$QQQ, $TLT

DailyPlay – Closing Trade (QQQ) Partial Closing Trade (TLT) – March 31, 2023

Closing Trade

- QQQ – 64% Loss: Buy to Close 8 Contracts (or 100% of your Contracts) April 14th $309/$315 Call Vertical Spreads @ $4.10 Debit. DailyPlay Portfolio: By Closing all 8 Contracts, we will be paying $3,280.

Partial Closing Trade

- TLT – 70.82% Loss: Sell to Close 2 Contracts (or 50% of your remaining Contracts) April 6th $104.50/$114 Call Vertical Spreads @ $0.89 Credit. DailyPlay Portfolio: By Closing 2 of the remaining 4 Contracts, we will receive $178.

Investment Rationale

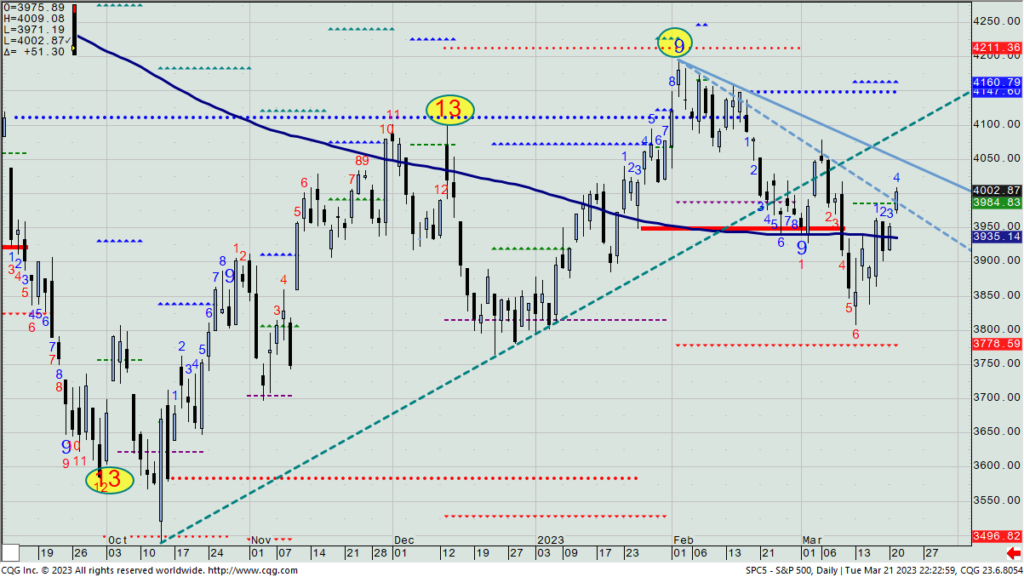

Stocks head into today’s end of week/month/quarter session with bulls controlling recent action, as banking crisis fears have dramatically decreased, and the bounce from the lower end of the 2023 trading range keeps bidders using minor weakness to buy more stock – whether new purchases or the covering of short positions. In fact, yesterday’s price action clinched a new bullish Propulsion Momentum signal for the SPX, with it targeting an upmove to the 4150 area – which unrelatedly happens to be the top of the trading range, anyway. I look for today and Monday to have some upped volatility – not only from today’s weekly option expiration, but also from new monthly and quarterly re-allocations.

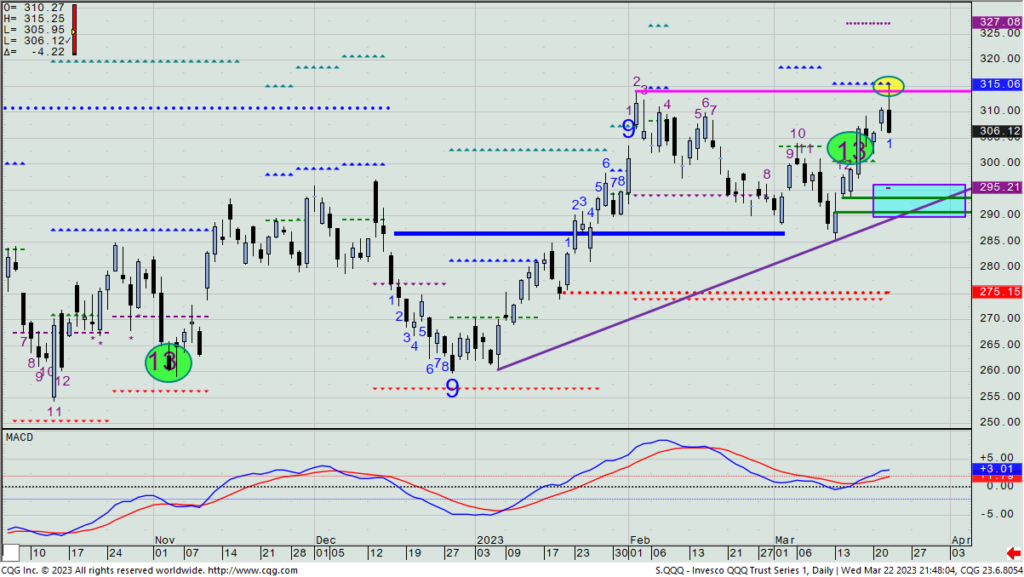

Late yesterday the QQQ was trading north of the $315.25 level – with my previously having stated that a close above that price was our exit signal to our bearish QQQ short call spread. We are out and lost 64%.

