in the portfolio from option prices at about 10am ET each day. You may or may not have that price as your actual debit paid or credit received on any given trade. It all depends what time of day you actually put the trade on. So, I use it as a guide for my follow-up recommendations, but you may have a better or worse price that you are really working with.

$USO, $BSX, $ARCH, $EBAY

DailyPlay – Partial Closing Trades (BSX, ARCH, EBAY, USO) – April 11, 2023

Partial Closing Trades

- BSX – 65.54% Gain: Sell to Close 2 Contracts (or 50% of your remaining Contracts) April 21st $48 Calls @ $2.45 Credit. DailyPlay Portfolio: By Closing 2 of the remaining 4 Contracts, we will receive $490.

- ARCH – 61.26% Loss: Buy to Close 3 Contracts (or 50% of your Contracts) April 21st $135/$130 Put Vertical Spreads @ $3.15 Debit. DailyPlay Portfolio: By Closing 3 of the 6 Contracts, we will pay $945.

- EBAY – 26.04% Loss: Sell to Close 2 Contracts (or 40% of your remaining Contracts) April 21st Call Vertical Spreads @ $1.42 Credit. DailyPlay Portfolio: By Closing 2 of the remaining 5 Contracts, we will receive $284.

- USO – 26.84% Gain: Sell to Close 1 Contract (or 1/3% of your remaining Contracts) Jul 21, 2023 $71/$77 Call Verticals @ $2.41 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 3 Contracts, we will receive $241.

Investment Rationale

Stocks opened lower yesterday on lower-than-expected Apple Mac sales figures, but the SPX bottomed by 10am and then trended higher the rest of the day, running into positive territory just minutes before the close. (That late surge might be the result of the influence of 0DTE options.) Nothing has changed from Monday’s action though: the market is still in a trading range, but I’m sensing a nearing change to that ennui coming sooner rather than later.

SPX – Daily

BSX posted a daily Setup +9 count yesterday, its first one in 5 months. We’re still long four $48 calls, up 65% on them. Let’s take 2 of 4 off today, and also raise your sell-stop on the last 2 to exit them if the option price falls to $2. (It’s possible this all happens today.)

BSX – Daily

ARCH has fallen beneath our lower strike price in our short put spread. As such, let’s exit 3 of 6 short $135/$130 put spreads we have on.

ARCH – Daily

We’re long 5 EBAY $42.5/$47.5 call spreads from $1.92. We’re down 26% on them even though the stock is higher than when we got in. (That’s classic theta decay, as we only have 10 DTE. Let’s exit 2 of them today to reduce the loss.

EBAY – Daily

We’re still long 3 USO call spreads that were part of a larger long iron condor trade we previously had on (and then removed the long put spread portion). We’re up 27% on this, and with the stock having stopped 5 days in a row at the 200-DMA and the TDST line, let’s take off one of these today.

USO – Daily

$MCK

DailyPlay – Opening Trade (MCK) – April 10, 2023

MCK Bearish Opening Trade Signal

View MCK Trade

Strategy Details

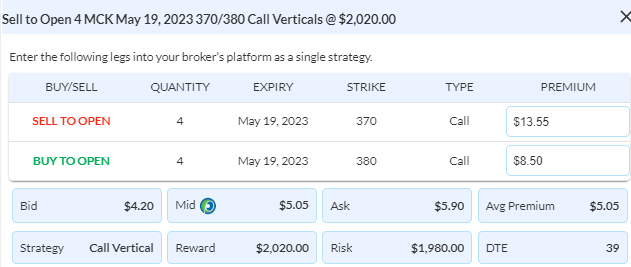

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 4 Contracts May 19th $370/$380 Call Vertical Spreads @ $5.05 Credit per contract.

Total Risk: This trade has a max risk of $1,980 (4 Contracts x $495) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $495 to select the # contracts for your portfolio.