I also want to lighten our long TLT trade, as we only have until a week from today for this long call spread to work. Take off 2 of the remaining 4 spreads today.

I have just spent some 90 minutes looking for a new idea for today, and I don’t find anything that I want to do that also has the options priced fairly. As such, I won’t add a position today, and we’ll see how things pan out over the weekend for new ideas come Monday.

$ADM

DailyPlay – Partial Closing Trade (ADM) – March 30, 2023

Partial Closing Trade

- ADM – 38.95% Gain: Buy to Close 4 Contracts (or 30% of your Contracts) April 21st $77.50/$75 Put Vertical Spreads @ $0.58 Debit. DailyPlay Portfolio: By Closing 4 of the 14 Contracts, we will be paying $232.

Investment Rationale

Stocks rose along with the Regional Bank Index (KBE) rising 0.6%, giving investors a sense that the worst is over from the potentially short-lived banking crisis earlier this month. The SPX gained 1.4%, while the NDX added 1.9% and the Russell 2000 tagged on 1.1%. All 11 sectors were higher, led by REITs and Technology. Health Care was again the laggard, as it has been so often this year.

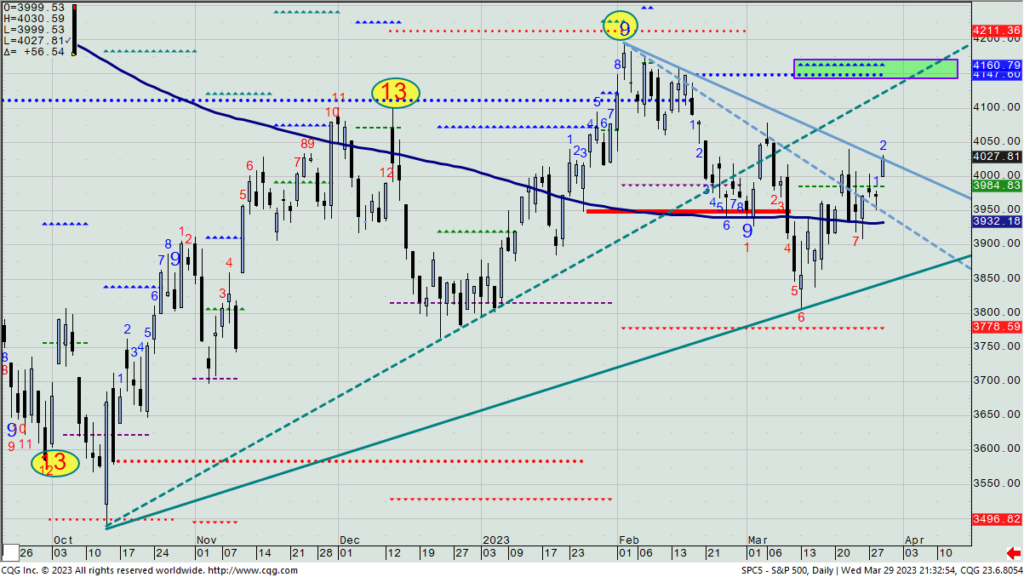

The SPX closed right on its downtrend line from the early Feb. high. A push through it should lead to additional follow-through buying, likely pushing the index back to right near that Feb. high. (Notice the two unrelated targets at 4148 and 4161 in the green rectangle.)

SPX – Daily

Moreover, with Tuesday having been a down close and yesterday and up one above the bullish Propulsion Momentum level (3985), a higher open/higher high/higher close today (vs. yesterday) confirms this signal with a 4161 target.