Counter Trend Signal: This stock has rallied to a level of resistance and is expected to pull back lower.

1M/6M Trends: Bullish/Bullish

Technical Score: 8/10

OptionsPlay Score: 115

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

The weekly “doji” candles (i.e., weekly open and close virtually the same) last week in the SPY and QQQ both came up against resistance, and could be foretelling if this week opens near its high and closes near its low (on a decent down week), as that would create an “evening star” pattern that is not only usually bearish, but could easily become the last high of the 6-month rally and start a downmove to test last year’s lows. On the flip side, a close this week above SPX 4155 would be bullish, if we see follow-through next week. Put these two opposite scenarios together, and I think we are shortly to see a decent directional move that changes the landscape we’ve seen so far in 2023.

If I am right, one way to play this idea is by buying volatility in the SPY or QQQ. Both are relatively inexpensive relative to what we’ve seen this year. Potential plays can be going long straddles, strangles, or even iron condors.

When it comes to looking at the option board on the VIX itself, look at the massive skew that ATM calls have relative to ATM puts (going out 37 days). The price differential is significant.

Let’s look at the stock chart of McKesson Corp. (MCK). Price has surged recently from a daily -13 bottom to now having reached a Setup +9 potential near-term top.

MCK – Daily

With calls priced quite high, let’s look to sell a May 19th $370/$380 call spread. It closed at $5.05 mid on Friday, representing almost 51% of the $10 strike differential. Earnings come out on May 8th, so we will be out by then. But frankly, collecting 50% into resistance from both the early-Feb. breakdown area and the downtrend from all-time highs seems like a bet worth taking.

$BSX

DailyPlay – Partial Closing Trade (BSX) – April 6

Partial Closing Trade

- BSX – 91.22% Gain: Sell to Close 4 Contracts (or 50% of your remaining Contracts) April 21st $48 Calls @ $2.83 Credit. DailyPlay Portfolio: By Closing 4 of the 8 Contracts, we will receive $1,200.

Investment Rationale

Stocks saw losses yesterday as we are seeing upped concerns regarding a slowing of the economy and increased wages that we see another quarter-point rate hike at the Fed’s next meeting in May. A quick look at the SPX’s daily chart shows the general struggle to maintain rallies above the 4100 area.

SPX – Daily

As we head into the holiday-shortened last trading session of the week, S&P futures are pretty flat, and today will likely be a relatively quiet session. Many trading desks will be lighter-staffed today, and I’d not expect any real fireworks to occur. Tomorrow is the big labor report, and we’ll be able to see how the futures react to the employment number, but you won’t be able to trade your option positions on it till Monday. Think about that if there’s anything you want to do today because of that.

Our long BSX $48 call is now up 91%. Let’s remove 4 of 8 today to lock that nice gain in.

BSX – Daily

That’s it for this week. Enjoy the long holiday weekend with family and friends.

$FSLR

DailyPlay – Opening Trade (FSLR) Closing Trade (TLT) Partial Closing Trade (ADM) – April 5, 2022

Closing Trade

- TLT – 10.16% Loss: Sell to Close 1 Contract (or 100% of your remaining Contracts) April 6th $104.50/$114 Call Vertical Spreads @ $2.74 Credit. DailyPlay Portfolio: By Closing the remaining Contract, we will receive $274. We partially closed this trade on March 28 @ $1.20 Credit when we closed 2 contracts, then on March 31 @ $0.89 Credit when we closed another 2 contracts, on April 4 @ $2.28 when we closed 1 contract. Our average cost basis for exiting this trade is therefore $1.53 Credit and our average loss on this trade is 49.7%.

Partial Closing Trade

- ADM – 57.89% Gain: Buy to Close 2 Contracts (or 25% of your remaining Contracts) April 21st $77.50/$75 Put Vertical Spreads @ $0.40 Debit. DailyPlay Portfolio: By Closing 2 of the 8 Contracts, we will be paying $80.

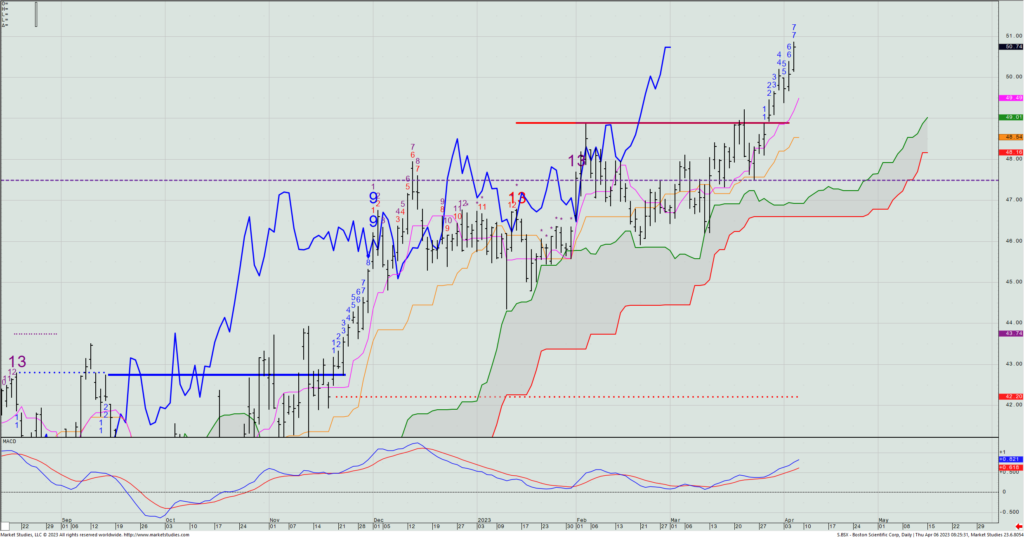

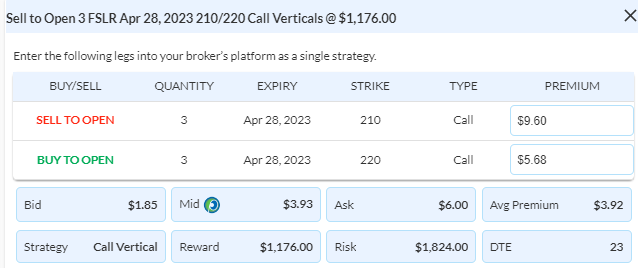

FSLR Bearish Opening Trade Signal

View FSLR Trade

Strategy Details

Strategy: Short Call Vertical Spread

Direction: Bearish

Details: Sell to Open 3 Contracts April 28th $210/$220 Call Vertical Spreads @ $3.93 Credit per contract.

Total Risk: This trade has a max risk of $1,824 (3 Contracts x $608) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $608 to select the # contracts for your portfolio.

Counter Trend Signal: This stock has rallied to a level of resistance and is expected to pull back lower.

1M/6M Trends: Neutral/Bullish

Technical Score: 10/10

OptionsPlay Score: 101

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

“Clear sailing ahead” can get muddied quickly, and yesterday was a perfect example of just that. The SPX peaked 30 minutes into the session, and it was straight down till just after 12pm ET, when they traded in a range for the balance of the day. The SPX lost 58 bps.; the NDX dropped 37 bps.; the Dow 59 bps; and the Russell a far more significant 175 bps. (Renewed fears of recession hit the little stocks the most.)

As the SPX had been nearing the important resistance zone from ~4150 to 4215, I had lightened up a bunch of exposure yesterday morning, just knowing that this key index was getting close to the top end of its 2023 trading range. And as I said in my free weekly In The Know Trader video I posted yesterday on YouTube (https://www.youtube.com/watch?v=TQH-DmZH54U), “Do What Works Until it Doesn’t”. In this case, lighten exposure on rallies to the top end of the trading range; add exposure at the bottom end. This is precisely what we have done this year, and this is in complete contrast to what has been so many other strategists’ theme in ‘23 of the bulls buying strength and the bears selling weakness.