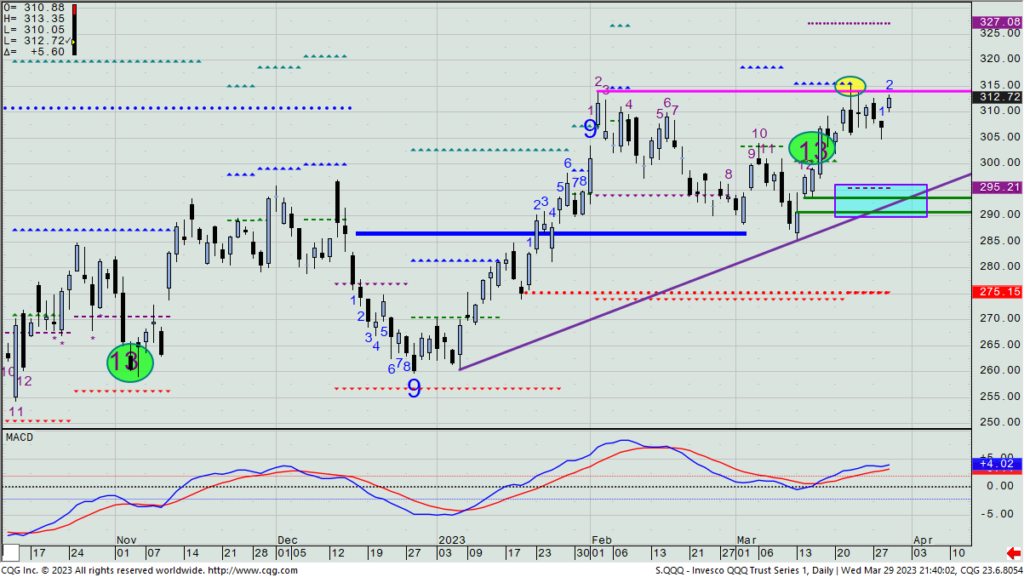

We are long IWM as a hedge vs. our bearish QQQ trade. I have previously stated that a QQQ close above $315.25 (today or any other day) will have us exit the short call spread we have on. So, watch for that to potentially occur any day now.

QQQ – Daily

We’re short 14 ADM April 21st $77.5/$75 put spreads. Price is virtually on the minor downtrend line, but also close to getting a real upside breakout, too. As such, let’s just be smart and remove 4 of the 14 put spreads today to lock in the 39% profit we have on a portion of our position.

ADM – Daily

$BROS

DailyPlay – Opening Trade (BROS) Closing Trade (LYFT) Partial Closing Trades (AKAM, BSX) – March 29, 2023

Closing Trade

- LYFT – 19.40% Gain: Buy to Close 1 Contract (or 100% of your remaining Contracts) April 14th $9 Put @ $0.54 Debit. DailyPlay Portfolio: By Closing the remaining 1 Contract, we will be paying $54. We partially closed this trade on March 24 @ $0.30 Debit when we closed 50% of the contracts. Our average cost basis for exiting the trade is, therefore $42 and our average gain on this trade is 37.31%.

Partial Closing Trades

- AKAM – 1.47% Loss: Sell to Close 2 Contracts (or 50% of your Contracts) April 21st $75/$82.50 Call Vertical Spreads @ $2.68 Credit. DailyPlay Portfolio: By Closing 2 of the 4 Contracts, we will receive $536.

- BSX – 2.03% Loss: Sell to Close 4 Contracts (or 1/3 of your Contracts) April 21st $48 Calls @ $1.45 Credit. DailyPlay Portfolio: By Closing 4 of the 12 Contracts, we will receive $580.

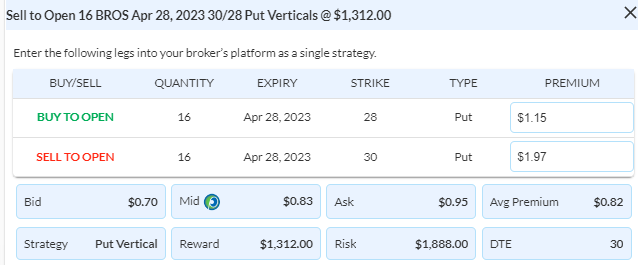

BROS Bullish Opening Trade Signal

View BROS Trade

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 16 Contracts April 28th $30/$28 Put Vertical Spreads @ $0.83 Credit per contract.

Total Risk: This trade has a max risk of $1,888 (16 Contracts x $118) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $118 to select the # contracts for your portfolio.

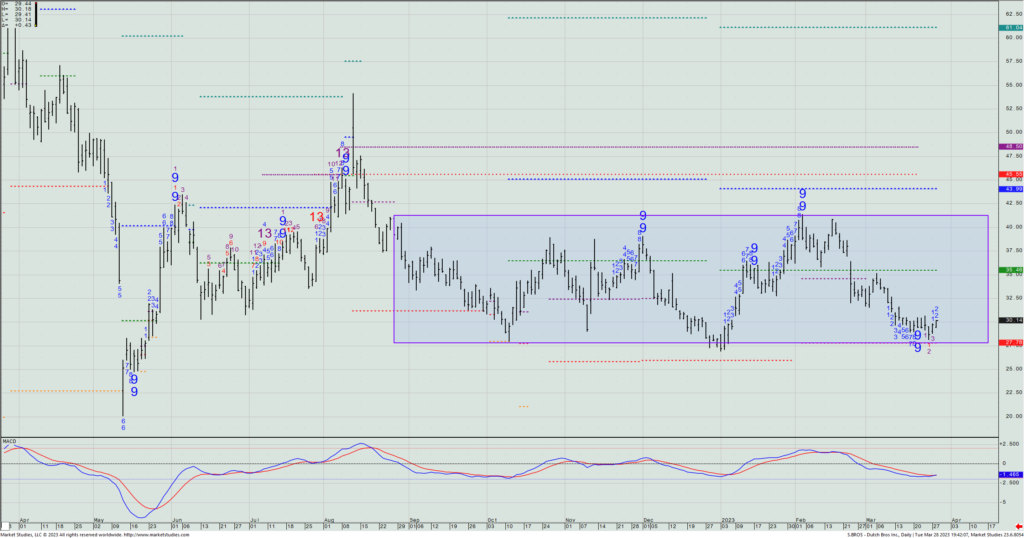

Counter Trend Signal: This stock has been trading lower but is expected to bounce higher off support at the bottom of its trading range.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 92

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

A small downward session for the SPX and Dow on Tuesday, though again, the tech laden NDX was off 3x what the SPX was. The confirmed bulls and bears are still boxing it out with each other, but there’s not yet a winner. I’ll continue to play the index trading ranges until I see something different occur.

Portfolio-wise, I see that LYFT sold off sharply this week, and although we had already bought back one of two short $9 puts for a nice profit, let’s exit the other one (+19%) before it goes against us. (The stock closed at $8.87 yesterday.) I might very well get back into selling puts next week, potentially at a lower price and strike.

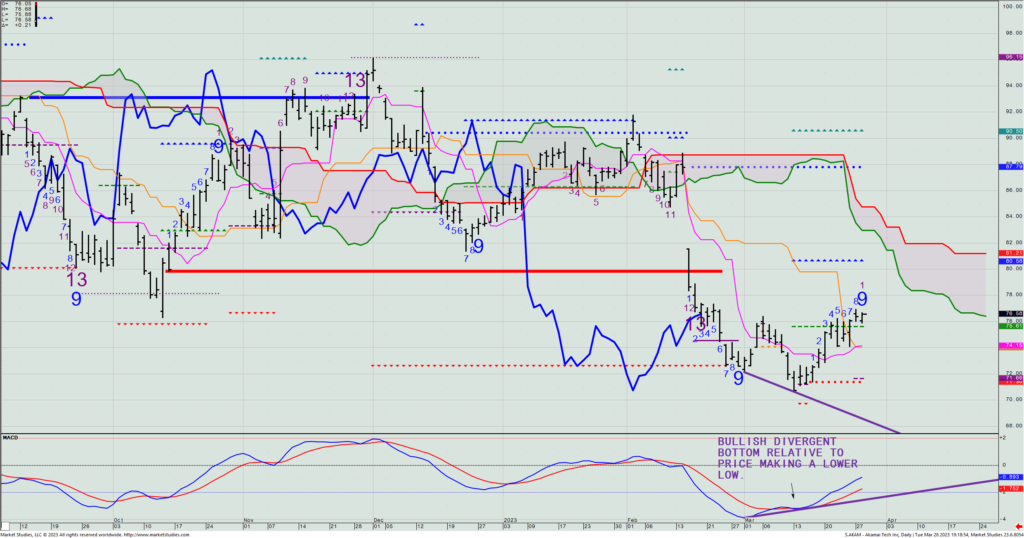

LYFT – Weekly

With our long AKAM April 21st $75/$82.5 call spread, we are basically even on the trade, with the stock up a bit from where we got in, but time having passed has cost us theta erosion. The stock has a daily Setup +9 count, but at the same time, a higher open today that also intraday takes out yesterday’s high and also closes up on the day produces a new bullish Propulsion Momentum signal – with a $80.55 target. Therefore, we will reduce our position down to only two call spreads IF A) the stock doesn’t open higher today, or B) if it does open higher but is down on the day going into the close. In either of those two cases, we will exit two call spreads today.

AKAM – Daily

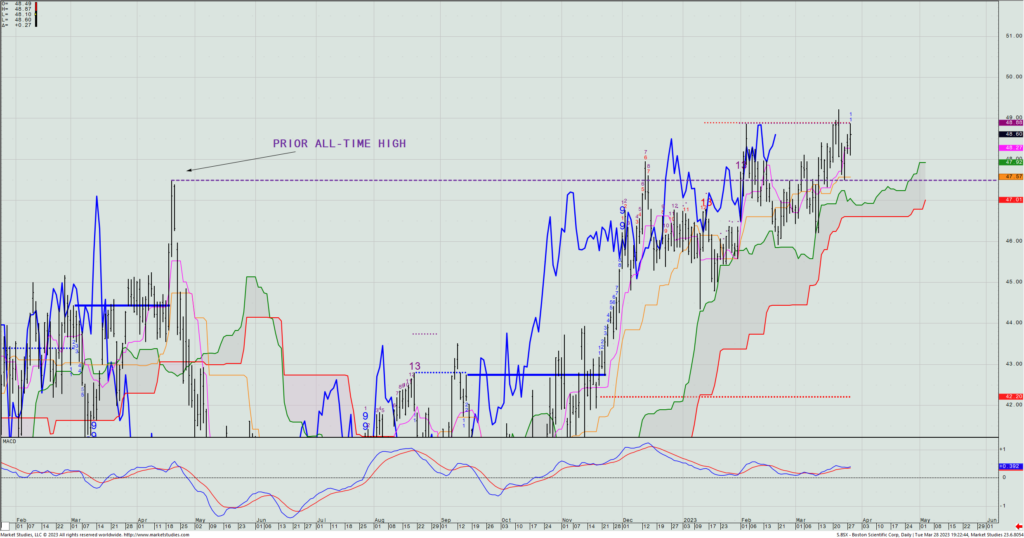

We are also long 12 BSX April 21st $48 calls at a cost of $1.48. They are now worth $1.45 based upon last night’s closing mid price. Though we have 24 days to go, with yesterday again topping at the same price it did 5-7 days ago, let’s take off four of 12 spreads today (simply to reduce risk).