Before I get to adjusting our positions, let me remind you that I make it a standard personal rule to not let winning trades turn into losers. That doesn’t mean that if an option position is quickly up 5%-10% I might not let it still play out, even if it then goes against me. But if I’m up 25% to 50% on a position, and then the profit goes away, so do I (i.e., I close the position). That means, you need be on your toes for our long IWM trade (entry was $173.85 and the stock closed yesterday only $1.50 higher); and our AKAM trade is now up 15%, so keep an eye on that, too. We’ll be getting out of either/both if our profit erodes down to breakeven.

Next, let’s talk about our long TLT trade that goes off the board on Thursday. We paid $3.05 for a long $104.5/$114 call spread. The ETF is trading at $107.13 as of yesterday’s close, and we’re still down on the trade because too much time past before Mr. TLT got the wax out of his ear to listen to me egging him on to trade higher. He finally got the message, but too little, too late. We have only one spread left, so just make sure you are out of it by Thursday’s close.

Next up: ADM. We’re got on a nice short put trade to the tune of a 58% profit on the remaining 8 spreads. We’ll take two more off today, and on any day that our P&L drops to less than a 50% gain going into the close, we’ll exit another 2 more.

With today being the next to last trading day of the week before a 3-day weekend, you can bet that I won’t be putting on any new long option trades now – whether they be puts or calls. Too much can happen over a long holiday weekend, and why buy something now that loses three days of theta so soon? But here’s a spread I’m willing to sell: the First Solar (FSLR) April 28th $210/$220 call spread. Yesterday it went out at $3.925, or 39% of the spread differential.

FSLR – Weekly

Notice that the close of the massive rally week in February was at $210.11. Not only is price underneath that now, but it only once progressed past that Friday close since then (i.e., last week), and 3 of the 4 prior weekly highs are all between $215 and $220. The longer this doesn’t trade higher, the more it shows some real institutional selling, and the odds increase for a pullback down to the target area I’ve highlighted in the yellow rectangle. Earnings come out one day before the April 28th expiration, so we will be out of this before that report comes out late this month.

$ARCH

DailyPlay – Opening Trade (ARCH) Partial Closing Trades (TLT, ADM, EBAY, BROS) – April 4, 2023

Partial Closing Trades

- TLT – 25.25% Loss: Sell to Close 1 Contract (or 50% of your remaining Contracts) April 6th $104.50/$114 Call Vertical Spreads @ $2.28 Credit. DailyPlay Portfolio: By Closing 1 of the remaining 2 Contracts, we will receive $228.

- ADM – 68.42% Gain: Buy to Close 2 Contracts (or 20% of your remaining Contracts) April 21st $77.50/$75 Put Vertical Spreads @ $0.30 Debit. DailyPlay Portfolio: By Closing 2 of the 10 Contracts, we will be paying $60.

- EBAY – 14.06% Gain: Sell to Close 1 Contract (or 15% of your Contracts) April 21st Call Vertical Spreads @ $2.14 Credit. DailyPlay Portfolio: By Closing 1 of the 6 Contracts, we will receive $214.

- BROS – 38.46% Gain: Buy to Close 4 Contracts (or 25% of your Contracts) April 28th $30/$28 Put Vertical Spreads @ $0.48 Debit. DailyPlay Portfolio: By Closing 4 of the 16 Contracts, we will receive $192.