BSX – Daily

For a new idea, join me in looking at the daily chart of the coffee retail chain, Dutch Bros. Inc. (BROS). The stock has been sideways for six months, and it’s near the bottom of the range and just posted a daily Setup -9 count. As such, let’s look to sell a April 28th $30/$28 put spread. Last night, that closed at $0.83, or 41% of the strike differential. Earnings aren’t till May 10th, so there should be enough time for this to meander higher in the next month before they come into play.

BROS – Daily

DailyPlay Updates – March 27, 2023

Investment Rationale

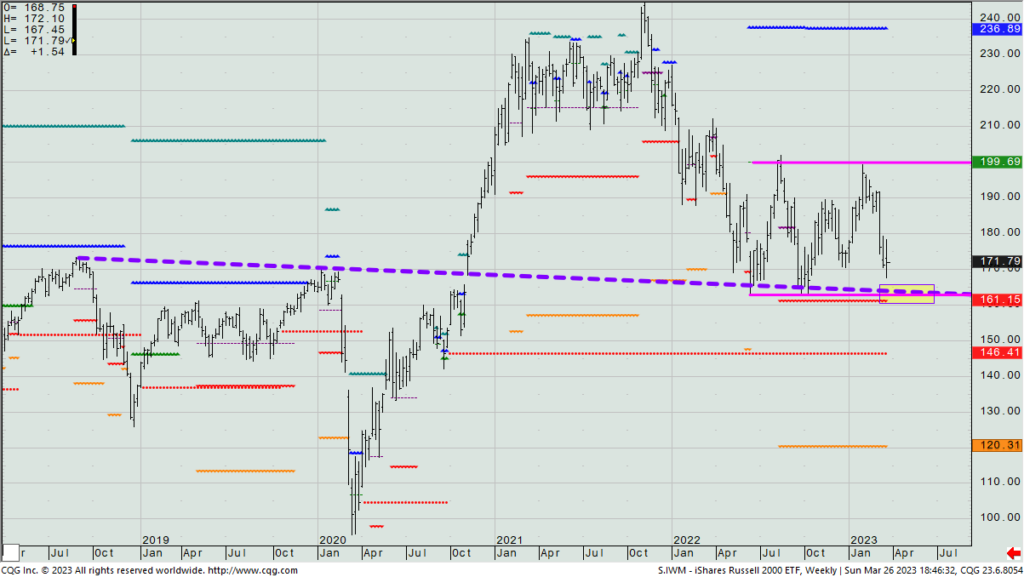

Here’s a potential hedge play to an idea we already have on: We are bearish the QQQ near the upper end of its trading range, by being long a put spread that expires in 10 days. Now that the Russell 2000 ETF (IWM) is nearing its lower end of its range, we can look to get long it. Ideally, I’d like to sell a put spread on it, but it’s priced way too cheaply (i.e., only receiving 25% of the strike differential I was looking at), so I’m forced to look at buying a call spread instead. But the one I was looking to buy cost 35% of the strike differential, so they’re too expensive. So, “what’s a choosy mother to do”? Well, in this case, maybe it’s just better to buy ~$2000 worth of the ETF, or approximately 11 shares of IWM.

IWM – Weekly

If the QQQ closes any day above last week’s high of $315.25, we’ll get out of the bearish QQQ spread (but hopefully be making money on our long IWM trade). Or, if IWM closes beneath $161, we’ll sell out of the IWM stock (but we’ll hopefully be making money on the QQQ trade).

$LYFT

DailyPlay – Partial Closing Trade (LYFT) – March 24, 2023

Partial Closing Trade

- LYFT – 55.22% Gain: Buy to Close 1 Contract (or 50% of your Contracts) April 14th $9 Put @ $0.30 Debit. DailyPlay Portfolio: By Closing 1 of the 2 Contracts, we will be paying $30.

Investment Rationale

Bulls controlled yesterday’s open and the morning, but bears took over the rest of the day, and the SPX only recovered 12 of Wednesday’s 65-point loss. Even more importantly, it closed some 60 points beneath the intraday high made in the morning – still suggesting that the market may see a pullback here while also potentially remaining within the larger trading range of 3864 to 4148. QQQ opened just beneath $310 and quickly got to $314+, but then actually closed just beneath its opening price, marking a daily doji and putting in a second top in as many days right near $315. (As a side note, traders are twice as bullish the NDX as they are the SPX (50% bulls vs. 26% bulls, respectively. What a huge change from last year.)

In my opinion, the bonds and the dollar are still the big keys to what the next bigger move comes for equities. Right now, the US Dollar Index is just tucking beneath its weekly cloud, and absent a rebound today, it’s looking more like its 2023 low near 100.5 can be tested. I also remain in the camp that bond yields will move southward to mark new 2023 lows beneath 3.33% (and at least trade down to 3.25% to 3.10%). I don’t see them getting back above their breakdown level of 3.80% from two weeks ago – certainly not in this phase of their pullback from the 4.09% island reversal high made on March 2nd.

Let’s make a couple of adjustments in our open positions:

- If ADM is not above $76.93 near today’s close, let’s look to exit 5 of the 14 short $77.5/$75 put spreads we have on.

- Let’s buy back 1 of 2 LYFT short $9 puts today.

I am headed out of town today and will be in the air back to NY on Monday morning during our weekly market outlook webinar. Tony or Prakash will be filling in for me.

$QQQ

DailyPlay – Opening Trade (QQQ) – March 23, 2023

QQQ Bearish Opening Trade Signal

View QQQ Trade

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

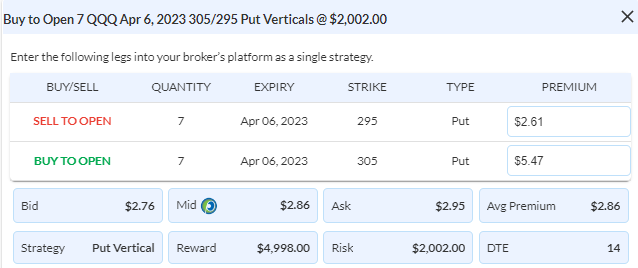

Details: Buy to Open 7 Contracts April 6th Put Vertical Spreads @ $2.86 Debit per contract.

Total Risk: This trade has a max risk of $2.002 (7 Contracts x $286) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $286 to select the # contracts for your portfolio.

Counter Trend Signal: This ETF has reached a resistance level and is expected to pull back from recent gains.

1M/6M Trends:Bullish/Bullish

Technical Score: 9/10

OptionsPlay Score: 142

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

An eerily quiet immediate reaction to the Fed rate hike and early Powell press conference turned into an ugly close to the day, as the final hour saw a constant stream of selling that took the SPX down 66 pts. (1.65%) to 3937. No one said trading was an easy game, and after a good bounce from 3864 just two weeks ago it’s actually no surprise that we saw a pullback to make buyers from this week second guess themselves. A close, interestingly, right on the flat 200-DMA.

SPX – Daily

Was there anything good about yesterday’s SPX price action? Well, the down close means that if we see a close today above 3985 (the daily Propulsion Momentum level) it would be qualified, meaning that a higher open/higher high/higher close on Friday would get a fresh buy signal – targeting near the early Feb. highs and a move back to the high end of the trading range.

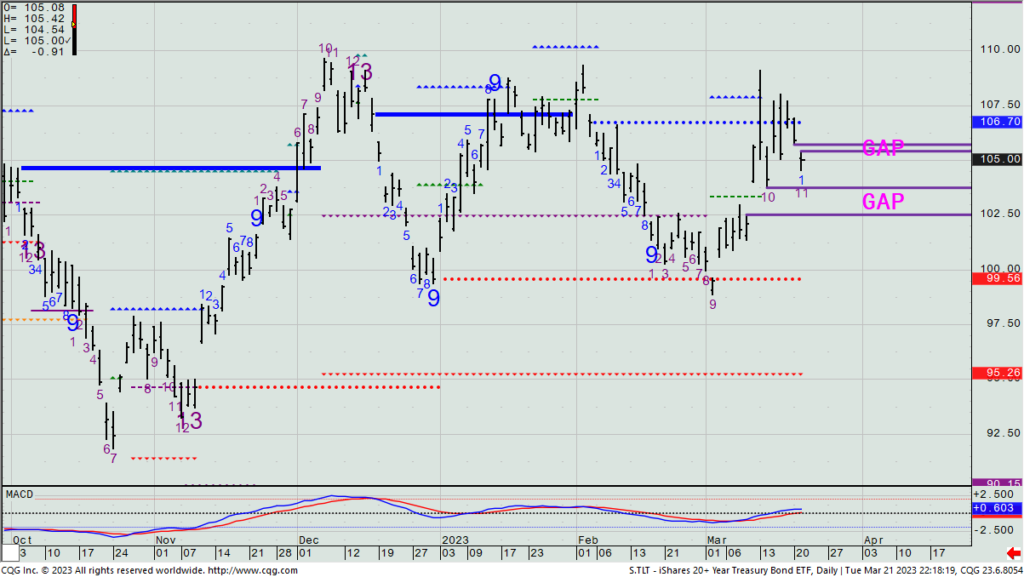

Yesterday, as instructed in the Daily Play, we were able to get out of the long TLT call spread at the same price we put it on at (i.e., $2.20). This was not because I don’t think interest rates are headed lower (i.e., I think they will), but because I make it a blanket rule for myself that when trading options – if I have a 50% profit on a position – I stop myself out at breakeven.