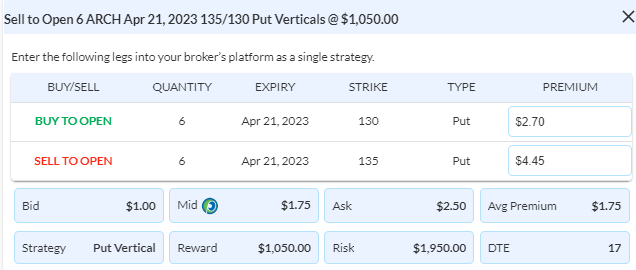

ARCH Bullish Opening Trade Signal

View ARCH Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 6 Contracts April 21st $135/$130 Put Vertical Spreads @ $1.75 Credit per contract.

Total Risk: This trade has a max risk of $1,950 (6 Contracts x $325) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $325 to select the # contracts for your portfolio.

Counter Trend Signal: This stock has been trading lower but is expected to respect support at this level.

1M/6M Trends: Bearish/Mildly Bearish

Technical Score: 6/10

OptionsPlay Score: 88

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks generally moved higher on Monday – though not the NDX. The SPX marked its highest close since mid- February as buyers are still in near-term control. In yesterday morning’s webinar, I mentioned that the important SPX resistance is ~4148 to 4215. With yesterday marking a Setup +6 count, we may see a move up into that zone the balance of this week, possibly culminating in a Setup +9 count on Thursday. (Don’t forget that the market is closed on Friday for Good Friday.)

SPX – Daily

I have built a predominantly long portfolio for us in anticipation of the current upmove that started from the failure to break the weekly bearish Propulsion Momentum level at 3864. As we start getting to the above-mentioned top of trading range resistance zone, we will be trimming most of those longs. We’ll start with the following today:

- TLT: Exit 1 of 2 long call spreads today. We’re down 25% and this expires on Thursday. Theta is hurting us. (The long TLT idea was right; the timing of entry was not.)

- ADM: Exit 2 of 10 short put spreads today. We’re up 68%.

- EBAY: Exit 1 of 6 long call spreads today. We’re up 14%.

- BROS: Exit 4 of 16 short put spreads. We’re up 38%.

Here’s a new idea to put on today (or any day this week that ARCH trades near $135. (It closed yesterday at $136.11.) To me, this chart looks like it’s done the work that it needed to at the bottom end of the range, and it continues to find support there. With earnings on April 25th, we’d have to use the April 21 expiration. The $135/$130 put spread went out at $1.75 yesterday – about 35% of the strike differential. Though I usually like to capture some 40% or more of the diff, this is a short-term play that the stock won’t likely trade much lower before earnings – giving us the chance to capture the bulk of the premium (and the theta component should largely come into play starting mid- to late- next week).

ARCH – Daily

$USO

DailyPlay – Partial Closing Trade (USO) – April 3, 2023

Investment Rationale

The quarter finished strong, and the SPX is within striking distance of the 2023 highs, less than 100 pts. away. Tech, which was the biggest sector gainer this year, is, in my opinion, due to not materially increase in relative performance in the near-future, most likely resting now after outperforming in Q1 by over 13.5%.

There was a news headline over the weekend, with OPEC cutting production more than expected. Crude oil quickly traded up over $6 last night, and I think this is the catalyst that will cement the recent low in oil near $65. That mid-March decline did NOT see open interest fall on (meaning longs were not forced out and that shorts did not cover), and what it does mean to me is that I want to remove the long put spread in our long USO condor spread, leaving us with just the long $71/$77 call spread. I think that shorts are going to get squeezed out, and given that the US government didn’t actually buy more oil under $70 (as they indicated they would) to replenish the Strategic Petroleum Reserve – they too will feel the pain of not having purchased when the opportunity came.

I’ve just looked at 9 different trade ideas in the past hour that I am willing to do based upon chart signals. Not a single one of them has a call debit spread priced at less than 38% of the strike differential, nor a put credit spread priced at more than 30% of the strike diff. It makes it virtually impossible to recommend a trade with options priced as they are right now. I know enough not to push things when there’s no edge to putting these trades on. As such, I am not going to give you a new trade idea today. (That’s me watching out for you.)