With our LYFT short $9 put, we are up about 60%. If tomorrow the put is trading beneath a 50% profit going into the closing bell, buy back one of two puts.

A new idea: Yesterday’s rally and lousy close gives us a defined risk level for a bearish QQQ trade, as Wednesday’s high was right at its Propulsion Exhaustion level, and the +13 signal from a week ago Wednesday is still in effect. As such, let’s look to buy an April 6th $305/$295 put spread for what was marked yesterday at $2.855 mid, or about 29% of the spread differential. I am purposely choosing a short-dated option to play for some attempt towards the blue rectangle support zone, which includes the bearish Propulsion Momentum level; unfilled close to low gap; and the uptrend line from the January low to occur shortly after the double-top just made against the Feb. high. Stop yourself out on any daily close above yesterday’s high (i.e., don’t wait for me to tell you to get out the next day).

QQQ – Daily

DailyPlay Updates – March 22, 2023

Investors poured back into financials – especially regional banks – as fears have quickly dissipated over the banking crisis. Can it actually be that there were but 3 “cockroaches” in the cabinet? I’m not convinced that more won’t come scampering out, but I am open and happy to being wrong, if that’s the way this all ultimately plays out. Meanwhile, the overall market moves higher on the bounce from the non-breakdown at 3864.

SPX – Daily

Today is the culmination of two weeks’ worth of important economic data that have led up to today’s FOMC announcement. The collective market is betting on a 25 bps. rate increase today, but we’ll see if that occurs, and just as – if not more importantly – what Chair Powell says in his 2:30pm ET press conference. Every word out of his mouth is scrutinized, so always be at the ready on a Fed day for lots of potential fireworks.

Given the potential volatility and meaning behind today’s Fed statement, I am not putting on a new position today. As per our open positions, the only one that I don’t like is that we saw something like a 50% gain in our TLT trade slide yesterday into a small loss. My bad for not alerting to the following beforehand, but as a blanket rule, if we are ever up 50% or more on a trade, make sure you have a stop in at no worse than what was your entry price on the position.

TLT – Daily

There are now two gaps near current levels: one above and one below. Both could be filled by the end of the week, but let’s look to close out the TLT spread trade at breakeven entry price of or near $2.20 any day this week.

$USO

DailyPlay – Partial Closing Trade (USO) – March 20, 2023

Partial Closing Trade

- USO – 8.92% Gain: Sell to Close 2 Contracts (or 40% of your Contracts) Jul 21st $71/$77 $63/$57 Iron Condors @ $4.15 Credit. DailyPlay Portfolio: By Closing 2 of the 5 Contracts, we will receive $830.

Investment rationale

As you heard me say in last Friday’s webinar, unless we saw the SPX close beneath 3862 to close out last week, I remain in the belief that for right now, the market stays in a trading range of 3864 to 4148. Now, I do think that when and if we hear about more regional banks having issues like SVB or Signature Bank had, we will see the 3864 give way and then the door gets opened for a further 350-point decline. But until and if that happens, for right now, we’ll trade the range.

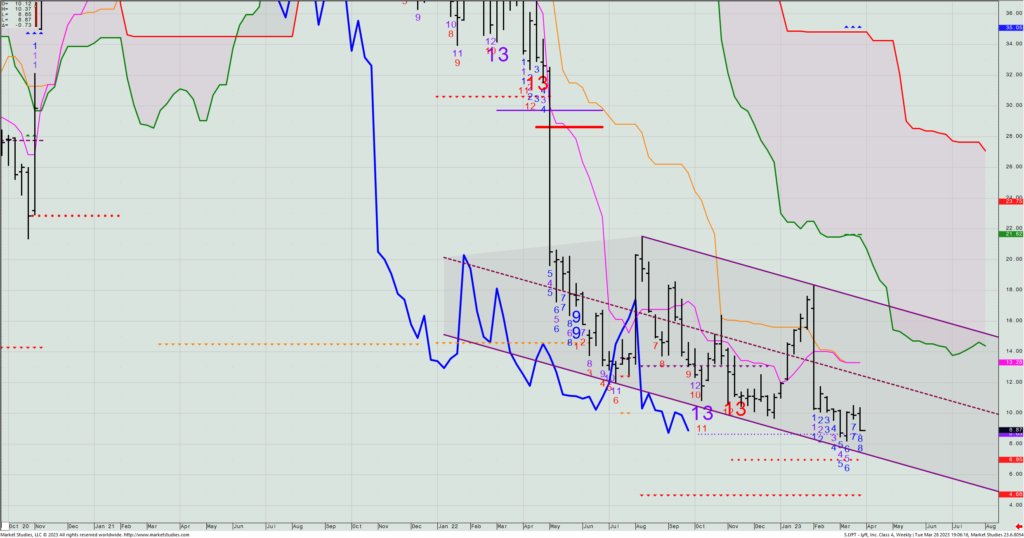

I do want to address the falling crude oil price, and that seeing it make the lowest low last week since late-2021 should help kick off a further decline, especially given all that new open interest that came in since the beginning of this year. (Those new oil commitments account for ~22% of all open interest.)

But – and in this case it’s a big but – the $66 level in oil has also been a major downside target since May ‘22; it’s also where the US govt. is replenishing the Strategic Oil Reserve; and last week also happened to mark an Aggressive Combo -13 signal (and the daily posted an Aggressive Sequential signal one day last week, too) along with only 12% of those polled being bullish oil right now. Despite that we have until July on our long USO iron condor, there are just too many reasons to leave the full position on. Thus, today we will exit 2 of 5 long iron condor spreads we hold, locking in but a small profit of 9% since we put this trade on, but acting upon this slew of signals we see that could give oil traders reason to hold support down in here. (And certainly, we hope they don’t, but as you know, “hope” is not a strategy.)

WTI Oil – Weekly

DailyPlay Updates – March 17, 2023

Investment Rationale

With First Republic Bank and Credit Suisse getting backstopped by cash injections from other banks, investors were quick to bid stocks back up, and yesterday saw the SPX close almost 70 pts. higher and safely above the key 3864 weekly bearish Propulsion Momentum level. Barring a close beneath there today, the SPX remains in a trading range bounded by that level and 4148 on top. Traders continue to have the edge over more confirmed bulls and bears, who this year have been beaten up badly by having stubborn opinions.

Propulsion levels have been golden since last summer. See the 4 highlighted rectangles below:

SPX – Weekly

Today is a major option expiration. Open interest in strikes even remotely near yesterday’s close is massive, but the single largest are in the SPY $390 puts (107K) and the $400 calls (103K). Many hundreds of thousands of options will go off the board today worthless – another reason why selling options is the preferred way to play by most smart money in the business.

We have on three option spread positions that expire today (i.e., SPOT, GLD, and ABBV). Yesterday I wrote to you to make sure that you are out of them by this morning.

$LYFT

DailyPlay – Opening Trade (LYFT) – March 16, 2023

LTFT Bullish Opening Trade Signal

View LYFT Trade

Strategy Details

Strategy: Short Put

Direction: Bullish

Details: Sell to Open 2 Contracts April 14th $9 Put @ $0.67 Credit per contract.

Total Risk: This trade has a max risk of $1,666 (2 Contracts x $833) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $833 to select the # contracts for your portfolio.

Counter Trend Signal: This stock has been trading lower and has reached an over-sold condition, from where a bounce higher is expected.

1M/6M Trends: Bearish/Bearish

Technical Score: 1/10

OptionsPlay Score: 100

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks closed lower yesterday, with the SPX down 27 pts. to 3891. But they only lost 1/3 of how low they went at yesterday’s midday bottom. That suggests there’s some buying coming in to offset the selling, and of most interest to me, is that after three sessions this week, we’ve only seen last Friday’s close exceeded by six points on just one of those closes. I continue to respect the 3864 weekly bearish Propulsion Momentum level, and if we don’t see a down close on this Friday relative to last Friday’s of 3864, then the odds get better that we could see a bounce from this area – one that could take the SPX back up to test the lower of two trendlines drawn from the Feb. high (about 100 points above current price).

As any of you know who are trading daily, market volatility has dramatically increased in the past several sessions, and trying to get a handle on its bigger move is no piece of cake. I still think that it will ultimately be downward earnings revisions that helps take the market lower from this range, but the day-to-day see-saw movement is going to truly test your skills.

We’ve got three spread positions on that expire Friday, so I suggest you get out of them today or tomorrow morning unless you plan on dealing with being exercised. These include:

- Short 2 SPOT $125/$130 call spreads. The stock closed at $125.65 on Wednesday, and we’re down 4.7% on these final two.

- Long 2 GLD $168.5/$176.5 call spreads. The stock closes at $178.21 on Wednesday, and we’re up 205% on these final two.

- Short 5 ABBV $145/$150$160/$165 iron condors. The stock closed at $154.06 on Wednesday, and we’re up 79% on these final 5.

Here’s an idea to consider for those willing to potentially get long a name if exercised in 30 days, and if not, collecting the premium. Let’s look at both the daily and monthly charts of LYFT. I see a potential bounce coming from the bottom of a well-established channel. Secondly, the monthly chart shows its first-ever -13 signal (this is an Aggressive Combo one). Combined, it gives me a sense that this is not a bad place to put on a bullish strategy, especially for the longer term if need be and if willing to buy the stock. Using the April 14th $9 strike, you can collect $67 per option sold, effectively making your purchase price $8.33 if exercised.

LYFT – Daily

LYFT – Monthly